Capital gains represent the profit earned from selling an asset at a higher price than its purchase cost, typically taxed at favorable rates for long-term investments. Carried interest refers to the share of profits that investment managers receive as compensation, often taxed under capital gains rules despite being earned through active management. Understanding the distinction is crucial for optimizing tax strategies and maximizing after-tax wealth in investment portfolios.

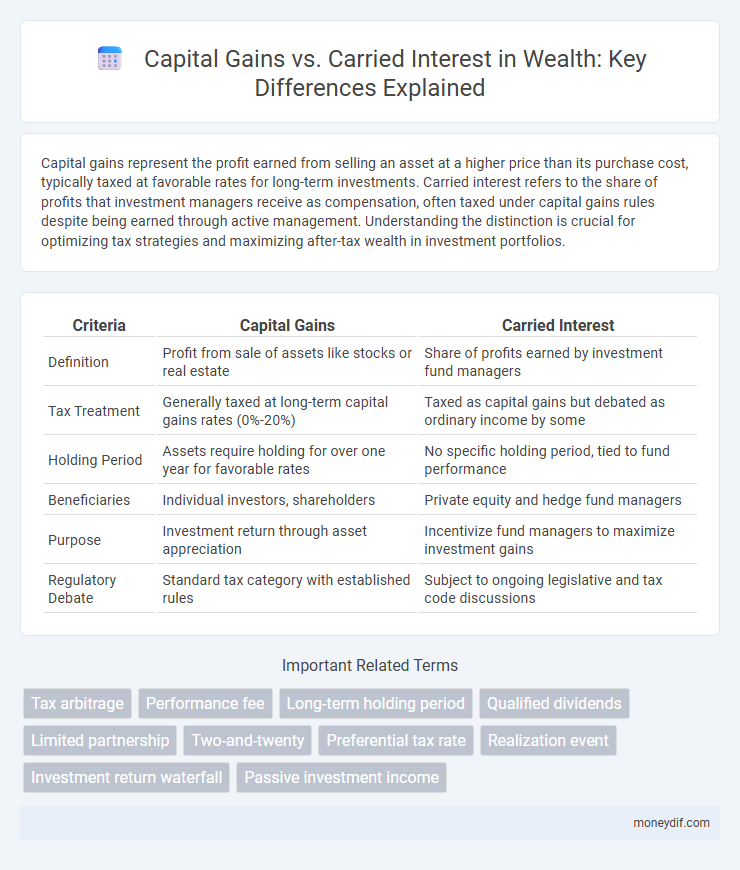

Table of Comparison

| Criteria | Capital Gains | Carried Interest |

|---|---|---|

| Definition | Profit from sale of assets like stocks or real estate | Share of profits earned by investment fund managers |

| Tax Treatment | Generally taxed at long-term capital gains rates (0%-20%) | Taxed as capital gains but debated as ordinary income by some |

| Holding Period | Assets require holding for over one year for favorable rates | No specific holding period, tied to fund performance |

| Beneficiaries | Individual investors, shareholders | Private equity and hedge fund managers |

| Purpose | Investment return through asset appreciation | Incentivize fund managers to maximize investment gains |

| Regulatory Debate | Standard tax category with established rules | Subject to ongoing legislative and tax code discussions |

Understanding Capital Gains: Definition and Types

Capital gains represent the profit realized from the sale of an asset, such as stocks, real estate, or businesses, and are typically categorized into short-term and long-term gains based on the holding period. Long-term capital gains, derived from assets held for more than one year, often benefit from lower tax rates compared to short-term gains, which are taxed as ordinary income. Understanding the distinction between these types is crucial for effective wealth management and optimizing tax strategies.

What is Carried Interest?

Carried interest is a share of the profits that investment fund managers receive as compensation, typically amounting to around 20% of the fund's gains, incentivizing performance without an upfront salary. Unlike ordinary income, carried interest is taxed at the lower long-term capital gains rate, often 20%, which creates tax efficiency for fund managers. This mechanism aligns the interests of fund managers with investors by rewarding successful investments and wealth creation.

Key Differences Between Capital Gains and Carried Interest

Capital gains represent the profit earned from the sale of an asset held for investment, typically taxed at favorable long-term rates, whereas carried interest is the share of profits allocated to fund managers as compensation, often taxed at capital gains rates despite being income. Capital gains apply to various asset classes like stocks, real estate, and bonds, while carried interest specifically pertains to private equity and hedge fund managers' earnings. The key difference lies in the nature and source of income: capital gains arise from asset appreciation, whereas carried interest is derived from fund management performance fees.

Tax Implications: Capital Gains vs Carried Interest

Capital gains are typically taxed at long-term capital gains rates, which are lower than ordinary income tax rates, providing significant tax advantages for investors holding assets over one year. Carried interest, earned by investment fund managers, is often taxed as capital gains rather than ordinary income, allowing managers to benefit from reduced tax rates despite this income stemming from services rendered. Recent legislative proposals aim to reclassify carried interest as ordinary income to increase tax revenue and close perceived loopholes in the wealth management sector.

Historical Background of Carried Interest

Carried interest originated in the 19th century within maritime trade, where ship captains and investors shared profits after expenses. This concept evolved into modern private equity and hedge funds, allowing fund managers to receive a share of investment gains as compensation. The historical background of carried interest highlights its role in aligning incentives between managers and investors, distinguishing it from standard capital gains taxation.

How Investors Benefit from Capital Gains

Investors benefit from capital gains through the appreciation of asset values, allowing them to realize profits upon sale at higher prices than their initial investments. These gains are often taxed at favorable long-term capital gains rates, enhancing after-tax returns compared to ordinary income. The leverage of market growth and strategic asset allocation maximizes wealth accumulation over time, making capital gains a cornerstone of investor wealth-building strategies.

Carried Interest in Private Equity and Hedge Funds

Carried interest represents the share of profits that general partners in private equity and hedge funds earn beyond their initial investment, typically around 20% of the fund's gains. This incentivizes fund managers to maximize returns, as carried interest is often taxed at favorable long-term capital gains rates rather than ordinary income rates. Understanding the tax treatment of carried interest is crucial for high-net-worth investors and fund managers optimizing wealth accumulation strategies.

Policy Debates: Calls for Reform

Capital gains tax rates and carried interest taxation remain central in wealth policy debates due to their implications for income inequality and tax fairness. Lawmakers and economists argue for reforming carried interest rules, highlighting that profits fund managers earn are often taxed at lower capital gains rates rather than higher ordinary income rates, reducing tax revenue. Proposals include aligning carried interest taxation more closely with ordinary income to address perceived loopholes and ensure the wealthy contribute equitably.

Impact on Wealth Accumulation

Capital gains provide investors with a tax-advantaged method to grow wealth through appreciation of assets held over time, often taxed at lower rates than ordinary income. Carried interest allows fund managers to earn a share of investment profits, typically taxed as capital gains, accelerating wealth accumulation by incentivizing performance. The differential tax treatment between these income types significantly influences strategies for maximizing long-term wealth growth in investment portfolios.

Future Outlook: Capital Gains and Carried Interest

Capital gains are expected to remain a key driver of wealth accumulation, benefiting from favorable tax policies and robust equity markets. Carried interest continues to attract scrutiny, with potential tax reforms aimed at aligning its treatment closer to ordinary income, which could impact private equity and hedge fund incentives. Investors should monitor legislative changes and market trends to optimize strategies for maximizing after-tax returns in both capital gains and carried interest opportunities.

Important Terms

Tax arbitrage

Tax arbitrage exploits differences in tax treatment between capital gains, usually taxed at preferential rates around 20%, and carried interest, which private equity and hedge fund managers may receive as compensation taxed similarly as capital gains rather than ordinary income rates up to 37%. This strategy leverages regulatory distinctions to minimize overall tax liabilities by classifying carried interest income as capital gains instead of higher-taxed ordinary income.

Performance fee

Performance fees in investment funds are typically structured as carried interest, representing a share of capital gains earned by fund managers beyond a predefined hurdle rate. Unlike standard capital gains taxed at investor rates, carried interest often enjoys favorable tax treatment, aligning manager incentives with fund performance outcomes.

Long-term holding period

Long-term holding periods typically exceed one year, resulting in favorable capital gains tax rates for asset appreciation, whereas carried interest allows fund managers to benefit from investment profits taxed as long-term capital gains despite shorter actual holding durations. This tax treatment incentivizes private equity and hedge fund managers by aligning earnings with long-term investment performance rather than ordinary income rates.

Qualified dividends

Qualified dividends are taxed at preferential long-term capital gains rates, typically ranging from 0% to 20%, aligning with long-term capital gains treatment rather than ordinary income rates. Unlike carried interest, which is taxed as long-term capital gains if held over one year but subject to specific IRS regulations, qualified dividends must meet specific holding period requirements and come from U.S. corporations or qualified foreign companies.

Limited partnership

Limited partnerships often structure carried interest as a share of profit rather than a capital gain, enabling fund managers to benefit from preferential long-term capital gains tax rates. The distinction between capital gains and carried interest is critical for tax optimization, as carried interest is typically taxed at lower rates than ordinary income despite representing compensation for services.

Two-and-twenty

Two-and-twenty refers to the common hedge fund fee structure charging 2% management fees and 20% performance fees, where carried interest represents the 20% share of profits taxed at capital gains rates, benefiting fund managers. This tax treatment on carried interest contrasts with ordinary income tax rates, sparking debate on fairness and tax policy in private equity and hedge fund compensation.

Preferential tax rate

Preferential tax rates apply to long-term capital gains, typically taxed at 0%, 15%, or 20% depending on income levels, while carried interest, treated as a capital gain rather than ordinary income, allows fund managers to benefit from these lower rates on their performance fees. This tax treatment incentivizes private equity and hedge fund managers by reducing their tax burden compared to the higher ordinary income tax rates.

Realization event

Realization events trigger the conversion of unrealized gains into taxable income, with capital gains typically taxed at favorable rates compared to ordinary income. Carried interest, often classified as capital gains from profit-sharing in private equity or hedge funds, faces scrutiny as tax authorities debate its treatment between capital gains and ordinary income taxation.

Investment return waterfall

Investment return waterfalls outline the distribution hierarchy between limited partners and general partners, prioritizing capital gains realization before carried interest allocation, which incentivizes fund managers by allowing them to earn a share of profits exceeding a predefined hurdle rate. Capital gains enhance the overall fund value, while carried interest serves as the performance fee tied to these gains, aligning manager compensation with investment success.

Passive investment income

Passive investment income includes earnings from capital gains, which are profits realized from the sale of assets like stocks or real estate held for investment purposes. Carried interest represents a share of profits earned by investment fund managers, often taxed at favorable capital gains rates, despite being compensation for services.

Capital gains vs carried interest Infographic

moneydif.com

moneydif.com