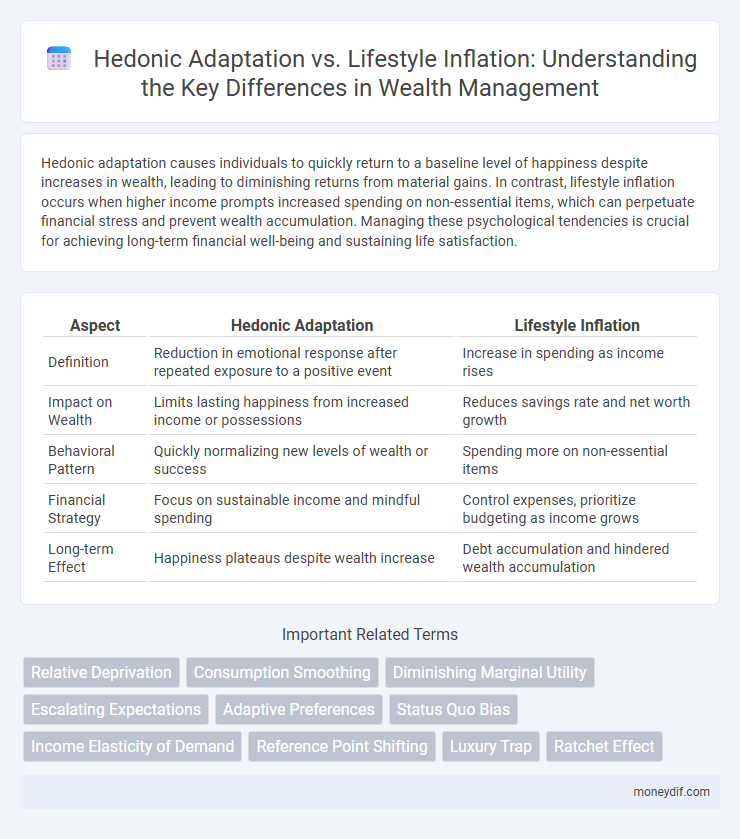

Hedonic adaptation causes individuals to quickly return to a baseline level of happiness despite increases in wealth, leading to diminishing returns from material gains. In contrast, lifestyle inflation occurs when higher income prompts increased spending on non-essential items, which can perpetuate financial stress and prevent wealth accumulation. Managing these psychological tendencies is crucial for achieving long-term financial well-being and sustaining life satisfaction.

Table of Comparison

| Aspect | Hedonic Adaptation | Lifestyle Inflation |

|---|---|---|

| Definition | Reduction in emotional response after repeated exposure to a positive event | Increase in spending as income rises |

| Impact on Wealth | Limits lasting happiness from increased income or possessions | Reduces savings rate and net worth growth |

| Behavioral Pattern | Quickly normalizing new levels of wealth or success | Spending more on non-essential items |

| Financial Strategy | Focus on sustainable income and mindful spending | Control expenses, prioritize budgeting as income grows |

| Long-term Effect | Happiness plateaus despite wealth increase | Debt accumulation and hindered wealth accumulation |

Understanding Hedonic Adaptation: The Science of Satisfaction

Hedonic adaptation refers to the psychological phenomenon where individuals quickly return to a baseline level of happiness after positive or negative changes in wealth or lifestyle. This process explains why accumulated wealth often fails to produce lasting satisfaction, as people rapidly adjust their expectations and desires. Understanding hedonic adaptation helps in managing lifestyle inflation by highlighting the importance of mindful spending and focusing on experiences rather than material gains for sustained happiness.

What Is Lifestyle Inflation? How Your Spending Grows

Lifestyle inflation occurs when increased income leads to higher spending on non-essential items, causing expenses to rise proportionally with earnings. This phenomenon often undermines wealth growth because the extra income is consumed rather than saved or invested. Unlike hedonic adaptation, which is the diminishing satisfaction from repeated pleasures, lifestyle inflation directly expands financial obligations and reduces potential savings.

The Psychological Roots of Hedonic Adaptation

Hedonic adaptation stems from the brain's tendency to normalize positive changes in wealth, causing diminished emotional returns over time despite increased income or lifestyle upgrades. Psychological mechanisms like baseline happiness levels and dopamine regulation contribute to this phenomenon, making initial financial gains feel less rewarding as they become routine. Understanding these intrinsic processes aids in managing expectations and promoting sustainable wealth satisfaction beyond transient luxury consumption.

Comparing Hedonic Adaptation and Lifestyle Inflation

Hedonic adaptation describes the tendency of individuals to quickly return to a stable level of happiness despite significant positive or negative changes in wealth, leading to diminished long-term satisfaction from increased income. Lifestyle inflation occurs when rising income triggers higher spending on luxury goods and services, offsetting potential gains in savings and wealth accumulation. Comparing these concepts reveals that while hedonic adaptation affects emotional responses to wealth changes, lifestyle inflation directly impacts financial behavior and net worth growth over time.

Wealth Trap: How Lifestyle Inflation Erodes Financial Gains

Lifestyle inflation steadily increases spending as income rises, which dilutes wealth accumulation and traps individuals in a cycle of living paycheck to paycheck despite higher earnings. Hedonic adaptation causes temporary satisfaction from new purchases to fade quickly, encouraging more spending to maintain perceived happiness. This combination creates a wealth trap where financial gains are constantly offset by escalating expenses, preventing long-term financial growth.

Breaking the Cycle: Strategies to Combat Hedonic Adaptation

Implementing mindful spending habits and setting clear financial goals effectively counters hedonic adaptation by shifting focus from accumulating possessions to valuing experiences and long-term wealth. Prioritizing savings rate increases over lifestyle inflation ensures sustained financial growth and prevents diminishing returns of material consumption on happiness. Regularly reassessing values and practicing gratitude strengthen resilience against the urge to escalate spending, promoting enduring contentment and improved wealth management.

The Role of Mindfulness in Managing Lifestyle Inflation

Mindfulness plays a crucial role in managing lifestyle inflation by fostering awareness of spending habits and emotional triggers behind consumption. Practicing mindfulness enables individuals to recognize moments of hedonic adaptation, where increased spending no longer brings proportional happiness, thus encouraging intentional financial decisions. Integrating mindfulness techniques can help maintain sustainable wealth growth while enhancing long-term contentment.

Achieving Sustainable Wealth: Balancing Happiness and Spending

Sustainable wealth hinges on managing hedonic adaptation by consciously preventing lifestyle inflation, ensuring spending aligns with long-term financial goals rather than fleeting pleasures. Prioritizing mindful consumption over impulsive upgrades helps maintain happiness without eroding savings or accumulating debt. Balancing emotional satisfaction with disciplined budgeting fosters enduring financial stability and genuine contentment.

Case Studies: Real-Life Examples of Lifestyle Inflation

Case studies highlight how lifestyle inflation often accelerates spending patterns as income rises, leading individuals to increase discretionary expenses such as luxury goods, dining, and travel, which diminishes savings rates despite higher earnings. For example, data from financial diaries reveal that professionals earning over $100,000 per year tend to escalate their housing and vehicle expenditures by 30-50%, offsetting income gains through amplified consumption. Contrastingly, studies of individuals practicing hedonic adaptation show that satisfaction levels stabilize over time, encouraging sustainable spending habits and long-term wealth accumulation.

Building Lasting Wealth: Prioritizing Lasting Fulfillment Over Temporary Pleasures

Hedonic adaptation causes satisfaction from lifestyle upgrades to fade quickly, prompting repeated spending increases without long-term happiness. Lifestyle inflation traps many in escalating expenses, preventing significant wealth accumulation despite rising income. Prioritizing lasting fulfillment involves disciplined saving and investing strategies that build wealth steadily, avoiding fleeting pleasures that undermine financial security.

Important Terms

Relative Deprivation

Relative deprivation occurs when individuals compare their current situation to others or past experiences, feeling worse despite objective improvements, which contrasts with hedonic adaptation where satisfaction returns to a baseline after positive changes; lifestyle inflation complicates this by increasing consumption and expectations, perpetuating feelings of deprivation. Understanding this interplay reveals why escalating desires and social comparisons inhibit long-term happiness despite material gains.

Consumption Smoothing

Consumption smoothing helps individuals maintain stable spending patterns over time despite income fluctuations, mitigating the impact of hedonic adaptation where increasing income leads to diminished satisfaction from consumption. This contrasts with lifestyle inflation, where rising income fuels higher consumption levels, preventing effective consumption smoothing and potentially reducing long-term financial well-being.

Diminishing Marginal Utility

Diminishing marginal utility explains why each additional unit of consumption yields less satisfaction, intensifying the effects of hedonic adaptation as people quickly adjust to new levels of happiness from increased spending. Lifestyle inflation counters this by increasing consumption to sustain utility, yet it often leads to fleeting joy due to the inherent decline in marginal utility over time.

Escalating Expectations

Escalating expectations driven by lifestyle inflation often accelerate hedonic adaptation, causing individuals to quickly return to a baseline level of happiness despite increased consumption. This cycle perpetuates the pursuit of greater material gains, undermining long-term satisfaction and financial well-being.

Adaptive Preferences

Adaptive preferences explain how individuals adjust their desires based on past experiences, often leading to hedonic adaptation where satisfaction diminishes despite increased consumption. This contrasts with lifestyle inflation, where rising income prompts higher spending, temporarily boosting happiness but ultimately triggering renewed adaptation and stable satisfaction levels.

Status Quo Bias

Status Quo Bias often reinforces Hedonic Adaptation by causing individuals to maintain their current level of consumption despite temporary increases in happiness, while Lifestyle Inflation accelerates the desire for higher spending, counteracting the stability favored by Status Quo Bias. This dynamic creates a psychological tension where the comfort of familiar financial habits competes with the pursuit of enhanced well-being through increased material possessions.

Income Elasticity of Demand

Income elasticity of demand measures how consumer demand for goods changes relative to income variations, revealing that luxury items typically have high income elasticity, while necessities have low elasticity. Hedonic adaptation reduces the impact of income increases on long-term demand as individuals return to baseline happiness, whereas lifestyle inflation drives continual demand growth by increasing consumption with rising income.

Reference Point Shifting

Reference point shifting occurs when individuals adjust their baseline expectations after experiencing lifestyle inflation, diminishing the positive impact of increased consumption. This phenomenon contributes to hedonic adaptation by causing satisfaction to return to baseline despite improved living standards.

Luxury Trap

Luxury trap occurs when individuals continuously elevate their spending to maintain a heightened lifestyle, driven by hedonic adaptation that reduces satisfaction from material gains over time; this cycle fuels lifestyle inflation as increased income leads to proportionally higher expenses, undermining long-term financial stability. Understanding the psychological mechanisms behind hedonic adaptation helps prevent lifestyle inflation, enabling smarter financial decisions and avoiding the pitfalls of the luxury trap.

Ratchet Effect

The Ratchet Effect describes how individuals quickly adjust spending habits upward after income increases, making it difficult to reduce expenses over time. This phenomenon interacts with Hedonic Adaptation, where people rapidly acclimate to new pleasures, and Lifestyle Inflation, as rising income leads to higher consumption without increasing long-term happiness.

Hedonic Adaptation vs Lifestyle Inflation Infographic

moneydif.com

moneydif.com