Asset securitization involves pooling various financial assets and transforming them into marketable securities to enhance liquidity and transfer risk. Asset-backed securities (ABS) are the financial instruments resulting from this process, representing claims on the cash flows generated by the underlying assets. Understanding the distinction between asset securitization as a process and ABS as the investment product is crucial for investors assessing risk and return profiles.

Table of Comparison

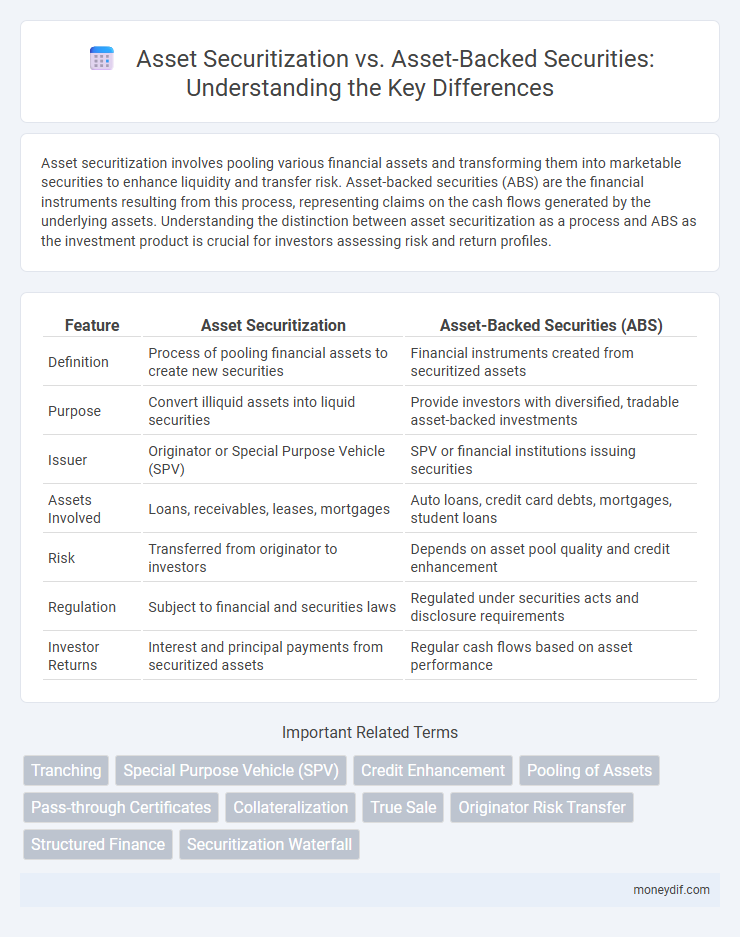

| Feature | Asset Securitization | Asset-Backed Securities (ABS) |

|---|---|---|

| Definition | Process of pooling financial assets to create new securities | Financial instruments created from securitized assets |

| Purpose | Convert illiquid assets into liquid securities | Provide investors with diversified, tradable asset-backed investments |

| Issuer | Originator or Special Purpose Vehicle (SPV) | SPV or financial institutions issuing securities |

| Assets Involved | Loans, receivables, leases, mortgages | Auto loans, credit card debts, mortgages, student loans |

| Risk | Transferred from originator to investors | Depends on asset pool quality and credit enhancement |

| Regulation | Subject to financial and securities laws | Regulated under securities acts and disclosure requirements |

| Investor Returns | Interest and principal payments from securitized assets | Regular cash flows based on asset performance |

Understanding Asset Securitization: Definition and Process

Asset securitization is a financial process that transforms illiquid assets, such as loans or receivables, into marketable securities by pooling them and issuing asset-backed securities (ABS) to investors. This process enhances liquidity and diversifies funding sources for originators by transferring credit risk to investors. Understanding asset securitization requires grasping the key steps: asset pooling, special purpose vehicle (SPV) creation, issuance of ABS, and the subsequent cash flow distribution to security holders.

Asset-Backed Securities (ABS): Key Concepts Explained

Asset-Backed Securities (ABS) are financial instruments backed by a pool of underlying assets such as loans, leases, credit card debt, or receivables, allowing issuers to convert illiquid assets into tradable securities. ABS provide liquidity and risk diversification by transferring asset-related cash flows to investors, who receive periodic payments derived from the underlying asset performance. These securities play a crucial role in capital markets by enhancing funding options for originators while offering investors exposure to various asset classes with structured credit risk.

Differences Between Asset Securitization and Asset-Backed Securities

Asset securitization is the process of pooling various financial assets, such as loans or receivables, and converting them into tradable securities to raise capital for issuers. Asset-backed securities (ABS) are the financial instruments created through this process, representing claims on the cash flows generated by the underlying assets. The key difference lies in securitization being the method, while ABS are the actual investment products issued to investors.

The Role of Underlying Assets in Securitization

Underlying assets serve as the fundamental collateral in asset securitization, directly influencing the credit quality and risk profile of the resulting securities. These assets, such as loans, receivables, or leases, generate predictable cash flows that back the asset-backed securities (ABS), ensuring investor confidence and market liquidity. The performance and stability of the underlying assets determine the securitization structure, pricing, and investor returns within the ABS market.

Key Players in the Securitization and ABS Markets

Key players in the securitization market include originators, such as banks and financial institutions, who pool assets for securitization, and special purpose vehicles (SPVs) that issue asset-backed securities (ABS). Investors, rating agencies, and servicers play critical roles in ABS markets by providing capital, assessing credit risk, and managing underlying asset collections. Trusts and underwriters also facilitate the issuance and distribution of ABS, ensuring liquidity and market efficiency.

Risk Analysis: Securitization vs Asset-Backed Securities

Risk analysis of asset securitization centers on the transfer of credit risk from the originator to investors, with performance heavily dependent on the underlying asset pool's quality and economic conditions. Asset-backed securities (ABS) carry risk related to the tranche structure, where senior tranches have lower default risk compared to subordinated tranches, reflecting varying levels of investor exposure. Both frameworks require rigorous stress testing, credit enhancement mechanisms, and continuous monitoring to mitigate potential losses and ensure financial stability.

Benefits of Asset Securitization for Financial Institutions

Asset securitization enables financial institutions to convert illiquid assets into liquid capital, enhancing balance sheet efficiency and reducing funding costs. This process diversifies risk by pooling various asset classes, such as loans or receivables, into tradable securities, which improves credit quality and attracts a broader investor base. Enhanced liquidity and risk transfer mechanisms through asset securitization support financial institutions in optimizing capital allocation and meeting regulatory requirements.

Types of Asset-Backed Securities: A Comparative Overview

Asset-backed securities (ABS) encompass various types, including mortgage-backed securities (MBS), auto loans, credit card receivables, and student loans, each securitized to transform illiquid assets into tradable instruments. Mortgage-backed securities primarily derive cash flows from residential or commercial mortgages, whereas collateralized debt obligations (CDOs) pool diversified debt types, offering complex risk structures. Comparing these asset-backed securities reveals differences in underlying asset classes, risk profiles, and investor appeal, critical for portfolio diversification and risk management.

Regulatory Framework: Securitization and ABS Compliance

Asset securitization involves pooling financial assets to create securities, requiring strict adherence to regulatory frameworks such as the Dodd-Frank Act and Basel III for transparency and risk mitigation. Asset-backed securities (ABS) must comply with specific disclosure mandates, including those set forth by the Securities and Exchange Commission (SEC) under Regulation AB to ensure investor protection. Regulatory compliance mandates ongoing reporting, risk retention rules, and due diligence to maintain market stability and prevent systemic risk.

Market Trends: The Future of Securitization and Asset-Backed Securities

Market trends in asset securitization emphasize growing adoption of blockchain technology to enhance transparency and reduce processing times, driving increased investor confidence. Asset-backed securities are evolving with a focus on diverse collateral types, such as renewable energy assets and consumer loans, responding to market demand for sustainable and resilient investment options. Regulatory frameworks are adapting to support innovation while mitigating risk, positioning securitization and asset-backed securities as critical components in future capital markets.

Important Terms

Tranching

Tranching in asset securitization involves dividing pooled financial assets into multiple classes with varying risk and return profiles, enhancing investor choice and managing credit risk. Asset-backed securities (ABS) represent these tranches, providing structured payment priorities and enabling efficient capital market funding for diversified asset portfolios like mortgages, auto loans, or credit card receivables.

Special Purpose Vehicle (SPV)

Special Purpose Vehicles (SPVs) facilitate asset securitization by isolating financial assets from the originator, enabling the issuance of asset-backed securities (ABS) to investors.

Credit Enhancement

Credit enhancement in asset securitization improves the credit profile of underlying asset pools by using mechanisms such as over-collateralization, reserve funds, or third-party guarantees to reduce the risk of default and protect investors. Asset-backed securities (ABS) rely on these credit enhancement techniques to achieve higher credit ratings, making the securities more attractive to investors by lowering perceived risk and increasing market liquidity.

Pooling of Assets

Pooling of assets in asset securitization combines multiple financial assets to create diversified, collateralized pools that underpin asset-backed securities, enhancing credit quality and investor appeal.

Pass-through Certificates

Pass-through certificates represent ownership in a pool of securitized assets where principal and interest payments pass directly to investors, distinguishing them from broader asset-backed securities that may include various structured tranches and credit enhancements.

Collateralization

Collateralization in asset securitization involves pooling various financial assets to create marketable securities, where the underlying assets serve as collateral to support bondholder payments; asset-backed securities (ABS) are the resulting financial instruments backed by these collateralized pools. Efficient collateralization enhances credit quality and investor confidence by isolating asset performance risks, thereby facilitating liquidity and capital flow in financial markets.

True Sale

True sale in asset securitization involves legally transferring assets to a separate bankruptcy-remote entity, ensuring the assets are isolated from the originator's creditors and thereby enhancing investor protection. In contrast, asset-backed securities (ABS) represent the financial instruments issued against these transferred assets, allowing investors to receive payments derived from the underlying asset cash flows.

Originator Risk Transfer

Originator Risk Transfer involves shifting credit risk from the originating entity to investors through Asset Securitization, where pools of underlying loans or receivables are transformed into Asset-backed Securities (ABS) for capital market funding. These ABS enhance liquidity and risk distribution by allowing originators to remove assets from their balance sheets while providing investors access to diversified, cash-flow generating financial instruments.

Structured Finance

Structured finance involves complex financial instruments designed to transfer risk and improve liquidity, with asset securitization being the process of pooling various financial assets to create asset-backed securities (ABS). Asset-backed securities represent claims on the cash flows generated by the underlying pooled assets, such as loans, leases, or receivables, providing investors with diversified income streams and issuers with enhanced capital management.

Securitization Waterfall

The securitization waterfall dictates the priority of cash flow distribution in asset securitization transactions, ensuring that asset-backed securities investors receive payments according to predefined seniority levels and risk tranches.

Asset Securitization vs Asset-backed Securities Infographic

moneydif.com

moneydif.com