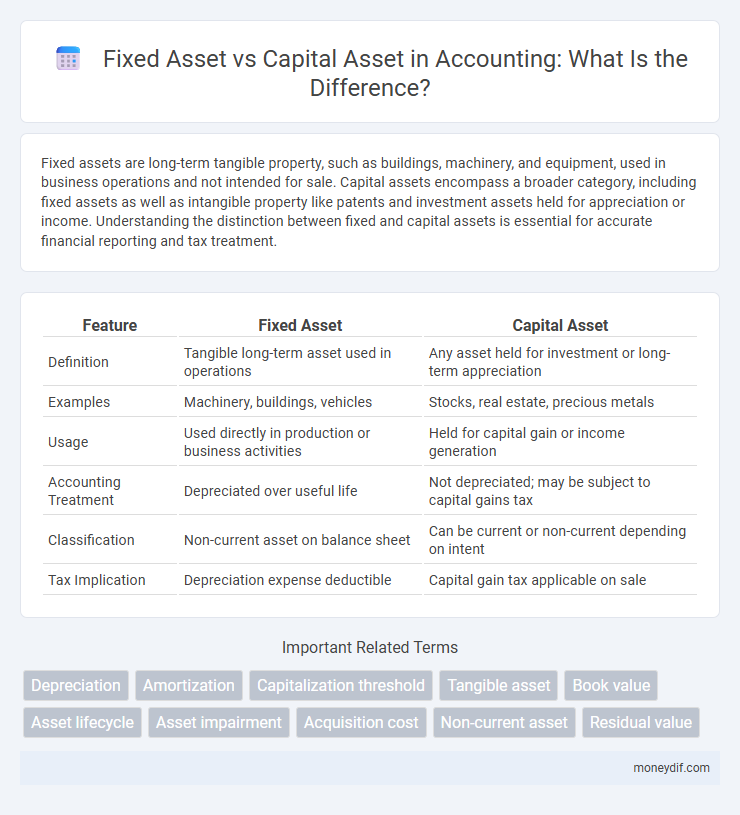

Fixed assets are long-term tangible property, such as buildings, machinery, and equipment, used in business operations and not intended for sale. Capital assets encompass a broader category, including fixed assets as well as intangible property like patents and investment assets held for appreciation or income. Understanding the distinction between fixed and capital assets is essential for accurate financial reporting and tax treatment.

Table of Comparison

| Feature | Fixed Asset | Capital Asset |

|---|---|---|

| Definition | Tangible long-term asset used in operations | Any asset held for investment or long-term appreciation |

| Examples | Machinery, buildings, vehicles | Stocks, real estate, precious metals |

| Usage | Used directly in production or business activities | Held for capital gain or income generation |

| Accounting Treatment | Depreciated over useful life | Not depreciated; may be subject to capital gains tax |

| Classification | Non-current asset on balance sheet | Can be current or non-current depending on intent |

| Tax Implication | Depreciation expense deductible | Capital gain tax applicable on sale |

Definition of Fixed Assets

Fixed assets are long-term tangible property used in business operations, such as machinery, buildings, and equipment, providing value over multiple accounting periods. Unlike capital assets, which encompass investments like stocks or real estate held for appreciation, fixed assets are primarily used to produce goods or services. Depreciation is often applied to fixed assets due to their limited useful life in operational use.

Definition of Capital Assets

Capital assets refer to significant assets owned by a business or individual, including property, buildings, equipment, and investments held for long-term use or appreciation. Unlike fixed assets, which are tangible and primarily used in operations, capital assets encompass a broader category that may include intangible assets and investment properties. The classification of an asset as a capital asset impacts accounting treatment, taxation, and financial reporting.

Key Differences Between Fixed Assets and Capital Assets

Fixed assets are tangible long-term assets like machinery, buildings, and equipment used in business operations, while capital assets encompass both tangible and intangible assets held for investment or personal use, such as stocks, bonds, and real estate. Fixed assets are recorded on the balance sheet at historical cost and depreciated over time, whereas capital assets include a broader range of property subject to capital gains tax upon sale. The primary differences lie in usage, accounting treatment, and tax implications, with fixed assets integral to production and capital assets often held for investment growth.

Classification Criteria for Fixed and Capital Assets

Fixed assets are classified based on their physical characteristics and usage in daily operations, typically including machinery, buildings, and equipment with a useful life exceeding one year. Capital assets encompass a broader category, covering long-term investments such as land, infrastructure, and intellectual property, distinguished by their significant value and longevity. The classification criteria for fixed and capital assets hinge on asset permanence, value thresholds, and purpose within financial reporting and asset management frameworks.

Examples of Fixed Assets and Capital Assets

Fixed assets include tangible items like machinery, buildings, and vehicles used in business operations for long-term purposes. Capital assets encompass a broader category, incorporating fixed assets as well as investments such as stocks, bonds, and real estate held for appreciation. Examples of fixed assets are factory equipment and office furniture, while capital assets also cover valuable personal or investment properties beyond regular business use.

Accounting Treatment for Fixed vs. Capital Assets

Accounting treatment for fixed assets involves recording them as long-term tangible assets subject to depreciation over their useful life, reflecting wear and tear in financial statements. Capital assets encompass a broader category, including fixed assets and intangible assets, which are recorded at acquisition cost and may be subject to different depreciation or amortization methods depending on asset classification. Accurate distinction and treatment impact asset valuation, balance sheet representation, and tax implications under accounting standards such as GAAP or IFRS.

Depreciation Methods for Fixed Assets

Fixed assets typically undergo systematic depreciation using methods such as straight-line, declining balance, and units of production to allocate their cost over useful life. Capital assets include long-term assets but may have differing depreciation rules based on tax regulations and asset classification. Selecting an appropriate depreciation method for fixed assets ensures accurate financial reporting and effective asset management.

Valuation Techniques for Capital Assets

Valuation techniques for capital assets typically include the cost approach, market approach, and income approach, each providing distinct methods to estimate asset worth. The cost approach calculates value based on the asset's replacement or reproduction cost less depreciation, the market approach uses comparable asset sales data to determine fair market value, and the income approach projects future cash flows discounted to present value. Accurate application of these valuation methods is crucial for capital assets, as they impact financial reporting, tax compliance, and investment decisions.

Impact on Financial Statements

Fixed assets, such as machinery and buildings, are long-term tangible assets recorded on the balance sheet and depreciated over their useful life, affecting both the asset value and accumulated depreciation accounts. Capital assets encompass a broader category including fixed assets and intangible assets, influencing the financial statements through capital expenditure recognition and potential impairment losses. The classification impacts cash flow statements by differentiating between operating and investing activities, while depreciation and amortization directly affect net income and equity.

Importance in Business Decision-Making

Fixed assets and capital assets both represent long-term investments crucial for business operations, yet capital assets often include a broader category encompassing fixed assets like property, plant, and equipment. Accurate classification impacts financial reporting, tax treatment, and investment analysis, guiding managers in resource allocation and strategic planning. Understanding these assets' roles enhances decision-making by optimizing asset management and improving capital budgeting effectiveness.

Important Terms

Depreciation

Depreciation systematically allocates the cost of fixed assets, which are tangible capital assets used in operations, over their useful lives to reflect wear and usage.

Amortization

Amortization refers to the gradual expensing of intangible fixed assets like patents, trademarks, or goodwill over their useful life, distinguishing it from depreciation which applies to tangible capital assets such as machinery or buildings. Properly applying amortization to fixed intangible assets ensures accurate financial reporting and asset valuation in compliance with accounting standards like GAAP or IFRS.

Capitalization threshold

The capitalization threshold defines the minimum cost at which a fixed asset is recorded as a capital asset on the balance sheet instead of being expensed immediately.

Tangible asset

Tangible assets, which include fixed assets like machinery and buildings, are physical items used in operations, while capital assets encompass both tangible and intangible long-term assets held for investment or company use.

Book value

Book value represents the recorded cost of a fixed asset minus accumulated depreciation, reflecting its net worth as a capital asset on the balance sheet.

Asset lifecycle

Asset lifecycle management encompasses the systematic tracking of fixed assets from acquisition through depreciation to disposal, ensuring accurate financial reporting and compliance with accounting standards. Capital assets, a subset of fixed assets, refer to tangible items like machinery or buildings that provide long-term value and require capitalization on the balance sheet.

Asset impairment

Asset impairment occurs when the carrying amount of a fixed asset, such as machinery or equipment, exceeds its recoverable amount, necessitating a write-down to reflect its reduced value. Capital assets, which typically include long-term investments and property, also require impairment testing to ensure their book value is not overstated on the balance sheet.

Acquisition cost

Acquisition cost for fixed assets represents the total expense incurred to purchase and prepare the asset for use, while capital asset acquisition cost specifically refers to the investment made to acquire long-term assets like property, plant, and equipment essential for business operations.

Non-current asset

Non-current assets encompass fixed assets like machinery and buildings, which are long-term tangible assets, while capital assets include both fixed assets and intangible assets used for investment or operational purposes.

Residual value

Residual value represents the estimated amount a fixed asset or capital asset can be sold for at the end of its useful life, impacting depreciation calculations and financial reporting. Accurate assessment of residual value helps businesses optimize asset management, tax deductions, and long-term investment decisions.

fixed asset vs capital asset Infographic

moneydif.com

moneydif.com