Hard assets like real estate, precious metals, and commodities provide tangible value and act as reliable hedges against inflation and market volatility. Soft assets, including intellectual property, brand reputation, and digital assets, offer significant growth potential through innovation and scalability but carry higher risk due to market perception and technological changes. Balancing hard and soft assets in a diversified portfolio enhances long-term wealth preservation and growth by leveraging stability and dynamic opportunity.

Table of Comparison

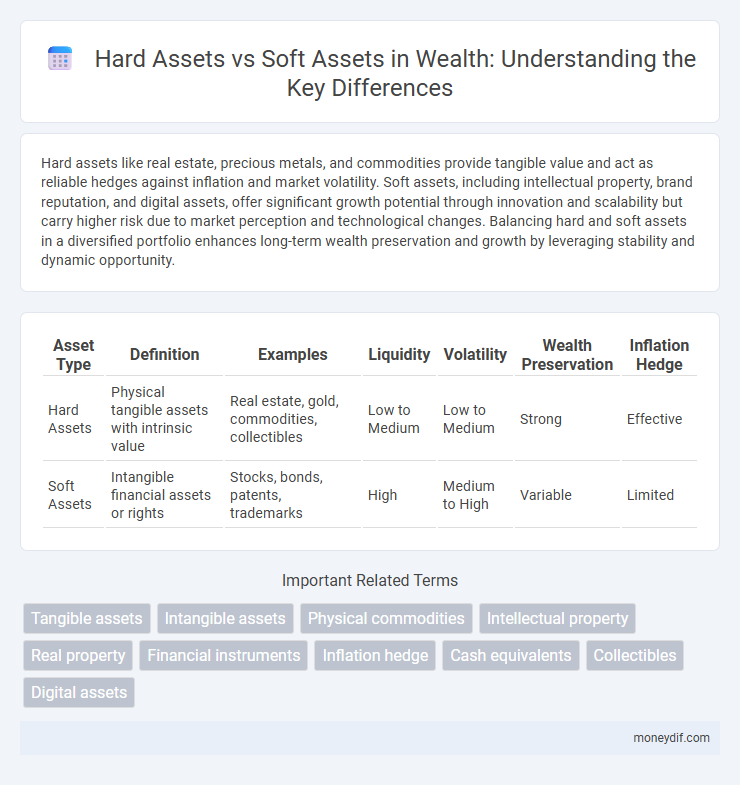

| Asset Type | Definition | Examples | Liquidity | Volatility | Wealth Preservation | Inflation Hedge |

|---|---|---|---|---|---|---|

| Hard Assets | Physical tangible assets with intrinsic value | Real estate, gold, commodities, collectibles | Low to Medium | Low to Medium | Strong | Effective |

| Soft Assets | Intangible financial assets or rights | Stocks, bonds, patents, trademarks | High | Medium to High | Variable | Limited |

Understanding Hard Assets and Soft Assets

Hard assets refer to tangible, physical items such as real estate, precious metals, and commodities that hold intrinsic value and typically provide inflation protection. Soft assets encompass intangible resources like stocks, bonds, intellectual property, and brand reputation, which derive value from legal rights and market perception. Understanding the differences between hard and soft assets helps investors diversify portfolios and balance risk by combining the stability of physical goods with the growth potential of financial instruments.

Key Differences Between Hard and Soft Assets

Hard assets encompass tangible property such as real estate, precious metals, and infrastructure, offering intrinsic physical value and protection against inflation. Soft assets include intangible resources like stocks, bonds, patents, and intellectual property, which derive value from legal rights and market demand. The key differences lie in liquidity, volatility, and risk profiles--hard assets tend to be less liquid but more stable, whereas soft assets generally provide higher liquidity with greater market fluctuations.

Examples of Hard Assets in Wealth Building

Hard assets in wealth building include physical and tangible items such as real estate, precious metals like gold and silver, and collectible art or antiques. These assets provide intrinsic value, often hedging against inflation and market volatility. Investors often prioritize hard assets due to their durability and potential for long-term appreciation.

Soft Assets: Definitions and Types

Soft assets are intangible resources that contribute to a business's value, including intellectual property, brand reputation, and customer relationships. Unlike hard assets such as real estate or machinery, soft assets are non-physical and often difficult to quantify but play a crucial role in competitive advantage and long-term growth. Key types of soft assets encompass patents, trademarks, copyrights, goodwill, proprietary technology, and human capital expertise.

Liquidity Comparison: Hard vs Soft Assets

Hard assets such as real estate, precious metals, and commodities generally exhibit lower liquidity due to the time and cost involved in buying or selling them. Soft assets, including stocks, bonds, and digital currencies, offer higher liquidity, allowing for quicker conversion into cash with minimal transaction costs. Investors often balance portfolios by combining hard assets for long-term stability and soft assets for immediate liquidity needs.

Risk and Return Profiles of Each Asset Class

Hard assets such as real estate, commodities, and precious metals typically offer lower volatility with moderate returns, providing a hedge against inflation and economic downturns due to their tangible nature. Soft assets like stocks, bonds, and intellectual property carry higher risk profiles but have the potential for greater long-term capital appreciation and income generation through dividends or interest. Diversifying between these asset classes balances risk and return, leveraging the stability of hard assets while capitalizing on the growth opportunities inherent in soft assets.

Hard Assets as Inflation Hedges

Hard assets such as real estate, precious metals, and commodities offer tangible value that typically appreciates during periods of inflation, providing stable purchasing power. Unlike soft assets like stocks and bonds, hard assets have intrinsic worth unaffected by currency devaluation, making them essential components in wealth preservation strategies. Investors often allocate a significant portion of their portfolios to hard assets to mitigate inflation risks and ensure long-term financial security.

The Role of Soft Assets in Diversification

Soft assets such as intellectual property, brand reputation, and human capital play a crucial role in portfolio diversification by providing non-correlated returns compared to traditional hard assets like real estate and commodities. These intangible assets often offer higher growth potential and resilience during market volatility, enhancing overall wealth stability. Integrating soft assets into investment strategies helps balance risk and optimize long-term wealth preservation.

Wealth Preservation Through Asset Allocation

Hard assets such as real estate, precious metals, and commodities provide tangible value and act as a hedge against inflation, preserving wealth over time. Soft assets, including stocks, bonds, and intellectual property, offer growth potential through income generation and capital appreciation but carry higher volatility. Effective wealth preservation employs a strategic asset allocation that balances the stability of hard assets with the growth prospects of soft assets to mitigate risk and maintain purchasing power.

Choosing the Right Mix: A Strategic Approach to Hard and Soft Assets

Balancing hard assets such as real estate, commodities, and precious metals with soft assets like stocks, bonds, and intellectual property is essential for diversifying a wealth portfolio and managing risk. Strategic allocation considers market volatility, liquidity needs, and long-term growth potential, leveraging hard assets for tangible value preservation and soft assets for income generation and appreciation. Optimizing this asset mix aligns with individual financial goals, enhances portfolio resilience, and capitalizes on economic cycles.

Important Terms

Tangible assets

Tangible assets, often referred to as hard assets, include physical items such as real estate, machinery, and equipment that hold intrinsic value and can be used in production or as collateral. In contrast, soft assets represent intangible resources like intellectual property, brand reputation, and goodwill that contribute to a company's value but lack physical form.

Intangible assets

Intangible assets, such as intellectual property, brand reputation, and trademarks, differ significantly from hard assets like machinery, buildings, and land due to their non-physical nature and difficulty in valuation. Unlike hard assets, which have measurable depreciation and clear market value, intangible assets contribute to a company's competitive advantage through innovation, customer relationships, and proprietary knowledge that drive long-term economic benefits.

Physical commodities

Physical commodities represent tangible hard assets such as metals, oil, and minerals, which are valuable for their intrinsic properties and industrial applications. In contrast, soft assets typically refer to agricultural products like wheat, coffee, and cotton, characterized by their perishability and cyclical supply influenced by weather conditions.

Intellectual property

Intellectual property, a key category of soft assets, includes intangible creations such as patents, trademarks, and copyrights that provide competitive advantage without physical form. Unlike hard assets like machinery or real estate, intellectual property offers scalable value through legal rights and innovation protection essential for business growth and market differentiation.

Real property

Real property, classified as a hard asset, consists of tangible fixed assets such as land and buildings that typically retain value over time and provide physical utility. In contrast, soft assets encompass intangible resources like intellectual property and goodwill, which lack physical substance but contribute significant economic benefits.

Financial instruments

Financial instruments linked to hard assets often include commodities futures, real estate investment trusts (REITs), and precious metals ETFs, providing tangible value and hedge against inflation. In contrast, soft asset instruments encompass patents, trademarks, and copyrights, typically represented through intangible asset-backed securities and intellectual property rights contracts.

Inflation hedge

Hard assets such as real estate, gold, and commodities typically serve as effective inflation hedges due to their intrinsic value and limited supply, while soft assets like stocks and bonds are more vulnerable to inflationary pressures because their value depends on future earnings and interest rates. Investors often prioritize hard assets during inflationary periods to preserve purchasing power and mitigate the erosion of returns caused by rising prices.

Cash equivalents

Cash equivalents, such as treasury bills and money market funds, provide high liquidity and immediate convertibility, distinguishing them from hard assets like real estate and machinery, which have tangible value but lower liquidity. Soft assets, including intellectual property and goodwill, offer intangible value but lack the quick cash conversion feature inherent to cash equivalents.

Collectibles

Collectibles represent a unique category of hard assets, offering tangible value through rarity, craftsmanship, and historical significance, which can appreciate over time unlike soft assets such as patents or trademarks that derive value primarily from intellectual property rights. Investing in collectibles provides diversification by holding physical items like art, coins, or vintage cars that are less affected by market fluctuations impacting soft assets.

Digital assets

Digital assets such as cryptocurrencies, NFTs, and digital intellectual property represent soft assets characterized by intangible value, ease of transfer, and high volatility. In contrast, hard assets like real estate, precious metals, and machinery provide physical presence, intrinsic value, and long-term stability, often serving as tangible collateral in financial markets.

Hard assets vs Soft assets Infographic

moneydif.com

moneydif.com