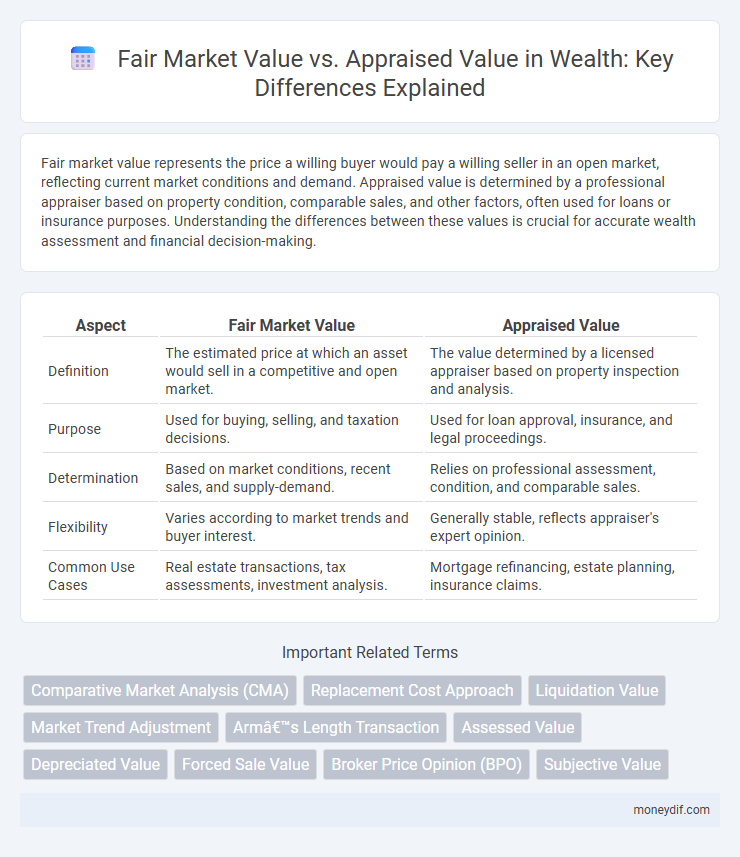

Fair market value represents the price a willing buyer would pay a willing seller in an open market, reflecting current market conditions and demand. Appraised value is determined by a professional appraiser based on property condition, comparable sales, and other factors, often used for loans or insurance purposes. Understanding the differences between these values is crucial for accurate wealth assessment and financial decision-making.

Table of Comparison

| Aspect | Fair Market Value | Appraised Value |

|---|---|---|

| Definition | The estimated price at which an asset would sell in a competitive and open market. | The value determined by a licensed appraiser based on property inspection and analysis. |

| Purpose | Used for buying, selling, and taxation decisions. | Used for loan approval, insurance, and legal proceedings. |

| Determination | Based on market conditions, recent sales, and supply-demand. | Relies on professional assessment, condition, and comparable sales. |

| Flexibility | Varies according to market trends and buyer interest. | Generally stable, reflects appraiser's expert opinion. |

| Common Use Cases | Real estate transactions, tax assessments, investment analysis. | Mortgage refinancing, estate planning, insurance claims. |

Understanding Fair Market Value: A Wealth-Building Perspective

Fair market value represents the estimated price an asset would fetch in an open and competitive market between a willing buyer and seller, reflecting true market conditions. Unlike appraised value, which is a professional estimate often used for taxation or loan purposes, fair market value provides a realistic benchmark for making informed investment decisions and wealth-building strategies. Recognizing the difference helps investors optimize portfolio allocations and maximize returns by aligning asset valuations with current market dynamics.

What Is Appraised Value and How Is It Determined?

Appraised value refers to the professional estimate of a property's worth conducted by a licensed appraiser based on factors such as location, condition, comparable sales, and market trends. It involves a thorough inspection and analysis to provide an unbiased valuation used for mortgage approvals, tax assessments, or sales negotiations. Unlike fair market value, which reflects what a willing buyer would pay in an open market, appraised value is a more structured assessment essential for financial and legal purposes.

Key Differences Between Fair Market Value and Appraised Value

Fair market value represents the estimated price a willing buyer would pay a willing seller in an open and competitive market, reflecting current market conditions. Appraised value is determined by a professional appraiser using specific criteria such as comparable sales, property condition, and location to provide an expert opinion of value. Key differences include fair market value being influenced by market demand and buyer-seller negotiation, while appraised value relies on objective analysis and standardized valuation methods.

The Role of Fair Market Value in Wealth Management

Fair market value represents the estimated price at which an asset would sell in an open and competitive market, reflecting true market conditions and liquidity. It plays a crucial role in wealth management by providing an accurate basis for investment decisions, tax reporting, and portfolio rebalancing. Unlike appraised value, which is often a subjective estimate by an expert, fair market value ensures consistency and transparency in asset valuation.

Why Appraised Value Matters in Investment Decisions

Appraised value provides a professional and objective assessment of a property's worth based on detailed inspections and comparable market data, crucial for accurate investment analysis. Unlike fair market value, which reflects the price a buyer is willing to pay, appraised value helps investors identify potential risks and realistic returns. Relying on appraised value ensures informed decisions, safeguarding against overpayment and enhancing portfolio performance.

How Market Conditions Impact Value Assessments

Fair market value fluctuates based on current market conditions, reflecting the price a willing buyer pays a willing seller in an open market. Appraised value considers recent comparable sales, but may lag during rapidly changing market trends, causing discrepancies between the two valuations. Understanding local economic factors and buyer demand is crucial for accurate wealth assessment and informed investment decisions.

Wealth Planning: Leveraging Value Differences for Your Portfolio

Understanding the distinction between fair market value and appraised value is crucial for effective wealth planning, as fair market value reflects the price a willing buyer would pay in an open market, whereas appraised value is a professional estimate often used for tax assessments or loan approvals. Leveraging these value differences allows investors to optimize portfolio allocation, minimize tax liabilities, and enhance asset diversification strategies. Strategic use of both valuations can help maximize returns and safeguard wealth by aligning investments with current market conditions and long-term financial goals.

Tax Implications: Fair Market Value vs Appraised Value

Fair market value represents the price a willing buyer would pay to a willing seller in an open market, often used by tax authorities to assess property taxes and capital gains. Appraised value, determined by a certified appraiser, provides a professional estimate but may differ significantly from fair market value, affecting tax liabilities and estate planning. Discrepancies between these values can lead to variations in property tax assessments and impact the calculation of taxable income during property sales or inheritance.

Navigating Real Estate Transactions: Which Value Counts?

Fair market value represents the price a willing buyer would pay a willing seller in an open market, reflecting current market conditions, while appraised value is an expert's professional opinion based on property analysis and comparables. In real estate transactions, lenders often rely on appraised value to assess loan risk, but buyers and sellers negotiate based on fair market value to ensure a competitive price. Understanding the distinction between these values is crucial for accurately navigating property sales, financing, and investment decisions.

Maximizing Wealth Through Accurate Value Assessment

Maximizing wealth hinges on accurately distinguishing fair market value, which reflects the price a knowledgeable buyer is willing to pay in an open market, from appraised value, an expert's estimate based on specific criteria and conditions. Relying on precise fair market value assessments ensures realistic asset pricing and optimal investment decisions, minimizing the risk of overvaluation or undervaluation. Incorporating comprehensive appraisals alongside market data enhances strategic asset management, unlocking true financial potential.

Important Terms

Comparative Market Analysis (CMA)

Comparative Market Analysis (CMA) estimates fair market value by analyzing recent sales of similar properties, reflecting current market conditions and buyer demand. Appraised value is determined by a licensed appraiser considering property features, condition, and location, often used for mortgage lending purposes.

Replacement Cost Approach

The Replacement Cost Approach estimates a property's value based on the expense to rebuild using current materials and labor, closely aligning with appraised value rather than fair market value, which reflects what a buyer is willing to pay in an open market. This method is crucial for insurance purposes, ensuring coverage matches the true rebuilding cost, while fair market value incorporates market demand and property condition beyond pure replacement expenses.

Liquidation Value

Liquidation value represents the estimated amount an asset would fetch in a forced sale under quick-sale conditions, typically lower than the fair market value, which assumes a willing buyer and seller in an open market. Appraised value, determined by a professional appraiser, serves as an expert estimate based on market data and condition, usually aligning more closely with fair market value than liquidation value.

Market Trend Adjustment

Market trend adjustment accounts for fluctuations between the appraised value and the current fair market value, reflecting recent sales data and economic conditions. This adjustment ensures property valuations remain accurate and competitive by aligning appraisals with real-time market dynamics.

Arm’s Length Transaction

An arm's length transaction occurs when buyers and sellers act independently without influence, ensuring the price reflects the fair market value, which is the likely sale price in an open market. In contrast, appraised value is an expert estimate based on property characteristics and market conditions, which may differ from actual transaction prices due to subjective adjustments or market fluctuations.

Assessed Value

Assessed value is a property value determined by local tax authorities primarily for taxation purposes, often calculated as a percentage of the fair market value, which reflects the price a willing buyer would pay a willing seller under normal conditions. Appraised value, established by a licensed appraiser, provides a professional estimate based on property condition, comparable sales, and market trends and may differ from both assessed and fair market values.

Depreciated Value

Depreciated value reflects the reduction in an asset's worth over time due to wear, age, or obsolescence, differing from fair market value, which represents the price a willing buyer would pay in an open market. Appraised value is determined by a professional appraiser based on factors such as condition, comparables, and location, and may not always align with the asset's depreciated or fair market values.

Forced Sale Value

Forced Sale Value typically falls below Fair Market Value and Appraised Value due to the urgency and restricted buyer pool in distressed sales, reflecting the likely price achievable under compulsion. While Fair Market Value represents the price a willing buyer and seller agree upon under normal conditions, and Appraised Value estimates worth based on comparable sales and property characteristics, Forced Sale Value accounts for time constraints and market pressure impacting sale proceeds.

Broker Price Opinion (BPO)

Broker Price Opinion (BPO) estimates the fair market value of a property based on current market trends and comparable sales, often utilized by lenders for quick property assessments. Unlike an appraised value determined by a licensed appraiser through a comprehensive inspection, BPOs offer a cost-effective, timely alternative but may lack the detailed accuracy required for formal lending decisions.

Subjective Value

Subjective value varies based on individual perception and personal circumstances, contrasting with fair market value which represents the price a willing buyer and seller agree upon under normal conditions. Appraised value, determined by a professional appraiser using standardized methods, often serves as an objective estimate to guide transactions and financing decisions.

Fair market value vs Appraised value Infographic

moneydif.com

moneydif.com