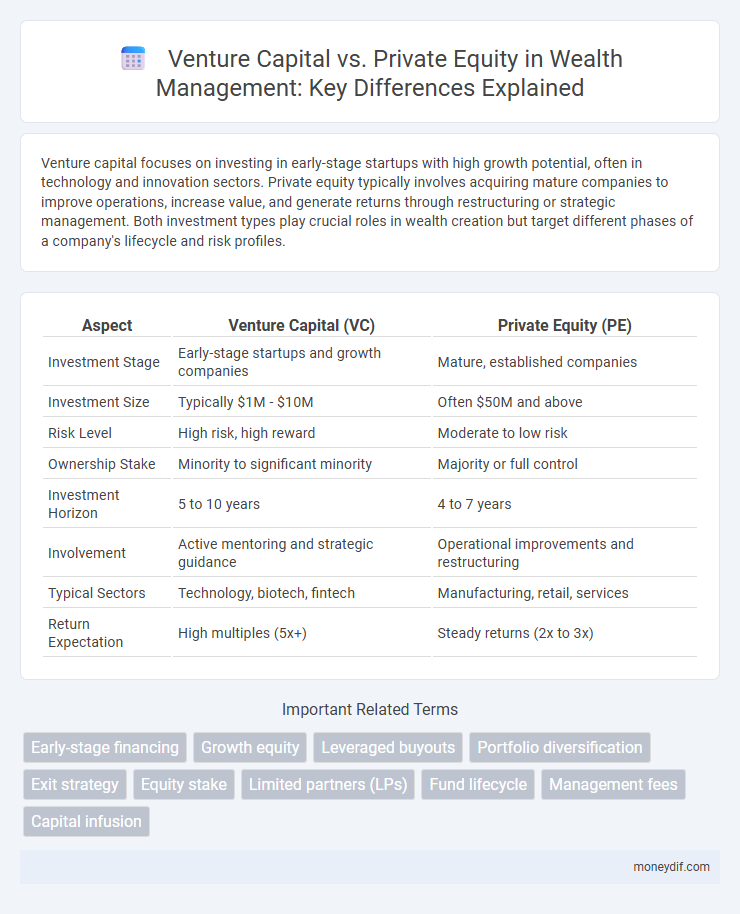

Venture capital focuses on investing in early-stage startups with high growth potential, often in technology and innovation sectors. Private equity typically involves acquiring mature companies to improve operations, increase value, and generate returns through restructuring or strategic management. Both investment types play crucial roles in wealth creation but target different phases of a company's lifecycle and risk profiles.

Table of Comparison

| Aspect | Venture Capital (VC) | Private Equity (PE) |

|---|---|---|

| Investment Stage | Early-stage startups and growth companies | Mature, established companies |

| Investment Size | Typically $1M - $10M | Often $50M and above |

| Risk Level | High risk, high reward | Moderate to low risk |

| Ownership Stake | Minority to significant minority | Majority or full control |

| Investment Horizon | 5 to 10 years | 4 to 7 years |

| Involvement | Active mentoring and strategic guidance | Operational improvements and restructuring |

| Typical Sectors | Technology, biotech, fintech | Manufacturing, retail, services |

| Return Expectation | High multiples (5x+) | Steady returns (2x to 3x) |

Understanding Venture Capital: A Beginner’s Guide

Venture capital is a form of private equity focused on investing in early-stage startups with high growth potential, often in technology or innovation sectors. Unlike private equity, which typically acquires more mature companies through buyouts, venture capital provides funding in exchange for equity to fuel product development and market expansion. Early-stage investments carry higher risk but offer substantial returns if the startup succeeds and achieves an exit through acquisition or initial public offering (IPO).

What Sets Private Equity Apart from Venture Capital?

Private equity primarily invests in established companies with proven cash flows, aiming to improve operations and generate long-term value through strategic management and restructuring. Venture capital targets early-stage startups with high growth potential but higher risk, providing capital in exchange for equity to fuel innovation and expansion. The key distinction lies in private equity's focus on mature businesses and controlling stakes, while venture capital emphasizes funding emerging ventures with minority investments.

Key Investment Stages: VC vs. PE

Venture capital primarily targets early-stage startups and emerging companies with high growth potential, often during seed or Series A funding rounds. Private equity focuses on mature companies, investing in later stages to optimize operations, drive expansion, or facilitate buyouts. These distinct investment stages influence risk profiles, return expectations, and portfolio diversification strategies for venture capital and private equity firms.

Risk and Return Profiles Compared

Venture capital investments typically present higher risk due to funding early-stage startups with uncertain futures, yet they offer potential for exponential returns if the company succeeds. Private equity generally targets more mature companies with established cash flows, resulting in comparatively lower risk and steadier, albeit potentially lower, returns. This risk-return spectrum is crucial for investors aiming to balance portfolio diversification between aggressive growth and stable income generation.

Fund Structures: Venture Capital vs. Private Equity

Venture capital funds typically operate as limited partnerships with a focus on early-stage investments, structured to allow for multiple investments in startups over the fund's lifecycle. Private equity funds also use a limited partnership model but emphasize leveraged buyouts and mature companies, often involving complex capital structures and longer investment horizons. Both fund types align investor interests through management fees and carried interest, but their deployment strategies and risk profiles differ significantly in fund structuring.

Due Diligence Processes in VC and PE

Venture Capital due diligence emphasizes growth potential, market validation, and founder capabilities, often conducting qualitative assessments and early-stage financial analysis. Private Equity due diligence focuses on comprehensive financial audits, operational efficiency, and risk mitigation in mature companies, utilizing detailed financial modeling and industry benchmarking. Both processes involve legal, commercial, and financial evaluations, but PE due diligence is typically more exhaustive due to higher investment scales and leverage structures.

Typical Portfolio Companies: Startups vs. Mature Businesses

Venture capital portfolios typically consist of early-stage startups with high growth potential, often in technology or innovative sectors, aiming for rapid scalability. Private equity investments focus on mature businesses with established revenue streams and stable cash flows, targeting operational improvements and long-term value creation. This fundamental difference drives distinct risk profiles and investment strategies between venture capital and private equity firms.

Exit Strategies in Venture Capital and Private Equity

Exit strategies in venture capital primarily include initial public offerings (IPOs), acquisitions, and secondary sales, enabling investors to realize returns within 5 to 10 years. In private equity, exit strategies often involve leveraged buyouts (LBOs), recapitalizations, and strategic sales, typically targeting longer holding periods of 7 to 12 years. Both approaches optimize value extraction through market timing, financial restructuring, and targeted divestitures to maximize investor returns.

Impact on Business Growth and Wealth Creation

Venture capital fuels early-stage startups by providing high-risk investment essential for disruptive innovation and rapid scaling, significantly accelerating business growth and wealth creation potential. Private equity targets mature companies through leveraged buyouts and operational improvements, driving sustainable expansion and long-term value enhancement. Both investment types contribute distinctly to the wealth ecosystem, with venture capital boosting entrepreneurial ventures and private equity optimizing established enterprises for maximal financial returns.

Which Is Right for You: Choosing Between Venture Capital and Private Equity

Venture capital targets early-stage startups with high growth potential, ideal for entrepreneurs seeking capital and strategic support to scale innovative ideas rapidly. Private equity focuses on established companies, aiming to improve operational efficiency and generate steady returns through long-term investments and restructuring. Selecting between venture capital and private equity depends on your business's maturity, risk tolerance, and growth objectives.

Important Terms

Early-stage financing

Early-stage financing primarily involves venture capital, which provides funding to startups and emerging companies with high growth potential in exchange for equity stakes. Private equity typically targets more mature companies, offering capital for expansion, restructuring, or buyouts rather than initial growth phases.

Growth equity

Growth equity targets established companies experiencing rapid expansion, providing capital to scale operations without significant ownership dilution. Unlike venture capital, which funds early-stage startups, and traditional private equity, which often acquires controlling stakes in mature firms, growth equity investors seek minority positions to fuel growth while minimizing risk.

Leveraged buyouts

Leveraged buyouts (LBOs) primarily fall under private equity strategies, involving acquiring companies using significant debt to enhance returns, whereas venture capital focuses on investing equity in early-stage startups with high growth potential. Private equity firms executing LBOs aim to improve operational efficiency and market positioning of mature companies, contrasting venture capital's emphasis on funding innovation and scaling emerging businesses.

Portfolio diversification

Portfolio diversification in venture capital focuses on high-risk, early-stage startups with potential for exponential growth, whereas private equity emphasizes investing in mature companies through buyouts to generate steady returns; combining both strategies reduces overall risk while enhancing exposure to varied market opportunities across different stages of company development. Effective diversification leverages venture capital's innovation-driven upside and private equity's stability to optimize risk-adjusted returns and create a balanced investment portfolio.

Exit strategy

Exit strategies in venture capital typically focus on initial public offerings (IPOs) or strategic acquisitions to realize returns quickly from high-growth startups, while private equity exit strategies often involve leveraged buyouts and secondary sales targeting mature companies for substantial long-term value creation. Both approaches prioritize maximizing investor returns but differ in timing, risk profiles, and liquidity events based on the company's stage and growth trajectory.

Equity stake

Equity stake in venture capital typically involves early-stage investments in high-growth startups, focusing on partial ownership to fuel innovation and market expansion, while private equity acquires larger, controlling equity stakes in mature companies to drive restructuring and value creation. Venture capital equity stakes are generally smaller and riskier, whereas private equity holds substantial or majority shares, aiming for operational improvements and long-term returns.

Limited partners (LPs)

Limited partners (LPs) in venture capital typically include institutional investors, pension funds, and high-net-worth individuals seeking high-growth startup opportunities with higher risk and longer liquidity horizons. In private equity, LPs often focus on more mature companies with established cash flows, prioritizing capital preservation and consistent returns through buyouts and restructuring strategies.

Fund lifecycle

The fund lifecycle in venture capital typically spans early-stage investments with shorter exit horizons, focusing on high-growth startups, whereas private equity funds invest in mature companies with longer holding periods aimed at operational improvements and stable returns. Venture capital funds emphasize seed to Series C rounds, while private equity primarily engages in buyouts, recapitalizations, and growth capital deployments during their respective investment, management, and exit stages.

Management fees

Management fees in venture capital typically range from 2% to 2.5% of committed capital during the investment period, reflecting the hands-on support and deal sourcing activities. Private equity management fees often start at 1.5% to 2% of assets under management, decreasing over time as investments mature and require less intensive oversight.

Capital infusion

Capital infusion in venture capital primarily targets early-stage startups with high growth potential, emphasizing equity investments to fuel innovation and market expansion. In contrast, private equity focuses on mature companies, deploying substantial capital to restructure operations, enhance efficiency, and drive long-term value creation.

Venture Capital vs Private Equity Infographic

moneydif.com

moneydif.com