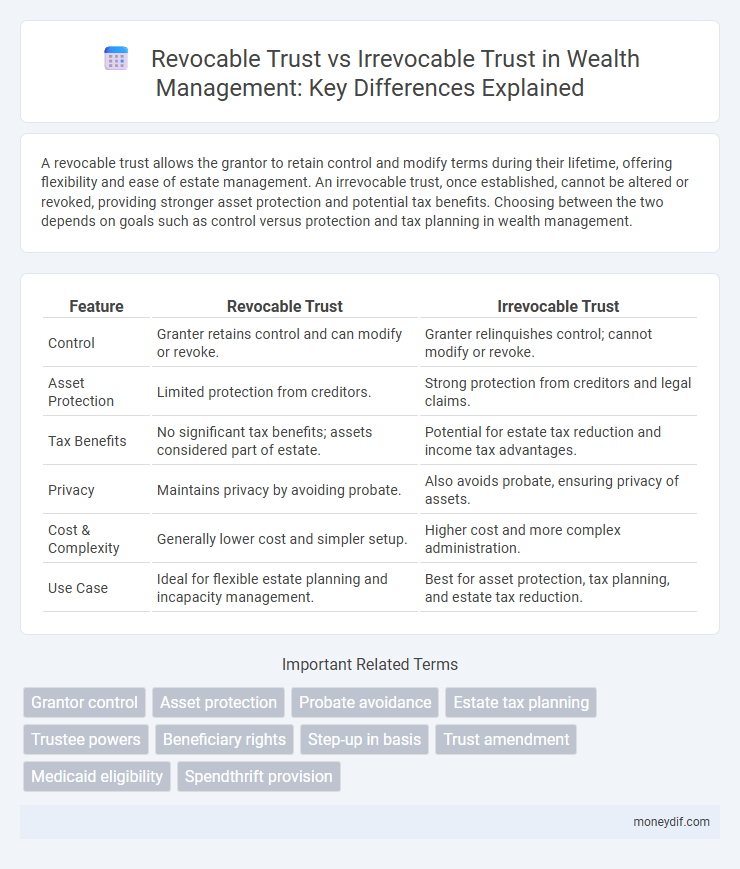

A revocable trust allows the grantor to retain control and modify terms during their lifetime, offering flexibility and ease of estate management. An irrevocable trust, once established, cannot be altered or revoked, providing stronger asset protection and potential tax benefits. Choosing between the two depends on goals such as control versus protection and tax planning in wealth management.

Table of Comparison

| Feature | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Control | Granter retains control and can modify or revoke. | Granter relinquishes control; cannot modify or revoke. |

| Asset Protection | Limited protection from creditors. | Strong protection from creditors and legal claims. |

| Tax Benefits | No significant tax benefits; assets considered part of estate. | Potential for estate tax reduction and income tax advantages. |

| Privacy | Maintains privacy by avoiding probate. | Also avoids probate, ensuring privacy of assets. |

| Cost & Complexity | Generally lower cost and simpler setup. | Higher cost and more complex administration. |

| Use Case | Ideal for flexible estate planning and incapacity management. | Best for asset protection, tax planning, and estate tax reduction. |

Understanding Revocable and Irrevocable Trusts

Revocable trusts allow grantors to maintain control and make changes or revoke the trust during their lifetime, providing flexibility and ease in estate management. Irrevocable trusts transfer ownership and control to a trustee permanently, offering potential tax benefits and protection from creditors but limiting modifications. Understanding the key differences between these trusts is essential for strategic wealth planning and asset protection.

Key Differences Between Revocable and Irrevocable Trusts

Revocable trusts allow the grantor to retain control over the assets and modify or revoke the trust during their lifetime, providing flexibility and ease of asset management. Irrevocable trusts, once established, transfer asset ownership out of the grantor's control, offering significant tax benefits, asset protection from creditors, and exclusion from probate. The primary differences center on control, tax implications, and legal protection, with revocable trusts favoring adaptability and irrevocable trusts prioritizing asset protection and estate tax reduction.

Advantages of Revocable Trusts

Revocable trusts offer flexibility and control, allowing the grantor to modify or revoke the trust during their lifetime. They help avoid probate, ensuring a faster and more private transfer of assets to beneficiaries. Additionally, revocable trusts provide seamless asset management in case of incapacity without losing ownership rights.

Benefits of Irrevocable Trusts

Irrevocable trusts offer significant benefits such as asset protection from creditors and legal judgments, as the grantor no longer owns the assets once transferred. They provide estate tax advantages by removing assets from the taxable estate, helping to reduce overall estate tax liability. These trusts also enable greater control over asset distribution, ensuring beneficiaries receive funds under specific terms and conditions.

Trusts and Asset Protection Strategies

Revocable trusts allow grantors to maintain control over assets and make amendments or revoke the trust during their lifetime, offering flexibility but limited asset protection since assets remain part of the grantor's estate. Irrevocable trusts transfer asset ownership out of the grantor's estate, providing stronger protection against creditors and reducing estate taxes, which makes them a preferred strategy for long-term asset protection and wealth preservation. Selecting between these trusts depends on balancing control with the need for shielding assets from liability and minimizing estate exposure.

Tax Implications of Trust Types

Revocable trusts provide flexibility by allowing grantors to modify or revoke the trust during their lifetime, but the trust's assets remain subject to estate taxes and income taxes. Irrevocable trusts remove assets from the grantor's taxable estate, offering potential estate tax savings and shielding income generated by trust assets from personal income tax liabilities. Selecting between revocable and irrevocable trusts depends heavily on individual tax planning goals, asset protection needs, and estate tax considerations.

Estate Planning with Trusts

Revocable trusts offer flexibility in estate planning by allowing grantors to modify or revoke the trust during their lifetime, making them ideal for managing and distributing assets while retaining control. Irrevocable trusts provide stronger asset protection and potential tax benefits by permanently transferring ownership, which can shield assets from creditors and reduce estate taxes. Choosing between revocable and irrevocable trusts depends on individual goals regarding control, tax planning, and asset protection within comprehensive estate strategies.

Privacy Considerations: Revocable vs Irrevocable

Revocable trusts offer limited privacy since they become part of the public record upon the grantor's death due to probate proceedings. Irrevocable trusts provide enhanced privacy by generally avoiding probate, keeping asset details and beneficiary information confidential. This distinction is crucial for individuals prioritizing discretion in managing and distributing wealth.

Choosing the Right Trust for Wealth Preservation

Choosing the right trust depends on the level of control desired and asset protection needed; revocable trusts offer flexibility by allowing asset management and amendments during the grantor's lifetime, while irrevocable trusts provide stronger protection against creditors and estate taxes by permanently transferring ownership. Wealth preservation strategies often favor irrevocable trusts to shield assets from probate and reduce estate tax liability. Understanding specific financial goals and legal implications is critical when deciding between revocable and irrevocable trusts for effective asset protection and legacy planning.

Common Mistakes in Trust Planning

Common mistakes in trust planning include failing to clearly distinguish between revocable and irrevocable trusts, leading to unintended tax consequences and lack of asset protection. Many investors mistakenly assume revocable trusts shield assets from creditors, overlooking that these trusts offer limited protection compared to irrevocable trusts, which transfer ownership and reduce estate taxes. Proper legal guidance is essential to tailor trust structures that accurately align with wealth preservation and estate planning goals.

Important Terms

Grantor control

Grantor control in a revocable trust allows the grantor to modify or revoke the trust assets and terms at any time, maintaining ownership and tax liability. In contrast, an irrevocable trust transfers control of assets to a trustee, removing the grantor's authority and providing potential benefits such as asset protection and estate tax reduction.

Asset protection

Revocable trusts offer flexible asset management and easy modifications but provide limited protection from creditors and lawsuits, as the grantor retains control and ownership. Irrevocable trusts transfer asset ownership out of the grantor's estate, offering stronger protection against creditors, estate taxes, and legal claims, though they restrict the grantor's control and ability to alter the trust terms.

Probate avoidance

Revocable trusts allow grantors to retain control over assets and modify terms during their lifetime, facilitating probate avoidance by transferring assets directly to beneficiaries without court intervention. Irrevocable trusts, which permanently remove assets from the grantor's estate, provide stronger probate avoidance benefits while also offering enhanced asset protection and potential tax advantages.

Estate tax planning

Estate tax planning using a revocable trust allows asset management flexibility and avoids probate but does not provide estate tax reduction or creditor protection, as the grantor retains control. In contrast, an irrevocable trust removes assets from the grantor's estate, potentially lowering estate taxes and shielding assets from creditors, but sacrifices control over those assets once transferred.

Trustee powers

Trustee powers in a revocable trust typically allow the grantor to retain control, modify, or revoke the trust during their lifetime, enabling flexibility in managing assets and making distributions. In contrast, trustee powers in an irrevocable trust are more limited and restrictive, as the grantor relinquishes control, providing enhanced asset protection and potential tax benefits but reducing the ability to alter trust terms.

Beneficiary rights

Beneficiaries of a revocable trust have limited rights during the grantor's lifetime, as the grantor retains control and can modify or revoke the trust, while beneficiaries of an irrevocable trust generally have more defined and protected rights since the grantor relinquishes control, making the trust assets shielded from creditors and estate taxes. Trust beneficiaries in irrevocable trusts receive greater security in asset distribution and protection, but typically cannot alter the terms or access trust assets until conditions stipulated in the trust instrument are met.

Step-up in basis

Step-up in basis allows assets held in a revocable trust to receive a stepped-up tax basis at the grantor's death, minimizing capital gains taxes for beneficiaries, whereas assets in an irrevocable trust may not qualify for this benefit unless specific criteria are met. The distinction hinges on ownership and control, with revocable trusts typically treated as part of the grantor's estate for tax purposes while irrevocable trusts are separate entities, potentially limiting step-up advantages.

Trust amendment

A trust amendment allows modifications to a revocable trust, enabling the grantor to change terms, beneficiaries, or trustees without court approval, while irrevocable trusts generally prohibit amendments or revocation once established, providing greater asset protection and tax benefits. Understanding the flexibility of revocable trusts versus the permanence of irrevocable trusts is crucial for effective estate planning and asset management.

Medicaid eligibility

Medicaid eligibility often depends on asset protection, where irrevocable trusts can shield assets from countable resources, unlike revocable trusts, which remain part of the grantor's estate and are considered available for Medicaid qualification. Establishing an irrevocable trust generally requires transferring ownership of assets out of the grantor's control for at least five years to meet Medicaid's look-back period and avoid penalties.

Spendthrift provision

A Spendthrift provision in a revocable trust allows the grantor to retain control while protecting trust assets from beneficiaries' creditors, but it is more effective in irrevocable trusts where the grantor relinquishes control and assets are shielded from creditors. Irrevocable trusts with Spendthrift clauses provide stronger protection since the trust assets are legally separated from the beneficiary's personal estate.

Revocable trust vs Irrevocable trust Infographic

moneydif.com

moneydif.com