Nonperforming assets (NPAs) refer to loans or advances on which the borrower is not making interest or principal repayments for a specified period, typically 90 days, indicating a failure to generate expected income. Distressed assets include a broader category of financial assets that are under financial stress, often at risk of default or significant value impairment, encompassing NPAs as well as assets facing operational or market challenges. Understanding the distinction is crucial for effective risk management and recovery strategies in financial institutions.

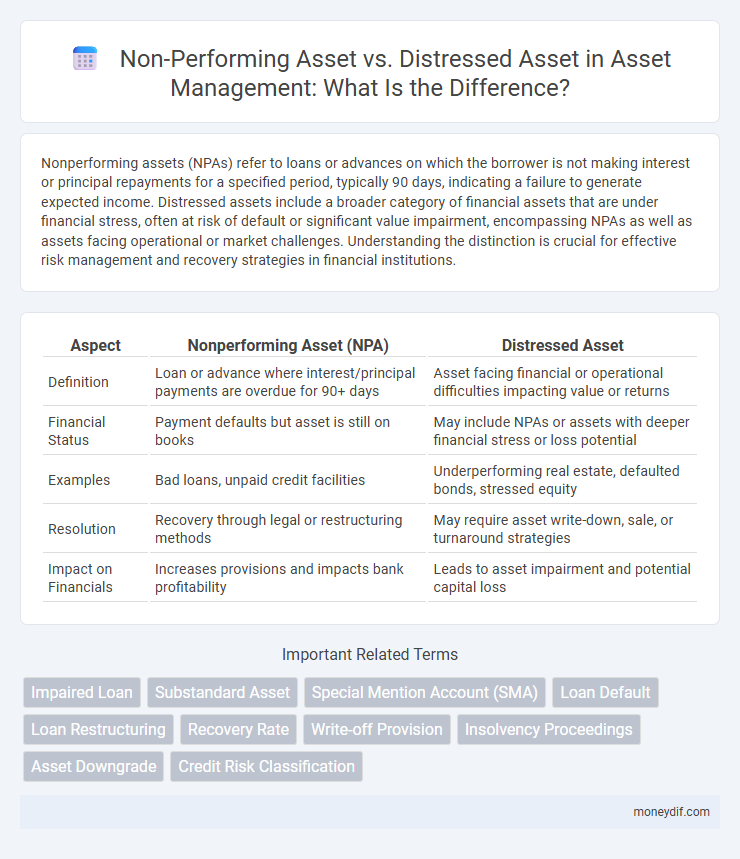

Table of Comparison

| Aspect | Nonperforming Asset (NPA) | Distressed Asset |

|---|---|---|

| Definition | Loan or advance where interest/principal payments are overdue for 90+ days | Asset facing financial or operational difficulties impacting value or returns |

| Financial Status | Payment defaults but asset is still on books | May include NPAs or assets with deeper financial stress or loss potential |

| Examples | Bad loans, unpaid credit facilities | Underperforming real estate, defaulted bonds, stressed equity |

| Resolution | Recovery through legal or restructuring methods | May require asset write-down, sale, or turnaround strategies |

| Impact on Financials | Increases provisions and impacts bank profitability | Leads to asset impairment and potential capital loss |

Definition of Nonperforming Asset

A Nonperforming Asset (NPA) is a loan or advance on which the borrower has stopped making interest or principal repayments for a specified period, typically 90 days or more. NPAs negatively impact a financial institution's profitability and capital adequacy as they indicate potential default risk. Unlike distressed assets, which may include broader financial difficulties, NPAs specifically refer to overdue loans affecting the lender's balance sheet performance.

Understanding Distressed Asset

Distressed assets are financial instruments or properties experiencing significant declines in value due to poor performance, legal issues, or economic challenges, often leading to insolvency or default risks. Unlike nonperforming assets, which primarily refer to loans overdue for a specific period, distressed assets encompass a broader range of troubled assets including mortgages, bonds, or real estate with compromised cash flows or operational difficulties. Investors seek distressed assets anticipating potential recovery or restructuring opportunities that can yield high returns despite inherent risks.

Key Differences Between Nonperforming and Distressed Assets

Nonperforming assets (NPAs) are loans or advances where the borrower has stopped making interest or principal repayments for a specified period, typically 90 days or more, indicating a failure in meeting contractual obligations. Distressed assets encompass a broader category, including NPAs but also assets under financial or operational stress, such as companies facing insolvency, restructuring, or severe cash flow problems. Key differences include the scope--NPAs are specifically tied to credit defaults, whereas distressed assets reflect overall financial instability--and the potential for recovery strategies, with distressed assets often requiring more complex interventions like restructuring or asset sales.

Causes Behind Asset Deterioration

Nonperforming assets (NPAs) primarily result from borrower defaults due to cash flow mismatches or operational inefficiencies, leading to missed loan repayments beyond 90 days. Distressed assets emerge from deeper financial instability, including insolvency, market downturns, or external shocks such as political unrest and economic recessions that severely impair asset recovery prospects. Both asset types reflect deteriorated credit quality but differ in the severity and underlying causes of financial distress.

Impact on Financial Institutions

Nonperforming assets (NPAs) reduce a financial institution's profitability by increasing provisioning requirements and straining capital adequacy ratios, leading to tighter credit conditions. Distressed assets, often comprising NPAs in severe deterioration, exacerbate liquidity challenges and elevate credit risk, impairing asset quality further. Effective management of both asset types is critical for maintaining financial stability and investor confidence in banking institutions.

Legal Implications and Regulatory Guidelines

Nonperforming assets (NPAs) are loans or advances for which the borrower has stopped making interest or principal repayments for 90 days or more, triggering mandatory classification under regulatory frameworks such as the Reserve Bank of India's Prudential Norms. Distressed assets, while broader in scope, include NPAs and encompass loans facing financial difficulties but not yet classified as nonperforming, often requiring legal intervention like debt restructuring or insolvency proceedings under the Insolvency and Bankruptcy Code (IBC). Legal implications for NPAs involve formal recovery mechanisms including asset reconstruction companies (ARCs) and SARFAESI Act enforcement, whereas distressed assets may necessitate preventive regulatory measures focused on resolution within stipulated timelines to minimize credit losses.

Methods of Identifying Nonperforming vs Distressed Assets

Nonperforming assets (NPAs) are identified through metrics such as delayed loan repayments beyond 90 days and missed interest payments, reflecting a borrower's inability to meet financial obligations. Distressed assets are recognized by more complex indicators including deteriorating cash flow, declining collateral value, and company-specific operational challenges signaling deeper financial instability. Banks and financial institutions utilize stress testing, loan monitoring systems, and asset quality reviews to differentiate between NPAs and distressed assets effectively.

Recovery and Resolution Strategies

Nonperforming assets (NPAs) typically undergo structured recovery strategies such as loan restructuring and asset monetization to improve cash flow and minimize losses. Distressed assets require more comprehensive resolution approaches including debt restructuring, strategic partnerships, or asset divestiture to restore financial stability. Both recovery and resolution strategies aim to maximize asset value and reduce the burden on financial institutions.

Role in Investment and Risk Management

Nonperforming assets (NPAs) represent loans or advances on which the borrower has defaulted, significantly impacting a financial institution's asset quality and risk exposure. Distressed assets, including NPAs, encompass broader impaired investments that require strategic intervention to mitigate potential losses and optimize recovery. Effective investment and risk management hinge on identifying, monitoring, and restructuring these assets to enhance portfolio performance and minimize financial instability.

Future Trends in Asset Classification

Future trends in asset classification increasingly emphasize advanced predictive analytics and artificial intelligence to differentiate nonperforming assets (NPAs) from distressed assets with greater accuracy. Enhanced data integration and machine learning models enable real-time monitoring of asset quality, improving early detection of financial distress before loan default. Regulatory frameworks are evolving to incorporate these technologies, promoting proactive risk management and more precise asset categorization.

Important Terms

Impaired Loan

Impaired loans are classified as nonperforming assets due to overdue payments, while distressed assets include impaired loans but also encompass assets under financial or operational stress regardless of payment status.

Substandard Asset

A substandard asset is a classification of a nonperforming asset showing clear signs of financial weakness and potential loss, distinct from a distressed asset which refers to securities or loans facing severe financial or operational difficulties but not necessarily classified under banking asset categories.

Special Mention Account (SMA)

Special Mention Account (SMA) refers to loans showing early signs of stress with overdue payments between 31 and 90 days, indicating potential risk before classification as Non-Performing Assets (NPAs). NPAs are loans with overdue payments beyond 90 days, reflecting confirmed repayment difficulties, while distressed assets encompass a broader category including both NPAs and accounts facing significant financial stress but not yet overdue.

Loan Default

A loan default occurs when a borrower fails to meet repayment obligations, causing the loan to be classified as a nonperforming asset (NPA), whereas a distressed asset is a broader category that includes NPAs and other financial assets struggling to generate expected returns due to financial difficulties.

Loan Restructuring

Loan restructuring involves modifying the terms of a nonperforming asset (NPA) loan to improve recovery and reduce default risk, while distressed assets broadly include loans or securities facing significant financial or operational challenges. Effective loan restructuring targets NPAs specifically to convert them into performing assets, whereas distressed asset management encompasses a wider scope of financial troubles beyond loan repayment issues.

Recovery Rate

Recovery Rate measures the proportion of a loan's value that can be recouped after default, often differing significantly between nonperforming assets (NPAs) and distressed assets due to variations in collateral quality and market conditions. Nonperforming assets typically have lower recovery rates compared to distressed assets, which may benefit from restructuring options or sale under duress, impacting their ultimate recovery potential.

Write-off Provision

Write-off provisions for nonperforming assets (NPAs) and distressed assets are critical in banking to mitigate credit risk and reflect realistic asset valuation. NPAs refer to loans with overdue payments exceeding 90 days, while distressed assets include loans under stress but not yet classified as NPAs, necessitating tailored write-off strategies based on asset quality and recovery potential.

Insolvency Proceedings

Insolvency proceedings prioritize the resolution of nonperforming assets characterized by prolonged default and significant credit impairment, whereas distressed assets may represent temporarily underperforming financial instruments with underlying recovery potential.

Asset Downgrade

Asset downgrade occurs when a financial institution reclassifies a performing asset to a nonperforming asset due to missed payments or deteriorating credit quality, indicating increased risk and potential default. Distressed assets represent a more severe category of nonperforming assets, typically involving borrowers in financial distress or insolvency, resulting in significant valuation decline and higher recovery uncertainty.

Credit Risk Classification

Credit risk classification differentiates nonperforming assets (NPAs), which are loans overdue for 90 days or more and exhibit payment default, from distressed assets that may not yet qualify as NPAs but show signs of financial stress and potential default. Accurate classification enables financial institutions to assess asset quality, allocate capital efficiently, and implement targeted recovery strategies to mitigate credit losses.

nonperforming asset vs distressed asset Infographic

moneydif.com

moneydif.com