Single stock risk refers to the potential for loss due to factors specific to an individual company, such as management decisions or product failures, which can cause significant volatility in that stock's price. Systematic risk, on the other hand, affects the entire market or a broad range of assets and cannot be eliminated through diversification, including risks from economic recessions, interest rate changes, and geopolitical events. Investors mitigate single stock risk by diversifying their portfolios, but systematic risk requires strategic asset allocation and hedging to manage potential impacts on overall wealth.

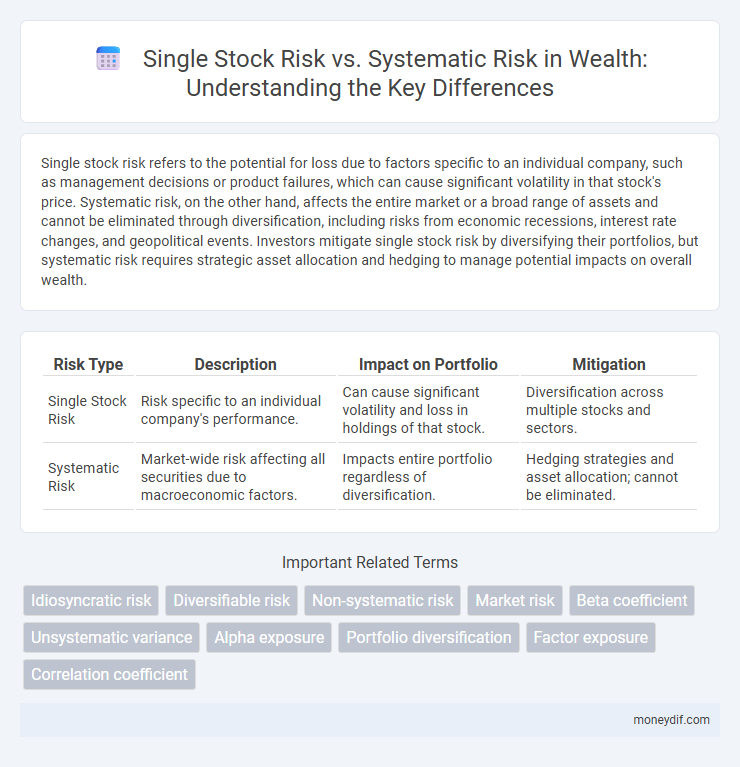

Table of Comparison

| Risk Type | Description | Impact on Portfolio | Mitigation |

|---|---|---|---|

| Single Stock Risk | Risk specific to an individual company's performance. | Can cause significant volatility and loss in holdings of that stock. | Diversification across multiple stocks and sectors. |

| Systematic Risk | Market-wide risk affecting all securities due to macroeconomic factors. | Impacts entire portfolio regardless of diversification. | Hedging strategies and asset allocation; cannot be eliminated. |

Understanding Single Stock Risk in Wealth Management

Single stock risk, also known as unsystematic risk, refers to the vulnerability of an individual stock to factors specific to its company, such as management decisions, competitive pressure, or product failures. Unlike systematic risk, which affects the entire market or asset class, single stock risk can be mitigated through diversification across multiple stocks and sectors. Understanding single stock risk is crucial in wealth management to optimize portfolio performance and reduce unexpected losses tied to individual equities.

Defining Systematic Risk: What Every Investor Should Know

Systematic risk refers to the inherent market-wide risks that cannot be eliminated through diversification, impacting all stocks simultaneously due to factors such as economic recessions, interest rate changes, or geopolitical events. Unlike single stock risk, which is specific to an individual company's performance or management decisions, systematic risk affects the entire financial market and is measured by beta in the Capital Asset Pricing Model (CAPM). Investors must understand that while single stock risk can be mitigated by holding a diversified portfolio, systematic risk requires strategic asset allocation and hedging techniques to manage overall market exposure.

Key Differences Between Single Stock and Systematic Risk

Single stock risk, also known as unsystematic risk, pertains to factors affecting a specific company, such as management decisions, product launches, or competitive pressures. Systematic risk, or market risk, impacts the entire market or economy due to macroeconomic factors like interest rate changes, inflation, or geopolitical events. Unlike single stock risk, which can be mitigated through diversification, systematic risk affects all investments and cannot be eliminated through portfolio management.

The Impact of Single Stock Risk on Portfolio Wealth

Single stock risk refers to the potential volatility and loss associated with an individual stock's price fluctuations, which can significantly affect portfolio wealth if that stock comprises a large portion of the portfolio. Systematic risk, by contrast, impacts the entire market and cannot be eliminated through diversification, but single stock risk can be mitigated by holding a diversified portfolio of assets. Understanding the impact of single stock risk is crucial for wealth management, as concentrated exposure to high-volatility stocks can lead to substantial wealth erosion despite favorable market trends.

Diversification: The Antidote to Single Stock Risk

Diversification mitigates single stock risk by spreading investments across various assets, reducing exposure to the volatility of any one stock. Systematic risk, influenced by market-wide factors such as economic downturns or interest rate changes, cannot be eliminated through diversification but can be managed with asset allocation strategies. Effective portfolio diversification enhances risk-adjusted returns by balancing idiosyncratic risks inherent in individual stocks.

Systematic Risk: How Market Forces Affect Your Wealth

Systematic risk, also known as market risk, refers to the inherent volatility that impacts the entire financial market, influencing the performance of all stocks regardless of individual company fundamentals. Unlike single stock risk, which is tied to specific company events or management decisions, systematic risk is driven by macroeconomic factors such as interest rate changes, inflation, political instability, and economic recessions. Understanding systematic risk is crucial for wealth management as it affects portfolio diversification strategies and long-term investment outcomes across asset classes.

Managing Wealth by Balancing Stock-Specific vs. Market Risk

Managing wealth effectively requires balancing single stock risk, which is the volatility specific to an individual company, with systematic risk that affects the entire market. Diversification strategies reduce exposure to stock-specific risk while systematic risk can be mitigated through asset allocation across different sectors and asset classes. Understanding the correlation between these risks helps investors optimize portfolio returns while maintaining desired risk levels.

Real-World Examples: Single Stock Risk vs Systematic Risk

Single stock risk is exemplified by Tesla's stock volatility, where company-specific events like production delays caused sharp price fluctuations. Systematic risk affects the entire market, illustrated by the 2008 financial crisis, which led to widespread declines across diverse portfolios. Investors mitigate single stock risk through diversification, but systematic risk requires broader strategies such as asset allocation and hedging.

Strategies to Mitigate Both Types of Investment Risk

Diversifying a portfolio by investing across various sectors and asset classes effectively reduces single stock risk, as it limits exposure to any one company's performance. Utilizing hedging techniques such as options and futures contracts can also mitigate systematic risk by protecting against market-wide fluctuations. Combining long-term investment horizons with strategic asset allocation enhances resilience against both idiosyncratic and market-driven risks.

Building Wealth While Navigating Investment Risks

Balancing single stock risk and systematic risk is essential for building wealth while navigating investment risks effectively. Diversifying across multiple assets reduces single stock risk, which stems from factors unique to a particular company, whereas systematic risk affects the entire market and cannot be eliminated through diversification. Investors targeting long-term wealth creation must implement strategies that manage exposure to market-wide fluctuations alongside individual security volatility.

Important Terms

Idiosyncratic risk

Idiosyncratic risk, unique to a single stock, can be diversified away, unlike systematic risk which affects the entire market and cannot be eliminated through diversification.

Diversifiable risk

Diversifiable risk, also known as unsystematic risk, pertains to single stock risk that can be mitigated through portfolio diversification, as it arises from firm-specific factors like management decisions or product recalls. Systematic risk, in contrast, affects the entire market due to macroeconomic factors such as interest rate changes or geopolitical events and cannot be eliminated through diversification.

Non-systematic risk

Non-systematic risk, also known as single stock risk, refers to the risk inherent to a specific company or industry and can be minimized through diversification, whereas systematic risk affects the entire market and cannot be eliminated by diversification.

Market risk

Market risk encompasses systematic risk, which affects the entire market, while single stock risk refers to unsystematic risk specific to an individual company's performance.

Beta coefficient

The beta coefficient measures a single stock's sensitivity to systematic risk, indicating its volatility relative to the overall market rather than its unsystematic risk.

Unsystematic variance

Unsystematic variance represents the single stock risk caused by firm-specific factors, whereas systematic risk reflects market-wide volatility affecting all stocks.

Alpha exposure

Alpha exposure represents the portion of a portfolio's returns attributed to active management skill, isolating single stock risk by capturing idiosyncratic factors uncorrelated with systematic market risk. By focusing on alpha, investors aim to enhance returns through stock-specific insights while minimizing exposure to broad market fluctuations driven by systematic risk.

Portfolio diversification

Portfolio diversification reduces single stock risk by spreading investments across multiple assets, but it cannot eliminate systematic risk inherent to the entire market.

Factor exposure

Factor exposure quantifies a stock's sensitivity to underlying risk factors like market, size, or value, separating systematic risk from idiosyncratic single stock risk. Systematic risk stems from broad market movements affecting all stocks, while single stock risk arises from company-specific events and operational performance.

Correlation coefficient

The correlation coefficient measures the relationship between a single stock's returns and broader market returns, indicating how much of the stock's risk is systematic versus idiosyncratic. A high correlation coefficient signals that the stock's movements are largely driven by systematic risk factors, while a low coefficient indicates predominance of unsystematic, stock-specific risk.

single stock risk vs systematic risk Infographic

moneydif.com

moneydif.com