Asset pledging involves using assets as collateral to secure a loan, restricting their transferability until the debt is settled. Asset encumbrance refers to any claim or liability attached to an asset that limits the owner's ability to freely dispose of it, often reducing the asset's market value. While pledging creates a formal security interest, encumbrance can be broader, encompassing liens, mortgages, or other restrictions impacting asset liquidity.

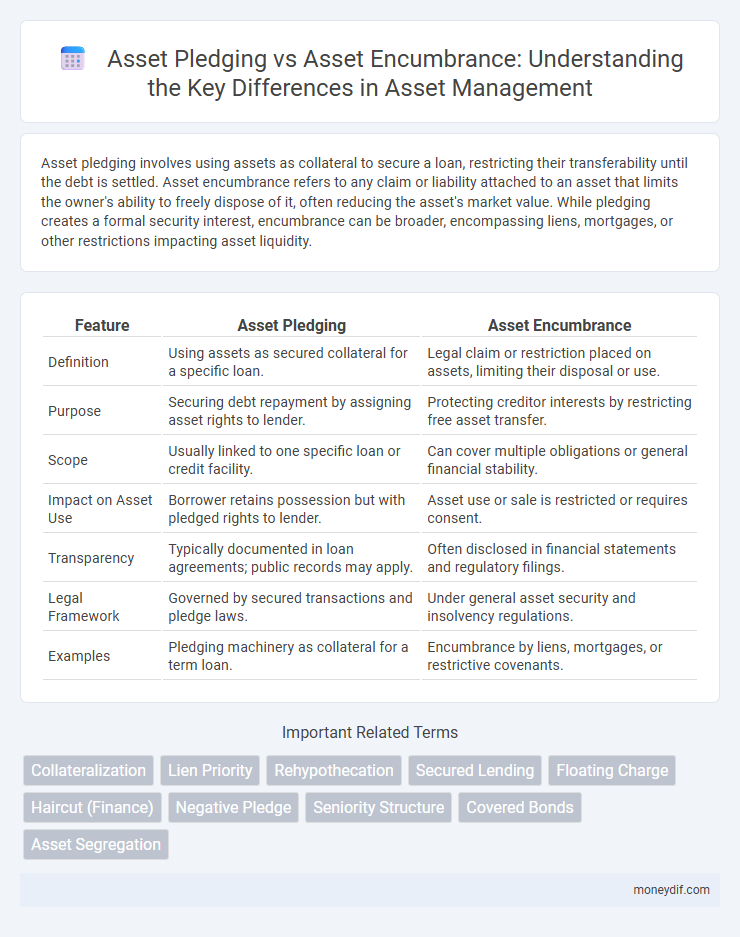

Table of Comparison

| Feature | Asset Pledging | Asset Encumbrance |

|---|---|---|

| Definition | Using assets as secured collateral for a specific loan. | Legal claim or restriction placed on assets, limiting their disposal or use. |

| Purpose | Securing debt repayment by assigning asset rights to lender. | Protecting creditor interests by restricting free asset transfer. |

| Scope | Usually linked to one specific loan or credit facility. | Can cover multiple obligations or general financial stability. |

| Impact on Asset Use | Borrower retains possession but with pledged rights to lender. | Asset use or sale is restricted or requires consent. |

| Transparency | Typically documented in loan agreements; public records may apply. | Often disclosed in financial statements and regulatory filings. |

| Legal Framework | Governed by secured transactions and pledge laws. | Under general asset security and insolvency regulations. |

| Examples | Pledging machinery as collateral for a term loan. | Encumbrance by liens, mortgages, or restrictive covenants. |

Introduction to Asset Pledging and Asset Encumbrance

Asset pledging involves using assets as collateral to secure a loan, creating a temporary claim by the lender until the debt is repaid. Asset encumbrance refers to the legal obligations or claims placed on an asset, limiting its free use or transfer due to liens, mortgages, or other burdens. Understanding the distinction between asset pledging and asset encumbrance is crucial for managing financial risks and ensuring clear asset ownership rights.

Defining Asset Pledging

Asset pledging is a financial arrangement where a borrower uses specific assets as collateral to secure a loan, granting the lender a legal claim over the pledged assets in case of default. This differs from asset encumbrance, which broadly refers to any claim, liability, or restriction on an asset that limits its transferability or use. Understanding asset pledging is crucial for accurately assessing credit risk and the availability of unencumbered assets in financial statements.

Understanding Asset Encumbrance

Asset encumbrance refers to the legal restriction on an asset that limits its transferability or use as collateral, often arising from liens, mortgages, or other claims. Unlike asset pledging, where a specific asset is explicitly designated as collateral for a loan, asset encumbrance can apply more broadly, reducing the asset's availability for additional borrowing or sale. Understanding asset encumbrance is crucial for accurate risk assessment and balance sheet management in financial institutions.

Key Differences Between Asset Pledging and Encumbrance

Asset pledging involves using assets as collateral to secure a loan, giving the lender a specific claim on the asset in case of default, whereas asset encumbrance refers to any claim, lien, or liability attached to an asset that restricts its free transfer or use. Pledging typically requires explicit agreement and is temporary, while encumbrance can arise from various legal claims, including mortgages, liens, or regulatory restrictions. The key difference lies in asset pledging's role as a deliberate loan security mechanism versus asset encumbrance as a broader, often automatic, restriction on asset liquidity and ownership.

Purposes and Uses in Financial Transactions

Asset pledging involves using specific assets as collateral to secure a loan or credit line, ensuring lender protection in case of default. Asset encumbrance refers to the restriction placed on assets due to existing claims or liens, impacting their availability for additional borrowing or sale. Both serve crucial roles in financial transactions by managing risk and influencing creditworthiness, with pledging actively creating security interests and encumbrance indicating existing obligations.

Legal Implications and Documentation

Asset pledging involves legally granting a creditor a security interest in an asset, requiring precise documentation such as pledge agreements to enforce rights in case of default. Asset encumbrance broadly refers to restrictions on an asset, including liens or claims, potentially limiting its transfer or use without detailed record-keeping and disclosure. The legal implications center on ownership rights, enforceability of claims, and priority of creditors, making thorough and jurisdiction-specific documentation critical for risk management.

Impact on Balance Sheets and Financial Ratios

Asset pledging involves using assets as collateral for specific liabilities, which keeps the assets on the balance sheet but creates a contingent liability that can affect solvency ratios. Asset encumbrance refers to the restriction placed on assets due to pledging or other claims, reducing the free or unencumbered asset base available to unsecured creditors and influencing liquidity ratios. The impact on financial ratios varies: asset pledging may increase leverage ratios by securing debt, while asset encumbrance reduces asset quality and can distort measures of financial flexibility.

Risks and Considerations for Lenders and Borrowers

Asset pledging involves borrowers offering specific assets as collateral, creating a direct claim for lenders in case of default, which enhances lender security but increases borrower risk of asset loss. Asset encumbrance refers to any claim or lien on assets that restricts their free use, often complicating lenders' ability to assess true asset availability and increasing risks of overvaluation or hidden liabilities. Both approaches require thorough due diligence on asset valuation, legal enforceability, and potential impacts on borrower liquidity and future financing options.

Real-World Examples of Asset Pledging and Encumbrance

Asset pledging involves using specific assets, such as real estate or equipment, as collateral for a loan, ensuring lenders can claim these assets if the borrower defaults. For instance, a manufacturing company pledging machinery to secure financing demonstrates this practice. Asset encumbrance, seen in cases like airlines mortgaging aircraft to raise capital, restricts the asset's transferability but does not transfer ownership, highlighting its impact on asset liquidity and creditor priority.

Conclusion: Choosing the Appropriate Approach

Choosing the appropriate approach between asset pledging and asset encumbrance depends on the specific financial objectives and risk tolerance of the entity. Asset pledging provides a clear security interest, enhancing creditor confidence while limiting the borrower's ability to freely use the asset. Asset encumbrance allows for more flexible collateral arrangements but may increase complexity in asset management and reduce the availability of unencumbered assets for future financing.

Important Terms

Collateralization

Collateralization involves using assets as security for a loan, where asset pledging grants the lender a specific claim on the pledged asset, enabling recovery in case of borrower default. Asset encumbrance refers to the broader legal restriction on assets that limits their availability for other claims, often resulting from multiple layers of secured obligations affecting the asset's marketability and liquidity.

Lien Priority

Lien priority determines the order in which creditors are paid from a debtor's pledged assets, with secured creditors holding a higher priority claim over others. Asset pledging involves granting specific collateral to secure a debt, establishing a lien, while asset encumbrance broadly refers to any claim, lien, or restriction on an asset that can affect its transferability or value.

Rehypothecation

Rehypothecation involves the reuse of pledged assets by a creditor, distinguishing asset pledging--which grants collateral rights to a lender--from asset encumbrance that broadly limits an asset's liquidity due to any third-party claims.

Secured Lending

Secured lending involves asset pledging, which grants lenders a specific claim on assets, whereas asset encumbrance broadly restricts an asset's use by creating claims that can limit future lending opportunities.

Floating Charge

Floating charges provide flexible asset pledging by allowing continued use of assets while creating a general security interest, whereas asset encumbrance broadly restricts asset disposal to secure debt obligations.

Haircut (Finance)

In finance, a haircut refers to the percentage reduction applied to the market value of an asset when it is used as collateral in asset pledging to protect lenders against valuation risk. Asset encumbrance involves legally restricting assets to secure liabilities, often resulting in higher haircuts due to increased risk and reduced asset liquidity.

Negative Pledge

Negative pledge clauses prevent borrowers from granting security interests over assets, thus avoiding asset encumbrance that restricts further pledging. Unlike asset pledging, which legally encumbers specific assets as loan collateral, negative pledges maintain asset freedom to secure future financing options.

Seniority Structure

Seniority structure defines the priority order of creditors in claims on assets, directly influencing asset pledging and asset encumbrance by determining which secured parties hold superior liens. Asset pledging creates specific security interests, while asset encumbrance reflects the overall burden on assets, impacting the availability and value of collateral within the established seniority hierarchy.

Covered Bonds

Covered bonds involve asset pledging where specific high-quality assets are secured to back the bond issuance, creating a dual recourse for investors. Asset encumbrance refers to the extent assets are reserved as collateral, impacting a financial institution's liquidity and risk profile by limiting unencumbered assets available for other obligations.

Asset Segregation

Asset segregation enhances financial transparency by distinctly separating pledged assets from encumbered ones, ensuring clearer risk assessment and regulatory compliance.

Asset Pledging vs Asset Encumbrance Infographic

moneydif.com

moneydif.com