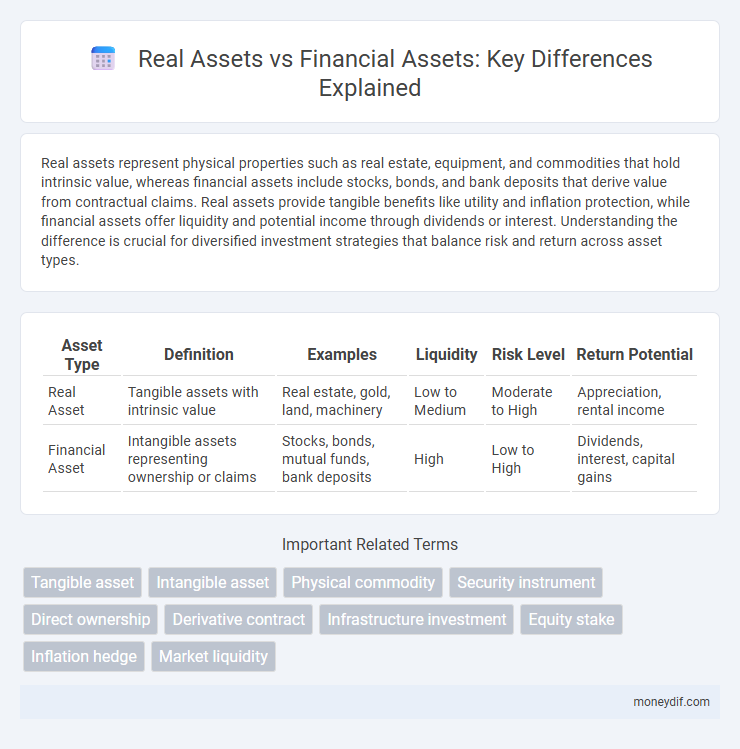

Real assets represent physical properties such as real estate, equipment, and commodities that hold intrinsic value, whereas financial assets include stocks, bonds, and bank deposits that derive value from contractual claims. Real assets provide tangible benefits like utility and inflation protection, while financial assets offer liquidity and potential income through dividends or interest. Understanding the difference is crucial for diversified investment strategies that balance risk and return across asset types.

Table of Comparison

| Asset Type | Definition | Examples | Liquidity | Risk Level | Return Potential |

|---|---|---|---|---|---|

| Real Asset | Tangible assets with intrinsic value | Real estate, gold, land, machinery | Low to Medium | Moderate to High | Appreciation, rental income |

| Financial Asset | Intangible assets representing ownership or claims | Stocks, bonds, mutual funds, bank deposits | High | Low to High | Dividends, interest, capital gains |

Introduction to Real Assets and Financial Assets

Real assets encompass physical and tangible properties such as real estate, commodities, and infrastructure that hold intrinsic value and provide utility. Financial assets represent intangible instruments like stocks, bonds, and bank deposits, deriving value from contractual claims or ownership rights. Understanding the distinction between real and financial assets is crucial for diversified investment portfolios and risk management strategies.

Defining Real Assets: Key Characteristics

Real assets are tangible physical assets such as real estate, machinery, and commodities that hold intrinsic value. They typically provide utility, generate income through direct use or production, and serve as a hedge against inflation due to their physical nature. Unlike financial assets, real assets have limited liquidity but offer protection against market volatility and currency risk.

Understanding Financial Assets: An Overview

Financial assets represent ownership of value in non-physical form, including stocks, bonds, and bank deposits, serving as claims on future cash flows or income. Unlike real assets, which consist of tangible properties such as real estate or machinery, financial assets derive their worth from contractual agreements or market prices. These assets play a crucial role in portfolio diversification, liquidity management, and capital allocation within financial markets.

Tangibility: Physical vs. Intangible Investments

Real assets represent tangible investments such as real estate, machinery, and commodities that have physical substance and intrinsic value. Financial assets, including stocks, bonds, and bank deposits, are intangible and derive value from contractual claims rather than physical form. The tangibility of real assets often provides inflation protection, while financial assets offer liquidity and ease of transfer.

Risk Profiles: Real Assets vs. Financial Assets

Real assets, such as real estate and commodities, typically exhibit lower volatility and provide inflation protection due to their tangible nature and intrinsic value. Financial assets, including stocks and bonds, tend to have higher liquidity but are subject to market fluctuations and credit risk, leading to greater price volatility. Understanding the distinct risk profiles of real and financial assets is essential for optimizing portfolio diversification and managing exposure to economic cycles.

Liquidity Comparison: Which Is More Accessible?

Real assets like real estate and commodities generally exhibit lower liquidity due to longer transaction times and higher market friction compared to financial assets such as stocks and bonds, which can be bought or sold quickly on established exchanges. Financial assets benefit from established markets and electronic trading platforms, enabling rapid conversion to cash with minimal price impact. Real assets often require significant time and costs to liquidate, making financial assets more accessible for investors needing quick access to funds.

Income Generation and Value Appreciation

Real assets, such as real estate and commodities, generate income through rental yields or physical utilization while offering value appreciation tied to market demand and scarcity. Financial assets, including stocks and bonds, provide income via dividends and interest payments, with value appreciation driven by company performance and market conditions. Both asset types contribute to wealth building by balancing income generation and potential capital gains.

Inflation Hedging: How Each Asset Class Performs

Real assets such as real estate and commodities typically provide strong inflation hedging by maintaining intrinsic value and generating income linked to price increases. Financial assets like stocks and bonds often face diminished purchasing power during inflationary periods, though equities may partially offset this through rising corporate earnings. Understanding these performance dynamics aids investors in constructing diversified portfolios to mitigate inflation risk effectively.

Portfolio Diversification Strategies

Real assets such as real estate, commodities, and infrastructure provide tangible value and inflation hedging benefits, contrasting with financial assets like stocks and bonds that represent ownership or claims on income. Incorporating real assets into a portfolio enhances diversification by reducing correlation with traditional financial instruments, thus mitigating systemic market risks. Effective portfolio diversification strategies leverage the complementary risk-return profiles of both asset classes to optimize long-term returns and preserve capital during volatility.

Choosing Between Real and Financial Assets: Key Considerations

Choosing between real assets and financial assets depends on factors such as risk tolerance, liquidity needs, and investment objectives. Real assets like real estate and commodities provide tangible value and inflation protection but often have lower liquidity and higher management costs. Financial assets, including stocks and bonds, offer greater liquidity and income potential but are more susceptible to market volatility and inflation risk.

Important Terms

Tangible asset

Tangible assets represent physical, real assets such as property, equipment, and inventory that hold intrinsic value and can be used in operations or sold. Unlike financial assets, which are intangible claims like stocks or bonds, tangible assets provide direct utility and can be appraised based on their physical presence and market demand.

Intangible asset

Intangible assets, unlike real assets such as property and financial assets like stocks, represent non-physical resources like intellectual property and brand value that contribute to a company's long-term competitive advantage.

Physical commodity

Physical commodities represent tangible real assets such as metals, oil, and agricultural products, providing intrinsic value and direct utility in contrast to financial assets like stocks or bonds that derive value from contractual claims. Real assets serve as a hedge against inflation and market volatility, while financial assets primarily offer liquidity and potential income through interest or dividends.

Security instrument

Security instruments serve as legal documents or contracts that provide collateral or guarantee payment tied to real assets like property or equipment, distinguishing them from financial assets such as stocks or bonds that represent ownership or debt claims without direct physical backing. Real asset-backed security instruments often offer tangible value and lower risk exposure compared to financial asset instruments, which rely more on market conditions and issuer creditworthiness.

Direct ownership

Direct ownership of a real asset involves holding tangible property such as real estate or natural resources, providing control over physical use and potential appreciation. In contrast, financial asset ownership entails holding claims or securities like stocks or bonds, which represent economic value but lack physical substance and are subject to market fluctuations.

Derivative contract

Derivative contracts are financial instruments whose value is derived from underlying real assets, such as commodities or real estate, or financial assets like stocks and bonds. These contracts enable investors to hedge risks or speculate on price movements without directly owning the physical asset or security.

Infrastructure investment

Infrastructure investment in real assets offers tangible long-term value and stable cash flows compared to financial assets, which are more liquid but subject to higher market volatility.

Equity stake

Equity stake in real assets like real estate offers tangible ownership and potential income generation, while equity in financial assets such as stocks provides liquidity and market-driven returns.

Inflation hedge

Real assets like real estate and commodities serve as effective inflation hedges by maintaining intrinsic value, whereas financial assets such as stocks and bonds often lose purchasing power during inflationary periods.

Market liquidity

Market liquidity for real assets is generally lower than financial assets due to higher transaction costs, longer settlement times, and reduced transparency.

Real asset vs Financial asset Infographic

moneydif.com

moneydif.com