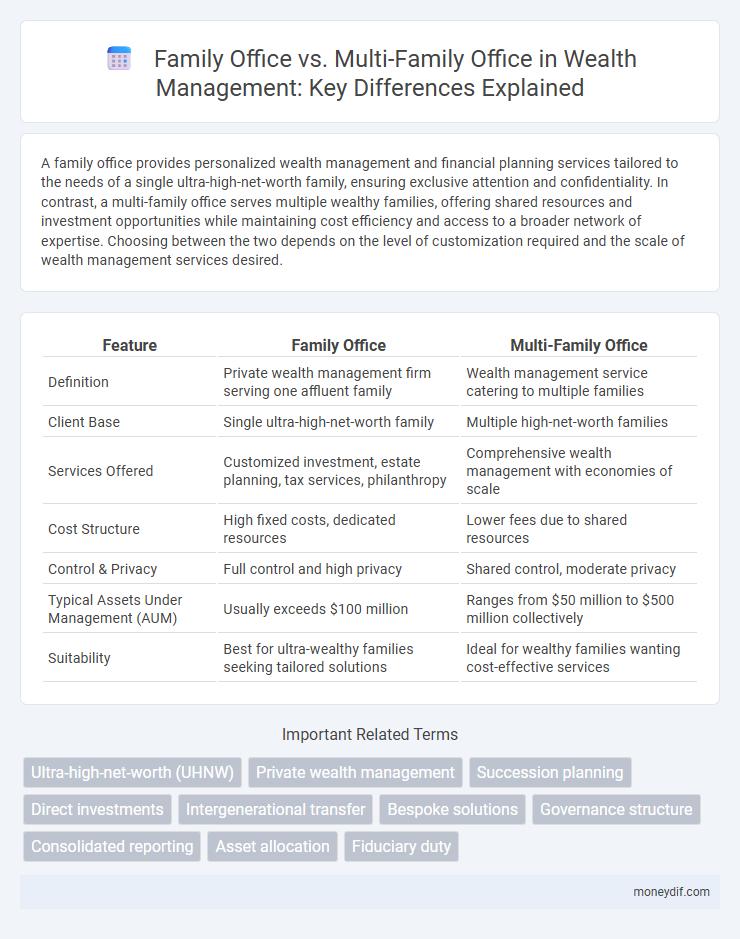

A family office provides personalized wealth management and financial planning services tailored to the needs of a single ultra-high-net-worth family, ensuring exclusive attention and confidentiality. In contrast, a multi-family office serves multiple wealthy families, offering shared resources and investment opportunities while maintaining cost efficiency and access to a broader network of expertise. Choosing between the two depends on the level of customization required and the scale of wealth management services desired.

Table of Comparison

| Feature | Family Office | Multi-Family Office |

|---|---|---|

| Definition | Private wealth management firm serving one affluent family | Wealth management service catering to multiple families |

| Client Base | Single ultra-high-net-worth family | Multiple high-net-worth families |

| Services Offered | Customized investment, estate planning, tax services, philanthropy | Comprehensive wealth management with economies of scale |

| Cost Structure | High fixed costs, dedicated resources | Lower fees due to shared resources |

| Control & Privacy | Full control and high privacy | Shared control, moderate privacy |

| Typical Assets Under Management (AUM) | Usually exceeds $100 million | Ranges from $50 million to $500 million collectively |

| Suitability | Best for ultra-wealthy families seeking tailored solutions | Ideal for wealthy families wanting cost-effective services |

Understanding Family Offices: Definitions and Structures

Family offices are private organizations that manage wealth, investments, and financial planning exclusively for a single affluent family, providing tailored services such as estate planning, tax management, and philanthropy coordination. Multi-family offices extend these personalized services to multiple unrelated families, offering economies of scale, access to broader investment opportunities, and shared administrative resources while maintaining customized strategies for each client. Understanding the distinct structures and service scopes of family offices versus multi-family offices is crucial for high-net-worth individuals seeking bespoke wealth management solutions.

What is a Multi-Family Office? Key Concepts Explained

A Multi-Family Office (MFO) provides comprehensive wealth management services to multiple affluent families, combining investment advisory, estate planning, tax services, and philanthropy support under one roof. Unlike a single-family office, which serves only one family, an MFO leverages shared resources and expertise to deliver cost efficiency, diversified investment opportunities, and tailored financial strategies. Key concepts include centralized governance, risk management, and holistic wealth preservation to address intergenerational wealth transfer and complex family dynamics.

Core Differences: Family Office vs. Multi-Family Office

A family office typically manages the wealth, estate planning, and investment strategies for a single ultra-high-net-worth family, offering highly personalized services tailored to unique family needs. In contrast, a multi-family office serves multiple families, pooling resources to provide cost-effective solutions while maintaining customized financial, tax, and legacy planning. The core difference lies in service exclusivity, with family offices focusing on individualized control versus multi-family offices emphasizing shared expertise and operational efficiencies.

Wealth Management Services: Comparing Offerings

Family offices provide tailored wealth management services exclusively for a single ultra-high-net-worth family, offering personalized investment strategies, estate planning, tax optimization, and concierge services. Multi-family offices serve multiple wealthy families, leveraging economies of scale to deliver a broader range of services like pooled investment opportunities, risk management, and cost-efficient administration. Both models emphasize holistic financial planning but differ in customization level, service scope, and operational structure.

Cost Analysis: Private Family Office vs. Shared Solutions

Private family offices typically incur higher costs due to dedicated staff, tailored services, and exclusive resource allocation, often surpassing $1 million annually for ultra-high-net-worth families. Multi-family offices offer cost efficiencies by distributing expenses across multiple clients, lowering fees through shared infrastructure and pooled investment opportunities, often reducing annual expenses to a fraction of single-family offices. Evaluating cost structures requires balancing personalized control in private offices against the affordability and diversified expertise found in multi-family office solutions.

Privacy and Control: Balancing Autonomy and Collaboration

Family offices offer high levels of privacy and control by managing a single family's wealth with tailored strategies, ensuring confidentiality and autonomous decision-making. Multi-family offices balance collaboration and resource sharing while maintaining privacy through structured governance and customized access controls. Choosing between them depends on the desired degree of autonomy versus the benefits of shared expertise and cost-efficiency.

Customization and Personalization: Who Does It Better?

Family offices offer highly tailored wealth management services, focusing exclusively on the unique needs and goals of a single high-net-worth family, ensuring deep personalization and bespoke investment strategies. Multi-family offices serve multiple families, providing cost-efficient access to professional expertise and a broader range of services while maintaining a level of customization through adaptable frameworks. When it comes to prioritizing customization and personalization, single-family offices generally outperform multi-family offices by delivering more exclusive, client-centric solutions aligned with the family's legacy and complex financial requirements.

Governance and Succession Planning: Unique Approaches

Family offices typically concentrate on personalized governance structures tailored to a single family's values and long-term vision, ensuring clear succession planning aligned with the family legacy. Multi-family offices implement standardized governance frameworks that incorporate best practices across diverse client families, facilitating collective knowledge sharing and risk management. Succession planning in multi-family offices often includes professional management transitions supported by external advisors, while single-family offices emphasize direct family involvement and customized training programs for heirs.

Choosing the Right Model: Factors Wealthy Families Must Consider

Choosing between a family office and a multi-family office hinges on factors such as the size of the family's wealth, complexity of financial needs, and desired level of control over investments. Single-family offices provide tailored, comprehensive services exclusive to one family, ideal for ultra-high-net-worth households seeking customization and privacy. Multi-family offices offer cost efficiencies, shared resources, and access to diverse expertise, making them suitable for affluent families aiming for professional management without the operational burden of a dedicated office.

Future Trends: Evolution of Family and Multi-Family Offices

Family offices are evolving by integrating advanced technology like AI-driven investment analytics and enhanced cybersecurity, optimizing wealth preservation and growth strategies for ultra-high-net-worth families. Multi-family offices are expanding their service offerings, incorporating ESG investing and personalized financial planning to meet the diverse needs of multiple client families while reducing operational costs. Future trends indicate a shift towards hybrid models leveraging digital platforms to improve transparency, collaboration, and tailored advisory services across both family office types.

Important Terms

Ultra-high-net-worth (UHNW)

Ultra-high-net-worth (UHNW) individuals often choose between family offices and multi-family offices to manage their complex wealth, with family offices offering highly personalized services tailored to a single family, while multi-family offices provide diversified expertise and cost efficiencies by serving multiple wealthy families. Both structures specialize in investment management, estate planning, tax strategies, and philanthropic advisory, but multi-family offices typically leverage broader resources and technology platforms that can benefit UHNW clients seeking collaborative opportunities and scalable service models.

Private wealth management

Private wealth management involves tailored financial services focusing on asset preservation, tax planning, and investment strategies for high-net-worth families. Family offices provide exclusive, customized support to a single affluent family, while multi-family offices serve multiple families by sharing resources and expertise to optimize wealth management solutions.

Succession planning

Succession planning in a family office focuses on preserving wealth, governance, and values within a single family, while multi-family offices offer structured strategies to manage complex inter-family dynamics and diversified asset transfers. Effective succession planning in both models ensures continuity, minimizes tax liabilities, and aligns long-term financial goals across generations.

Direct investments

Direct investments in a family office often involve personalized, high-conviction opportunities tailored to the specific wealth and values of the family, emphasizing control and long-term growth. Multi-family offices aggregate capital from multiple families, providing diversified direct investment access with professional management, risk mitigation, and scalability benefits.

Intergenerational transfer

Intergenerational transfer in family offices focuses on preserving wealth and values across generations through customized estate planning, tax strategies, and governance structures, ensuring seamless succession. Multi-family offices leverage shared resources and expertise to manage complex transfers for multiple families, optimizing costs and fostering collaborative investment opportunities.

Bespoke solutions

Bespoke solutions in family offices focus on personalized wealth management services tailored to the unique financial goals and legacy planning of a single family, contrasting with multi-family offices that offer scalable, shared services across multiple families while maintaining a high degree of customization. Family offices emphasize deep, exclusive engagement with comprehensive estate, tax, and investment strategies, whereas multi-family offices balance cost efficiency with the flexibility to address diverse client needs through pooled resources.

Governance structure

A family office typically operates with a centralized governance structure tailored to a single family's wealth management, focusing on personalized investment strategies, estate planning, and legacy preservation. In contrast, a multi-family office employs a more complex governance framework designed to serve multiple families, integrating diverse financial interests with standardized compliance, risk management, and shared administrative resources.

Consolidated reporting

Consolidated reporting in family offices integrates financial data across multiple entities to provide a unified view essential for effective wealth management, while multi-family offices extend this service by offering consolidated reporting for multiple families, enabling comparative analysis and streamlined decision-making. Utilizing advanced reporting platforms, both setups enhance transparency, risk assessment, and portfolio optimization tailored to their respective client structures.

Asset allocation

Asset allocation in a family office typically focuses on personalized strategies tailored to the unique risk tolerance, liquidity needs, and generational goals of a single wealthy family, emphasizing direct investments and alternative assets. In contrast, multi-family offices leverage pooled resources to diversify portfolios across multiple families, providing access to broader investment opportunities and cost efficiencies while maintaining customized allocation frameworks.

Fiduciary duty

Fiduciary duty in a family office involves the obligation to act in the best financial interests of a single ultra-high-net-worth family, ensuring personalized wealth management and asset protection. In contrast, a multi-family office extends fiduciary responsibilities across multiple families, requiring robust conflict-of-interest policies and tailored strategies to serve diverse client needs while maintaining confidentiality and trust.

Family office vs Multi-family office Infographic

moneydif.com

moneydif.com