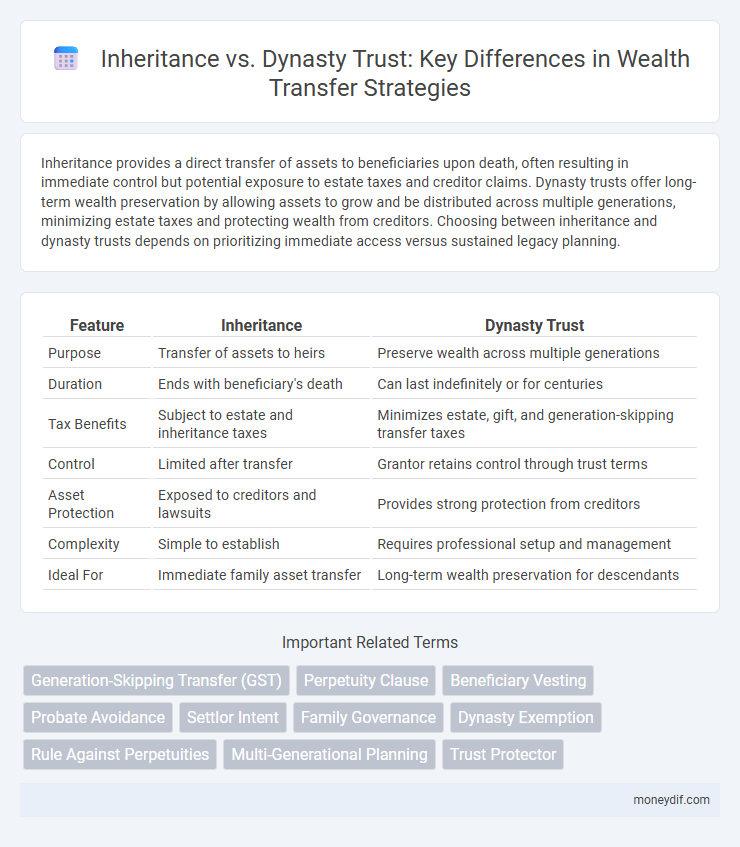

Inheritance provides a direct transfer of assets to beneficiaries upon death, often resulting in immediate control but potential exposure to estate taxes and creditor claims. Dynasty trusts offer long-term wealth preservation by allowing assets to grow and be distributed across multiple generations, minimizing estate taxes and protecting wealth from creditors. Choosing between inheritance and dynasty trusts depends on prioritizing immediate access versus sustained legacy planning.

Table of Comparison

| Feature | Inheritance | Dynasty Trust |

|---|---|---|

| Purpose | Transfer of assets to heirs | Preserve wealth across multiple generations |

| Duration | Ends with beneficiary's death | Can last indefinitely or for centuries |

| Tax Benefits | Subject to estate and inheritance taxes | Minimizes estate, gift, and generation-skipping transfer taxes |

| Control | Limited after transfer | Grantor retains control through trust terms |

| Asset Protection | Exposed to creditors and lawsuits | Provides strong protection from creditors |

| Complexity | Simple to establish | Requires professional setup and management |

| Ideal For | Immediate family asset transfer | Long-term wealth preservation for descendants |

Understanding Inheritance: Basics and Principles

Inheritance involves the legal transfer of assets, rights, and obligations from a deceased individual to their heirs, governed by wills or state laws. Key principles include the identification of beneficiaries, the probate process to validate the will, and potential tax implications affecting the estate's value. Understanding these basics is crucial for effective estate planning and ensuring the intended distribution of wealth across generations.

Dynasty Trusts Explained: A Modern Wealth Tool

Dynasty trusts are powerful estate planning tools designed to preserve family wealth across multiple generations while minimizing estate taxes and probate costs. These trusts can last indefinitely in states that have abolished the rule against perpetuities, allowing assets to grow tax-deferred and providing long-term financial security for descendants. Unlike traditional inheritance methods, dynasty trusts offer controlled asset distribution and protection from creditors and divorce, making them ideal for sustaining multi-generational wealth.

Key Differences Between Inheritance and Dynasty Trusts

Inheritance typically involves the direct transfer of assets from one generation to the next, often triggering immediate tax consequences and limited control over asset distribution. Dynasty trusts are structured to preserve wealth across multiple generations, minimizing estate taxes and providing long-term management and protection of assets. Key differences include duration, tax implications, and control mechanisms, with dynasty trusts offering enhanced longevity and flexibility compared to traditional inheritance.

Tax Implications: Inheritance vs Dynasty Trusts

Inheritance transfers often trigger estate taxes based on the decedent's taxable estate value, potentially reducing the amount beneficiaries receive. Dynasty trusts, designed to span multiple generations, offer significant tax advantages by minimizing estate and gift taxes through generation-skipping transfer tax exemptions. Utilizing dynasty trusts enables wealth preservation by deferring or avoiding tax liabilities, enhancing long-term asset protection compared to standard inheritance distributions.

Asset Protection: Which Strategy Offers More Security?

Inheritance typically allows for direct asset transfer but exposes wealth to probate risks and creditor claims, reducing protection. Dynasty trusts provide enhanced asset protection by preserving wealth across generations, shielding assets from creditors, lawsuits, and estate taxes indefinitely. This trust structure offers superior security through perpetual control and strategic legal safeguards, making it the preferred choice for sustained wealth preservation.

Multigenerational Wealth Planning Strategies

Inheritance typically involves the direct transfer of assets to beneficiaries upon death, while dynasty trusts are designed to preserve and grow wealth across multiple generations without incurring repeated estate taxes. Dynasty trusts offer greater control over asset distribution, allowing families to establish conditions that protect wealth from creditors and poor financial decisions over decades or centuries. Incorporating dynasty trusts into multigenerational wealth planning strategies enhances long-term financial security by ensuring sustained wealth accumulation and tax-efficient asset protection for future heirs.

Legal Considerations in Estate Transfers

Inheritance involves direct asset transfer to beneficiaries upon death, governed by state probate laws that may result in delays and public record disclosures. Dynasty trusts provide a legal structure designed to preserve wealth across multiple generations, minimizing estate taxes and protecting assets from creditors and legal claims. Estate planning with dynasty trusts requires careful compliance with the Rule Against Perpetuities and state-specific trust laws to ensure long-term asset protection and tax efficiency.

Control and Flexibility: Customizing Wealth Distribution

Inheritance offers direct asset transfer but limits control over how and when beneficiaries access wealth, potentially leading to disputes or mismanagement. Dynasty trusts provide enhanced flexibility by allowing grantors to set detailed terms for wealth distribution across multiple generations, preserving assets while minimizing estate taxes. This customization empowers families to maintain long-term financial stability and control without immediate asset depletion.

Common Pitfalls in Passing Down Wealth

Common pitfalls in passing down wealth through inheritance include lack of clear communication, which often leads to family disputes and mismanagement of assets. Dynasty trusts offer a strategic solution by providing long-term asset protection and tax efficiency across multiple generations, but improper structuring can trigger unforeseen tax liabilities or restrictions on beneficiary access. Ensuring professional estate planning and regular trust reviews is essential to avoid pitfalls like underfunded trusts or outdated provisions that fail to reflect current family dynamics and legal changes.

Choosing the Right Approach for Your Legacy

Inheritance transfers assets directly to beneficiaries but may expose wealth to probate and estate taxes, potentially reducing the amount received. Dynasty trusts offer long-term asset protection by preserving wealth across multiple generations while minimizing tax liabilities and shielding assets from creditors. Selecting the right approach depends on factors like the size of the estate, tax considerations, and the desire to maintain family control over assets.

Important Terms

Generation-Skipping Transfer (GST)

Generation-Skipping Transfer (GST) tax applies to transfers of assets that skip a generation, aiming to prevent double taxation on inheritances passed directly to grandchildren or later descendants. Dynasty trusts utilize GST tax exemptions to preserve wealth across multiple generations without incurring repeated estate or inheritance taxes, thereby maximizing asset protection and long-term financial legacy.

Perpetuity Clause

A perpetuity clause in inheritance planning limits the duration that assets can be held in trust, distinguishing dynasty trusts designed to preserve wealth across multiple generations indefinitely. While traditional inheritance trusts may terminate after a beneficiary's lifetime due to perpetuity rules, dynasty trusts leverage jurisdictional exceptions to bypass these limits, ensuring long-term asset protection and tax advantages.

Beneficiary Vesting

Beneficiary vesting in inheritance allows heirs to gain property rights outright or after conditions, contrasting with dynasty trusts where assets remain controlled within the trust across generations to preserve wealth and minimize estate taxes. Unlike inheritance distributions, dynasty trusts limit beneficiary control, ensuring long-term asset preservation while beneficiary vesting typically involves eventual direct ownership transfer.

Probate Avoidance

Probate avoidance minimizes court involvement and expedites asset transfer, making Inheritance Trusts effective for distributing assets directly to beneficiaries while protecting against probate delays. Dynasty Trusts extend probate avoidance across multiple generations by preserving wealth within the trust, reducing estate taxes, and providing long-term asset protection.

Settlor Intent

Settlor intent is pivotal in distinguishing between inheritance trusts and dynasty trusts, as it determines the settlor's specific wishes regarding asset distribution and duration of trust administration. Dynasty trusts are designed to preserve wealth across multiple generations without estate taxation, reflecting a settlor intent focused on long-term family legacy, whereas inheritance trusts typically emphasize immediate beneficiary protection and asset allocation after death.

Family Governance

Family governance structures balance control and flexibility by distinguishing between inheritance strategies and dynasty trusts, where inheritance typically involves direct asset transfer to beneficiaries, and dynasty trusts provide long-term wealth preservation across multiple generations by sheltering assets from estate taxes and creditor claims. Implementing a dynasty trust within family governance fosters sustained family wealth, governance continuity, and mitigates risks associated with inheritance disputes and asset dissipation.

Dynasty Exemption

The Dynasty Exemption allows wealth to be transferred across multiple generations without incurring estate taxes, making it a powerful tool when comparing Inheritance structures to Dynasty Trusts. Unlike a traditional inheritance that may face estate taxes at each generational transfer, a Dynasty Trust leverages the Dynasty Exemption to preserve assets and minimize tax liabilities over an extended period.

Rule Against Perpetuities

The Rule Against Perpetuities limits the duration of future interest in property to prevent indefinite control beyond certain lifetimes, impacting inheritance by ensuring assets transfer within legally defined timeframes. Dynasty trusts exploit exemptions or legal reforms to maintain wealth across multiple generations, circumventing the Rule's restrictions and enabling long-term estate planning.

Multi-Generational Planning

Multi-generational planning leverages inheritance strategies to preserve wealth across decades while minimizing estate taxes and probate costs through structures like dynasty trusts. Dynasty trusts enable assets to remain protected and grow tax-efficiently for multiple generations without being subject to repeated taxation upon each inheritance transfer.

Trust Protector

A Trust Protector plays a crucial role in managing and modifying Dynasty Trusts, offering flexibility to adapt inheritance provisions over multiple generations while safeguarding beneficiaries' interests and ensuring the trust's longevity. Unlike traditional inheritance trusts, Dynasty Trusts with a Trust Protector can address changing tax laws and family dynamics, enhancing asset protection and long-term wealth preservation.

Inheritance vs Dynasty Trust Infographic

moneydif.com

moneydif.com