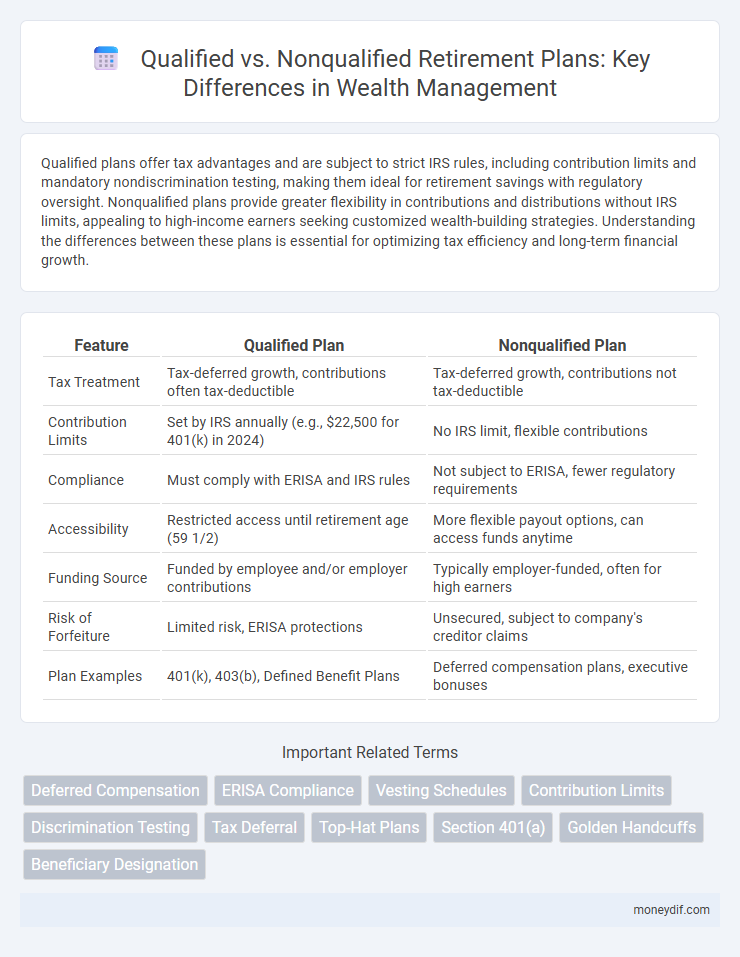

Qualified plans offer tax advantages and are subject to strict IRS rules, including contribution limits and mandatory nondiscrimination testing, making them ideal for retirement savings with regulatory oversight. Nonqualified plans provide greater flexibility in contributions and distributions without IRS limits, appealing to high-income earners seeking customized wealth-building strategies. Understanding the differences between these plans is essential for optimizing tax efficiency and long-term financial growth.

Table of Comparison

| Feature | Qualified Plan | Nonqualified Plan |

|---|---|---|

| Tax Treatment | Tax-deferred growth, contributions often tax-deductible | Tax-deferred growth, contributions not tax-deductible |

| Contribution Limits | Set by IRS annually (e.g., $22,500 for 401(k) in 2024) | No IRS limit, flexible contributions |

| Compliance | Must comply with ERISA and IRS rules | Not subject to ERISA, fewer regulatory requirements |

| Accessibility | Restricted access until retirement age (59 1/2) | More flexible payout options, can access funds anytime |

| Funding Source | Funded by employee and/or employer contributions | Typically employer-funded, often for high earners |

| Risk of Forfeiture | Limited risk, ERISA protections | Unsecured, subject to company's creditor claims |

| Plan Examples | 401(k), 403(b), Defined Benefit Plans | Deferred compensation plans, executive bonuses |

Understanding Qualified and Nonqualified Plans

Qualified plans, such as 401(k)s and pensions, offer tax advantages and must comply with ERISA regulations, providing employees with retirement savings protections and employer contribution limits. Nonqualified plans, including deferred compensation and executive bonus plans, lack these regulatory constraints, allowing more flexibility but fewer guarantees and tax benefits. Understanding the distinctions helps individuals optimize retirement strategies by balancing tax efficiency, contribution limits, and plan security.

Key Differences Between Qualified and Nonqualified Plans

Qualified plans offer tax-deferred growth and employer contributions that are subject to strict IRS regulations, including contribution limits and nondiscrimination rules, ensuring broad employee eligibility. Nonqualified plans provide more flexibility with fewer regulatory constraints, allowing higher contribution limits and customization for select employees but typically lack the same tax advantages and are considered unsecured liabilities by employers. The key differences lie in tax treatment, regulatory oversight, participant eligibility, and the degree of employer funding protection.

Tax Implications of Each Plan Type

Qualified plans offer tax-deferred growth and employer contributions are tax-deductible, with distributions taxed as ordinary income upon withdrawal. Nonqualified plans do not receive favorable tax treatment on contributions but provide flexibility, and employees are taxed on benefits when they are paid out, not when earned. Understanding the timing and nature of tax liabilities for each plan is critical for effective retirement planning and wealth management.

Contribution Limits and Funding Rules

Qualified plans have strict IRS-imposed contribution limits, such as the 401(k) salary deferral cap of $23,000 for employees under 50 in 2024, and require employer contributions to comply with nondiscrimination rules. Nonqualified plans lack federal contribution limits, allowing highly compensated employees to defer larger amounts, but they are subject to fewer funding restrictions and no ERISA protection. These funding differences impact plan security and tax treatment, with qualified plans needing to hold assets in a trust, while nonqualified plans are typically unfunded promises payable from the employer's general assets.

Employer and Employee Participation

Qualified plans offer both employer and employee tax advantages, including tax-deferred growth and potential employer contributions subject to IRS limits, fostering broad participation and compliance with ERISA regulations. Nonqualified plans provide more flexible benefit structures tailored to key executives or select employees without contribution limits but lack the same tax benefits and protections, often requiring the employer to assume greater funding risk. Employer participation in qualified plans typically involves matching or profit-sharing contributions, while in nonqualified plans, employers may design discretionary or supplemental benefits to attract and retain top talent.

Distribution and Withdrawal Guidelines

Qualified plans, governed by ERISA and IRS regulations, require mandatory minimum distributions (RMDs) starting at age 73, with withdrawals typically subject to ordinary income tax. Nonqualified plans offer more flexible distribution schedules without RMD requirements, but withdrawals may trigger varying tax treatments depending on plan design. Understanding these distinctions is crucial for optimizing tax efficiency and retirement income strategies.

Regulatory Compliance and Reporting

Qualified plans adhere to strict regulatory compliance under ERISA and IRS codes, requiring annual reporting through Form 5500 and mandatory fiduciary oversight to protect participants. Nonqualified plans face fewer regulations, allowing greater flexibility in design and contribution limits but lack the same level of protective reporting requirements and participant safeguards. Employers must carefully navigate these differences to balance compliance obligations with strategic compensation goals.

Advantages and Disadvantages of Qualified Plans

Qualified plans offer significant tax advantages, including tax-deferred growth and employer contributions that reduce taxable income. They must adhere to strict IRS regulations and contribution limits, which can limit flexibility compared to nonqualified plans. Compliance requirements ensure strong participant protections but may increase administrative complexity and costs.

Benefits and Drawbacks of Nonqualified Plans

Nonqualified plans offer greater flexibility in contribution limits and plan design compared to qualified plans, making them attractive for high-income earners seeking additional tax-deferred savings beyond standard limits. These plans, however, lack the tax advantages and protections of qualified plans, as contributions are made with after-tax dollars and are subject to creditors' claims in case of bankruptcy. Nonqualified plans also have fewer regulatory requirements, enabling customized benefits but increasing the risk of forfeiture if the employer faces financial difficulties.

Choosing the Right Plan for Your Wealth Strategy

Qualified plans, such as 401(k)s and IRAs, offer tax-deferred growth and employer matching but are subject to strict IRS contribution limits and required minimum distributions. Nonqualified plans provide greater flexibility in contribution amounts and investment options, making them ideal for high-net-worth individuals seeking customized wealth strategies without immediate tax consequences. Evaluating your income level, risk tolerance, and retirement timeline is essential when selecting between these plans to maximize tax advantages and long-term financial growth.

Important Terms

Deferred Compensation

Deferred compensation plans allow employees to postpone income tax on earnings until a future date, with qualified plans meeting IRS requirements for tax advantages and contribution limits, while nonqualified plans offer more flexibility but lack these tax benefits and protections. Qualified plans, such as 401(k)s, provide employer tax deductions and employee protection under ERISA, whereas nonqualified plans are typically used for high-earning executives with customized terms and carry greater risk if the company faces financial difficulties.

ERISA Compliance

ERISA compliance mandates specific reporting, disclosure, and fiduciary standards exclusively for qualified plans, which benefit from tax advantages and must meet participation, vesting, and funding requirements. Nonqualified plans, typically used for executive compensation, are exempt from ERISA's strict rules but lack the same tax benefits and do not require formal IRS qualification.

Vesting Schedules

Vesting schedules in qualified plans are regulated by the Employee Retirement Income Security Act (ERISA) and require employees to earn ownership of employer contributions over a defined period, typically through cliff or graded vesting methods. Nonqualified plans offer more flexible vesting schedules without ERISA restrictions, allowing employers to tailor ownership timelines based on specific company policies or executive agreements.

Contribution Limits

Contribution limits for qualified plans, such as 401(k)s and IRAs, are strictly regulated by the IRS, with annual caps like $22,500 for 401(k) plans in 2024, ensuring tax-deferred growth within these limits. Nonqualified plans lack standardized contribution limits, allowing employers and employees to negotiate flexible funding amounts, but contributions do not receive the same immediate tax benefits or protection under ERISA regulations.

Discrimination Testing

Discrimination testing evaluates whether Qualified Plans favor highly compensated employees over non-highly compensated employees, ensuring compliance with IRS non-discrimination rules to maintain tax-qualified status. Nonqualified Plans are exempt from such testing but do not offer the same favorable tax treatment, often used to provide additional benefits to key employees.

Tax Deferral

Tax deferral in qualified plans, such as 401(k)s and traditional IRAs, allows earnings to grow tax-free until withdrawal, typically during retirement when the individual may be in a lower tax bracket. Nonqualified plans, including deferred compensation agreements, offer tax deferral on earnings but lack the regulatory protections and tax advantages of qualified plans, leading to greater risk but potentially more flexible contribution limits.

Top-Hat Plans

Top-Hat Plans are a type of nonqualified retirement plan designed for select management or highly compensated employees, providing benefits beyond those available in qualified plans, which must comply with ERISA regulations and nondiscrimination requirements. Unlike qualified plans, Top-Hat Plans offer greater flexibility in contributions and distributions but do not receive the same favorable tax treatment or fiduciary protections.

Section 401(a)

Section 401(a) of the Internal Revenue Code governs qualified retirement plans, ensuring tax-deferred contributions and earnings while meeting strict IRS requirements such as nondiscrimination and minimum vesting standards. In contrast, nonqualified plans do not meet these requirements, offering more flexible benefit terms but lacking the favorable tax treatment and protections of Section 401(a) qualified plans.

Golden Handcuffs

Golden Handcuffs are incentive strategies used primarily in nonqualified plans to retain key executives by offering deferred compensation benefits that are not subject to the strict IRS limits governing qualified plans. Unlike qualified plans, such as 401(k)s, nonqualified plans allow for greater flexibility in contribution amounts and vesting schedules, making them a preferred tool for creating customized retention incentives without immediate tax consequences.

Beneficiary Designation

Beneficiary designation in qualified plans, such as 401(k) or pension plans, is governed by strict ERISA rules ensuring protections like spousal consent, while nonqualified plans offer more flexibility without federal mandates, allowing plan sponsors to define beneficiary terms more freely. Qualified plans often require primary and contingent beneficiaries to be clearly designated to preserve tax benefits and comply with IRS regulations, whereas nonqualified plans can permit more informal or revocable beneficiary designations.

Qualified plan vs Nonqualified plan Infographic

moneydif.com

moneydif.com