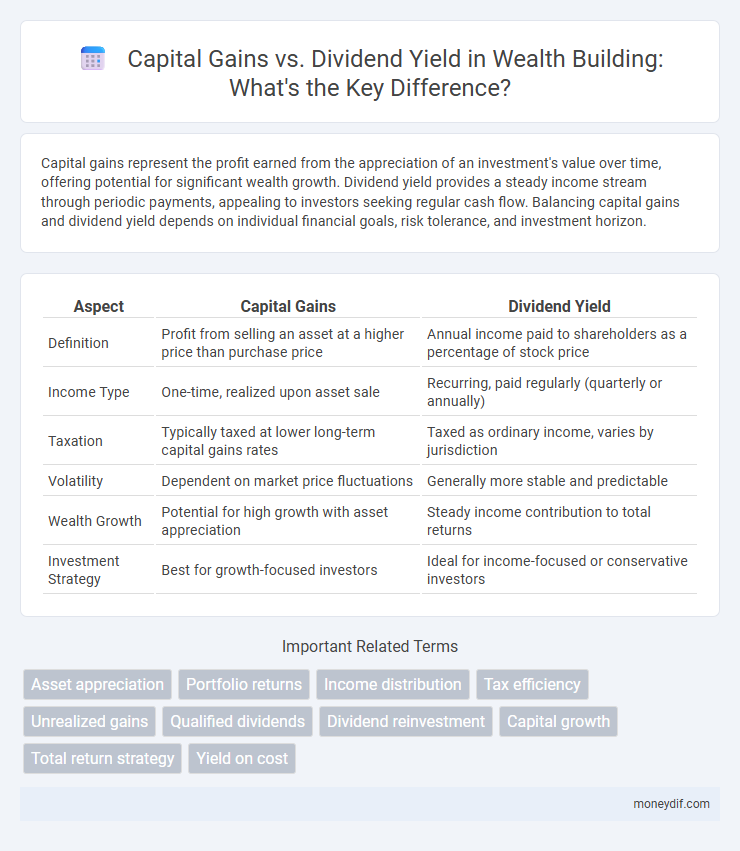

Capital gains represent the profit earned from the appreciation of an investment's value over time, offering potential for significant wealth growth. Dividend yield provides a steady income stream through periodic payments, appealing to investors seeking regular cash flow. Balancing capital gains and dividend yield depends on individual financial goals, risk tolerance, and investment horizon.

Table of Comparison

| Aspect | Capital Gains | Dividend Yield |

|---|---|---|

| Definition | Profit from selling an asset at a higher price than purchase price | Annual income paid to shareholders as a percentage of stock price |

| Income Type | One-time, realized upon asset sale | Recurring, paid regularly (quarterly or annually) |

| Taxation | Typically taxed at lower long-term capital gains rates | Taxed as ordinary income, varies by jurisdiction |

| Volatility | Dependent on market price fluctuations | Generally more stable and predictable |

| Wealth Growth | Potential for high growth with asset appreciation | Steady income contribution to total returns |

| Investment Strategy | Best for growth-focused investors | Ideal for income-focused or conservative investors |

Understanding Capital Gains and Dividend Yield

Capital gains represent the profit earned from the increase in the value of an asset, typically realized when selling stocks or real estate, while dividend yield measures the annual dividends paid by a company relative to its stock price, indicating income generation. Investors seeking growth often prioritize capital gains for long-term wealth accumulation, whereas those focusing on income prefer dividend yield for steady cash flow. Understanding the balance between capital gains and dividend yield helps optimize portfolio strategy based on risk tolerance and financial goals.

Key Differences Between Capital Gains and Dividend Yield

Capital gains represent the profit realized when an asset is sold for a higher price than its purchase price, reflecting the appreciation of the investment's value. Dividend yield measures the income generated from owning shares, expressed as a percentage of the stock's current price, and represents recurring cash flow to shareholders. Key differences include capital gains being subject to capital gains tax upon sale, while dividend yield provides regular income taxed as dividend income, with implications for investors' strategies focusing on growth versus income.

How Capital Gains Impact Wealth Accumulation

Capital gains significantly accelerate wealth accumulation by increasing the value of invested assets, allowing investors to realize profits when selling appreciated securities. Unlike dividend yield, which provides regular income, capital gains compound over time through reinvestment and market appreciation, enhancing overall portfolio growth. This compounding effect, driven by rising asset prices, often results in substantial wealth accumulation for long-term investors.

Dividend Yield: A Steady Income Strategy

Dividend yield offers investors a steady income strategy by providing regular cash flow through dividends, often preferred by those seeking consistent earnings over time. It reflects the annual dividend payments relative to the stock price, making it a crucial metric for income-focused portfolios. Compared to capital gains, which rely on asset price appreciation, dividend yield delivers predictable returns that can enhance portfolio stability and reduce volatility.

Tax Implications of Capital Gains vs Dividend Yield

Capital gains are typically taxed at a lower rate than ordinary income, making long-term investment gains more tax-efficient for high-net-worth individuals. Dividend yields, while providing regular income, are often subject to higher dividend tax rates depending on jurisdiction and investor status, potentially reducing overall after-tax returns. Strategic portfolio allocation between capital gains and dividend income can optimize tax liabilities and enhance net wealth accumulation.

Risk and Volatility: Capital Gains Versus Dividend Yield

Capital gains typically exhibit higher volatility and risk due to market price fluctuations, whereas dividend yield provides more stable and predictable income streams, often appealing to conservative investors. Stocks with strong dividend yields tend to experience less price turbulence, offering a buffer during market downturns, while capital gains depend on favorable market conditions for significant appreciation. Portfolio diversification between capital gains and dividend yield strategies can effectively balance risk and enhance wealth accumulation over time.

Suitability for Different Investor Profiles

Capital gains suit growth-oriented investors willing to accept market volatility for potentially higher returns, emphasizing asset appreciation over time. Dividend yield appeals to income-focused investors, such as retirees, seeking steady, predictable cash flow from their investments. Risk tolerance and investment horizon are crucial factors in determining which strategy aligns with an individual's financial goals.

Diversification: Blending Capital Gains and Dividends

Blending capital gains and dividend yield enhances portfolio diversification by balancing growth and income streams, reducing risk exposure to market volatility. Capital gains provide potential for significant appreciation through asset price increases, while dividends offer steady income and can signal financial health of companies. This dual approach supports long-term wealth accumulation and stability, optimizing returns across market cycles.

Historical Performance of Capital Gains and Dividend Yield

Capital gains have historically outperformed dividend yield in long-term wealth accumulation, with the S&P 500 delivering average annual capital gains of approximately 10% compared to dividend yields averaging around 2%. Over the past century, reinvested capital gains contributed significantly to portfolio growth, while dividend yields provided consistent but lower income streams. Market volatility impacts capital gains more sharply, but consistent dividend payments often offer stability during downturns.

Choosing the Right Strategy for Long-Term Wealth

Choosing the right strategy for long-term wealth involves understanding the distinct benefits of capital gains and dividend yield. Capital gains offer potential for significant growth through asset appreciation, ideal for investors seeking to maximize wealth over time. Dividend yield provides a steady income stream, appealing to those prioritizing regular cash flow and reinvestment opportunities to compound returns.

Important Terms

Asset appreciation

Asset appreciation generates capital gains by increasing the asset's market value over time, whereas dividend yield provides income through periodic payments based on the asset's current price.

Portfolio returns

Portfolio returns consist of capital gains, reflecting asset price appreciation, combined with dividend yield, representing periodic income distributions.

Income distribution

Income distribution patterns reveal that capital gains often provide higher long-term returns compared to dividend yield, influencing investor preferences and tax strategies.

Tax efficiency

Capital gains offer tax efficiency by typically being taxed at lower rates and deferred until realization, unlike dividend yields which are often taxed as ordinary income in the year received.

Unrealized gains

Unrealized gains represent the increase in value of an asset before sale, impacting capital gains potential, whereas dividend yield reflects the actual income generated from dividends relative to the asset's price.

Qualified dividends

Qualified dividends are taxed at lower capital gains rates, making them more tax-efficient than ordinary dividend yields for maximizing after-tax investment returns.

Dividend reinvestment

Dividend reinvestment amplifies total returns by converting dividend yield into compounded capital gains, enhancing long-term portfolio growth.

Capital growth

Capital growth focuses on increasing the value of an investment through capital gains, which often outpaces dividend yield in long-term wealth accumulation.

Total return strategy

Total return strategy emphasizes maximizing overall investment gains by combining capital gains appreciation with dividend yield to optimize portfolio performance.

Yield on cost

Yield on cost measures the return based on the original investment price, highlighting how capital gains increase this yield over time as the stock price rises. Unlike dividend yield, which is calculated on the current market price, yield on cost reflects the growing income relative to the initial purchase price, emphasizing the impact of reinvested dividends and price appreciation on long-term investment performance.

capital gains vs dividend yield Infographic

moneydif.com

moneydif.com