Earned income requires active work and time investment, typically through salaries or wages, and is heavily influenced by hours worked and job performance. Passive income generates revenue with minimal effort after the initial investment, such as rental properties, dividends, or royalties, allowing wealth to grow independently of daily labor. Diversifying income streams by balancing earned and passive income enhances financial stability and long-term wealth accumulation.

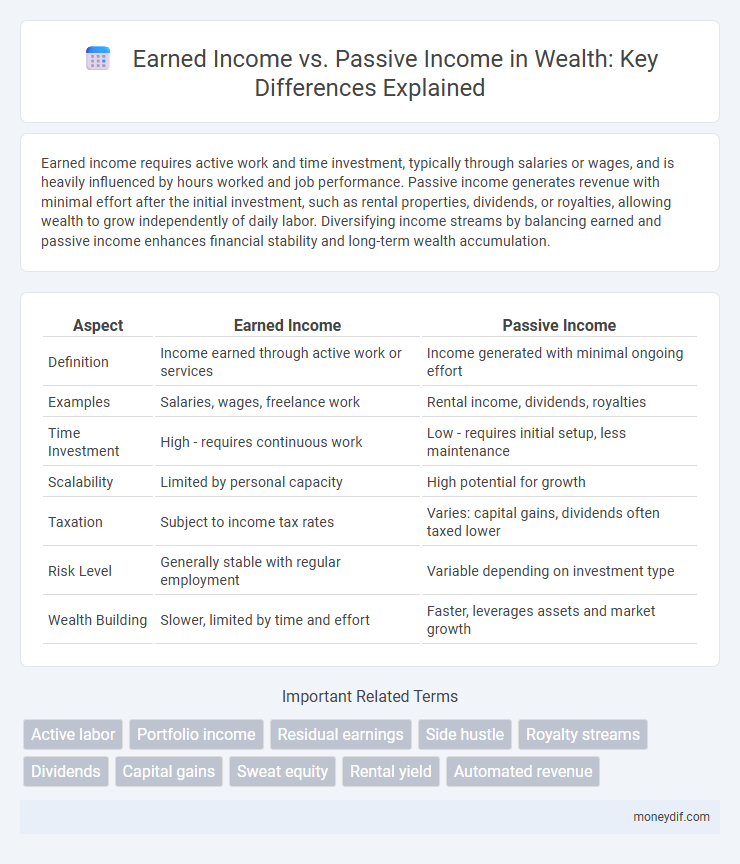

Table of Comparison

| Aspect | Earned Income | Passive Income |

|---|---|---|

| Definition | Income earned through active work or services | Income generated with minimal ongoing effort |

| Examples | Salaries, wages, freelance work | Rental income, dividends, royalties |

| Time Investment | High - requires continuous work | Low - requires initial setup, less maintenance |

| Scalability | Limited by personal capacity | High potential for growth |

| Taxation | Subject to income tax rates | Varies: capital gains, dividends often taxed lower |

| Risk Level | Generally stable with regular employment | Variable depending on investment type |

| Wealth Building | Slower, limited by time and effort | Faster, leverages assets and market growth |

Understanding Earned Income: Definition and Examples

Earned income refers to the money received from active participation in work or services, including salaries, wages, tips, and commissions. This type of income is directly linked to hours worked or performance, making it subject to payroll taxes and often influencing personal tax brackets. Common examples of earned income include earnings from full-time employment, freelance projects, and bonuses earned through sales or performance metrics.

What Is Passive Income? Key Concepts Explained

Passive income refers to earnings generated with minimal active effort, typically through investments like rental properties, dividends, or royalties. Unlike earned income, which requires continuous work or services, passive income allows money to flow steadily from assets or business ventures. Building multiple streams of passive income can enhance financial stability and accelerate wealth accumulation.

Main Differences Between Earned and Passive Income

Earned income is generated through active work such as salaries, wages, and commissions, requiring direct effort and time investment. Passive income originates from assets or investments, like rental properties, dividends, and royalties, needing minimal day-to-day involvement. The main differences include the level of activity required to maintain the income stream and the potential for scalability without proportional increases in effort.

Advantages of Focusing on Earned Income

Earned income provides consistent and stable cash flow through active work, offering greater control over earnings and the ability to directly influence financial growth. It enhances skills development and career advancement opportunities, which can lead to higher salaries and job security. Focusing on earned income also facilitates easier access to loans and credit, as regular paychecks demonstrate financial reliability to lenders.

The Benefits of Building Passive Income Streams

Building passive income streams offers financial stability by generating revenue with minimal ongoing effort, allowing wealth accumulation beyond traditional earned income. Passive income sources such as rental properties, dividends, and royalties provide consistent cash flow that can diversify investment portfolios and reduce reliance on active employment. This approach enhances long-term financial freedom, enabling reinvestment opportunities and wealth growth even during periods of limited earned income.

Common Sources of Earned Income

Common sources of earned income include salaries, wages, tips, commissions, and bonuses earned through active work or services. Freelance work, consulting fees, and income from self-employment also constitute earned income, requiring continuous effort and time investment. This contrasts with passive income, which typically arises from investments or rental properties without daily involvement.

Popular Passive Income Opportunities

Popular passive income opportunities include real estate rentals, dividend investing, and creating digital products such as eBooks or online courses. These avenues generate revenue with minimal day-to-day involvement, contrasting with earned income that requires active labor. Investing in index funds and peer-to-peer lending platforms also offers scalable passive income streams for wealth building.

Tax Implications: Earned Income vs Passive Income

Earned income, such as wages and salaries, is typically subject to higher ordinary income tax rates and payroll taxes, including Social Security and Medicare. Passive income, like rental income or earnings from investments, often benefits from lower tax rates, such as capital gains tax or qualified dividend rates, and may offer deductions or credits unique to passive activities. Understanding the tax implications is crucial for wealth management strategies aiming to optimize after-tax income and leverage tax-efficient investment vehicles.

How to Transition from Earned to Passive Income

Transitioning from earned income to passive income involves strategically investing in assets such as real estate, dividend-paying stocks, or creating digital products that generate ongoing revenue. Building multiple income streams requires consistent reinvestment of earned income into scalable opportunities with potential for automation or minimal active management. Prioritizing financial education and leveraging tax-advantaged accounts accelerates the shift toward sustainable passive income, enabling long-term wealth growth.

Choosing the Right Income Strategy for Wealth Creation

Selecting the appropriate income strategy is crucial for effective wealth creation, emphasizing earned income for immediate cash flow and passive income for long-term financial stability. Diversifying between active work-generated earnings and investments such as rental properties or dividends maximizes wealth potential and risk management. Prioritizing passive income sources accelerates wealth accumulation by generating revenue streams independent of direct labor intensity.

Important Terms

Active labor

Active labor generates earned income through direct participation in work or services, requiring continuous effort and time investment. Unlike passive income, which arises from investments or assets with minimal daily involvement, active labor income depends on active personal engagement and skills.

Portfolio income

Portfolio income, generated from investments like dividends, interest, and capital gains, differs from earned income, which stems from active work such as salaries or wages. Unlike passive income, which includes earnings from rental properties or businesses without active involvement, portfolio income primarily involves financial asset management and trading activities.

Residual earnings

Residual earnings refer to income generated continuously after the initial effort, distinguishing earned income, which requires active work, from passive income that accrues with minimal ongoing involvement. Passive income streams such as royalties, dividends, and rental income exemplify residual earnings, enabling wealth accumulation beyond traditional earned wages.

Side hustle

Side hustles generate earned income through active work, requiring ongoing effort and time investment, while passive income streams produce revenue with minimal daily involvement, often from investments or automated businesses. Understanding the distinction aids in optimizing financial growth by balancing active earnings with scalable, residual income sources.

Royalty streams

Royalty streams generate passive income by allowing creators to earn recurring revenue from intellectual property such as books, music, or patents without active involvement. Unlike earned income, which requires continuous labor or services, royalty income provides ongoing financial benefits based on ownership rights and asset utilization.

Dividends

Dividends are classified as passive income because they are earnings from investments rather than active work, contrasting with earned income which is generated through employment or business activities. Investors receive dividends as regular distributions from a company's profits, providing a steady passive income stream without directly participating in the company's operations.

Capital gains

Capital gains are typically classified as passive income when derived from the sale of investments, while earned income arises from active participation like wages or salaries. Understanding the distinction impacts tax treatment, as earned income is subject to payroll taxes, whereas capital gains often benefit from lower tax rates under long-term investment holding periods.

Sweat equity

Sweat equity represents the non-monetary investment of time and effort that individuals contribute to a business, often leading to earned income through active participation rather than passive income generated by investments. Unlike passive income streams, which require minimal ongoing involvement, sweat equity reflects the direct labor and skills applied to create value and ownership in ventures.

Rental yield

Rental yield, a key metric in real estate investment, measures the annual rental income generated as a percentage of the property's value, highlighting the passive income potential compared to earned income from active work. High rental yields indicate efficient asset utilization, providing steady cash flow with less direct involvement than earned income sources like salaries or freelance work.

Automated revenue

Automated revenue systems generate earned income through active management and strategic workflows, distinguishing from passive income which accrues with minimal ongoing effort. Leveraging tools like subscription platforms and automated sales funnels maximizes cash flow by converting active labor into scalable, semi-passive earnings.

Earned income vs Passive income Infographic

moneydif.com

moneydif.com