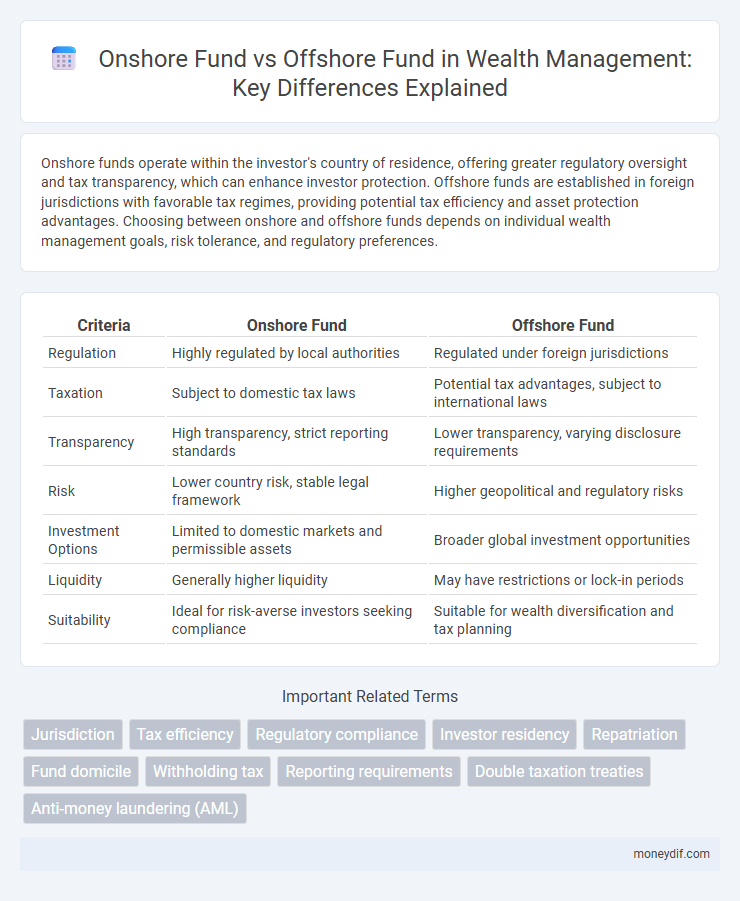

Onshore funds operate within the investor's country of residence, offering greater regulatory oversight and tax transparency, which can enhance investor protection. Offshore funds are established in foreign jurisdictions with favorable tax regimes, providing potential tax efficiency and asset protection advantages. Choosing between onshore and offshore funds depends on individual wealth management goals, risk tolerance, and regulatory preferences.

Table of Comparison

| Criteria | Onshore Fund | Offshore Fund |

|---|---|---|

| Regulation | Highly regulated by local authorities | Regulated under foreign jurisdictions |

| Taxation | Subject to domestic tax laws | Potential tax advantages, subject to international laws |

| Transparency | High transparency, strict reporting standards | Lower transparency, varying disclosure requirements |

| Risk | Lower country risk, stable legal framework | Higher geopolitical and regulatory risks |

| Investment Options | Limited to domestic markets and permissible assets | Broader global investment opportunities |

| Liquidity | Generally higher liquidity | May have restrictions or lock-in periods |

| Suitability | Ideal for risk-averse investors seeking compliance | Suitable for wealth diversification and tax planning |

Introduction to Onshore and Offshore Funds

Onshore funds are investment vehicles established within the investor's country of residence, subject to local regulations and tax laws, offering greater transparency and regulatory oversight. Offshore funds are domiciled in foreign jurisdictions with favorable tax regimes, designed to provide tax efficiency, asset protection, and access to international markets. Understanding the fundamental distinctions between onshore and offshore funds is crucial for optimizing investment strategies based on regulatory environment, tax implications, and risk tolerance.

Key Differences Between Onshore and Offshore Funds

Onshore funds are regulated within the investor's country, offering greater transparency, tax obligations aligned with local laws, and easier access to legal recourse, whereas offshore funds operate in foreign jurisdictions that provide tax advantages, confidentiality, and flexible regulatory environments. Onshore funds typically appeal to domestic investors seeking compliance with national financial regulations, while offshore funds attract those looking for asset protection, international diversification, and potential tax optimization. The choice between onshore and offshore funds hinges on factors such as regulatory preferences, tax implications, investor residency, and risk tolerance.

Regulatory Framework: Onshore vs Offshore

Onshore funds operate under stringent regulatory frameworks established by domestic authorities, ensuring transparency, investor protection, and compliance with local laws such as the Securities Act in the US or FCA guidelines in the UK. Offshore funds benefit from more flexible regulatory environments often designed to attract international capital through tax efficiency and reduced reporting requirements, but this can lead to varying degrees of investor protection and increased scrutiny from global regulatory bodies like the FATF. The choice between onshore and offshore funds depends on balancing regulatory oversight with investment objectives, risk tolerance, and jurisdiction-specific legal considerations.

Tax Implications for Investors

Onshore funds typically offer greater tax transparency, allowing investors to benefit from favorable domestic tax treatments and avoidance of foreign tax complexities. Offshore funds often provide tax deferral advantages and potential exposure to lower tax rates, but investors may face reporting requirements and risks of double taxation depending on their home country's regulations. Choosing between onshore and offshore funds requires careful evaluation of individual tax residency, compliance obligations, and long-term investment strategies to optimize after-tax returns.

Accessibility and Investor Eligibility

Onshore funds offer greater accessibility to domestic investors due to local regulations and compliance with national securities laws, often requiring lower minimum investments and simpler eligibility criteria. Offshore funds, while providing broader global investment opportunities and potential tax advantages, frequently impose stricter investor eligibility requirements such as accredited or high-net-worth status and higher minimum investment thresholds. Accessibility differences impact investor choice significantly, with onshore funds appealing to a wider retail investor base and offshore funds catering mostly to institutional or wealthy individuals seeking international diversification.

Reporting and Disclosure Requirements

Onshore funds are subject to stringent reporting and disclosure requirements mandated by local regulators, ensuring transparency and investor protection through detailed financial statements and periodic filings. Offshore funds often benefit from more lenient disclosure obligations, which can result in less transparency but provide investors with privacy and potential tax advantages. Regulatory jurisdictions like the Cayman Islands or Luxembourg prioritize confidentiality, whereas jurisdictions such as the United States or the United Kingdom enforce rigorous compliance with securities laws and investor reporting standards.

Risk and Compliance Factors

Onshore funds typically offer greater regulatory oversight and compliance with stringent local laws, reducing risks related to transparency and investor protection. Offshore funds, while often providing tax efficiency and privacy benefits, carry higher risks due to less rigorous regulatory frameworks and potential exposure to changes in international compliance standards. Investors must weigh onshore compliance stability against offshore flexibility when assessing risk profiles in wealth management strategies.

Advantages of Onshore Funds

Onshore funds offer enhanced regulatory oversight and investor protection due to strict compliance with local financial laws and transparent reporting standards. They provide easier access to legal recourse and tax benefits aligned with domestic regulations, ensuring better alignment with investors' home country financial goals. Onshore funds also tend to facilitate greater liquidity and simpler administrative processes, making them attractive for individual and institutional investors prioritizing security and stability.

Benefits of Offshore Fund Structures

Offshore fund structures offer significant tax advantages, including reduced or deferred tax liabilities, which enhance overall investment returns. They provide increased confidentiality and asset protection due to robust legal frameworks in jurisdictions like the Cayman Islands or Bermuda. Additionally, offshore funds facilitate global diversification and access to international markets, appealing to high-net-worth investors seeking to optimize portfolio growth and risk management.

Choosing the Right Fund for Wealth Management

Selecting the right fund for wealth management requires understanding the key differences between onshore and offshore funds, including tax implications, regulatory environments, and asset protection benefits. Onshore funds often provide greater transparency and regulatory oversight, making them suitable for investors prioritizing security and local tax compliance. Offshore funds offer potential advantages in diversification, tax efficiency, and access to international markets, appealing to high-net-worth individuals seeking global opportunities and privacy.

Important Terms

Jurisdiction

Jurisdiction determines regulatory frameworks and tax obligations distinguishing onshore funds, typically operating within domestic legal systems with stringent compliance and transparency requirements, from offshore funds, which are established in low-tax or tax-neutral jurisdictions offering greater confidentiality and flexibility. Onshore funds benefit from investor protections aligned with local laws, while offshore funds appeal to international investors seeking tax efficiency and asset protection under more lenient regulatory environments.

Tax efficiency

Onshore funds typically offer higher tax transparency and favorable treatment under domestic tax laws, enhancing tax efficiency for local investors through reduced withholding taxes and access to tax treaties. Offshore funds may provide tax deferral and asset protection benefits but often face higher taxation on distributions and stricter regulatory scrutiny, impacting overall tax efficiency.

Regulatory compliance

Regulatory compliance for onshore funds involves adhering to stringent domestic laws, including SEC regulations, tax reporting, and investor disclosures, ensuring transparency and investor protection. Offshore funds face complex compliance challenges such as international anti-money laundering laws, offshore tax regulations, and varying jurisdictional requirements, which necessitate specialized legal frameworks to mitigate risk and avoid penalties.

Investor residency

Investor residency significantly influences tax implications and regulatory compliance for onshore funds, which are domiciled within the investor's home country, offering greater transparency and access to local legal protections. Offshore funds, typically established in tax-neutral jurisdictions, provide residency investors with potential tax efficiency and privacy benefits but face increased scrutiny under global anti-money laundering and tax reporting standards.

Repatriation

Repatriation of profits from offshore funds to onshore funds involves navigating complex tax regulations and foreign exchange controls to maximize returns and compliance. Efficient repatriation strategies prioritize minimizing withholding taxes, adhering to international tax treaties, and optimizing currency conversion processes to enhance capital flow between jurisdictions.

Fund domicile

Fund domicile significantly impacts regulatory environment, taxation, and investor protection, with onshore funds typically domiciled in countries like the U.S., U.K., or Germany, offering stricter compliance and transparency; offshore funds, located in jurisdictions such as the Cayman Islands, Bermuda, or Luxembourg, provide benefits like tax efficiency, confidentiality, and lighter regulatory frameworks. Selection of domicile influences fund structure, investor eligibility, reporting requirements, and cross-border distribution strategies, making domicile a key consideration in fund formation and investment decisions.

Withholding tax

Withholding tax on onshore funds is typically subject to domestic tax regulations, resulting in automatic deduction at source on dividends and interest payments, whereas offshore funds often benefit from reduced or zero withholding tax rates due to tax treaties and favorable jurisdictional policies. Understanding the specific tax treaties and compliance requirements between the investor's country and the fund's location is essential to optimize net returns and avoid double taxation.

Reporting requirements

Onshore funds are subject to stricter reporting requirements, including detailed disclosures to local regulatory authorities such as the SEC in the United States, ensuring transparency and investor protection; offshore funds often benefit from reduced reporting obligations under jurisdictions like the Cayman Islands or Bermuda, focusing primarily on anti-money laundering and tax compliance. These regulatory differences impact investor transparency and fund administration complexity, with onshore funds typically providing more comprehensive periodic reports compared to the streamlined filing processes offshore funds utilize.

Double taxation treaties

Double taxation treaties reduce tax liabilities for investors in onshore funds by allowing credit or exemption for taxes paid abroad, enhancing cross-border investment efficiency. Offshore funds, however, may benefit from tax neutrality under these treaties but often face limited treaty protections compared to onshore structures, influencing fund domicile decisions and investor tax planning.

Anti-money laundering (AML)

Anti-money laundering (AML) regulations enforce stringent transparency and reporting requirements on onshore funds, ensuring comprehensive oversight and reducing risks of illicit financial flows. Offshore funds often face increased scrutiny due to their jurisdictions' varying AML standards, making enhanced due diligence essential to mitigate potential money laundering threats.

Onshore fund vs Offshore fund Infographic

moneydif.com

moneydif.com