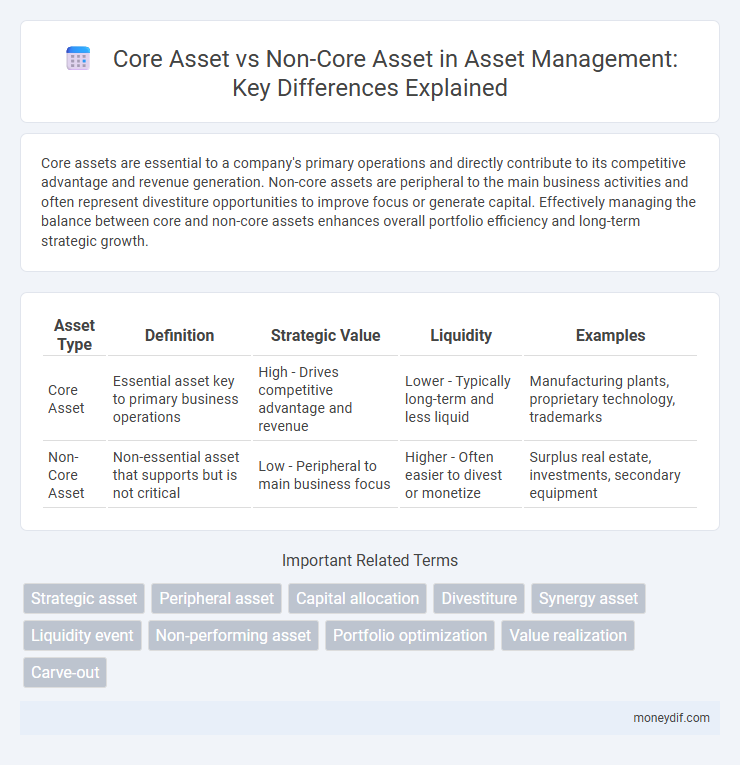

Core assets are essential to a company's primary operations and directly contribute to its competitive advantage and revenue generation. Non-core assets are peripheral to the main business activities and often represent divestiture opportunities to improve focus or generate capital. Effectively managing the balance between core and non-core assets enhances overall portfolio efficiency and long-term strategic growth.

Table of Comparison

| Asset Type | Definition | Strategic Value | Liquidity | Examples |

|---|---|---|---|---|

| Core Asset | Essential asset key to primary business operations | High - Drives competitive advantage and revenue | Lower - Typically long-term and less liquid | Manufacturing plants, proprietary technology, trademarks |

| Non-Core Asset | Non-essential asset that supports but is not critical | Low - Peripheral to main business focus | Higher - Often easier to divest or monetize | Surplus real estate, investments, secondary equipment |

Defining Core Assets and Non-Core Assets

Core assets represent primary business resources crucial for generating revenue and sustaining competitive advantage, such as key intellectual property, major production facilities, or flagship products. Non-core assets are peripheral resources that do not directly impact the company's main operations, including secondary real estate holdings, non-essential equipment, or non-strategic investments. Distinguishing between core and non-core assets enables effective portfolio management and strategic decision-making focused on maximizing business value.

Key Differences Between Core and Non-Core Assets

Core assets represent essential resources that are critical to a company's primary business operations, often generating steady revenue and strategic value over the long term. Non-core assets, by contrast, include properties or investments not central to the main business focus, typically held for divestiture or to improve liquidity. The key differences lie in their impact on operational efficiency, strategic alignment, and financial stability, with core assets driving growth while non-core assets offer flexibility for restructuring or capital allocation.

Strategic Importance of Core Assets

Core assets represent the essential holdings that drive a company's strategic growth, competitive advantage, and long-term value creation. These assets are critical for maintaining market position and often include proprietary technology, key intellectual property, or prime real estate integral to operations. Non-core assets typically serve supportive or non-essential roles and can be divested without significantly impacting the core business strategy.

How to Identify Core vs Non-Core Assets

Core assets generate consistent revenue and are essential to a company's primary business operations, such as manufacturing plants in a production company or flagship retail stores in a retail chain. Non-core assets are peripheral or secondary to the main business, including surplus properties, investments, or subsidiaries that do not contribute directly to the core revenue stream. Identifying core versus non-core assets involves analyzing their contribution to cash flow, strategic importance, and alignment with long-term business objectives.

Examples of Core Assets in Different Industries

Core assets include intellectual property such as patents in technology firms, manufacturing plants in automotive companies, and prime retail locations in consumer goods industries. Financial institutions often consider key software systems and customer databases as core assets critical to their operations. In energy sectors, essential infrastructure like pipelines and refineries represents core assets vital to production and distribution.

Role of Non-Core Assets in Business Operations

Non-core assets play a strategic role in business operations by providing flexibility and liquidity, allowing companies to focus on their primary strengths while generating additional revenue through the sale or lease of these assets. These assets can include surplus real estate, outdated equipment, or minority investments that do not align with the company's main business objectives. Efficient management of non-core assets helps optimize capital allocation and supports long-term growth by freeing resources for core activities.

Financial Implications of Asset Classification

Core assets generate consistent revenue streams and are integral to a company's primary operations, significantly enhancing financial stability and long-term valuation. Non-core assets, often peripheral or underutilized, may be divested to improve liquidity and reduce operational complexity, impacting cash flow and balance sheet strength. Accurate classification affects investment strategy, risk assessment, and capital allocation, directly influencing shareholder value and financial performance.

Impact on Portfolio Management Strategies

Core assets, such as stable income-generating properties or blue-chip stocks, form the foundation of portfolio management strategies by providing consistent returns and reducing overall risk. Non-core assets, including speculative investments or non-essential holdings, offer diversification opportunities but often require higher risk tolerance and active management. Balancing core and non-core assets optimizes portfolio performance by managing volatility while capturing growth potential.

Divestment of Non-Core Assets: Benefits and Risks

Divestment of non-core assets allows companies to streamline operations, improve liquidity, and focus on core competencies, resulting in increased shareholder value and enhanced strategic flexibility. However, risks include potential loss of future growth opportunities, undervaluation during sale, and negative impact on employee morale or market perception. Effective assessment and strategic planning are essential to maximize benefits while mitigating financial and reputational risks associated with non-core asset divestiture.

Best Practices in Asset Segmentation and Optimization

Core assets drive a company's primary revenue streams and competitive advantage, warranting focused investment and strategic management to maximize their value. Non-core assets, while not central to operations, should be regularly evaluated for divestiture or repurposing to enhance overall portfolio efficiency. Implementing clear asset segmentation criteria, leveraging data analytics, and aligning asset management with business objectives are best practices that optimize resource allocation and improve financial performance.

Important Terms

Strategic asset

Strategic assets, vital for competitive advantage, differ from core assets by directly supporting a company's primary business objectives, while non-core assets are peripheral and often disposable without impacting strategic direction.

Peripheral asset

Peripheral assets complement core assets by supporting primary business functions, while non-core assets are unrelated or marginally related resources that do not directly influence the core operations.

Capital allocation

Effective capital allocation prioritizes investment in core assets to maximize long-term value while strategically divesting non-core assets to optimize operational efficiency.

Divestiture

Divestiture strategically involves the sale or disposal of non-core assets to streamline operations and enhance focus on core assets that drive a company's primary revenue and competitive advantage. Prioritizing core assets enables better resource allocation and strengthens market position, while divesting non-core assets improves financial health and reduces operational complexity.

Synergy asset

Synergy asset enhances value by integrating core assets, which drive primary business operations, with non-core assets that provide supplemental support or secondary benefits.

Liquidity event

A liquidity event involving core assets typically generates higher valuation and strategic value compared to non-core assets, which are often divested to improve cash flow and streamline operations.

Non-performing asset

Non-performing assets (NPAs) often impact both core and non-core assets by reducing their profitability and liquidity, with core assets typically comprising essential business operations that generate consistent revenue, while non-core assets are peripheral holdings that may be divested to improve financial stability. Managing NPAs effectively involves prioritizing the recovery or restructuring of non-core assets to minimize risk exposure and preserve the value of core assets critical to the company's long-term growth.

Portfolio optimization

Portfolio optimization involves balancing core assets, which provide stable long-term value, against non-core assets that offer higher growth potential but with increased risk.

Value realization

Value realization is maximized when core assets, which are central to a company's strategic operations, are leveraged for growth and competitive advantage, while non-core assets are divested or managed efficiently to free up resources. Strategic focus on core assets enhances long-term profitability and market positioning, whereas effective management of non-core assets supports liquidity and risk reduction.

Carve-out

Carve-outs strategically separate non-core assets from a company's core assets to enhance focus and unlock value by divesting underperforming or non-essential business units. Core assets represent the primary revenue-generating operations, while non-core assets are peripheral or subsidiary operations that can be sold, spun off, or restructured during the carve-out process.

Core asset vs Non-core asset Infographic

moneydif.com

moneydif.com