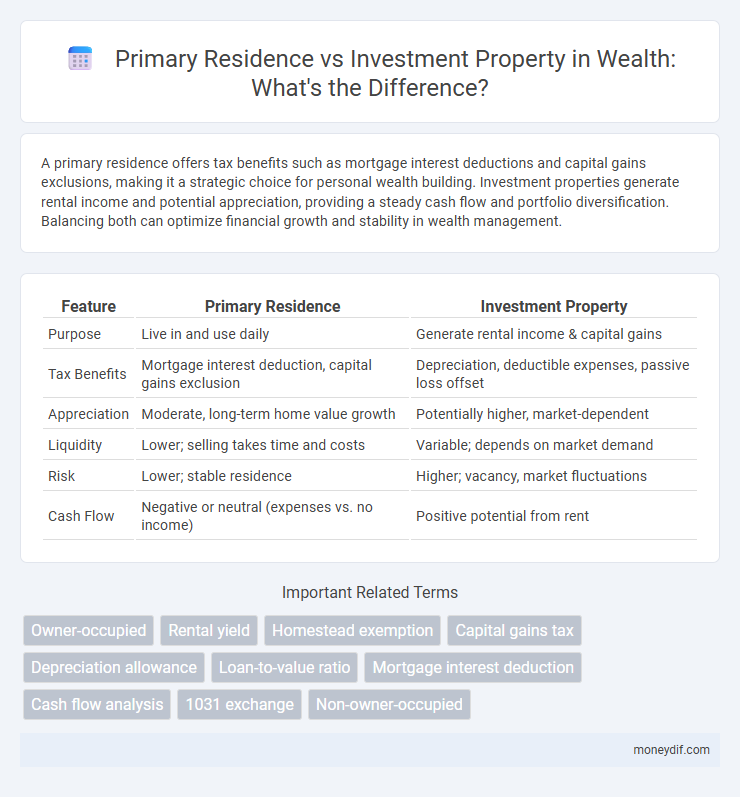

A primary residence offers tax benefits such as mortgage interest deductions and capital gains exclusions, making it a strategic choice for personal wealth building. Investment properties generate rental income and potential appreciation, providing a steady cash flow and portfolio diversification. Balancing both can optimize financial growth and stability in wealth management.

Table of Comparison

| Feature | Primary Residence | Investment Property |

|---|---|---|

| Purpose | Live in and use daily | Generate rental income & capital gains |

| Tax Benefits | Mortgage interest deduction, capital gains exclusion | Depreciation, deductible expenses, passive loss offset |

| Appreciation | Moderate, long-term home value growth | Potentially higher, market-dependent |

| Liquidity | Lower; selling takes time and costs | Variable; depends on market demand |

| Risk | Lower; stable residence | Higher; vacancy, market fluctuations |

| Cash Flow | Negative or neutral (expenses vs. no income) | Positive potential from rent |

Understanding Primary Residence and Investment Property

A primary residence is the main home where an individual or family lives, offering tax benefits like mortgage interest deductions and exemption from capital gains tax upon sale, which investment properties typically do not provide. Investment properties are purchased to generate rental income or appreciate in value, often involving higher expenses such as maintenance, property management fees, and distinct tax treatments, including depreciation and taxable rental income. Recognizing these differences is crucial for strategic wealth building and optimizing real estate investment portfolios.

Key Financial Differences Between Home and Investment

Primary residences typically offer tax deductions on mortgage interest and property taxes, which can lower overall taxable income, whereas investment properties allow for deductions on expenses such as repairs, management fees, and depreciation, directly affecting net rental income. Investment properties generate rental income that must be reported as taxable revenue, with capital gains on sale often taxed at higher rates compared to primary residences, which may qualify for capital gains exclusions under specific conditions. Financing terms also differ, as investment property loans usually require higher down payments and come with higher interest rates compared to primary residence mortgages, impacting overall cash flow and return on investment.

Tax Implications: Primary Residence vs Investment Property

Tax implications differ significantly between a primary residence and an investment property, impacting overall financial strategy. Primary residences often qualify for capital gains tax exclusions up to $250,000 ($500,000 for married couples) when sold, while investment properties are subject to capital gains tax without such exclusions and may incur depreciation recapture taxes. Understanding mortgage interest deductions, property tax deductions, and eligibility for tax deferral strategies like 1031 exchanges is crucial for optimizing tax benefits in real estate investments.

Wealth Building Potential: Homeownership vs Property Investing

Primary residences build wealth through home equity accumulation and property appreciation, offering tax benefits like mortgage interest deductions. Investment properties generate income streams via rental yields and can appreciate, enhancing portfolio diversification and long-term capital growth. Balancing both strategies optimizes wealth building by combining stability with cash flow and market exposure.

Mortgage Considerations for Residences and Investments

Mortgage considerations for primary residences often include lower interest rates, tax benefits, and more flexible lending criteria compared to investment properties. Investment property mortgages typically require higher down payments, come with increased interest rates, and have stricter qualification standards due to higher perceived risk. Understanding these distinctions is crucial for optimizing financial strategies and maximizing wealth growth through real estate holdings.

Risk Factors: Living In vs Leasing Out Property

Living in a primary residence typically reduces market risk exposure due to personal use and emotional attachment, whereas leasing out investment property introduces risks such as tenant turnover, vacancy, and fluctuating rental income. Investment properties also face higher maintenance and management costs, increasing financial vulnerability during market downturns. Understanding these risk factors is crucial for wealth-building strategies involving real estate assets.

Cash Flow and Equity: Comparing Long-Term Gains

Primary residences often build equity steadily through mortgage payments and potential property value appreciation, while investment properties generate cash flow via rental income that can offset expenses and increase net returns. Investment properties typically offer higher cash flow, but carry risks such as vacancies and maintenance costs that impact profitability. Long-term wealth accumulation depends on balancing equity growth from primary residences with cash flow benefits and tax advantages from investment properties.

Legal Protections for Homeowners vs Landlords

Primary residences offer homeowners robust legal protections, including homestead exemptions that shield equity from creditors and stringent eviction laws favoring occupant security. Investment properties, governed by landlord-tenant laws, provide landlords rights to collect rent and address property damage but generally expose them to fewer personal asset protections. Understanding these distinctions is crucial for wealth preservation and risk management in real estate portfolios.

Selling and Capital Gains: What Owners Should Know

Selling a primary residence often benefits from capital gains tax exclusions, allowing homeowners to exclude up to $250,000 ($500,000 for married couples) of profit from taxable income if ownership and use tests are met. Investment properties, however, do not qualify for this exclusion and are subject to capital gains tax on the full profit, with potential depreciation recapture increasing the tax liability. Understanding these tax distinctions is crucial for owners to strategically plan property sales and optimize wealth retention.

Choosing the Right Property Path for Your Wealth Goals

Selecting a primary residence often builds long-term equity and provides personal stability, whereas investment properties can generate passive income and offer tax benefits. Evaluating factors like market trends, cash flow potential, and your financial timeline is crucial in aligning property choices with wealth goals. Balancing risk tolerance and investment objectives ensures the optimal property strategy to enhance net worth and achieve financial independence.

Important Terms

Owner-occupied

Owner-occupied properties, defined as primary residences where owners reside, typically receive favorable mortgage rates and tax benefits compared to investment properties used solely for rental income or capital appreciation.

Rental yield

Rental yield on investment properties typically ranges from 4% to 10%, significantly higher than the negligible or negative yield associated with primary residences.

Homestead exemption

Homestead exemption significantly reduces property taxes on a primary residence but is typically unavailable for investment properties, emphasizing its role in homeowner tax relief.

Capital gains tax

Capital gains tax on a primary residence is often exempt or reduced under specific residency criteria, whereas investment properties typically incur full capital gains tax on profits after depreciation recapture and allowable deductions.

Depreciation allowance

Depreciation allowance on an investment property enables property owners to deduct the wear and tear of the building and fixtures over time, reducing taxable income, whereas primary residences typically do not qualify for depreciation deductions because they are owner-occupied. Investment properties must be depreciated using the IRS's Modified Accelerated Cost Recovery System (MACRS) over 27.5 years for residential real estate, while no such allowance applies for personal use properties.

Loan-to-value ratio

Loan-to-value (LTV) ratio for a primary residence typically ranges from 80% to 90%, reflecting lower risk and favorable mortgage terms, while investment properties often have stricter LTV limits around 65% to 75% due to higher lender risk. Higher LTV ratios on primary residences enable borrowers to finance a larger portion of the home's value, whereas investment property loans require larger down payments to mitigate increased default risk.

Mortgage interest deduction

Mortgage interest deduction applies to primary residences with limits on loan amounts, while interest on investment property mortgages is deductible as a business expense without the same caps.

Cash flow analysis

Cash flow analysis reveals that primary residences typically generate negative cash flow due to personal expenses, while investment properties often produce positive cash flow through rental income exceeding mortgage and maintenance costs.

1031 exchange

A 1031 exchange allows investors to defer capital gains taxes by swapping investment properties but does not apply to primary residences, which qualify for separate capital gains exclusions.

Non-owner-occupied

Non-owner-occupied properties are classified as investment properties rather than primary residences because they are not occupied by the property owner.

primary residence vs investment property Infographic

moneydif.com

moneydif.com