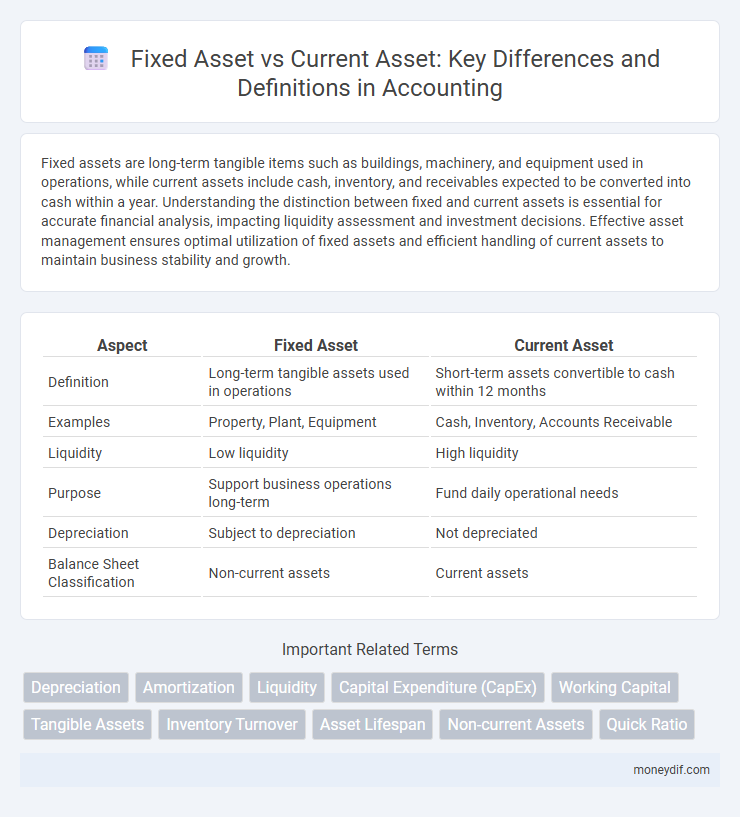

Fixed assets are long-term tangible items such as buildings, machinery, and equipment used in operations, while current assets include cash, inventory, and receivables expected to be converted into cash within a year. Understanding the distinction between fixed and current assets is essential for accurate financial analysis, impacting liquidity assessment and investment decisions. Effective asset management ensures optimal utilization of fixed assets and efficient handling of current assets to maintain business stability and growth.

Table of Comparison

| Aspect | Fixed Asset | Current Asset |

|---|---|---|

| Definition | Long-term tangible assets used in operations | Short-term assets convertible to cash within 12 months |

| Examples | Property, Plant, Equipment | Cash, Inventory, Accounts Receivable |

| Liquidity | Low liquidity | High liquidity |

| Purpose | Support business operations long-term | Fund daily operational needs |

| Depreciation | Subject to depreciation | Not depreciated |

| Balance Sheet Classification | Non-current assets | Current assets |

Definition of Fixed Assets

Fixed assets refer to long-term tangible property owned by a company, such as land, buildings, machinery, and equipment, which are used in operations and not intended for immediate sale. These assets provide value over multiple accounting periods and are subject to depreciation except for land. Unlike current assets, fixed assets are not easily converted into cash within a year and play a crucial role in a company's productive capacity and financial stability.

Definition of Current Assets

Current assets are assets that a company expects to convert into cash, sell, or consume within one fiscal year or operating cycle, whichever is longer. They include cash and cash equivalents, accounts receivable, inventory, and other short-term investments. Current assets provide essential liquidity for daily operations and short-term financial obligations.

Key Differences Between Fixed and Current Assets

Fixed assets represent long-term tangible properties such as buildings, machinery, and equipment used in production or operations, with depreciation applied over their useful life. Current assets include cash, inventory, accounts receivable, and other resources expected to be converted into cash or used within one year. The key differences lie in their liquidity, lifespan, and role in financial statements--fixed assets provide ongoing value, whereas current assets support short-term financial stability and operational liquidity.

Examples of Fixed Assets

Fixed assets include tangible long-term items such as machinery, buildings, vehicles, and land, which are essential for business operations and not intended for immediate sale. These assets provide value over multiple accounting periods and are recorded on the balance sheet at their historical cost minus accumulated depreciation. Unlike current assets, fixed assets are not easily converted into cash within a year and play a critical role in production and company infrastructure.

Examples of Current Assets

Current assets include cash, accounts receivable, inventory, and short-term investments, representing resources expected to be converted into cash within one year. These assets are critical for maintaining a company's liquidity and operational efficiency. Unlike fixed assets such as property, plant, and equipment, current assets are primarily used for day-to-day business activities.

Importance of Fixed and Current Assets in Financial Statements

Fixed assets represent long-term tangible resources critical for production and operational capacity, significantly impacting depreciation expenses and asset valuation in financial statements. Current assets, including cash, inventory, and receivables, are essential for liquidity assessment and short-term financial health analysis. Accurate classification and valuation of both fixed and current assets provide investors and stakeholders with clear insight into a company's resource management and operational efficiency.

Asset Liquidity: Fixed vs Current Assets

Current assets, such as cash, accounts receivable, and inventory, possess high liquidity, enabling quick conversion into cash within one fiscal year to support operational needs. Fixed assets, including property, plant, and equipment, exhibit low liquidity due to their long-term usage and difficulty in rapid sale without significant value loss. Understanding asset liquidity distinctions informs financial analysis, cash flow management, and strategic investment decisions in asset allocation.

Depreciation of Fixed Assets

Fixed assets, unlike current assets, are long-term tangible property used in business operations and subject to depreciation over their useful life, reflecting wear and tear or obsolescence. Depreciation methods such as straight-line or declining balance allocate the cost of fixed assets systematically, impacting financial statements and tax calculations. Current assets, including cash, inventory, and receivables, are not depreciated because they are expected to be converted into cash or consumed within one operating cycle.

Role of Current Assets in Cash Flow Management

Current assets play a critical role in cash flow management by providing liquidity necessary for daily operations and short-term obligations. These include cash, accounts receivable, and inventory, which can be quickly converted into cash to meet immediate financial needs. Efficient management of current assets ensures a company maintains sufficient cash flow, minimizes borrowing costs, and supports operational stability.

Impact of Asset Classification on Business Decisions

Fixed assets, such as machinery and buildings, represent long-term investments that influence strategic decisions related to capital budgeting and depreciation methods. Current assets, including cash, inventory, and accounts receivable, affect liquidity management and short-term operational planning. Accurate classification of assets enables businesses to optimize financial ratios and improve decision-making efficiency regarding resource allocation.

Important Terms

Depreciation

Depreciation primarily applies to fixed assets such as machinery and buildings, reflecting their gradual loss of value over time, whereas current assets like inventory and cash are not depreciated.

Amortization

Amortization systematically allocates the cost of intangible fixed assets over their useful life, whereas current assets are not amortized as they are expected to be converted into cash within one year.

Liquidity

Liquidity measures a company's ability to convert current assets into cash quickly, whereas fixed assets are less liquid due to their long-term usage and difficulty in immediate conversion.

Capital Expenditure (CapEx)

Capital Expenditure (CapEx) primarily involves investments in fixed assets such as property, plant, and equipment that provide long-term value and are capitalized on the balance sheet. In contrast, current assets like inventory or receivables represent short-term operational resources that are expensed rather than capitalized.

Working Capital

Working capital, calculated as current assets minus current liabilities, reflects the business's ability to cover short-term obligations, contrasting with fixed assets that represent long-term investments not readily convertible to cash.

Tangible Assets

Tangible assets are physical items classified as fixed assets when used long-term in operations, while current assets include tangible items expected to be converted into cash or used within one year.

Inventory Turnover

Inventory turnover measures how efficiently a company manages current assets by converting inventory into sales, distinct from fixed assets which are long-term resources not directly involved in inventory turnover calculations.

Asset Lifespan

Asset lifespan varies significantly between fixed assets and current assets, with fixed assets like machinery and buildings typically having a long useful life exceeding one year, while current assets such as inventory and accounts receivable are expected to be converted into cash or consumed within a single operating cycle. Understanding the distinction in asset lifespan is critical for accurate financial reporting and efficient asset management, as fixed assets are depreciated over time whereas current assets are measured at their net realizable value.

Non-current Assets

Non-current assets, including fixed assets like property, plant, and equipment, provide long-term value and differ from current assets, which are expected to be converted into cash within one year.

Quick Ratio

The Quick Ratio measures a company's short-term liquidity by comparing its most liquid assets, excluding fixed assets and inventory, to its current liabilities.

Fixed asset vs Current asset Infographic

moneydif.com

moneydif.com