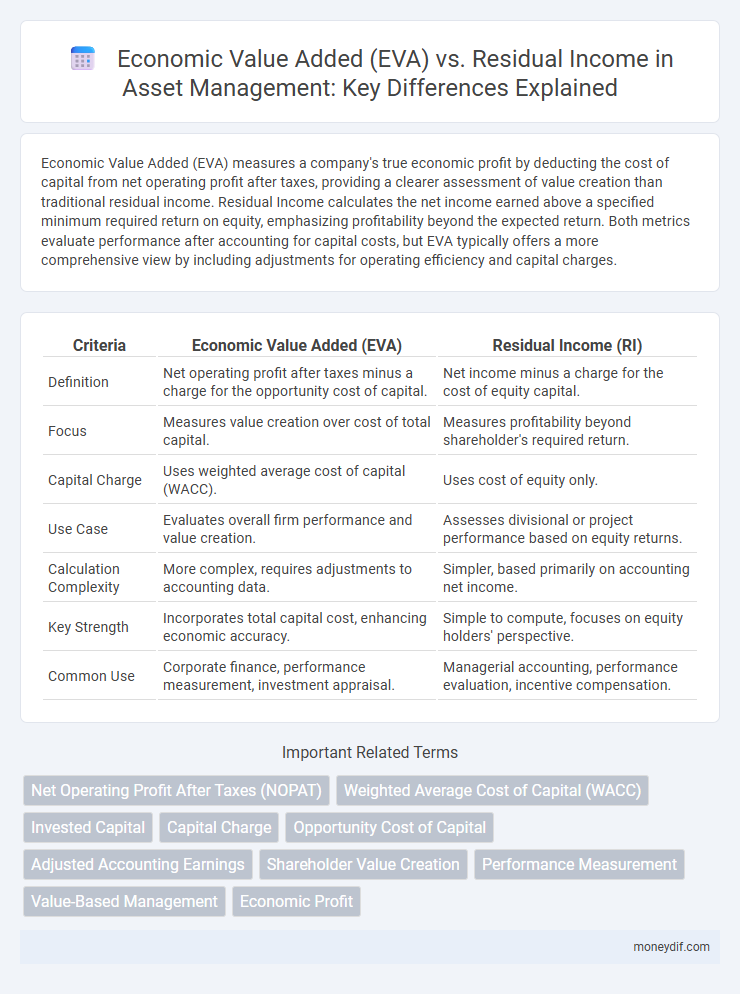

Economic Value Added (EVA) measures a company's true economic profit by deducting the cost of capital from net operating profit after taxes, providing a clearer assessment of value creation than traditional residual income. Residual Income calculates the net income earned above a specified minimum required return on equity, emphasizing profitability beyond the expected return. Both metrics evaluate performance after accounting for capital costs, but EVA typically offers a more comprehensive view by including adjustments for operating efficiency and capital charges.

Table of Comparison

| Criteria | Economic Value Added (EVA) | Residual Income (RI) |

|---|---|---|

| Definition | Net operating profit after taxes minus a charge for the opportunity cost of capital. | Net income minus a charge for the cost of equity capital. |

| Focus | Measures value creation over cost of total capital. | Measures profitability beyond shareholder's required return. |

| Capital Charge | Uses weighted average cost of capital (WACC). | Uses cost of equity only. |

| Use Case | Evaluates overall firm performance and value creation. | Assesses divisional or project performance based on equity returns. |

| Calculation Complexity | More complex, requires adjustments to accounting data. | Simpler, based primarily on accounting net income. |

| Key Strength | Incorporates total capital cost, enhancing economic accuracy. | Simple to compute, focuses on equity holders' perspective. |

| Common Use | Corporate finance, performance measurement, investment appraisal. | Managerial accounting, performance evaluation, incentive compensation. |

Introduction to Asset Performance Metrics

Economic Value Added (EVA) measures a company's financial performance by calculating net operating profit after taxes minus the capital charge, reflecting true economic profit generated from assets. Residual Income (RI) assesses asset performance by deducting a required return on equity from net income, emphasizing shareholder value creation beyond the cost of equity. Both metrics provide insights into asset efficiency and value generation, guiding strategic investment and operational decisions.

Defining Economic Value Added (EVA)

Economic Value Added (EVA) measures a company's financial performance by calculating net operating profit after taxes (NOPAT) minus the capital charge for its invested capital. It represents the value created beyond the required return of the company's shareholders, emphasizing true economic profit rather than accounting profit. EVA helps in assessing asset efficiency and management effectiveness by linking operating performance to the cost of capital.

Understanding Residual Income (RI)

Residual Income (RI) measures the net operating profit earned above the minimum required return on a company's assets, reflecting true economic profit beyond accounting earnings. Unlike Economic Value Added (EVA), which incorporates adjustments to accounting profit and capital charges, RI directly calculates the surplus income after deducting a charge for the cost of capital. Understanding RI helps investors and managers assess asset efficiency by linking profitability to the cost of equity and debt capital employed.

Key Differences: EVA vs Residual Income

Economic Value Added (EVA) measures a company's financial performance by calculating net operating profit after taxes minus the capital charge, emphasizing value creation beyond cost of capital. Residual Income represents the net income generated over a minimum required return on equity, highlighting profitability relative to shareholder expectations. The key difference lies in EVA incorporating the entire capital invested (debt and equity) while Residual Income focuses solely on equity, affecting how performance is assessed and capital costs are accounted for.

Calculation Methods for EVA and RI

Economic Value Added (EVA) is calculated by subtracting the capital charge, derived from the company's invested capital multiplied by the weighted average cost of capital (WACC), from its net operating profit after taxes (NOPAT). Residual Income (RI) is computed by deducting a required return on equity, calculated using the equity capital times the cost of equity, from net income. Both methods assess value creation but EVA emphasizes overall capital cost while RI focuses solely on equity returns.

Impact on Asset Valuation

Economic Value Added (EVA) measures the true economic profit by deducting the cost of capital from net operating profit after taxes, directly influencing asset valuation by highlighting value creation over time. Residual Income calculates net income minus a charge for the cost of equity, emphasizing shareholder value but potentially overlooking total capital costs impacting asset appraisal. EVA's comprehensive capital charge provides a more precise indicator of asset performance and sustainable value generation compared to Residual Income, enhancing the accuracy of asset valuation models.

Relevance in Corporate Financial Management

Economic Value Added (EVA) measures a firm's financial performance by calculating net operating profit after taxes minus the capital charge, emphasizing value creation beyond the cost of capital. Residual Income similarly assesses profitability by subtracting a charge for equity capital from net income, but EVA is often preferred for its explicit adjustment for operating efficiency and capital costs. Both metrics enhance corporate financial management by aligning performance evaluation with shareholder value maximization and informed investment decisions.

Pros and Cons: EVA Compared to Residual Income

Economic Value Added (EVA) provides a clear measure of value creation by deducting the cost of capital from net operating profit after taxes, offering a comprehensive view of financial performance tied to asset utilization. However, EVA calculations require detailed adjustments to accounting figures, which can be complex and time-consuming compared to Residual Income that uses straightforward accounting profits minus a charge on equity. While EVA enhances strategic decision-making through economic profit emphasis, Residual Income offers simplicity and ease of understanding, making it useful for performance evaluation with less computational effort.

Real-World Examples: EVA and Residual Income Applications

Economic Value Added (EVA) and Residual Income both measure financial performance by assessing net operating profit after taxes minus the cost of capital; companies like Coca-Cola use EVA to optimize capital allocation and enhance shareholder value. Residual Income, favored in firms such as General Electric, drives managerial accountability by evaluating profit beyond a firm's required return on equity. Real-world applications demonstrate EVA's emphasis on value creation, while Residual Income supports operational decision-making by highlighting profitability relative to equity cost.

Choosing the Right Metric for Asset Optimization

Economic Value Added (EVA) measures a company's financial performance by calculating net operating profit after taxes minus the cost of capital, making it ideal for assessing asset efficiency and value creation. Residual Income focuses on the net income exceeding the minimum required return on equity, offering a straightforward approach for evaluating profitability on asset investments. For asset optimization, EVA is often preferred due to its comprehensive consideration of capital costs, enabling more precise identification of value-generating assets.

Important Terms

Net Operating Profit After Taxes (NOPAT)

Net Operating Profit After Taxes (NOPAT) represents a company's potential earnings from operations after taxes, serving as a key input for Economic Value Added (EVA) calculations, which measure value creation by subtracting the capital charge from NOPAT. Residual Income, closely related, calculates net income exceeding a minimum required return on equity, focusing on shareholder value rather than operational efficiency reflected in NOPAT and EVA.

Weighted Average Cost of Capital (WACC)

Weighted Average Cost of Capital (WACC) serves as the discount rate in calculating Economic Value Added (EVA), representing the minimum return required by investors to cover the cost of capital. EVA, unlike Residual Income which uses a firm-specific cost of equity, incorporates WACC to measure value creation by comparing net operating profit after taxes (NOPAT) to the total capital charge, aligning financial performance with investor expectations.

Invested Capital

Invested Capital represents the total funds invested in a company's operations, forming the basis for calculating Economic Value Added (EVA) and Residual Income by measuring the net operating profit after deducting the capital charge.

Capital Charge

Capital Charge represents the minimum return required on invested capital, directly impacting Economic Value Added (EVA) and Residual Income by serving as the benchmark deduction from net operating profit to measure true economic profitability.

Opportunity Cost of Capital

Opportunity Cost of Capital represents the minimum return required by investors and serves as a critical benchmark in calculating Economic Value Added (EVA), which measures a firm's net operating profit after deducting this cost, reflecting true economic profit. Residual Income, while also subtracting a charge for capital, focuses on net income exceeding the cost of equity capital specifically, highlighting shareholder value creation beyond standard accounting profits.

Adjusted Accounting Earnings

Adjusted Accounting Earnings refine net income by incorporating non-cash charges and removing accounting distortions to provide a clearer operational profit measure, closely aligning with Residual Income, which represents net operating profit after deducting a charge for capital cost. Economic Value Added (EVA) further adjusts residual income by integrating market-based cost of capital and capital charges to measure true economic profit, emphasizing value creation beyond traditional accounting metrics.

Shareholder Value Creation

Economic Value Added (EVA) measures shareholder value creation by calculating net operating profit after taxes minus the capital charge, while Residual Income evaluates profitability by subtracting a firm's cost of equity from its net income, both emphasizing value beyond accounting profits.

Performance Measurement

Economic Value Added (EVA) measures corporate performance by calculating net operating profit after taxes minus the capital charge, emphasizing value creation beyond the cost of capital. Residual Income (RI) similarly assesses profitability by subtracting a charge for the opportunity cost of invested capital but may utilize different accounting adjustments, making EVA more comprehensive for performance measurement.

Value-Based Management

Value-Based Management (VBM) integrates Economic Value Added (EVA) and Residual Income to enhance corporate performance by focusing on value creation beyond accounting profits. EVA measures net operating profit after tax minus a charge for capital, providing a refined indicator of true economic profit, while Residual Income represents net income minus a capital charge, emphasizing shareholder value generation.

Economic Profit

Economic Profit measures a firm's financial performance by deducting total opportunity costs from net operating profit, closely aligning with Economic Value Added (EVA), which refines this concept by adjusting net operating profit after taxes (NOPAT) for capital costs to evaluate true value creation. Residual Income similarly assesses performance by subtracting a charge for the cost of equity from net income, but EVA incorporates broader capital costs, making it a more comprehensive metric for value-added financial analysis.

Economic Value Added (EVA) vs Residual Income Infographic

moneydif.com

moneydif.com