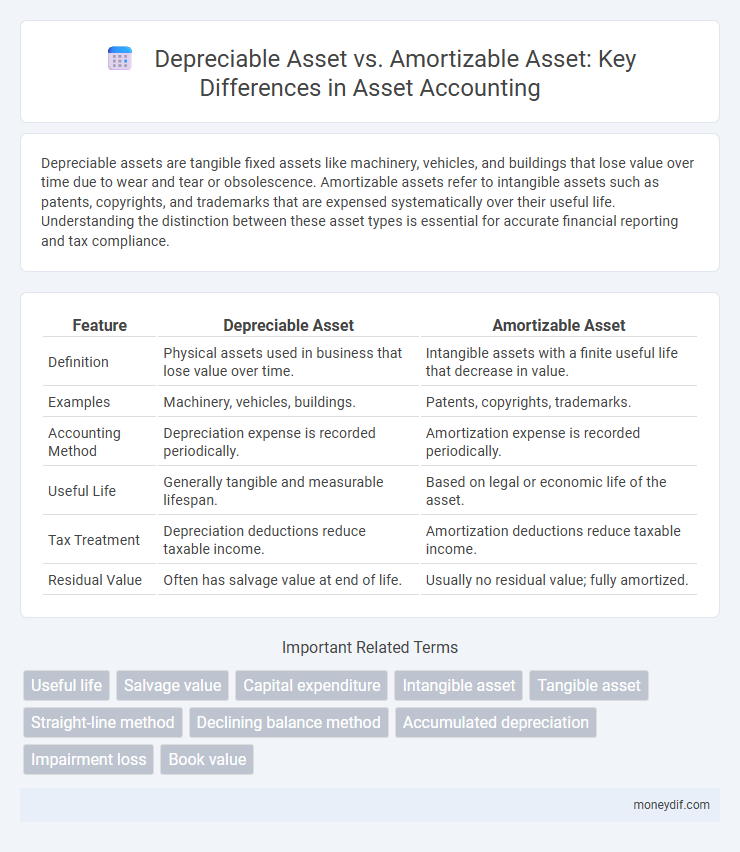

Depreciable assets are tangible fixed assets like machinery, vehicles, and buildings that lose value over time due to wear and tear or obsolescence. Amortizable assets refer to intangible assets such as patents, copyrights, and trademarks that are expensed systematically over their useful life. Understanding the distinction between these asset types is essential for accurate financial reporting and tax compliance.

Table of Comparison

| Feature | Depreciable Asset | Amortizable Asset |

|---|---|---|

| Definition | Physical assets used in business that lose value over time. | Intangible assets with a finite useful life that decrease in value. |

| Examples | Machinery, vehicles, buildings. | Patents, copyrights, trademarks. |

| Accounting Method | Depreciation expense is recorded periodically. | Amortization expense is recorded periodically. |

| Useful Life | Generally tangible and measurable lifespan. | Based on legal or economic life of the asset. |

| Tax Treatment | Depreciation deductions reduce taxable income. | Amortization deductions reduce taxable income. |

| Residual Value | Often has salvage value at end of life. | Usually no residual value; fully amortized. |

Introduction to Depreciable and Amortizable Assets

Depreciable assets are tangible fixed assets such as machinery, buildings, and equipment that lose value over time due to wear and tear, and their cost is allocated over their useful life through depreciation. Amortizable assets consist of intangible assets like patents, copyrights, and trademarks, whose cost is systematically expensed over their estimated useful life via amortization. Understanding the distinction enables accurate financial reporting and tax compliance by matching asset costs with revenue generation periods.

Key Definitions: Depreciation vs Amortization

Depreciable assets refer to tangible fixed assets like machinery, buildings, and vehicles that lose value over time due to wear and tear, accounted for through depreciation. Amortizable assets involve intangible assets such as patents, trademarks, or copyrights, whose cost is systematically allocated using amortization. Depreciation applies to physical assets, while amortization is specific to intangible assets, both serving to match asset costs with their revenue-generating periods.

Types of Depreciable Assets

Depreciable assets primarily include tangible fixed assets such as machinery, buildings, vehicles, and equipment used in business operations. These assets wear out, become obsolete, or lose value over time due to physical use and exposure. In contrast, amortizable assets refer to intangible assets like patents, copyrights, and software, which lose value through legal or contractual lifespan rather than physical deterioration.

Types of Amortizable Assets

Amortizable assets primarily include intangible assets such as patents, copyrights, trademarks, and goodwill, which lose value over time due to usage or legal limitations. Unlike depreciable assets that consist of tangible property like machinery and buildings, amortizable assets are systematically expensed over their useful life based on amortization schedules. This distinction ensures accurate financial reporting by matching the costs of intangible assets to the periods benefiting from their use.

Accounting Methods for Depreciation

Depreciable assets, including tangible fixed assets like machinery and buildings, are accounted for using methods such as straight-line, declining balance, and sum-of-the-years'-digits to systematically allocate the asset's cost over its useful life. Amortizable assets, primarily intangible assets like patents and copyrights, utilize the straight-line method or units-of-production method for cost allocation, reflecting the asset's consumption or usage pattern. Selecting the appropriate accounting method affects financial statements by influencing expense recognition, asset valuation, and tax liabilities.

Accounting Methods for Amortization

Amortizable assets, such as intangible assets including patents and copyrights, require systematic allocation of their cost over their useful life using methods like straight-line amortization, which evenly spreads expense. Depreciable assets, typically tangible assets like machinery and buildings, are accounted for using methods such as declining balance or sum-of-the-years'-digits, reflecting the asset's decreasing value. Accounting for amortization ensures precise expense matching, influencing financial statements and tax reporting.

Factors Influencing Asset Classification

Factors influencing asset classification into depreciable or amortizable categories include the asset's physical form and useful life; tangible assets like machinery undergo depreciation, while intangible assets such as patents are amortized. The method of cost allocation varies based on whether the asset loses value through wear and tear or legal/contractual limitations affecting its useful life. Regulatory guidelines and accounting standards also play a critical role in determining the appropriate classification and subsequent expense recognition.

Tax Implications: Depreciable vs Amortizable Assets

Depreciable assets, such as machinery and buildings, allow businesses to deduct the asset's cost over its useful life through depreciation, reducing taxable income annually according to IRS schedules. Amortizable assets, including patents and copyrights, enable expense recognition of intangible asset costs over a specified period, often 15 years, for tax deduction purposes. Understanding these distinctions ensures accurate tax reporting and optimizing tax benefits under the Internal Revenue Code.

Financial Statement Impact

Depreciable assets, such as machinery and buildings, reduce the carrying value on the balance sheet through systematic depreciation expense, directly impacting net income and accumulated depreciation accounts. Amortizable assets, including intangible assets like patents and copyrights, decrease asset values via amortization expense, which also lowers net income but typically lacks a salvage value component. Both depreciation and amortization expenses are non-cash charges that allocate the assets' costs over their useful lives, influencing financial ratios and tax deductions reported on the income statement and balance sheet.

Choosing the Right Approach for Asset Management

Depreciable assets, such as machinery and buildings, lose value over time due to wear and tear, making straight-line or declining balance depreciation methods essential for accurate expense allocation. Amortizable assets, including patents and copyrights, require systematic amortization to allocate their intangible value over their useful life. Selecting the appropriate approach between depreciation and amortization enhances financial reporting accuracy and optimizes asset management strategies.

Important Terms

Useful life

The useful life of a depreciable asset refers to the period during which the tangible fixed asset is expected to be productive for economic benefits, typically ranging from a few years to several decades, depending on the asset type. In contrast, the useful life of an amortizable asset, which is an intangible asset like patents or copyrights, defines the timeframe over which the asset's cost is systematically allocated, often based on legal, regulatory, or contractual life limits.

Salvage value

Salvage value represents the estimated residual amount an asset can be sold for at the end of its useful life and is a key component in calculating depreciation for tangible depreciable assets, such as machinery or vehicles. In contrast, amortizable assets, which are intangible like patents or copyrights, typically do not involve salvage value in their amortization schedules since these assets generally have no residual worth after their amortization period.

Capital expenditure

Capital expenditure for depreciable assets involves tangible fixed assets like machinery and buildings, while amortizable assets pertain to intangible assets such as patents and copyrights.

Intangible asset

Intangible assets are classified as amortizable assets due to their finite useful lives, whereas depreciable assets refer to tangible fixed assets subject to depreciation over time.

Tangible asset

Tangible assets, such as machinery and buildings, are classified as depreciable assets due to their physical existence and wear over time, whereas amortizable assets refer to intangible assets like patents and trademarks that lose value through systematic amortization.

Straight-line method

The straight-line method allocates equal depreciation expense annually for depreciable assets like machinery, while it amortizes intangible assets such as patents over their useful life.

Declining balance method

The declining balance method accelerates depreciation for depreciable assets like equipment but is not applicable to amortizable assets such as intangible properties.

Accumulated depreciation

Accumulated depreciation represents the total reduction in value of a depreciable asset, such as machinery or vehicles, over its useful life, while amortizable assets, like patents or copyrights, have accumulated amortization reflecting cost allocation without physical wear. Understanding the distinction between depreciable tangible assets and amortizable intangible assets is crucial for accurate financial reporting and asset management.

Impairment loss

Impairment loss occurs when the recoverable amount of a depreciable asset, such as property or equipment, or an amortizable asset, like intangible assets, declines below its carrying amount, requiring a write-down to reflect the reduced value.

Book value

Book value reflects the net asset cost after subtracting accumulated depreciation for depreciable assets or accumulated amortization for amortizable assets.

Depreciable asset vs Amortizable asset Infographic

moneydif.com

moneydif.com