Revenue streams represent all the sources generating income for a business, while profit pools focus on the areas within those streams that yield the highest profitability. Understanding profit pools helps companies allocate resources efficiently to maximize returns rather than just increasing top-line revenue. Strategic analysis of both revenue streams and profit pools is crucial for sustainable wealth growth and long-term financial success.

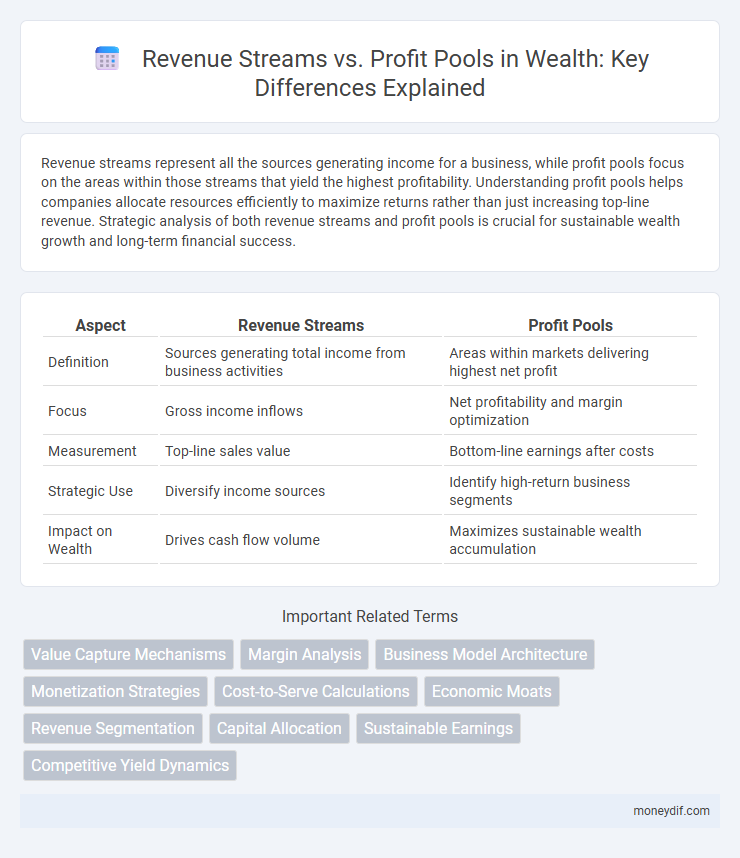

Table of Comparison

| Aspect | Revenue Streams | Profit Pools |

|---|---|---|

| Definition | Sources generating total income from business activities | Areas within markets delivering highest net profit |

| Focus | Gross income inflows | Net profitability and margin optimization |

| Measurement | Top-line sales value | Bottom-line earnings after costs |

| Strategic Use | Diversify income sources | Identify high-return business segments |

| Impact on Wealth | Drives cash flow volume | Maximizes sustainable wealth accumulation |

Understanding Revenue Streams in Wealth Building

Revenue streams in wealth building represent the diverse sources of income generated from investments, business activities, and passive earnings, directly influencing cash flow and financial stability. Identifying and optimizing multiple revenue streams enables sustained wealth accumulation and mitigates risks associated with reliance on a single income source. Effective revenue stream management prioritizes consistent income generation and scalability to enhance long-term wealth growth.

Exploring the Concept of Profit Pools

Profit pools represent the total profits available within an industry segment, highlighting where value is truly created beyond mere revenue generation. Analyzing profit pools enables businesses to identify high-margin areas and optimize resource allocation for maximum profitability. Understanding the distinction between revenue streams and profit pools is crucial for strategic decision-making in wealth management.

Key Differences Between Revenue Streams and Profit Pools

Revenue streams represent the total income generated from sales or services before deducting any expenses, highlighting different sources such as product lines or customer segments. Profit pools focus on the actual profit available within specific areas of the business after costs, emphasizing where the highest margins or profitability lie. The key difference is that revenue streams measure gross inflows, while profit pools reveal the net financial value and strategic opportunities for wealth maximization.

Identifying Lucrative Revenue Streams for Wealth Accumulation

Identifying lucrative revenue streams involves analyzing market demand, scalability, and profit margins to target high-value opportunities that contribute significantly to wealth accumulation. Diversifying income sources across multiple sectors enhances financial stability and maximizes overall returns from various profit pools. Prioritizing sustainable and recurring revenue streams ensures consistent wealth growth and long-term financial success.

Mapping Profit Pools in High-Growth Industries

Mapping profit pools in high-growth industries reveals concentrated areas of substantial earnings beyond mere revenue streams, highlighting segments with the highest profitability potential. Analyzing cost structures, customer value propositions, and competitive dynamics within these industries enables identification of lucrative niches where profit margins outpace revenue growth. Targeting these profit pools allows businesses to allocate resources strategically, optimizing long-term wealth creation through focused investment and innovation.

Strategic Approaches to Maximizing Revenue Streams

Maximizing revenue streams involves identifying diverse income sources, optimizing pricing strategies, and leveraging market segmentation to capture value efficiently. Strategic approaches include diversifying product or service offerings and enhancing customer acquisition efforts to sustain continuous cash flow. Focusing on scalable channels and aligning resources effectively supports long-term revenue growth beyond existing profit pools.

Leveraging Profit Pools for Sustainable Wealth

Leveraging profit pools enables businesses to identify high-margin segments within their industry, optimizing revenue streams for sustainable wealth growth. By focusing resources on lucrative profit pools rather than merely increasing top-line revenue, companies enhance long-term financial stability and competitive advantage. Strategic allocation toward these profit-rich areas drives consistent cash flow and maximizes return on investment over time.

Assessing Risks in Revenue Streams and Profit Pools

Assessing risks in revenue streams involves analyzing the stability and predictability of income sources, considering market fluctuations, customer retention rates, and competitive pressures. Profit pools require evaluating cost structures, margin variability, and operational vulnerabilities that could impact overall profitability. Effective risk assessment enables strategic allocation of resources to optimize both revenue generation and profit maximization within wealth management.

Case Studies: Wealth Creation Through Profit Pool Analysis

Examining case studies in wealth creation through profit pool analysis reveals businesses that strategically identify high-margin segments, resulting in optimized revenue streams. Companies leveraging data-driven insights to shift focus from overall revenue to profit pools consistently achieve sustainable growth and higher returns on investment. These case studies demonstrate the critical importance of targeting lucrative niches within broader markets to maximize wealth accumulation.

Future Trends in Revenue Streams and Profit Pools for Wealth

Future trends in wealth management emphasize diversified revenue streams driven by digital assets, personalized financial products, and subscription-based advisory services. Profit pools are expanding as technology-enabled platforms and automated investment solutions reduce costs while enhancing customer engagement. The integration of artificial intelligence and blockchain technology is reshaping wealth ecosystems, creating new opportunities for scalable, data-driven revenue generation and sustainable profit margins.

Important Terms

Value Capture Mechanisms

Value capture mechanisms are strategies that businesses use to secure a portion of the value created within revenue streams, directly impacting profit pools by determining how profits are distributed across industry participants. Effective value capture aligns pricing, cost structure, and competitive positioning to maximize profit pools within target markets.

Margin Analysis

Margin analysis identifies profitability differences between revenue streams and profit pools by evaluating gross margins, operating costs, and net earnings per segment, revealing which revenue sources deliver the highest returns. Analyzing profit pools helps businesses optimize resource allocation by targeting areas where incremental investment maximizes profit growth rather than solely increasing revenue.

Business Model Architecture

Business Model Architecture strategically organizes revenue streams to maximize profit pools by identifying high-value customer segments and optimizing resource allocation. Focusing on scalable revenue sources within the architecture enhances overall profitability and sustainable competitive advantage.

Monetization Strategies

Monetization strategies focusing on revenue streams identify diverse income sources such as subscription fees, advertising, and product sales to boost overall cash flow. Profit pools analyze these streams by evaluating market segments' profitability, guiding businesses to allocate resources toward the most lucrative opportunities for sustainable growth.

Cost-to-Serve Calculations

Cost-to-Serve calculations identify the expenses incurred to deliver products or services to specific customer segments, directly impacting profit pool analysis by revealing the true profitability within various revenue streams. Accurate allocation of costs enables companies to optimize pricing strategies and resource distribution, enhancing profit margins across diverse revenue channels.

Economic Moats

Economic moats protect companies by sustaining competitive advantages that secure consistent revenue streams, enabling long-term market dominance. Profit pools focus on capturing the most lucrative segments within an industry, maximizing profitability beyond just revenue growth by targeting high-margin areas.

Revenue Segmentation

Revenue segmentation analyzes revenue streams by categorizing income sources to identify distinct profit pools, enabling businesses to target high-margin segments more effectively. Understanding the variations in revenue streams and their contribution to overall profit pools helps optimize resource allocation and drive strategic growth initiatives.

Capital Allocation

Capital allocation strategically directs financial resources toward high-value profit pools instead of simply chasing diverse revenue streams, maximizing overall return on investment. By analyzing profit margins within different revenue streams, companies identify and prioritize allocations that enhance long-term profitability and sustainable growth.

Sustainable Earnings

Sustainable earnings depend on identifying robust revenue streams that consistently generate income while optimizing profit pools to maximize margins and long-term value creation. Focusing on high-margin segments within profit pools enables businesses to enhance financial resilience and competitive advantage amid evolving market dynamics.

Competitive Yield Dynamics

Competitive yield dynamics influence the allocation of profit pools by shaping how revenue streams are optimized across market segments and product lines. Identifying high-yield opportunities within profit pools enables companies to prioritize investments and pricing strategies that maximize overall market profitability.

Revenue Streams vs Profit Pools Infographic

moneydif.com

moneydif.com