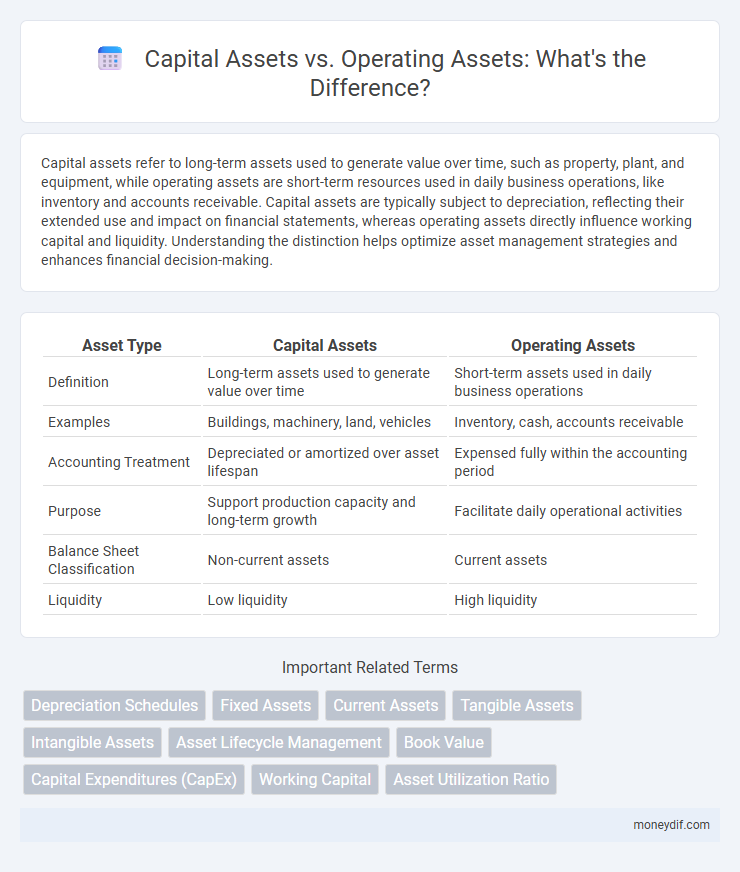

Capital assets refer to long-term assets used to generate value over time, such as property, plant, and equipment, while operating assets are short-term resources used in daily business operations, like inventory and accounts receivable. Capital assets are typically subject to depreciation, reflecting their extended use and impact on financial statements, whereas operating assets directly influence working capital and liquidity. Understanding the distinction helps optimize asset management strategies and enhances financial decision-making.

Table of Comparison

| Asset Type | Capital Assets | Operating Assets |

|---|---|---|

| Definition | Long-term assets used to generate value over time | Short-term assets used in daily business operations |

| Examples | Buildings, machinery, land, vehicles | Inventory, cash, accounts receivable |

| Accounting Treatment | Depreciated or amortized over asset lifespan | Expensed fully within the accounting period |

| Purpose | Support production capacity and long-term growth | Facilitate daily operational activities |

| Balance Sheet Classification | Non-current assets | Current assets |

| Liquidity | Low liquidity | High liquidity |

Introduction to Capital Assets and Operating Assets

Capital assets refer to long-term tangible properties such as buildings, machinery, and land that a company uses for production or operations, typically lasting over one year. Operating assets include both current assets like inventory and accounts receivable, as well as fixed assets directly involved in daily business functions. Understanding the distinction helps in financial analysis, asset management, and optimizing resource allocation for sustainable growth.

Definition and Key Characteristics

Capital assets refer to long-term tangible assets such as buildings, machinery, and land, which are used to generate revenue over multiple accounting periods. Operating assets encompass both current and fixed assets actively utilized in day-to-day business operations, including inventory, cash, and equipment. Key characteristics of capital assets include their depreciation over time and significant initial investment, whereas operating assets are characterized by their liquidity or continual use in production processes.

Examples of Capital Assets

Capital assets include long-term tangible assets such as buildings, machinery, land, and vehicles used in business operations. These assets are essential for production and typically have a useful life extending beyond one fiscal year, distinguishing them from operating assets like inventory and supplies. Investing in capital assets often involves substantial expenditure aimed at generating durable value and supporting business growth.

Examples of Operating Assets

Operating assets include machinery, equipment, and inventory essential for daily business operations. These assets directly contribute to production processes and service delivery, such as vehicles used for company logistics or computers supporting administrative tasks. Unlike capital assets, operating assets are frequently consumed or used up during routine activities, playing a vital role in maintaining operational efficiency.

Differences in Accounting Treatment

Capital assets are recorded on the balance sheet and depreciated over their useful life, reflecting long-term investment value. Operating assets, often current assets, are expensed immediately or within a short period as they are consumed in daily operations. The key accounting difference lies in capitalization and depreciation for capital assets versus immediate expense recognition for operating assets.

Impact on Financial Statements

Capital assets, such as property, plant, and equipment, appear on the balance sheet as long-term assets and are depreciated over time, affecting both the statement of financial position and the income statement through depreciation expense. Operating assets, including inventory and accounts receivable, are classified as current assets and directly influence working capital and cash flow management on financial statements. The distinction impacts key financial ratios and performance metrics, with capital assets influencing long-term solvency and operating assets affecting liquidity and operational efficiency.

Depreciation and Amortization Methods

Capital assets typically undergo depreciation using methods such as straight-line, declining balance, or units of production to allocate cost over their useful life. Operating assets, often intangible, are amortized through systematic methods like straight-line amortization to expense their value gradually. Accurate application of depreciation and amortization methods improves financial reporting and asset management efficiency.

Role in Business Operations

Capital assets, such as property, machinery, and equipment, represent long-term investments essential for producing goods and services, impacting a company's balance sheet and depreciation schedules. Operating assets include current assets like inventory, accounts receivable, and cash, directly involved in day-to-day business activities and short-term operational efficiency. Understanding the distinct roles of capital and operating assets is crucial for optimizing asset management and improving financial performance.

Tax Implications for Capital and Operating Assets

Capital assets, including property, plant, and equipment, often receive favorable tax treatment through depreciation deductions and potential capital gains tax upon disposal. Operating assets, primarily inventory and supplies, are typically expensed immediately, reducing taxable income in the short term without depreciation benefits. Differentiating these assets is critical for strategic tax planning, as capital assets can impact long-term tax liabilities while operating assets affect immediate tax expenses.

Choosing the Right Asset Strategy for Growth

Capital assets, such as buildings and machinery, provide long-term value and support large-scale growth initiatives, while operating assets like inventory and cash flow enable day-to-day business functions and agility. Selecting the right asset strategy involves balancing investment in capital assets to build infrastructure with maintaining sufficient operating assets to ensure liquidity and operational efficiency. Companies prioritizing growth should assess asset turnover ratios and depreciation costs to optimize resource allocation and maximize return on investment.

Important Terms

Depreciation Schedules

Depreciation schedules for capital assets typically follow a systematic allocation of the asset's cost over its useful life, using methods such as straight-line or declining balance to match expense recognition with asset utilization. Operating assets, often categorized as short-term or maintenance-related, may not require formal depreciation schedules and are generally expensed fully when incurred due to their shorter useful life and frequent replacement.

Fixed Assets

Fixed assets encompass long-term tangible property used in business operations, categorized into capital assets such as land, buildings, and machinery that hold value over multiple years, and operating assets which are actively utilized in day-to-day production or service activities. Understanding the distinction between capital assets, which are subject to depreciation, and operating assets, which directly impact operational efficiency, is crucial for accurate financial reporting and asset management.

Current Assets

Current assets include cash, accounts receivable, and inventory, representing resources expected to be converted to cash within one year. Capital assets, such as machinery and buildings, differ as long-term investments used in operations, whereas operating assets encompass both capital assets and current assets actively employed in daily business activities.

Tangible Assets

Tangible assets represent physical items such as machinery, buildings, and land, often categorized into capital assets and operating assets based on their intended use and accounting treatment. Capital assets are long-term tangible assets expected to provide value over multiple years, while operating assets are tangible assets utilized directly in the day-to-day functioning of a business.

Intangible Assets

Intangible assets such as patents, trademarks, and goodwill are classified under capital assets due to their long-term value and contribution to a company's financial health, distinguishing them from operating assets that primarily support daily business functions. These capitalized intangible assets enhance the company's market position and competitive advantage, while operating assets like inventory and equipment facilitate routine operational activities.

Asset Lifecycle Management

Asset Lifecycle Management (ALM) optimizes the complete lifespan of capital assets, including acquisition, maintenance, depreciation, and disposal, ensuring maximum return on investment and regulatory compliance. Operating assets, typically short-term or consumable resources, require distinct management strategies focused on operational efficiency and cost control rather than long-term value preservation.

Book Value

Book value represents the recorded cost of capital assets and operating assets minus accumulated depreciation, reflecting their net worth on the balance sheet.

Capital Expenditures (CapEx)

Capital Expenditures (CapEx) primarily involve investments in Capital Assets such as buildings and machinery, which provide long-term value, whereas Operating Assets relate to short-term assets used in daily business operations and are not typically funded through CapEx.

Working Capital

Working capital represents the difference between current assets and current liabilities, focusing on the liquidity necessary for day-to-day operations, while capital assets--also known as fixed assets--refer to long-term tangible assets like machinery and buildings used for production. Operating assets include both current assets and capital assets essential for running daily business activities, distinguishing them from purely financial investments.

Asset Utilization Ratio

The Asset Utilization Ratio measures how efficiently a company uses its capital assets, including both fixed and operating assets, to generate revenue.

Capital Assets vs Operating Assets Infographic

moneydif.com

moneydif.com