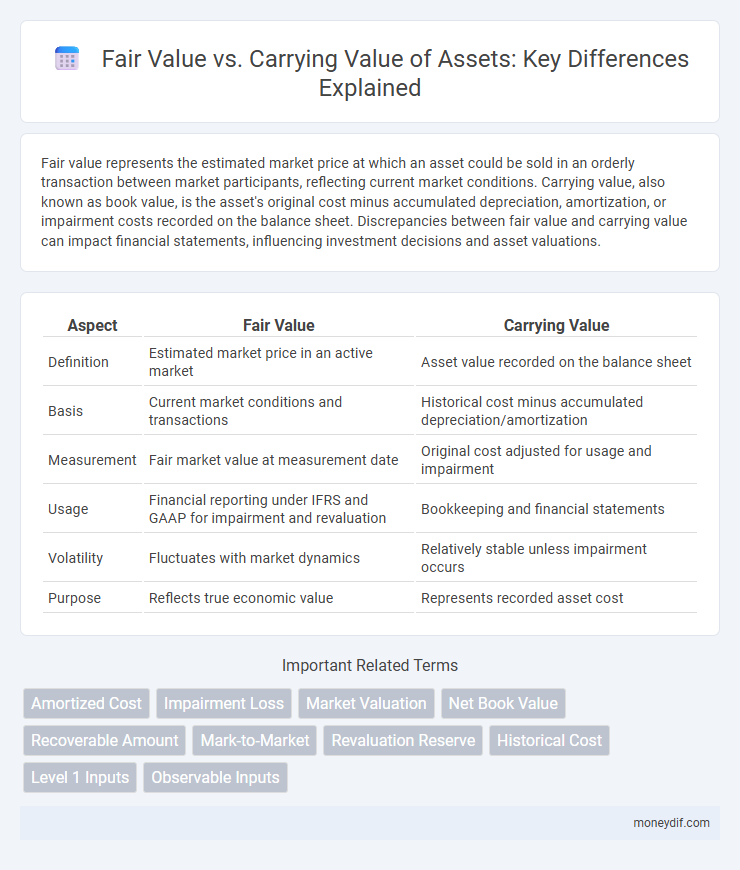

Fair value represents the estimated market price at which an asset could be sold in an orderly transaction between market participants, reflecting current market conditions. Carrying value, also known as book value, is the asset's original cost minus accumulated depreciation, amortization, or impairment costs recorded on the balance sheet. Discrepancies between fair value and carrying value can impact financial statements, influencing investment decisions and asset valuations.

Table of Comparison

| Aspect | Fair Value | Carrying Value |

|---|---|---|

| Definition | Estimated market price in an active market | Asset value recorded on the balance sheet |

| Basis | Current market conditions and transactions | Historical cost minus accumulated depreciation/amortization |

| Measurement | Fair market value at measurement date | Original cost adjusted for usage and impairment |

| Usage | Financial reporting under IFRS and GAAP for impairment and revaluation | Bookkeeping and financial statements |

| Volatility | Fluctuates with market dynamics | Relatively stable unless impairment occurs |

| Purpose | Reflects true economic value | Represents recorded asset cost |

Definition of Fair Value in Asset Accounting

Fair value in asset accounting refers to the estimated price at which an asset could be exchanged between knowledgeable, willing parties in an arm's length transaction. It reflects the current market conditions, providing a more accurate and timely valuation compared to carrying value, which is based on historical cost less accumulated depreciation or impairment. This measurement ensures assets are reported at amounts that represent their true economic value.

Understanding Carrying Value of Assets

Carrying value of assets represents the net book value recorded on the balance sheet, calculated as the original cost minus accumulated depreciation, amortization, or impairment losses. It reflects the asset's accounting value rather than its current market worth, distinguishing it from fair value, which estimates the price an asset would fetch in an orderly transaction. Accurate understanding of carrying value is essential for financial reporting, asset management, and assessing a company's financial health.

Key Differences: Fair Value vs Carrying Value

Fair value represents the estimated market price at which an asset can be sold or transferred between knowledgeable, willing parties, reflecting current market conditions. Carrying value, also known as book value, is the asset's original cost minus accumulated depreciation, amortization, or impairment costs recorded in the company's financial statements. Key differences include fair value's reliance on external market inputs and real-time valuation, whereas carrying value is based on historical cost adjusted for accounting policies, impacting asset valuation accuracy and decision-making.

Methods for Calculating Fair Value

Fair value is calculated using market-based methods such as the market approach, income approach, and cost approach. The market approach relies on observable prices of identical or comparable assets in active markets. The income approach estimates fair value by discounting expected future cash flows, while the cost approach determines value based on the replacement or reproduction cost of the asset, adjusted for depreciation.

Determining Carrying Value on Balance Sheets

Carrying value on balance sheets represents the asset's original cost minus accumulated depreciation, amortization, or impairment expenses. This value reflects the book value of the asset rather than its current market worth, providing a consistent measure for financial reporting. Firms determine carrying value to assess asset utilization and financial position without the volatility of fair market fluctuations.

Impact of Valuation Methods on Financial Statements

Fair value measurement reflects the current market conditions, providing a more accurate and timely asset valuation on financial statements compared to carrying value, which is based on historical cost less depreciation. Differences between fair value and carrying value can lead to significant fluctuations in reported earnings and equity, affecting stakeholders' perception of a company's financial health. The choice of valuation method influences asset impairment recognition, goodwill adjustments, and investment property reporting under accounting standards like IFRS and US GAAP.

Fair Value Measurement Standards and Guidelines

Fair value measurement standards, such as IFRS 13 and ASC 820, establish a framework for assessing assets at their exit price in an orderly transaction between market participants. These guidelines require the use of observable market data and valuation techniques including the market approach, income approach, and cost approach to ensure accurate and consistent fair value reporting. Entities must disclose levels of the fair value hierarchy, inputs used in valuation, and any changes in valuation methods to enhance transparency and comparability in financial statements.

Impairment and Revaluation: Impacts on Asset Values

Impairment reduces an asset's carrying value to its recoverable amount when the carrying amount exceeds fair value, reflecting a loss that impacts financial statements. Revaluation adjusts the carrying value to fair value periodically, either increasing or decreasing it based on market conditions and asset usefulness. Both impairment and revaluation affect asset values by aligning recorded amounts with current fair value, influencing balance sheet accuracy and investment decisions.

Real-World Examples: Fair Value vs Carrying Value

Fair value represents the estimated market price an asset would fetch in a current, orderly transaction between market participants, while carrying value reflects the asset's book value recorded on the balance sheet after accounting for depreciation or amortization. For example, real estate properties are often recorded at carrying value, which may differ significantly from their fair value as market conditions fluctuate. In the case of equity securities, fair value changes daily based on market prices, contrasting with the carrying value that may reflect historical cost or adjusted values.

Implications for Investors and Stakeholders

Fair value reflects an asset's current market price, providing investors with a more accurate and timely assessment of its worth, while carrying value represents the asset's original cost minus depreciation, which may underestimate true value. Discrepancies between fair value and carrying value can impact investment decisions, risk assessments, and portfolio valuations by highlighting potential over- or undervaluation on financial statements. Stakeholders rely on fair value for transparency and informed decision-making, although its volatility might introduce uncertainty compared to the stability of carrying value.

Important Terms

Amortized Cost

Amortized cost measures an asset or liability's value after accounting for principal repayments and interest amortization, differing from fair value which reflects current market conditions. Fair value provides a timely market-based measurement, while carrying amount based on amortized cost focuses on historical transaction data adjusted over time, impacting financial reporting and asset valuation decisions.

Impairment Loss

Impairment loss occurs when the carrying value of an asset exceeds its recoverable amount, often compared to its fair value, indicating the asset is overvalued on the balance sheet. Recognizing impairment ensures that the asset is reported at the lower of its carrying amount or fair value less costs to sell, reflecting more accurate financial statements.

Market Valuation

Market valuation assesses an asset's fair value by reflecting current market conditions, which can differ significantly from its carrying value recorded on the balance sheet.

Net Book Value

Net Book Value (NBV) represents an asset's original cost minus accumulated depreciation, reflecting its carrying value on the balance sheet, whereas Fair Value indicates the estimated market price an asset would fetch in an orderly transaction. The comparison between Fair Value and Carrying Value (NBV) is crucial for impairment testing and financial reporting, as significant differences may require adjustments to ensure accurate asset valuation.

Recoverable Amount

The recoverable amount is the higher of an asset's fair value less costs of disposal and its carrying value, determining whether an impairment loss must be recognized.

Mark-to-Market

Mark-to-Market accounting adjusts an asset's carrying value to its current fair value, reflecting real-time market conditions on the balance sheet. This approach ensures transparency by aligning the book value with the asset's actual market price, unlike historical cost methods that may show outdated or inflated values.

Revaluation Reserve

Revaluation Reserve reflects the difference between an asset's Fair Value and its Carrying Value, representing unrealized gains recognized in equity.

Historical Cost

Historical cost represents the original transaction value of an asset, providing a verifiable and objective measurement, while fair value reflects the current market price that could be received or paid in an orderly transaction. Carrying value, often based on historical cost less accumulated depreciation or amortization, may differ significantly from fair value due to market fluctuations and changes in asset conditions.

Level 1 Inputs

Level 1 Inputs in fair value measurement consist of quoted prices in active markets for identical assets or liabilities, providing the most reliable basis for comparing fair value to carrying value.

Observable Inputs

Observable inputs, classified as Level 1 or Level 2 in fair value hierarchy, directly impact the accuracy of fair value measurements compared to carrying value, enhancing transparency in financial reporting.

Fair Value vs Carrying Value Infographic

moneydif.com

moneydif.com