Asset turnover measures how efficiently a company uses its total assets to generate sales, while inventory turnover specifically assesses how quickly inventory is sold and replaced within a period. A high asset turnover ratio indicates effective overall asset management, whereas a high inventory turnover ratio points to efficient inventory control and product demand. Comparing both ratios helps identify strengths and weaknesses in asset utilization and inventory management strategies.

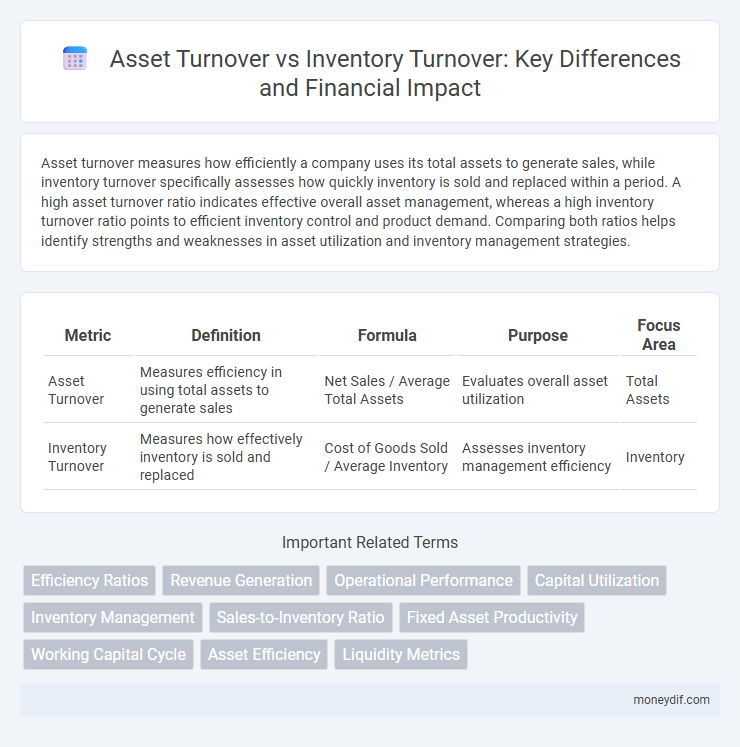

Table of Comparison

| Metric | Definition | Formula | Purpose | Focus Area |

|---|---|---|---|---|

| Asset Turnover | Measures efficiency in using total assets to generate sales | Net Sales / Average Total Assets | Evaluates overall asset utilization | Total Assets |

| Inventory Turnover | Measures how effectively inventory is sold and replaced | Cost of Goods Sold / Average Inventory | Assesses inventory management efficiency | Inventory |

Introduction to Asset Turnover and Inventory Turnover

Asset turnover measures a company's efficiency in generating sales from its total assets, calculated by dividing net sales by average total assets. Inventory turnover evaluates how effectively a company manages its inventory by measuring the number of times inventory is sold and replaced over a period, determined by dividing the cost of goods sold by average inventory. Both ratios provide critical insights into operational performance and asset management efficiency.

Defining Asset Turnover Ratio

Asset Turnover Ratio measures a company's efficiency in using its total assets to generate sales revenue, calculated by dividing net sales by average total assets. This ratio highlights how effectively a business utilizes all its assets, including inventory, fixed assets, and receivables, to drive revenue. Unlike Inventory Turnover, which focuses solely on inventory management efficiency, Asset Turnover offers a broader perspective on overall asset utilization.

Understanding Inventory Turnover Ratio

Inventory turnover ratio measures how efficiently a company manages its stock by calculating the number of times inventory is sold and replaced within a period. This ratio provides insight into inventory management effectiveness, impacting overall asset turnover by indicating how well assets are converted into sales. High inventory turnover suggests strong sales performance and efficient asset utilization, while low turnover may signal excess stock or obsolescence.

Key Differences Between Asset Turnover and Inventory Turnover

Asset turnover measures a company's efficiency in using its total assets to generate sales, while inventory turnover specifically assesses how quickly inventory is sold and replaced within a period. Asset turnover ratio compares net sales to average total assets, reflecting overall asset utilization, whereas inventory turnover ratio compares cost of goods sold to average inventory, focusing on inventory management effectiveness. Key differences include the scope of assets considered and the specific operational insight each ratio provides for financial analysis.

Significance of Asset Turnover in Financial Analysis

Asset turnover measures a company's efficiency in using its total assets to generate sales, providing critical insight into operational performance and resource utilization. Unlike inventory turnover, which focuses solely on inventory management, asset turnover encompasses all assets, reflecting overall management effectiveness in capital allocation. High asset turnover indicates strong asset utilization and can signal better profitability and competitive advantage in financial analysis.

Importance of Inventory Turnover for Business Operations

Inventory turnover is a critical metric that measures how efficiently a company manages its stock by calculating the number of times inventory is sold and replaced over a period. High inventory turnover indicates effective inventory management, leading to reduced holding costs, minimized risk of obsolescence, and improved cash flow. Unlike asset turnover, which assesses overall asset efficiency, inventory turnover specifically drives operational performance by optimizing the balance between inventory levels and sales demand.

Calculating Asset Turnover: Formula and Examples

Asset turnover is calculated by dividing net sales by average total assets, measuring how efficiently a company uses its assets to generate revenue. For example, if a company has net sales of $500,000 and average total assets of $250,000, the asset turnover ratio is 2.0, indicating $2 in sales for every dollar of assets. This ratio differs from inventory turnover, which specifically assesses how quickly inventory is sold, highlighting overall asset efficiency rather than just inventory management.

Calculating Inventory Turnover: Formula and Examples

Inventory turnover measures how efficiently a company sells and replaces its stock over a period, calculated by dividing the cost of goods sold (COGS) by the average inventory. For example, if a business has a COGS of $500,000 and an average inventory of $100,000, the inventory turnover ratio is 5, indicating the inventory is sold and replenished five times annually. High inventory turnover suggests effective inventory management and strong sales performance, which can positively impact asset turnover ratios.

Interpreting Asset vs Inventory Turnover in Performance Evaluation

Asset turnover measures how efficiently a company uses its total assets to generate sales, reflecting overall operational effectiveness. Inventory turnover specifically evaluates how quickly inventory is sold and replaced, indicating inventory management efficiency and demand forecasting accuracy. Comparing asset turnover with inventory turnover provides a balanced view of both asset utilization and inventory control, crucial for optimizing working capital and driving profitability in performance evaluation.

Best Practices to Optimize Both Ratios

Optimizing asset turnover and inventory turnover requires streamlining asset utilization and improving inventory management processes through technologies like ERP systems and just-in-time inventory strategies. Implementing regular asset performance reviews and inventory audits enhances accurate demand forecasting and reduces holding costs, leading to improved operational efficiency. Emphasizing cross-departmental collaboration ensures alignment between procurement, sales, and production, maximizing turnover ratios and driving higher return on assets.

Important Terms

Efficiency Ratios

Efficiency ratios, such as asset turnover and inventory turnover, measure how effectively a company utilizes its assets to generate sales and manage inventory levels. Asset turnover evaluates total revenue relative to average total assets, while inventory turnover assesses cost of goods sold against average inventory, both crucial for optimizing operational performance and cash flow.

Revenue Generation

Revenue generation is strongly influenced by both asset turnover and inventory turnover, as higher asset turnover indicates efficient use of assets to produce sales, while increased inventory turnover reflects effective inventory management boosting sales velocity. Companies optimizing these ratios typically achieve stronger cash flow and profitability by minimizing holding costs and maximizing asset utilization.

Operational Performance

Improving operational performance requires balancing asset turnover to maximize total asset utilization while optimizing inventory turnover to reduce holding costs and enhance cash flow efficiency.

Capital Utilization

Capital utilization efficiency improves when asset turnover increases relative to inventory turnover, indicating better conversion of assets into revenue without excessive inventory buildup.

Inventory Management

Higher inventory turnover directly enhances asset turnover by efficiently converting inventory into sales, optimizing overall asset utilization.

Sales-to-Inventory Ratio

The Sales-to-Inventory Ratio measures how efficiently a company converts inventory into sales, influencing overall Asset Turnover by reflecting inventory management effectiveness. A higher Sales-to-Inventory Ratio often correlates with an increased Inventory Turnover, indicating faster movement of goods and more efficient use of assets in generating revenue.

Fixed Asset Productivity

Fixed Asset Productivity, measured by Asset Turnover, indicates how efficiently a company uses its fixed assets to generate revenue, whereas Inventory Turnover reflects the frequency of inventory sales, highlighting operational efficiency in managing stock.

Working Capital Cycle

The Working Capital Cycle measures the time taken to convert net current assets and liabilities into cash, impacting liquidity and operational efficiency. A high Asset Turnover ratio indicates efficient use of assets to generate sales, while a higher Inventory Turnover ratio reflects effective inventory management, both crucial for shortening the Working Capital Cycle and improving cash flow.

Asset Efficiency

Asset Turnover measures how efficiently a company uses its total assets to generate sales, calculated by dividing net sales by average total assets, while Inventory Turnover focuses specifically on inventory management efficiency, determined by dividing cost of goods sold by average inventory. Comparing these ratios highlights how well a company converts both overall assets and inventory into revenue, providing a comprehensive view of asset efficiency and operational performance.

Liquidity Metrics

Liquidity metrics such as current ratio and quick ratio measure a firm's ability to meet short-term obligations, while asset turnover and inventory turnover ratios assess operational efficiency by indicating how effectively assets and inventory generate sales. Higher asset turnover compared to inventory turnover suggests efficient use of total assets in driving revenue, whereas a narrower gap may highlight inventory management challenges affecting liquidity.

Asset Turnover vs Inventory Turnover Infographic

moneydif.com

moneydif.com