Impairment refers to a permanent reduction in the recoverable value of an asset below its carrying amount, often triggered by unexpected changes in market conditions or physical damage. A write-down is an accounting adjustment that reduces the value of an asset on the balance sheet due to impairments or decreased market value but may not indicate a permanent loss. Both impairment and write-down affect financial statements by lowering asset values, yet impairment typically involves a more significant and lasting decline.

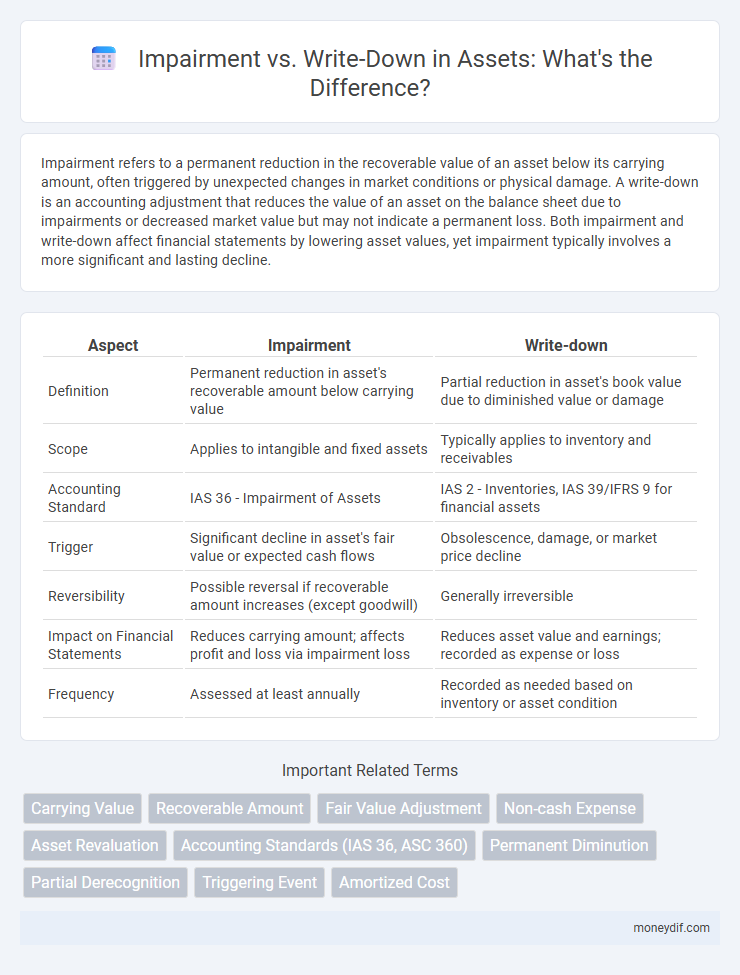

Table of Comparison

| Aspect | Impairment | Write-down |

|---|---|---|

| Definition | Permanent reduction in asset's recoverable amount below carrying value | Partial reduction in asset's book value due to diminished value or damage |

| Scope | Applies to intangible and fixed assets | Typically applies to inventory and receivables |

| Accounting Standard | IAS 36 - Impairment of Assets | IAS 2 - Inventories, IAS 39/IFRS 9 for financial assets |

| Trigger | Significant decline in asset's fair value or expected cash flows | Obsolescence, damage, or market price decline |

| Reversibility | Possible reversal if recoverable amount increases (except goodwill) | Generally irreversible |

| Impact on Financial Statements | Reduces carrying amount; affects profit and loss via impairment loss | Reduces asset value and earnings; recorded as expense or loss |

| Frequency | Assessed at least annually | Recorded as needed based on inventory or asset condition |

Understanding Asset Impairment: Key Concepts

Asset impairment occurs when the carrying amount of an asset exceeds its recoverable amount, indicating a decline in its value. Write-down is the accounting action taken to adjust the asset's book value to its impaired value. Understanding asset impairment involves recognizing indicators of impairment, measuring recoverable amounts, and recording losses appropriately to reflect true asset value.

Defining Write-Down in Asset Management

A write-down in asset management refers to the deliberate reduction of an asset's book value when its market value falls below its recorded cost, reflecting a decrease in the asset's recoverable amount. Unlike impairment, which follows strict accounting standards and involves formal testing for asset value decline, write-downs can be more discretionary and are often used for inventory, receivables, or fixed assets. This adjustment ensures that financial statements accurately represent the current value of assets, preventing overstatement and aligning with fair value principles.

Differences Between Impairment and Write-Down

Impairment refers to a permanent reduction in the recoverable value of an asset due to significant adverse changes, often assessed through detailed impairment tests in accordance with accounting standards like IFRS or GAAP. Write-down is a partial reduction in asset value that may be temporary or less severe, reflecting a decrease in carrying amount without necessarily signaling permanent loss. The key difference lies in impairment indicating a more severe and often irreversible decline, while write-downs may be adjusted or reversed in future periods depending on changes in asset value.

Accounting Standards for Asset Impairment

Asset impairment under IAS 36 requires recognizing a loss when the carrying amount exceeds the recoverable amount, defined as the higher of fair value less costs to sell and value in use. Write-downs reduce asset carrying amounts for obsolescence or partial damage but may not meet impairment criteria under IFRS or US GAAP. Accurate impairment testing involves cash flow projections, discount rates, and market conditions, ensuring compliance with accounting standards for transparent financial reporting.

Triggers and Indicators of Asset Impairment

Triggers and indicators of asset impairment include significant declines in market value, adverse changes in regulatory or economic environments, and physical damage or obsolescence affecting asset performance. Write-downs occur when the carrying amount of an asset exceeds its recoverable amount, prompting recognition of impairment losses. Timely identification of impairment indicators is crucial for accurate financial reporting and maintaining asset value integrity.

Recognizing and Measuring Write-Downs

Recognizing and measuring write-downs involves identifying when an asset's carrying amount exceeds its recoverable amount, indicating impairment. The write-down amount is calculated as the difference between the asset's book value and its fair value less costs to sell or its value in use, whichever is higher. Accurate measurement ensures financial statements reflect the asset's true economic value, aligning with relevant accounting standards such as IAS 36 or ASC 360.

Impact of Impairment vs Write-Down on Financial Statements

Impairment reduces the carrying amount of an asset to its recoverable amount, significantly affecting both the balance sheet and income statement by recognizing a loss that lowers net income and asset value. A write-down, typically less severe, adjusts the asset's book value to reflect its diminished utility or market value, impacting the financial statements primarily through reduced asset value and a smaller charge to earnings. Both impairments and write-downs lead to decreased asset values but differ in magnitude and timing of the recognition of losses, influencing financial ratios and investor perception.

Examples of Asset Impairment and Write-Down Scenarios

An example of asset impairment occurs when machinery suffers permanent damage due to a factory fire, reducing its recoverable value below its carrying amount. A write-down scenario is seen when inventory becomes obsolete, prompting a reduction in its book value to reflect its net realizable value. Both impairments and write-downs adjust asset values on the balance sheet to represent current fair or recoverable amounts accurately.

Reporting and Disclosure Requirements

Impairment requires companies to disclose the nature, amount, and reasons for the loss in financial statements, ensuring transparency in asset valuation changes. Write-downs must be reported with details on the asset's original cost, the amount written off, and the resulting carrying amount. Both impairment and write-down disclosures help stakeholders assess the impact on financial performance and asset recoverability.

Best Practices for Managing Asset Impairment and Write-Downs

Effective management of asset impairment and write-downs requires regular asset valuation and timely identification of triggering events to ensure accurate financial reporting. Implementing thorough documentation and consistent review procedures enhances transparency and supports compliance with accounting standards such as IFRS and GAAP. Leveraging specialized asset management software enables real-time tracking of asset performance and facilitates early detection of impairment indicators.

Important Terms

Carrying Value

Carrying value represents an asset's book value on financial statements and is reduced by impairment losses when the asset's recoverable amount falls below its carrying value, whereas write-downs specifically adjust the carrying value downward due to partial loss in asset value without complete asset retirement.

Recoverable Amount

The recoverable amount represents the higher value between an asset's fair value less costs to sell and its value in use, serving as a benchmark to assess impairment losses when an asset's carrying amount exceeds this threshold. Impairment results in recognizing a loss to reduce the asset's book value to its recoverable amount, while a write-down specifically refers to adjusting the asset's carrying amount to reflect a diminished recoverable value.

Fair Value Adjustment

Fair value adjustment reflects current market conditions and may result in increases or decreases to asset carrying values, while impairment specifically indicates a permanent decline in asset value below its carrying amount, necessitating a write-down. Write-downs are accounting entries that reduce the book value of an asset to its recoverable amount after determining impairment, ensuring financial statements reflect realistic asset valuations.

Non-cash Expense

Non-cash expenses such as impairment reflect a significant permanent reduction in asset value, whereas write-downs indicate a partial decrease that may be recoverable.

Asset Revaluation

Asset revaluation involves adjusting the carrying value of an asset to reflect its current fair market value, often leading to an increase, whereas impairment recognizes a permanent decrease in an asset's recoverable amount below its carrying value, necessitating a write-down to reflect the asset's reduced utility or value. Write-downs result from impairment losses and directly reduce the asset's book value, impacting financial statements by lowering reported earnings and asset balances.

Accounting Standards (IAS 36, ASC 360)

IAS 36 and ASC 360 provide guidelines for asset impairment, specifying when an impairment loss must be recognized versus a write-down to reflect reductions in the asset's recoverable amount or carrying value.

Permanent Diminution

Permanent diminution refers to a lasting decline in the value of an asset, often recognized as an impairment loss when the asset's recoverable amount falls below its carrying amount. Unlike a write-down, which can be temporary and reversed if the asset's value recovers, impairment reflects a permanent decrease requiring adjustment in financial statements to reflect the asset's true value.

Partial Derecognition

Partial derecognition occurs when a company removes a portion of an asset or liability from its balance sheet, reflecting only the impaired or diminished value rather than the entire amount. Impairment focuses on reducing the carrying amount to recoverable value due to loss in asset utility, while write-down adjusts the asset's value downward without full derecognition, capturing temporary devaluation.

Triggering Event

A triggering event in impairment testing signals a significant decline in an asset's recoverable value, necessitating an impairment review to determine if a write-down is required. This event may include adverse market conditions, legal changes, or physical damage, directly affecting the asset's carrying amount on the balance sheet.

Amortized Cost

Amortized cost involves valuing financial assets by gradually expensing premiums, discounts, and fees over time, while impairment reflects a permanent decline in asset value requiring recognition of losses; in contrast, write-downs are accounting adjustments reducing the asset's book value to reflect decreased recoverability without necessarily indicating permanence. Understanding the distinction between impairment and write-down is crucial for accurate financial reporting under IFRS and GAAP frameworks.

impairment vs write-down Infographic

moneydif.com

moneydif.com