Asset swaps involve exchanging the returns or cash flows of a specific asset for those of another financial instrument, allowing investors to manage risk or improve yield profiles. Liability swaps, on the other hand, focus on exchanging the terms of debt obligations, such as interest rates or currencies, to optimize funding costs and align liabilities with asset performance. Both strategies serve to enhance balance sheet management but target different aspects of financial portfolios.

Table of Comparison

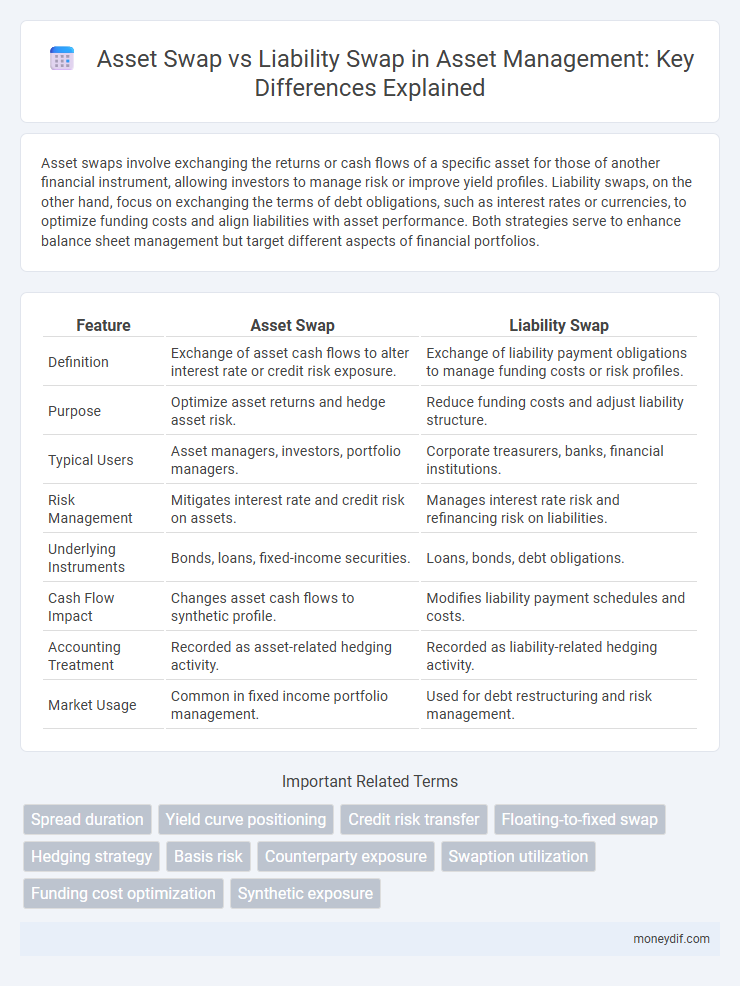

| Feature | Asset Swap | Liability Swap |

|---|---|---|

| Definition | Exchange of asset cash flows to alter interest rate or credit risk exposure. | Exchange of liability payment obligations to manage funding costs or risk profiles. |

| Purpose | Optimize asset returns and hedge asset risk. | Reduce funding costs and adjust liability structure. |

| Typical Users | Asset managers, investors, portfolio managers. | Corporate treasurers, banks, financial institutions. |

| Risk Management | Mitigates interest rate and credit risk on assets. | Manages interest rate risk and refinancing risk on liabilities. |

| Underlying Instruments | Bonds, loans, fixed-income securities. | Loans, bonds, debt obligations. |

| Cash Flow Impact | Changes asset cash flows to synthetic profile. | Modifies liability payment schedules and costs. |

| Accounting Treatment | Recorded as asset-related hedging activity. | Recorded as liability-related hedging activity. |

| Market Usage | Common in fixed income portfolio management. | Used for debt restructuring and risk management. |

Introduction to Asset Swaps and Liability Swaps

Asset swaps involve exchanging the cash flows of a fixed-income asset with a different set of cash flows, often to transform fixed-rate payments into floating rates or vice versa, optimizing the asset's risk-return profile. Liability swaps, on the other hand, focus on reshaping the debt structure by swapping the cash flow characteristics of existing liabilities, enabling better alignment with an institution's liability management strategy. Both asset and liability swaps are crucial tools in interest rate risk management, enhancing balance sheet flexibility through customized cash flow adjustments.

Defining Asset Swap: Structure and Purpose

An asset swap involves exchanging the cash flows of a fixed-rate asset with those of a floating-rate liability, allowing investors to manage interest rate risk more effectively. This structure typically includes the purchase of a bond combined with entering into an interest rate swap agreement to convert fixed coupon payments into floating payments. The primary purpose of an asset swap is to enhance portfolio flexibility and match liabilities with desired cash flow characteristics while optimizing yield.

Understanding Liability Swap: Key Features

Liability swaps involve exchanging debt obligations to modify interest rate exposure, currency risk, or maturity profiles, helping institutions manage financial risk efficiently. Key features include the restructuring of existing liabilities without altering the underlying asset base, enabling improved cash flow management and reduced funding costs. This strategy is crucial for balancing on-balance-sheet risk and optimizing capital structure in corporate finance and banking.

Core Differences Between Asset Swaps and Liability Swaps

Asset swaps involve exchanging the cash flows of a fixed-income asset for floating-rate payments to manage interest rate risk or enhance yield. Liability swaps focus on transforming the interest obligations of existing debt, typically converting fixed-rate liabilities into floating-rate ones or vice versa, to optimize financing costs. The core difference lies in the asset swap targeting investment portfolio risks, while liability swaps address the issuer's debt structure and cost management.

Use Cases: When to Choose Asset Swap vs. Liability Swap

Asset swaps are ideal for investors seeking to hedge interest rate risk on bond holdings or to enhance yield by exchanging fixed coupon payments for floating-rate returns. Liability swaps suit corporations aiming to manage debt service costs or adjust interest rate exposure on outstanding loans by converting fixed-rate liabilities into floating rates or vice versa. Choosing asset swaps typically aligns with portfolio optimization goals, while liability swaps are preferred for tailoring balance sheet interest expenses.

Risk Management in Asset and Liability Swaps

Asset swaps and liability swaps serve distinct roles in risk management by allowing institutions to realign cash flows and risk profiles. Asset swaps transform fixed-income asset returns into floating rates to mitigate interest rate risk, while liability swaps adjust debt obligations to optimize funding costs and manage credit risk. Effective risk management in these swaps hinges on accurately modeling market movements and counterparty exposure to maintain portfolio stability and regulatory compliance.

Impact on Balance Sheet and Financial Reporting

Asset swaps involve exchanging fixed income securities to manage interest rate risk, impacting the asset side of the balance sheet by altering the composition and duration of investment portfolios. Liability swaps focus on modifying debt obligations, affecting the liability side by changing interest payment structures and overall debt profiles. Both swaps require detailed disclosure in financial reporting, influencing key metrics like net interest margin and risk exposure on financial statements.

Market Participants: Who Uses Asset and Liability Swaps

Asset swaps primarily attract institutional investors such as pension funds and insurance companies seeking to adjust yield profiles without altering credit exposure. Liability swaps are favored by corporations and financial institutions aiming to optimize debt structures and hedge interest rate or currency risks. Both market participants employ these swaps to manage balance sheet risks efficiently in dynamic financial markets.

Regulatory and Compliance Considerations

Asset swaps primarily involve exchanging cash flows from securities, requiring compliance with accounting standards such as IFRS 9 and regulatory frameworks like Basel III, which emphasize risk-weighted asset calculations and capital adequacy. Liability swaps focus on restructuring debt obligations, subject to regulations governing disclosure, debt covenants, and credit risk management under frameworks like Dodd-Frank and EMIR. Both swaps demand rigorous reporting, transparency, and adherence to anti-money laundering (AML) and know-your-customer (KYC) rules to mitigate systemic risk and ensure financial stability.

Future Trends in Asset and Liability Swaps

Future trends in asset and liability swaps indicate increasing adoption of advanced analytics and AI-driven risk assessment models to optimize portfolio performance and mitigate market volatility. Integration of blockchain technology enhances transparency and settlement efficiency, reducing counterparty risk in both asset and liability swap transactions. Regulatory evolution continues to shape swap market structures, with a focus on standardization and collateral management improvements to ensure greater financial stability.

Important Terms

Spread duration

Spread duration measures the sensitivity of an asset swap or liability swap's value to changes in credit spreads, with asset swaps typically having positive spread duration and liability swaps exhibiting negative spread duration.

Yield curve positioning

Yield curve positioning involves strategically aligning asset swap exposures to optimize returns relative to liability swaps, which hedge funding costs and cash flow timing risks. Effective management of these swaps balances interest rate risk between assets and liabilities, enhancing net interest margin through curve steepening, flattening, or butterfly trades.

Credit risk transfer

Credit risk transfer through asset swaps involves exchanging the credit exposure of underlying assets, whereas liability swaps transfer the issuer's credit risk by swapping debt obligations with different credit profiles.

Floating-to-fixed swap

A floating-to-fixed swap involves exchanging variable interest payments for fixed-rate payments, commonly utilized in asset swaps to hedge floating-rate asset exposure by converting it to fixed cash flows. In contrast, liability swaps focus on managing debt obligations by swapping the floating interest payments on liabilities to fixed rates, stabilizing borrowing costs and reducing interest rate risk.

Hedging strategy

Hedging strategy involving asset swaps focuses on offsetting interest rate or credit risk by exchanging fixed-rate asset cash flows for floating-rate payments, optimizing yield and risk balance. Liability swaps, conversely, manage funding cost and interest exposure by transforming the characteristics of liabilities, aligning debt profiles with asset cash flows to enhance financial stability and reduce mismatch risk.

Basis risk

Basis risk in asset swaps versus liability swaps arises from the mismatch between the reference interest rates or credit spreads used in the swap agreements and the actual cash flows of the underlying assets or liabilities. This risk affects hedging effectiveness and may lead to unexpected gains or losses due to imperfect correlation between swap benchmarks and the economic drivers of the assets or liabilities involved.

Counterparty exposure

Counterparty exposure in asset swaps involves the risk of the swap counterparty defaulting on payments, whereas in liability swaps, it includes the risk associated with transferring debt obligations which can impact the firm's credit profile and funding costs.

Swaption utilization

Swaption utilization enables flexible management of interest rate risk by allowing strategic selection between asset swap hedges to enhance yield and liability swap hedges to optimize funding costs.

Funding cost optimization

Funding cost optimization involves choosing between asset swaps and liability swaps to minimize overall borrowing expenses and improve balance sheet efficiency. Asset swaps generally focus on modifying the asset side's interest rate exposure to reduce funding costs, while liability swaps restructure debt obligations to achieve lower interest payments and enhance liquidity management.

Synthetic exposure

Synthetic exposure in asset swaps creates a tailored risk profile by combining fixed-income securities with derivative contracts, enabling investors to transform bond cash flows and hedge interest rate or credit risks. Liability swaps similarly adjust a firm's debt structure by exchanging fixed or floating rate obligations, optimizing funding costs while managing balance sheet risk through customized synthetic positions.

asset swap vs liability swap Infographic

moneydif.com

moneydif.com