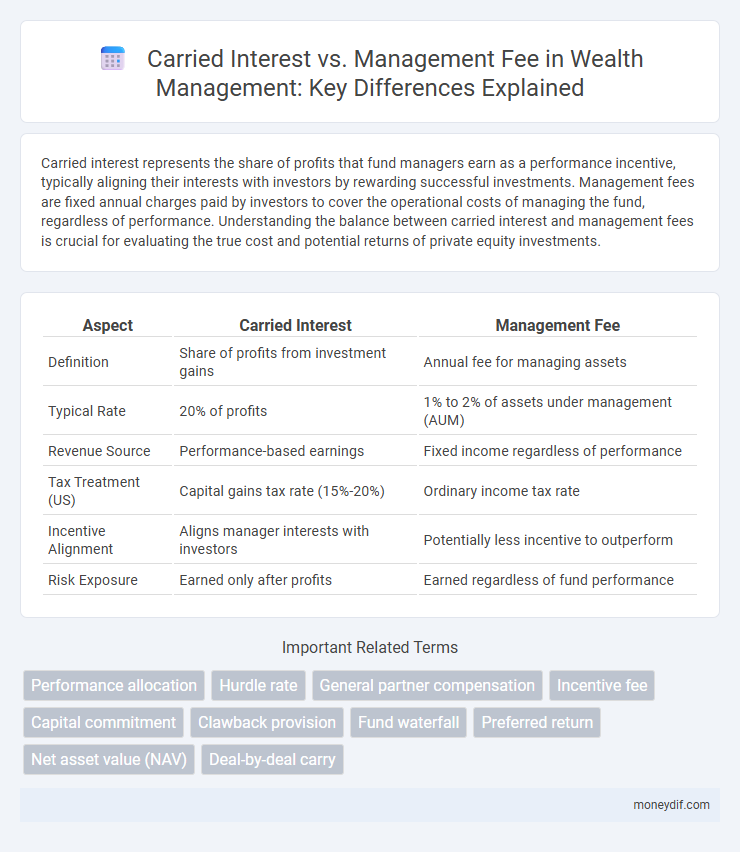

Carried interest represents the share of profits that fund managers earn as a performance incentive, typically aligning their interests with investors by rewarding successful investments. Management fees are fixed annual charges paid by investors to cover the operational costs of managing the fund, regardless of performance. Understanding the balance between carried interest and management fees is crucial for evaluating the true cost and potential returns of private equity investments.

Table of Comparison

| Aspect | Carried Interest | Management Fee |

|---|---|---|

| Definition | Share of profits from investment gains | Annual fee for managing assets |

| Typical Rate | 20% of profits | 1% to 2% of assets under management (AUM) |

| Revenue Source | Performance-based earnings | Fixed income regardless of performance |

| Tax Treatment (US) | Capital gains tax rate (15%-20%) | Ordinary income tax rate |

| Incentive Alignment | Aligns manager interests with investors | Potentially less incentive to outperform |

| Risk Exposure | Earned only after profits | Earned regardless of fund performance |

Understanding Carried Interest and Management Fees

Carried interest represents a share of profits earned by investment managers, typically around 20%, incentivizing performance in private equity and hedge funds. Management fees, usually set at 2% of assets under management, provide stable income regardless of fund performance, covering operational expenses. Understanding the distinction between carried interest and management fees is crucial for assessing compensation structures and aligning investor-manager interests in wealth management.

Key Differences Between Carried Interest and Management Fees

Carried interest represents the profit share a fund manager earns, typically around 20%, incentivizing performance and aligning interests with investors, while management fees are fixed charges, usually 1-2% of assets under management, covering operational costs regardless of fund performance. Carried interest is taxed as capital gains in many jurisdictions, offering favorable tax treatment, whereas management fees are taxed as ordinary income. The timing of income recognition also differs: carried interest is realized upon profit distribution, whereas management fees are received periodically, providing steady cash flow.

How Carried Interest Works in Wealth Management

Carried interest in wealth management represents a share of profits earned by investment managers, typically around 20%, incentivizing superior fund performance. Unlike management fees, which are fixed charges usually around 2% of assets under management, carried interest aligns the manager's financial interests with those of the investors. This performance-based compensation model drives asset growth and long-term wealth creation by rewarding successful investment outcomes.

The Structure of Management Fees Explained

Management fees in wealth management typically represent a fixed percentage of assets under management (AUM), commonly ranging from 1% to 2% annually, providing a steady income stream irrespective of fund performance. This fee structure ensures operational stability and covers administrative expenses, contrasting with carried interest, which is performance-based and paid as a share of investment profits, usually around 20%. The predictable nature of management fees aligns advisers' incentives with asset growth while reducing reliance on investment success for compensation.

Tax Implications: Carried Interest vs. Management Fees

Carried interest is typically taxed at the lower capital gains rate, offering significant tax advantages for fund managers compared to management fees, which are taxed as ordinary income. This tax treatment incentivizes fund managers to prioritize performance-based compensation tied to investment gains. Understanding these tax implications is crucial for optimizing after-tax earnings in private equity and hedge fund management.

Impact on Investor Returns

Carried interest aligns fund managers' incentives with investors by offering a share of the profits, typically around 20%, which can significantly boost net returns when investments perform well. Management fees, commonly about 2% of assets under management, provide steady income for managers but reduce investors' overall returns regardless of fund performance. Understanding the trade-off between these fees is crucial for investors aiming to maximize after-fee returns in private equity or hedge fund investments.

Pros and Cons of Carried Interest for Fund Managers

Carried interest offers fund managers a significant upside by allowing them to earn a share of the fund's profits, typically around 20%, which aligns their interests with investors and incentivizes superior performance. However, this compensation structure can introduce volatility in income due to dependency on fund profitability and may attract regulatory scrutiny or adverse tax treatment compared to stable management fees, which generally provide a fixed, predictable revenue stream. Fund managers must balance the high-reward potential of carried interest against the risks of fluctuating earnings and compliance complexity in their wealth management strategy.

Why Management Fees Matter in Wealth Planning

Management fees provide a reliable income stream for wealth managers, ensuring stability regardless of investment performance fluctuations. Carried interest depends on investment gains and is less predictable, making management fees essential for cash flow and operational planning. Consistent management fees support long-term wealth planning by enabling fiduciaries to maintain service quality and strategic focus without relying solely on variable profits.

Regulatory Considerations and Industry Trends

Regulatory considerations surrounding carried interest focus on its tax treatment, as policymakers debate whether it qualifies for capital gains rates or should be taxed as ordinary income, influencing fund managers' compensation structures. Industry trends reveal a growing push for transparency and regulatory compliance, with increased scrutiny from the IRS and SEC leading private equity firms to adjust fee disclosures and reporting practices. Management fees remain more stable and predictable but face pressure from investors demanding lower fees and performance-based alignments, shifting the balance between carried interest incentives and management fee models.

Choosing the Right Fee Structure for Your Wealth Goals

Selecting the optimal fee structure depends on aligning your wealth goals with risk tolerance and investment horizon. Carried interest incentivizes fund managers through profit-sharing, promoting higher performance but with variable costs, while management fees provide predictable expenses regardless of fund returns. Evaluating the balance between consistent fees and performance-based rewards ensures a tailored approach to maximizing long-term wealth growth.

Important Terms

Performance allocation

Performance allocation in private equity primarily refers to carried interest, which is a share of the profits rewarded to fund managers, while management fees are fixed annual payments covering operational costs and do not depend on fund performance.

Hurdle rate

The hurdle rate is the minimum return private equity investors must receive before fund managers earn carried interest, distinguishing it from management fees which are fixed and unrelated to investment performance.

General partner compensation

General partner compensation primarily derives from carried interest, typically 20% of profits, while management fees, usually around 2% of committed capital, cover operational expenses.

Incentive fee

Incentive fees, typically structured as carried interest, align fund managers' profits with investment performance, whereas management fees provide a fixed percentage of assets under management regardless of returns.

Capital commitment

Capital commitment defines the total amount investors pledge to a private equity fund, directly influencing the carried interest earned by fund managers as a share of profits above a certain return threshold, while management fees are typically calculated as a fixed percentage of committed capital regardless of fund performance. Carried interest aligns manager incentives with investor returns, contrasting with management fees that provide steady income and cover operational costs.

Clawback provision

Clawback provisions in private equity ensure that general partners return excess carried interest if total profits fall below the hurdle rate, while management fees remain unaffected as fixed compensation.

Fund waterfall

Fund waterfall allocates profits by prioritizing return of capital and preferred return to investors before distributing carried interest to fund managers, while management fees are fixed periodic payments unrelated to profit distribution.

Preferred return

Preferred return ensures limited partners receive a minimum profit before carried interest allocation, contrasting with management fees which are fixed payments for fund management regardless of performance.

Net asset value (NAV)

Net Asset Value (NAV) influences carried interest calculations by reflecting fund performance, whereas management fees are typically fixed based on committed capital, independent of NAV changes.

Deal-by-deal carry

Deal-by-deal carry allocates carried interest to fund managers based on individual deal profits, unlike management fees which are fixed charges covering operational expenses regardless of deal performance.

carried interest vs management fee Infographic

moneydif.com

moneydif.com