Assets represent everything of value owned by an individual or business, including cash, investments, property, and equipment. Equity signifies the residual interest in those assets after liabilities are deducted, reflecting true ownership or net worth. Understanding the difference between assets and equity is crucial for accurately assessing financial health and making informed wealth management decisions.

Table of Comparison

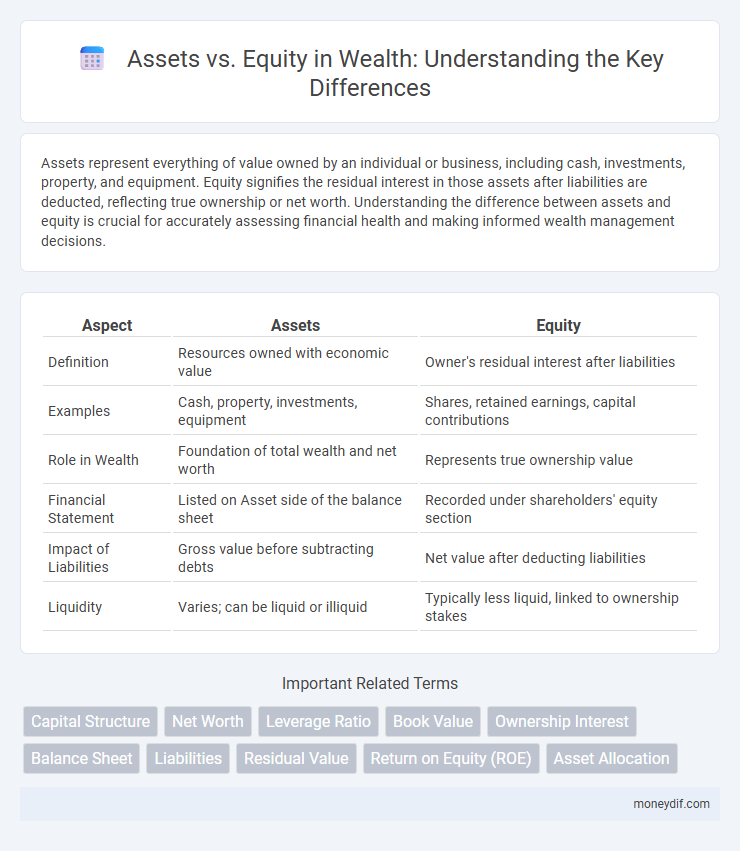

| Aspect | Assets | Equity |

|---|---|---|

| Definition | Resources owned with economic value | Owner's residual interest after liabilities |

| Examples | Cash, property, investments, equipment | Shares, retained earnings, capital contributions |

| Role in Wealth | Foundation of total wealth and net worth | Represents true ownership value |

| Financial Statement | Listed on Asset side of the balance sheet | Recorded under shareholders' equity section |

| Impact of Liabilities | Gross value before subtracting debts | Net value after deducting liabilities |

| Liquidity | Varies; can be liquid or illiquid | Typically less liquid, linked to ownership stakes |

Understanding Assets and Equity

Assets represent the total resources owned by an individual or entity, including cash, investments, property, and other valuable possessions. Equity reflects the residual interest after liabilities are subtracted from total assets, indicating the true net worth or ownership value. Understanding the distinction between assets and equity is crucial for assessing financial health and making informed wealth management decisions.

Key Differences Between Assets and Equity

Assets represent the total resources owned by an individual or company that hold economic value, including cash, property, inventory, and investments. Equity refers to the owner's residual interest in the assets after deducting liabilities, essentially reflecting net worth or ownership stake. Understanding the distinction is crucial for financial analysis, where assets indicate overall resources, and equity signifies the true value attributable to shareholders or owners.

Types of Assets: Tangible and Intangible

Tangible assets include physical items such as real estate, machinery, and inventory, which provide measurable value and can be used as collateral for loans. Intangible assets encompass non-physical resources like patents, trademarks, copyrights, and goodwill, contributing significantly to a company's market value without a physical form. Understanding the distinction between tangible and intangible assets is crucial for accurate asset valuation and equity assessment in wealth management.

The Role of Equity in Wealth Building

Equity represents ownership value in assets such as real estate or businesses and plays a crucial role in wealth building by providing a foundation for financial growth and stability. As asset values increase, equity grows, enabling individuals to leverage it for loans or reinvestments, thereby amplifying wealth accumulation. Monitoring equity levels helps manage risks and maximize returns within a diversified investment strategy.

How Assets Impact Net Worth

Assets directly influence net worth by representing the total value of owned resources, including cash, investments, property, and other valuables. Equity, defined as the difference between assets and liabilities, quantifies net worth by subtracting debts from these asset values. Increasing assets without accruing proportional liabilities enhances equity, thereby improving overall financial health and wealth accumulation.

Equity Ownership: What It Means

Equity ownership represents the portion of assets an individual or entity truly owns after all liabilities are deducted, reflecting real financial stake in a property or business. It signifies control and value accumulation potential, often increasing as assets appreciate or debt decreases. Understanding equity ownership is crucial for evaluating net worth and making informed investment decisions.

Valuing Assets vs. Measuring Equity

Valuing assets involves determining the current market worth of tangible and intangible resources owned by an individual or business, which forms the foundation of assessing overall wealth. Measuring equity, on the other hand, calculates the residual interest after liabilities are subtracted from total assets, revealing true net worth and financial stability. Accurate asset valuation combined with precise equity measurement enables informed decision-making in investment, lending, and wealth management strategies.

Growing Wealth: Asset Accumulation vs. Equity Expansion

Growing wealth involves balancing asset accumulation, which refers to acquiring valuable resources like real estate, stocks, and savings, with equity expansion, the increase in ownership value within those assets. Asset accumulation builds the foundation for financial stability, while equity expansion enhances net worth by increasing the proportion of ownership free from debt. Focusing on both strategies ensures sustainable wealth growth by combining tangible resource acquisition with the rising value of individual investments.

Risks and Rewards: Assets Compared to Equity

Assets provide tangible value and diversify an investment portfolio, reducing overall risk exposure, but they may generate lower returns compared to equity. Equity represents ownership in a company, offering higher potential rewards through capital appreciation and dividends, yet it carries increased volatility and market risks. Balancing assets and equity is crucial for optimizing wealth growth while managing financial uncertainties.

Creating a Balanced Wealth Portfolio

Building a balanced wealth portfolio requires understanding the distinction between assets and equity, where assets represent valuable resources owned, such as real estate, stocks, and cash, while equity refers to the owner's stake in those assets after liabilities are deducted. Diversifying across different asset classes, including fixed income, equities, and alternative investments, helps manage risk and optimize returns. Consistently rebalancing the portfolio to maintain strategic asset allocation aligns with individual financial goals and market conditions.

Important Terms

Capital Structure

Capital structure balances a company's assets financed through equity and debt to optimize financial stability and growth potential.

Net Worth

Net worth represents the difference between total assets and total liabilities, reflecting the owner's equity in a business or individual's financial position.

Leverage Ratio

The Leverage Ratio measures the proportion of a company's total assets financed by equity, indicating financial stability and risk exposure. A higher leverage ratio signifies greater reliance on debt relative to equity, impacting the firm's ability to absorb losses.

Book Value

Book value represents a company's net asset value calculated by subtracting total liabilities from total assets, reflecting the equity available to shareholders.

Ownership Interest

Ownership interest represents a shareholder's equity stake in a company's assets after deducting liabilities, reflecting their residual claim on net assets.

Balance Sheet

A balance sheet presents a company's financial position by detailing assets, liabilities, and equity, where assets reflect resources controlled and equity represents owners' residual interest after liabilities. The fundamental accounting equation, Assets = Liabilities + Equity, ensures balance, highlighting the relationship between what a company owns and owes versus shareholder value.

Liabilities

Liabilities represent financial obligations that, combined with equity, fully finance a company's assets according to the accounting equation: Assets = Liabilities + Equity.

Residual Value

Residual value represents the estimated amount an asset is expected to recover at the end of its useful life, impacting both the asset's book value and the owner's equity in financial statements.

Return on Equity (ROE)

Return on Equity (ROE) measures a company's profitability by comparing net income to shareholders' equity, reflecting how effectively assets financed by equity generate earnings.

Asset Allocation

Asset allocation strategically balances investments between assets such as bonds and cash versus equity stocks to optimize portfolio risk and return.

assets vs equity Infographic

moneydif.com

moneydif.com