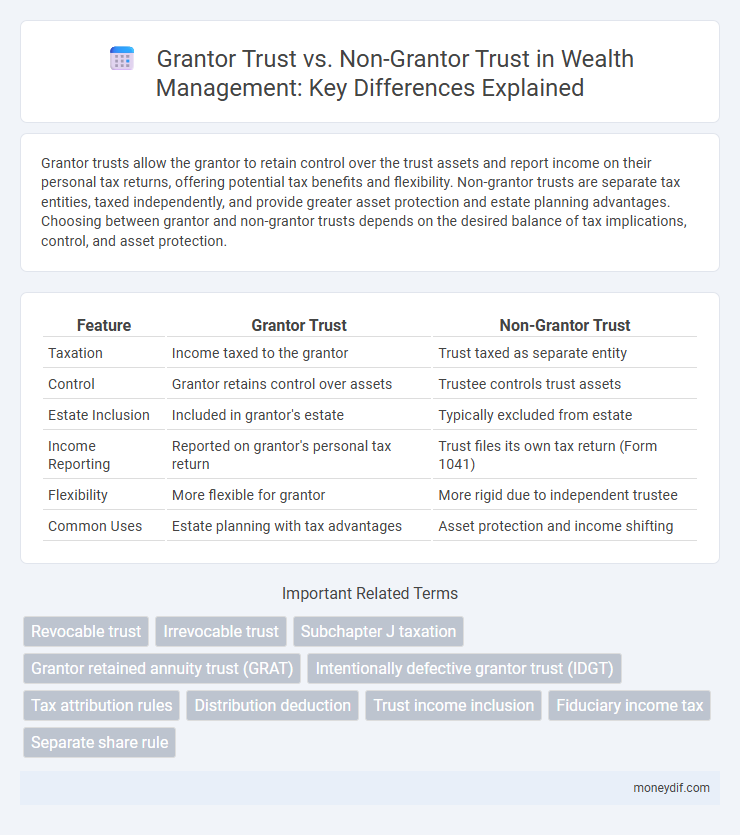

Grantor trusts allow the grantor to retain control over the trust assets and report income on their personal tax returns, offering potential tax benefits and flexibility. Non-grantor trusts are separate tax entities, taxed independently, and provide greater asset protection and estate planning advantages. Choosing between grantor and non-grantor trusts depends on the desired balance of tax implications, control, and asset protection.

Table of Comparison

| Feature | Grantor Trust | Non-Grantor Trust |

|---|---|---|

| Taxation | Income taxed to the grantor | Trust taxed as separate entity |

| Control | Grantor retains control over assets | Trustee controls trust assets |

| Estate Inclusion | Included in grantor's estate | Typically excluded from estate |

| Income Reporting | Reported on grantor's personal tax return | Trust files its own tax return (Form 1041) |

| Flexibility | More flexible for grantor | More rigid due to independent trustee |

| Common Uses | Estate planning with tax advantages | Asset protection and income shifting |

Understanding Grantor and Non-Grantor Trusts

Grantor trusts allow the grantor to retain control over income and principal, resulting in the grantor being taxed on trust income, which offers flexibility for estate planning and tax benefits. Non-grantor trusts are separate tax entities where the trust itself is responsible for taxes, often used to shift tax burdens and protect assets from creditors. Understanding the distinctions in control, taxation, and purpose between grantor and non-grantor trusts is crucial for effective wealth management and asset protection strategies.

Key Differences Between Grantor and Non-Grantor Trusts

Grantor trusts are controlled by the grantor, who retains ownership rights and is responsible for reporting income and paying taxes on the trust's earnings, while non-grantor trusts are separate tax entities that pay taxes independently and distribute income to beneficiaries who then report it. Key differences include tax liability, control, and income distribution: grantor trusts centralize tax obligations on the grantor, whereas non-grantor trusts impose tax liabilities on the trust or beneficiaries. Understanding these distinctions is essential for effective estate planning, tax strategy, and asset protection.

Tax Implications of Grantor Trusts

Grantor trusts are treated as disregarded entities for tax purposes, meaning income, deductions, and credits are reported on the grantor's individual tax return, resulting in direct tax liability for the grantor. This structure allows for income to be taxed at the grantor's potentially lower individual rate and avoids double taxation commonly associated with non-grantor trusts. The grantor retains control over trust assets, which triggers grantor trust status under the Internal Revenue Code sections 671-679, leading to transparent tax treatment.

Tax Treatment of Non-Grantor Trusts

Non-grantor trusts are separate taxable entities required to file their own income tax returns using IRS Form 1041, with income potentially taxed at higher rates than individual brackets. Unlike grantor trusts, where income is taxed to the grantor, non-grantor trusts pay taxes on undistributed income, retaining earnings inside the trust for future beneficiaries. Understanding the distinct tax treatment helps optimize wealth preservation and minimize estate tax liabilities through strategic trust planning.

Asset Protection and Trust Structures

Grantor trusts allow the grantor to retain control over trust assets, offering limited asset protection since assets may be reachable by creditors. Non-grantor trusts, structured as separate tax entities, provide stronger asset protection by isolating trust assets from grantor liabilities and external claims. Choosing between these trust structures depends on the desired balance between tax benefits and robust asset protection strategies.

Choosing the Right Trust for Wealth Preservation

Choosing the right trust for wealth preservation depends on the desired level of control and tax implications. Grantor trusts allow the grantor to retain control over assets and report income on their personal tax return, providing flexibility but less tax sheltering. Non-grantor trusts are separate tax entities, offering potential estate tax benefits and creditor protection, making them suitable for long-term wealth preservation and estate planning strategies.

Estate Planning Benefits of Grantor Trusts

Grantor trusts provide unique estate planning benefits by allowing the trust creator to retain certain powers, which enables income to be taxed at the grantor's individual rate, often resulting in lower overall tax liability. Assets transferred to a grantor trust are typically excluded from the estate for estate tax purposes, reducing the size of the taxable estate and potentially minimizing estate taxes. This structure also offers flexibility in managing and distributing trust assets while maintaining control and facilitating efficient wealth transfer across generations.

Non-Grantor Trusts for Charitable Giving and Philanthropy

Non-grantor trusts for charitable giving enable donors to separate trust income from their personal tax returns, providing distinct tax advantages and promoting philanthropic impact. These trusts generate income taxed at the trust level but offer flexibility in distributing assets to charitable organizations, enhancing long-term wealth preservation. Utilizing non-grantor trusts strategically supports targeted charitable missions while optimizing estate and gift tax benefits.

Managing Control and Flexibility in Trusts

Grantor trusts provide the grantor with extensive control over trust assets and income, allowing for flexible management and potential tax benefits, as the grantor retains the power to revoke or amend the trust. Non-grantor trusts, on the other hand, operate independently from the grantor, offering less control but increased asset protection and distinct tax treatment, as trust income is taxed separately. Choosing between grantor and non-grantor trusts depends on balancing the desire for control against the need for flexibility, tax considerations, and asset protection goals.

Common Mistakes in Establishing Trusts

Common mistakes in establishing grantor trusts versus non-grantor trusts include misunderstanding tax implications, such as failing to recognize that grantor trusts attribute income to the grantor while non-grantor trusts are separate taxable entities. Improperly drafting trust documents can lead to unintended control retention in grantor trusts, negating estate planning benefits. Neglecting to update beneficiary designations or failing to consult tax professionals often results in suboptimal asset protection and tax efficiency.

Important Terms

Revocable trust

A revocable trust, often classified as a grantor trust, allows the grantor to retain control over the trust assets and income for tax purposes, resulting in income being reported on the grantor's personal tax return. Unlike non-grantor trusts that are separate tax entities with distinct tax rates and reporting requirements, revocable trusts do not shield assets from estate taxation but provide flexibility in estate planning and asset management.

Irrevocable trust

An irrevocable trust permanently relinquishes the grantor's control over assets, distinguishing it from a grantor trust where the grantor retains tax responsibilities and control, whereas a non-grantor trust is treated as a separate tax entity with its own tax ID. Tax consequences and asset protection vary significantly between irrevocable grantor trusts, which still report income on the grantor's tax return, and irrevocable non-grantor trusts, which pay taxes independently and often provide stronger creditor protection.

Subchapter J taxation

Subchapter J taxation governs the income tax rules for trusts, distinguishing between grantor trusts, which report income on the grantor's personal tax return under IRC Sections 671-679, and non-grantor trusts, which are separate taxable entities subject to distinct tax rates and deductions under IRC Sections 641-678. Grantor trusts allow income to be taxed directly to the grantor, avoiding trust-level taxation, whereas non-grantor trusts pay tax on income retained within the trust and distribute income to beneficiaries who then report it on their tax returns.

Grantor retained annuity trust (GRAT)

A Grantor Retained Annuity Trust (GRAT) is a specialized grantor trust designed to transfer future appreciation of assets to beneficiaries with minimal gift tax consequences by retaining an annuity payment from the trust. Unlike non-grantor trusts, GRATs are considered grantor trusts for income tax purposes, meaning the grantor pays income tax on trust earnings, effectively shifting tax burden away from the trust and increasing estate transfer efficiency.

Intentionally defective grantor trust (IDGT)

An Intentionally Defective Grantor Trust (IDGT) is a strategic estate planning tool where the grantor maintains certain income tax liabilities, enabling the trust's assets to grow outside the grantor's estate for estate tax purposes while still being taxed to the grantor. Unlike non-grantor trusts, which are separate tax entities responsible for their own income taxes, IDGTs allow the grantor to pay income taxes on trust earnings, effectively making additional tax-free gifts to beneficiaries and reducing the taxable estate.

Tax attribution rules

Tax attribution rules for grantor trusts treat all income, deductions, and credits as belonging directly to the grantor, resulting in taxation at the grantor's individual tax rates. Non-grantor trusts are separate tax entities subject to distinct tax brackets, with income taxed to the trust unless distributed to beneficiaries, who then report it on their own returns.

Distribution deduction

Distribution deductions for grantor trusts are generally not allowed since income is taxed directly to the grantor, whereas non-grantor trusts can claim distribution deductions on income distributed to beneficiaries, reducing the trust's taxable income. This distinction impacts how income taxation and deduction strategies are applied between grantor and non-grantor trusts under IRS rules.

Trust income inclusion

Trust income inclusion varies significantly between grantor and non-grantor trusts, as grantor trusts report income on the grantor's personal tax return, allowing for direct inclusion of all trust income. In contrast, non-grantor trusts are separate tax entities that must file their own tax returns and pay taxes on undistributed income, resulting in different income inclusion rules and potential tax consequences.

Fiduciary income tax

Fiduciary income tax treatment differs significantly between grantor trusts and non-grantor trusts, with grantor trusts reporting income on the grantor's individual tax return while non-grantor trusts file separate tax returns and are subject to distinct tax brackets. Non-grantor trusts face higher marginal tax rates at lower income thresholds, making income distribution planning crucial for minimizing overall tax liabilities.

Separate share rule

The Separate Share Rule allows each beneficiary's trust share to be treated as a distinct trust for tax purposes, enabling Grantor trusts to retain income tax liability with the grantor, while Non-grantor trusts pay their own taxes on income. This rule facilitates effective income distribution and tax planning by differentiating the grantor's tax responsibility from that of individual beneficiaries in complex trust arrangements.

Grantor trust vs Non-grantor trust Infographic

moneydif.com

moneydif.com