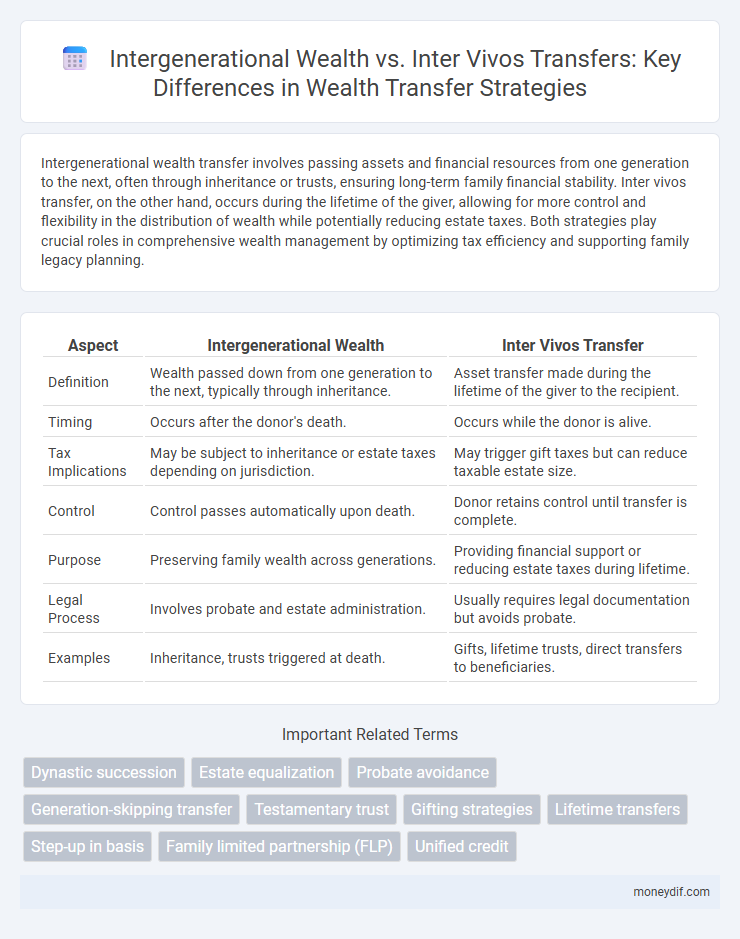

Intergenerational wealth transfer involves passing assets and financial resources from one generation to the next, often through inheritance or trusts, ensuring long-term family financial stability. Inter vivos transfer, on the other hand, occurs during the lifetime of the giver, allowing for more control and flexibility in the distribution of wealth while potentially reducing estate taxes. Both strategies play crucial roles in comprehensive wealth management by optimizing tax efficiency and supporting family legacy planning.

Table of Comparison

| Aspect | Intergenerational Wealth | Inter Vivos Transfer |

|---|---|---|

| Definition | Wealth passed down from one generation to the next, typically through inheritance. | Asset transfer made during the lifetime of the giver to the recipient. |

| Timing | Occurs after the donor's death. | Occurs while the donor is alive. |

| Tax Implications | May be subject to inheritance or estate taxes depending on jurisdiction. | May trigger gift taxes but can reduce taxable estate size. |

| Control | Control passes automatically upon death. | Donor retains control until transfer is complete. |

| Purpose | Preserving family wealth across generations. | Providing financial support or reducing estate taxes during lifetime. |

| Legal Process | Involves probate and estate administration. | Usually requires legal documentation but avoids probate. |

| Examples | Inheritance, trusts triggered at death. | Gifts, lifetime trusts, direct transfers to beneficiaries. |

Understanding Intergenerational Wealth: A Comprehensive Overview

Intergenerational wealth refers to the transfer of assets, values, and financial stability from one generation to the next, often preserved through estate planning, trusts, and inheritance. Inter vivos transfers involve gifting assets during the lifetime of the wealth holder, which can strategically reduce estate taxes and facilitate family financial support. Understanding these mechanisms is crucial for effective wealth management and ensuring long-term financial legacy across generations.

Defining Inter Vivos Transfers: Concepts and Practices

Inter vivos transfers refer to the voluntary exchange of assets or wealth between individuals during their lifetime, rather than as a bequest upon death. These transfers often include gifts, trusts, and financial support intended to provide for beneficiaries such as family members or charitable organizations while the donor is still alive. Understanding the legal, tax, and financial implications of inter vivos transfers is essential for effective wealth management and ensuring a strategic distribution of assets across generations.

Key Differences Between Intergenerational Wealth and Inter Vivos Transfers

Intergenerational wealth involves the transfer of assets and wealth across multiple generations, typically through inheritance after death, emphasizing long-term family financial continuity and legacy planning. Inter vivos transfers occur during the lifetime of the donor, enabling immediate transfer of property or funds, often used for tax planning or gifting purposes. Key differences include timing, legal implications, and financial impact, with intergenerational wealth focusing on estate transfer post-mortem, while inter vivos transfers affect current asset distribution and tax liability.

Advantages of Intergenerational Wealth Planning

Intergenerational wealth planning ensures the strategic transfer of assets across multiple generations, minimizing estate taxes and preserving family wealth over time. This approach facilitates long-term financial security by establishing trusts, gifting strategies, and succession plans tailored to family goals. Compared to inter vivos transfers, intergenerational planning offers greater control over asset distribution and protection from market volatility and creditor claims.

Benefits and Challenges of Inter Vivos Transfers

Inter vivos transfers enable wealth distribution during the donor's lifetime, facilitating immediate financial support and potential tax advantages such as reduced estate taxes. These transfers can strengthen family relationships by addressing needs directly and encouraging responsible asset management. However, challenges include possible conflicts among heirs, loss of control over assets, and the necessity of careful legal planning to avoid unintended tax consequences or disputes.

Legal Considerations in Wealth Transfer Mechanisms

Legal considerations in intergenerational wealth and inter vivos transfers center on tax implications, regulatory compliance, and property rights. Estate planning documents such as wills, trusts, and powers of attorney must be carefully drafted to ensure seamless asset transfer while minimizing estate taxes and probate costs. Understanding state-specific laws and federal gift tax exemptions is critical to structuring transfers that protect beneficiaries and preserve family wealth across generations.

Tax Implications: Inheritance vs. Lifetime Gifts

Intergenerational wealth transfer through inheritance often incurs estate taxes based on the decedent's total estate value, potentially reducing the net amount received by heirs. Inter vivos transfers, or lifetime gifts, may be subject to gift tax thresholds established by the IRS, but strategic annual exclusions and unified credit can minimize immediate tax liabilities. Careful planning between inheritance and lifetime gifts optimizes tax efficiency, preserving a greater portion of wealth for future generations.

Strategies for Effective Intergenerational Wealth Transfer

Maximizing intergenerational wealth transfer involves strategic use of inter vivos gifts, trusts, and estate planning to minimize tax liabilities and ensure asset protection. Employing techniques such as irrevocable trusts and lifetime gifting leverages gift tax exemptions while facilitating the smooth transition of wealth across generations. Regularly updating financial plans and engaging professional advisors optimize asset allocation and safeguard family wealth continuity.

Impact of Wealth Transfers on Family Dynamics

Wealth transfers between generations significantly shape family dynamics by influencing power structures, emotional bonds, and financial responsibilities. Intergenerational wealth often strengthens long-term family cohesion and legacy preservation, while inter vivos transfers--gifts given during the donor's lifetime--can affect sibling relationships and caregiving roles. The timing and nature of wealth transfers impact decision-making processes, fostering either cooperation or conflict within families across generations.

Choosing the Right Approach: Intergenerational Wealth or Inter Vivos Transfer

Choosing between intergenerational wealth transfer and inter vivos transfer hinges on the goals of asset distribution and tax efficiency. Intergenerational wealth transfer typically occurs through estate planning instruments like trusts and wills, ensuring wealth preservation across generations while minimizing estate taxes. Inter vivos transfers, made during the lifetime, offer benefits such as reduced estate tax liability and the opportunity to witness the impact of gifted assets, making them ideal for proactive wealth management.

Important Terms

Dynastic succession

Dynastic succession involves the strategic transfer of wealth across multiple generations to preserve family assets and power, often prioritizing intergenerational wealth preservation through trusts and estates. Inter vivos transfers, which occur during the lifetime of the benefactor, complement this by enabling tax-efficient distribution and control over wealth, reducing probate risks and facilitating smoother wealth transition between generations.

Estate equalization

Estate equalization involves distributing assets fairly among heirs to balance intergenerational wealth disparities, ensuring each beneficiary receives an equitable share despite differing types or values of inherited property. Inter vivos transfers, made during a donor's lifetime, can strategically reduce estate size and taxes while facilitating early wealth distribution to heirs, complementing estate equalization by managing wealth transition proactively.

Probate avoidance

Probate avoidance strategies, such as living trusts and joint ownership, facilitate seamless inter vivos transfers that bypass probate, preserving intergenerational wealth by ensuring assets pass directly to heirs without court intervention. These methods reduce estate taxes, legal fees, and delays, enhancing the efficient transfer of wealth across generations and maintaining family financial stability.

Generation-skipping transfer

Generation-skipping transfer (GST) involves the transfer of assets directly to a beneficiary two or more generations below the grantor, often minimizing estate taxes compared to inter vivos transfers made during the grantor's lifetime. This strategy enhances intergenerational wealth preservation by bypassing the immediate next generation, thus reducing estate taxation and facilitating more efficient wealth accumulation across multiple generations.

Testamentary trust

Testamentary trusts facilitate intergenerational wealth transfer by deferring asset distribution until after the grantor's death, providing tax advantages and control over inheritance that are not available in inter vivos transfers, which involve immediate asset distribution during the grantor's lifetime and may trigger gift taxes. These trusts optimize estate planning by preserving wealth for future generations while minimizing estate taxes and protecting assets from creditors and beneficiaries' poor financial decisions.

Gifting strategies

Gifting strategies for intergenerational wealth focus on maximizing tax-efficient transfers by leveraging lifetime exemptions and annual gift tax exclusions to reduce estate tax burdens. Inter vivos transfers involve gifts made during the donor's lifetime, enabling immediate wealth distribution and potential growth outside the taxable estate.

Lifetime transfers

Lifetime transfers, including inter vivos transfers, play a crucial role in intergenerational wealth preservation by enabling the direct gifting of assets to heirs during the donor's lifetime, often minimizing estate taxes and facilitating financial support. These transfers typically involve property, trusts, or cash and are strategically used to optimize wealth distribution while ensuring legal and tax compliance across generations.

Step-up in basis

Step-up in basis allows heirs to reset the tax basis of inherited assets to their market value at the time of the original owner's death, minimizing capital gains taxes and enhancing intergenerational wealth transfer. In contrast, inter vivos transfers occur during the grantor's lifetime, often retaining the original basis and potentially incurring higher capital gains upon eventual sale.

Family limited partnership (FLP)

Family limited partnerships (FLPs) serve as an effective vehicle for intergenerational wealth transfer by allowing senior family members to retain control over assets while gifting limited partnership interests to younger generations, thereby minimizing gift and estate taxes. Utilizing an FLP for inter vivos transfers facilitates strategic wealth preservation and gradual ownership transition, leveraging valuation discounts on minority interests to enhance tax efficiency.

Unified credit

Unified credit allows individuals to shield a combined amount of lifetime gifts and estate transfers from federal estate tax, effectively facilitating intergenerational wealth transfer by maximizing tax exemptions. Inter vivos transfers utilize this credit during the giver's lifetime, enabling tax-efficient wealth passage to heirs without reducing the unified credit available at death.

Intergenerational wealth vs inter vivos transfer Infographic

moneydif.com

moneydif.com