Carried forward loss allows investors to offset capital gains in future years, reducing taxable income and optimizing tax strategy. A wash sale occurs when securities are sold at a loss and repurchased within 30 days, disallowing the loss deduction for tax purposes. Understanding the distinction helps investors maximize tax benefits while avoiding IRS penalties.

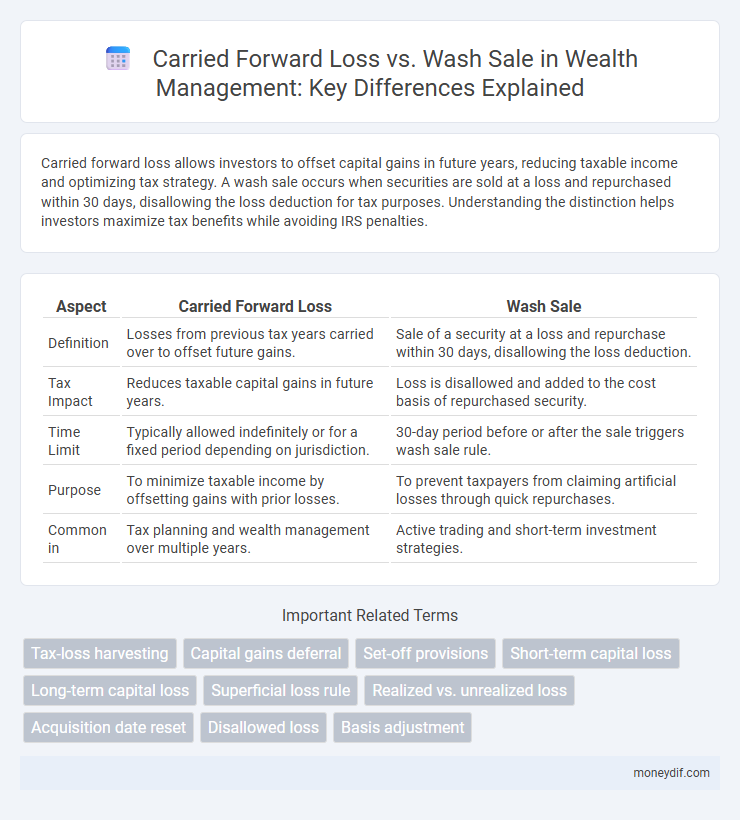

Table of Comparison

| Aspect | Carried Forward Loss | Wash Sale |

|---|---|---|

| Definition | Losses from previous tax years carried over to offset future gains. | Sale of a security at a loss and repurchase within 30 days, disallowing the loss deduction. |

| Tax Impact | Reduces taxable capital gains in future years. | Loss is disallowed and added to the cost basis of repurchased security. |

| Time Limit | Typically allowed indefinitely or for a fixed period depending on jurisdiction. | 30-day period before or after the sale triggers wash sale rule. |

| Purpose | To minimize taxable income by offsetting gains with prior losses. | To prevent taxpayers from claiming artificial losses through quick repurchases. |

| Common in | Tax planning and wealth management over multiple years. | Active trading and short-term investment strategies. |

Understanding Carried Forward Loss: Key Concepts

Carried forward loss allows investors to offset future capital gains by applying current year's unrealized losses, reducing taxable income over time. This tax strategy helps optimize wealth management by preserving losses that can be used against gains in different fiscal periods. Understanding the distinction from wash sales, which disallow loss claims when identical securities are repurchased within 30 days, is critical for effective tax planning and minimizing liabilities.

What Is a Wash Sale? Definition and Implications

A wash sale occurs when an investor sells a security at a loss and repurchases the same or substantially identical security within 30 days before or after the sale, disallowing the loss deduction for tax purposes. This rule prevents taxpayers from claiming artificial tax losses while maintaining their investment positions. Understanding wash sale implications is crucial for effective tax planning and accurate calculation of carried forward losses.

Carried Forward Loss vs. Wash Sale: Core Differences

Carried forward loss allows investors to offset future capital gains by using previous years' investment losses, reducing taxable income over time. In contrast, a wash sale occurs when an investor sells a security at a loss and repurchases the same or a substantially identical security within 30 days, disallowing the immediate deduction of that loss. The core difference lies in tax treatment: carried forward losses are deferred tax benefits applied to future gains, while wash sales result in the loss being added to the cost basis of the repurchased asset, postponing tax recognition.

Tax Treatment: Carried Forward Loss Explained

Carried forward losses allow taxpayers to offset future taxable income by applying current year capital losses to subsequent years, reducing overall tax liability. These losses must be reported to tax authorities and tracked accurately, as there are specific time limits and restrictions depending on jurisdiction. Unlike wash sales, which disallow loss claims on repurchased securities within 30 days, carried forward losses provide a legitimate way to minimize taxes on future capital gains.

Tax Impact of Wash Sales: What Investors Need to Know

Wash sales trigger the disallowance of tax deductions on sold securities if repurchased within 30 days, impacting investors' ability to use realized losses for tax benefits. Unlike carried forward losses, which can offset gains in future tax years, wash sale losses are deferred by adjusting the cost basis of repurchased securities, complicating tax planning strategies. Understanding the wash sale rule helps investors avoid unexpected tax liabilities and optimize their portfolio's tax efficiency.

How to Utilize Carried Forward Loss for Wealth Management

Carried forward losses can be strategically utilized to offset future capital gains, reducing taxable income and enhancing overall wealth management. Investors must track these losses meticulously to apply them against gains in subsequent years, thereby deferring tax liabilities and preserving capital. Proper planning around carried forward losses supports optimized portfolio performance and long-term financial growth.

Wash Sale Rules: Avoiding Common Mistakes

Wash sale rules prohibit claiming a tax deduction on a security sold at a loss if the same or substantially identical security is purchased within 30 days before or after the sale, which can inadvertently defer tax benefits. Investors must track transaction dates and security types meticulously to avoid triggering the wash sale rule, preventing the carried forward loss from being disallowed. Understanding IRS guidelines on wash sales is crucial for accurate tax reporting and maximizing tax efficiency in wealth management strategies.

Strategic Tax Planning: Leveraging Losses Effectively

Strategic tax planning leverages carried forward losses by offsetting future taxable income to reduce tax liabilities, preserving capital for investment. Understanding wash sale rules is crucial, as repurchasing substantially identical securities within 30 days disallows immediate loss recognition, impacting tax deductions. Efficiently managing loss deferrals and timing sales optimizes tax outcomes and enhances wealth preservation strategies.

Wealth-Building Tips: Managing Investment Losses

Carried forward losses enable investors to offset future capital gains, reducing taxable income and preserving wealth-building potential. Wash sale rules disallow claiming a loss if the same or substantially identical security is repurchased within 30 days, preventing tax loss harvesting abuses. Strategically managing these provisions maximizes tax efficiency and optimizes long-term investment growth.

Regulatory Compliance: Carried Forward Loss and Wash Sale Guidelines

Regulatory compliance for carried forward losses mandates strict adherence to tax authority guidelines, allowing investors to offset future capital gains with previous losses under specified conditions. Wash sale rules prohibit claiming a loss on the sale of a security if the same or a substantially identical security is purchased within 30 days before or after the sale, ensuring accurate loss reporting. Understanding these distinctions is crucial for proper tax filing and avoiding penalties in wealth management strategies.

Important Terms

Tax-loss harvesting

Tax-loss harvesting allows investors to offset capital gains by selling securities at a loss, with unused losses carried forward to future tax years to reduce taxable income. Wash sale rules prohibit claiming a tax loss if the same or substantially identical security is repurchased within 30 days, affecting the ability to realize immediate tax benefits from the loss.

Capital gains deferral

Capital gains deferral strategies often involve utilizing carried forward losses to offset taxable gains, reducing immediate tax liabilities. Wash sale rules disallow claiming losses on repurchased securities within 30 days, complicating the application of carried forward losses for deferral purposes.

Set-off provisions

Set-off provisions allow taxpayers to reduce taxable income by offsetting carried forward losses against current gains, while wash sale rules disallow the recognition of losses when identical securities are repurchased within 30 days, preventing artificial loss claims. Understanding the interaction between carryforward of losses and wash sale regulations is crucial for accurate tax reporting and optimization of capital gains tax liabilities.

Short-term capital loss

Short-term capital loss arises when an asset held for one year or less is sold at a loss, which can be used to offset short-term capital gains and, if excess, carried forward to future tax years. Wash sale rules disallow the deduction of a loss if the same or substantially identical security is repurchased within 30 days before or after the sale, impacting the calculation and timing of carried forward losses.

Long-term capital loss

Long-term capital loss can be carried forward indefinitely to offset future capital gains, providing taxpayers with a valuable tax planning tool. Wash sale rules disallow claiming a loss if the same or substantially identical stock is purchased within 30 days before or after the sale, affecting the recognition of long-term capital losses and the ability to carry them forward.

Superficial loss rule

The Superficial Loss Rule disallows claiming a capital loss for tax purposes when an asset is sold at a loss and a substantially identical asset is repurchased within 30 days, impacting the ability to carry forward that loss against future gains. This rule also influences wash sale adjustments, ensuring that superficial losses are added to the cost basis of the repurchased asset to prevent immediate realization of tax benefits while preserving loss deferral strategies.

Realized vs. unrealized loss

Realized loss occurs when an asset is sold for less than its purchase price, directly impacting taxable income, while unrealized loss represents a decline in asset value that is not yet sold and therefore not taxable. Carried forward loss allows taxpayers to apply net operating losses to future tax periods, whereas wash sale rules disallow claiming a loss if a substantially identical security is repurchased within 30 days, affecting the ability to realize and carry forward losses.

Acquisition date reset

Acquisition date reset occurs when a wash sale triggers the deferral of a loss by adding the disallowed loss to the basis of the repurchased security, effectively resetting the acquisition date to the new purchase date; this contrasts with carried forward loss, which involves maintaining the original acquisition date for tax loss carryforwards without adjustment. Understanding the distinction is crucial for accurate tax treatment of capital losses and basis calculations under IRS wash sale rules.

Disallowed loss

Disallowed loss occurs when a security sold at a loss is repurchased within 30 days, triggering the wash sale rule that prevents immediate loss deduction; instead, the disallowed loss is added to the cost basis of the repurchased security, affecting the carried forward loss calculation. Properly tracking disallowed losses ensures accurate adjustment of carried forward losses used to offset future capital gains.

Basis adjustment

Basis adjustment in carried forward losses recalibrates the cost basis of securities to reflect unrealized losses carried over for tax purposes, preventing double taxation. In wash sale rules, the basis is adjusted to include the disallowed loss from repurchasing substantially identical securities within 30 days, ensuring accurate loss deferral and preventing immediate tax benefits.

Carried forward loss vs Wash sale Infographic

moneydif.com

moneydif.com