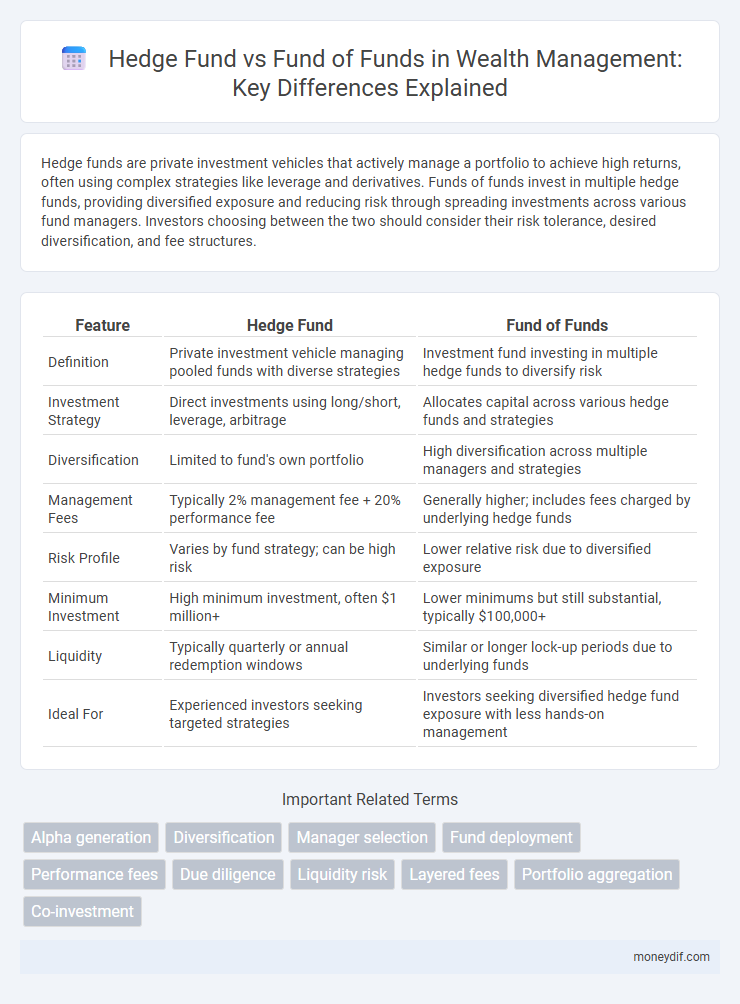

Hedge funds are private investment vehicles that actively manage a portfolio to achieve high returns, often using complex strategies like leverage and derivatives. Funds of funds invest in multiple hedge funds, providing diversified exposure and reducing risk through spreading investments across various fund managers. Investors choosing between the two should consider their risk tolerance, desired diversification, and fee structures.

Table of Comparison

| Feature | Hedge Fund | Fund of Funds |

|---|---|---|

| Definition | Private investment vehicle managing pooled funds with diverse strategies | Investment fund investing in multiple hedge funds to diversify risk |

| Investment Strategy | Direct investments using long/short, leverage, arbitrage | Allocates capital across various hedge funds and strategies |

| Diversification | Limited to fund's own portfolio | High diversification across multiple managers and strategies |

| Management Fees | Typically 2% management fee + 20% performance fee | Generally higher; includes fees charged by underlying hedge funds |

| Risk Profile | Varies by fund strategy; can be high risk | Lower relative risk due to diversified exposure |

| Minimum Investment | High minimum investment, often $1 million+ | Lower minimums but still substantial, typically $100,000+ |

| Liquidity | Typically quarterly or annual redemption windows | Similar or longer lock-up periods due to underlying funds |

| Ideal For | Experienced investors seeking targeted strategies | Investors seeking diversified hedge fund exposure with less hands-on management |

Hedge Funds vs Fund of Funds: Core Differences

Hedge funds directly invest in a diversified portfolio of assets, actively managing risk and seeking high returns through various strategies like long-short equity, arbitrage, and derivatives. Fund of funds invest by pooling capital into multiple hedge funds, providing diversification and professional selection but often incurring higher fees and layered management costs. The core difference lies in direct investment and control in hedge funds versus indirect exposure and broader diversification through multiple hedge fund managers in fund of funds.

Understanding the Investment Structures

Hedge funds deploy capital directly into diverse asset classes, using strategies like long/short equity, global macro, or event-driven to maximize risk-adjusted returns. Fund of funds invest in multiple hedge funds, offering investors diversified exposure and professional manager selection but typically incur higher fees due to an additional management layer. Understanding these structures is crucial for aligning investment goals with risk tolerance and cost considerations in wealth management.

Risk and Return Profiles Compared

Hedge funds typically offer higher return potential by employing aggressive strategies such as leverage and short selling, but they also carry increased risk and less liquidity. Fund of funds diversify risk by investing in multiple hedge funds, thereby reducing exposure to any single manager or strategy, which often results in more stable but comparatively lower returns. Investors must weigh the trade-off between the concentrated risk and higher returns of hedge funds versus the diversified risk and smoother return profile of fund of funds.

Diversification Strategies Explained

Hedge funds invest directly in a wide range of assets and employ diverse strategies like long-short equity, arbitrage, and macroeconomic trends to achieve superior risk-adjusted returns. Fund of funds diversify further by pooling capital into multiple hedge funds, spreading risk across various management styles and underlying assets, reducing reliance on any single strategy. This layered diversification enhances portfolio stability and mitigates volatility more effectively than investing in individual hedge funds alone.

Minimum Investment Requirements

Hedge funds typically demand substantial minimum investments, often ranging from $100,000 to $1 million, catering to high-net-worth individuals and institutional investors. Fund of funds usually have lower minimum investment thresholds, sometimes starting around $25,000 to $100,000, making them more accessible to a broader range of investors. These varied entry points reflect differing risk profiles and diversification strategies inherent in each investment vehicle.

Fee Structures: Costs and Transparency

Hedge funds typically charge a management fee around 2% of assets under management and a performance fee of 20% on profits, creating higher costs but offering potential for outsized returns. Fund of funds impose an additional management fee, generally 1%, on top of the underlying hedge fund fees, leading to a double-layered fee structure that can significantly reduce net investor returns. Transparency varies as hedge funds often provide less detailed fee breakdowns, whereas fund of funds generally offer clearer disclosures to justify their aggregated expense layers.

Performance Metrics and Historical Returns

Hedge funds typically exhibit higher volatility and alpha generation compared to fund of funds, which often deliver more stable but moderate returns due to diversification across multiple hedge funds. Performance metrics such as the Sharpe ratio and Sortino ratio frequently favor hedge funds for aggressive growth, while fund of funds demonstrate lower risk-adjusted returns due to layered fees and reduced exposure to individual fund volatility. Historical returns reveal hedge funds achieving annualized returns between 8% to 15%, whereas fund of funds generally report returns in the 5% to 10% range, reflecting their risk-mitigation strategy through asset aggregation.

Regulatory Oversight and Compliance

Hedge funds typically operate under a lighter regulatory framework compared to funds of funds, which are subject to stricter oversight due to their indirect investments in multiple underlying hedge funds. Regulatory bodies like the SEC impose comprehensive compliance requirements on funds of funds, including enhanced transparency and risk management protocols to protect investors from layered fees and operational risks. This increased regulatory scrutiny ensures funds of funds maintain rigorous due diligence processes, while hedge funds may face varying rules depending on their structure and jurisdiction.

Investor Suitability and Access

Hedge funds typically require high net worth investors due to their high minimum investment thresholds and complex risk profiles, making them suitable for accredited investors seeking direct exposure to alternative strategies. Fund of funds offer broader access by pooling capital from multiple investors, including those with lower minimum investments, while providing diversification across various hedge funds to mitigate risk. Investors focused on accessibility and reduced risk often prefer fund of funds, whereas those prioritizing direct control and potentially higher returns may choose individual hedge funds.

Key Pros and Cons for Wealth Growth

Hedge funds offer direct investment in diverse strategies with potential for high returns but come with higher risk and often steep fees, impacting wealth growth. Fund of funds provide diversification by investing in multiple hedge funds, reducing risk and volatility, though they tend to have layered fees that can erode overall returns. Investors need to weigh the trade-off between concentrated exposure with hedge funds and broader risk mitigation with fund of funds to optimize long-term wealth accumulation.

Important Terms

Alpha generation

Alpha generation in hedge funds typically involves direct active management strategies aimed at outperforming the market, while funds of funds generate alpha by diversifying across multiple hedge funds to reduce risk and enhance returns.

Diversification

Diversification in hedge funds involves allocating capital across various strategies and asset classes within a single fund to reduce risk, while fund of funds amplifies this effect by investing in multiple hedge funds, thereby spreading risk across diverse managers and approaches. This layered diversification enhances risk mitigation and potential returns by combining uncorrelated hedge fund strategies and reducing exposure to individual fund performance.

Manager selection

Selecting a hedge fund manager requires evaluating investment strategy, track record, risk management, and transparency, whereas selecting a fund of funds manager emphasizes diversification, due diligence capabilities, and access to top-performing hedge funds.

Fund deployment

Hedge funds directly deploy capital into diverse assets using aggressive strategies, while fund of funds allocate capital by investing in multiple hedge funds to diversify risk and optimize returns.

Performance fees

Hedge funds typically charge performance fees around 20% of profits, while funds of funds often charge combined fees averaging 1% management plus 10% performance fees due to their layered investment structure.

Due diligence

Due diligence in hedge funds requires in-depth analysis of investment strategies, risk management, and performance metrics, while fund of funds due diligence emphasizes evaluating underlying hedge funds' diversification, fees, and manager selection processes.

Liquidity risk

Hedge funds face higher liquidity risk due to longer lock-up periods and redemption restrictions compared to fund of funds, which typically offer more diversified and frequent liquidity options.

Layered fees

Hedge funds typically charge a single management and performance fee, while fund of funds incur layered fees due to additional management charges at both the underlying hedge fund level and the fund of funds level.

Portfolio aggregation

Portfolio aggregation enhances risk management by consolidating exposures across hedge funds and fund of funds to provide a unified performance and risk assessment.

Co-investment

Co-investment in hedge funds allows investors to directly participate alongside the fund manager for potentially higher returns and lower fees compared to traditional fund of funds structures that invest indirectly through multiple hedge funds.

hedge fund vs fund of funds Infographic

moneydif.com

moneydif.com