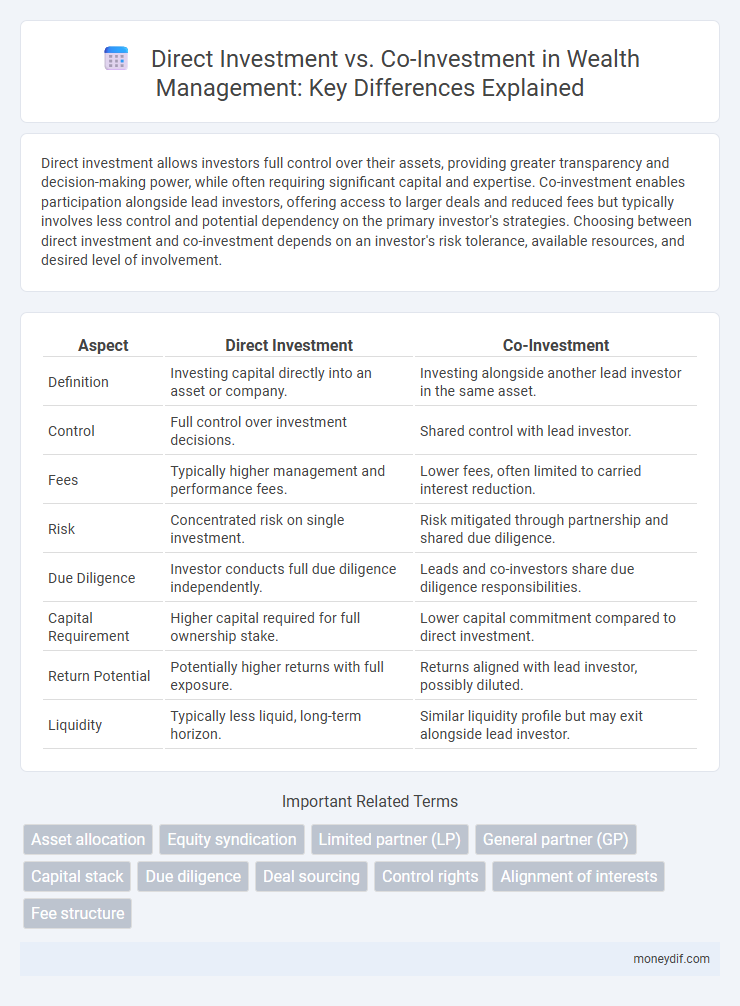

Direct investment allows investors full control over their assets, providing greater transparency and decision-making power, while often requiring significant capital and expertise. Co-investment enables participation alongside lead investors, offering access to larger deals and reduced fees but typically involves less control and potential dependency on the primary investor's strategies. Choosing between direct investment and co-investment depends on an investor's risk tolerance, available resources, and desired level of involvement.

Table of Comparison

| Aspect | Direct Investment | Co-Investment |

|---|---|---|

| Definition | Investing capital directly into an asset or company. | Investing alongside another lead investor in the same asset. |

| Control | Full control over investment decisions. | Shared control with lead investor. |

| Fees | Typically higher management and performance fees. | Lower fees, often limited to carried interest reduction. |

| Risk | Concentrated risk on single investment. | Risk mitigated through partnership and shared due diligence. |

| Due Diligence | Investor conducts full due diligence independently. | Leads and co-investors share due diligence responsibilities. |

| Capital Requirement | Higher capital required for full ownership stake. | Lower capital commitment compared to direct investment. |

| Return Potential | Potentially higher returns with full exposure. | Returns aligned with lead investor, possibly diluted. |

| Liquidity | Typically less liquid, long-term horizon. | Similar liquidity profile but may exit alongside lead investor. |

Defining Direct Investment and Co-Investment

Direct investment involves allocating capital directly into a company or asset, granting investors full control and decision-making authority over their investment. Co-investment refers to investing alongside other investors, typically in partnership with private equity or venture capital firms, allowing participants to access larger deals with shared risks and reduced fees. Both strategies offer unique advantages in wealth management by balancing control, diversification, and potential returns.

Key Differences Between Direct Investment and Co-Investment

Direct investment involves committing capital independently to assets or companies, granting full control and decision-making authority, whereas co-investment allows investors to pool resources with others, sharing risks and returns proportionally. Direct investments often require larger capital commitments and more intensive management, while co-investments provide access to larger deals with potentially reduced fees and enhanced diversification. Key differences include the level of control, capital requirements, risk exposure, and involvement in operational decisions.

Risk Profiles: Direct Investment vs Co-Investment

Direct investment typically involves higher risk exposure as investors assume full responsibility for asset performance and operational management. Co-investment allows risk sharing among multiple investors, reducing individual exposure while maintaining potential for significant returns. Diversification and collective due diligence in co-investments often lead to more balanced risk profiles compared to direct investments.

Capital Requirements and Allocation Strategies

Direct investment typically demands higher capital requirements, as investors must fund the entire equity stake independently, allowing greater control over asset selection and management. Co-investment involves partnering with lead investors to contribute a smaller portion of capital alongside them, enabling diversification and risk mitigation while accessing larger deals. Allocation strategies in direct investment emphasize concentrated holdings and active oversight, whereas co-investment supports broader portfolio diversification with lower individual capital commitments.

Decision-Making Control and Influence

Direct investment grants investors full decision-making control and greater influence over asset management and strategic direction, enabling tailored portfolio adjustments aligned with specific financial goals. Co-investment involves partnering with lead investors, resulting in shared decision-making power and reduced individual influence, but often offers access to larger deals and diversified risk. Evaluating the trade-off between autonomy and collaborative influence is crucial for optimizing investment outcomes in wealth management.

Access to Deals and Investment Opportunities

Direct investment offers unparalleled control and decision-making power, granting investors exclusive access to unique opportunities and the ability to tailor portfolios closely to their strategies. Co-investment enhances access to high-quality deals often reserved for institutional investors, enabling participants to leverage the lead investor's due diligence and industry connections. Both approaches expand the investment landscape but differ in risk exposure, capital commitment, and operational involvement.

Fee Structures and Cost Implications

Direct investment typically involves higher management fees and carried interest as investors rely solely on a fund manager's expertise, whereas co-investment often offers significantly reduced or waived fees since investors directly participate alongside the lead sponsor. The cost implications of direct investment include ongoing expenses such as due diligence and portfolio monitoring, which can be substantial without shared resources. In contrast, co-investment minimizes these fees and operational costs, enhancing net returns by leveraging the lead investor's infrastructure while maintaining greater control over capital deployment.

Performance Trends: Historical Returns Comparison

Direct investment historically yields higher returns due to full control over asset allocation and decision-making, often outperforming co-investments by 2-4% annually. Co-investment performance tends to be more stable with lower fees, benefiting from the lead investor's expertise, but typically delivers more modest return premiums. Studies show that over a 10-year period, direct investments have averaged 12-15% IRR, whereas co-investments average 9-12%, influenced by factors like deal access and risk diversification.

Suitability for Different Investor Profiles

Direct investment suits high-net-worth individuals seeking full control over asset selection and management, allowing tailored portfolio strategies with higher risk tolerance. Co-investment appeals to investors desiring access to exclusive deals and professional expertise while sharing risks and reducing fees through collaboration with experienced lead investors. Institutional investors and family offices often prefer co-investments for diversification and enhanced returns without the operational burden of sole management.

Strategic Considerations for Wealth Growth

Direct investment allows wealth holders to maintain full control over asset selection and portfolio management, enabling tailored risk exposure and timing strategies that align with specific growth objectives. Co-investment offers access to larger, often institutional-quality deals with reduced fees, while leveraging expertise and due diligence from experienced lead investors. Weighing factors such as control preferences, diversification benefits, cost structures, and alignment with long-term capital appreciation goals informs strategic wealth growth decisions.

Important Terms

Asset allocation

Direct investment offers greater control and customization in asset allocation while co-investment provides reduced risk exposure and access to larger deals through partnership.

Equity syndication

Equity syndication involves multiple investors pooling capital for direct investment in target companies, enabling diversification and risk-sharing. Co-investment differs by allowing limited partners to invest alongside a lead investor directly in specific deals, often resulting in enhanced control and reduced management fees.

Limited partner (LP)

Limited partners (LPs) prefer direct investment for greater control and transparency, while co-investment offers LPs opportunities to invest alongside general partners (GPs) with reduced fees and enhanced deal access.

General partner (GP)

General partners (GPs) typically lead direct investments by managing the entire fund portfolio, whereas co-investments allow limited partners to invest alongside GPs in specific deals, enhancing returns with lower fees and increased exposure.

Capital stack

Direct investment in the capital stack typically involves primary equity positions with higher control and risk, while co-investment allows limited partners to invest alongside sponsors in specific tranches, optimizing risk-return profiles.

Due diligence

Due diligence in direct investment involves comprehensive evaluation of target companies, including financial, operational, and legal aspects to ensure informed decision-making and risk mitigation. In co-investment scenarios, due diligence entails collaborative scrutiny between lead investors and co-investors, focusing on shared governance structures, alignment of investment objectives, and distribution of responsibilities to optimize investment outcomes.

Deal sourcing

Deal sourcing for direct investment involves identifying and evaluating opportunities independently, while co-investment leverages partnerships to share risks and access larger deals.

Control rights

Control rights in direct investment provide the investor with decision-making authority and operational influence over the company, often granting board representation and veto power. In contrast, co-investment typically offers limited control rights, focusing on proportional financial exposure without significant involvement in management decisions.

Alignment of interests

Alignment of interests in direct investment ensures full control and profit retention by the investor, while co-investment aligns interests by sharing risks, decision-making, and returns among multiple investors.

Fee structure

Direct investment typically involves higher fees, including management and performance fees, while co-investment usually offers reduced or no management fees, aligning cost efficiency with investment collaboration.

direct investment vs co-investment Infographic

moneydif.com

moneydif.com