Strategic assets are long-term resources that provide sustained competitive advantage and drive core business objectives, often involving significant investment and planning. Tactical assets are short-term, flexible resources used to address immediate operational needs and support day-to-day activities. Understanding the distinction ensures effective allocation of assets to balance growth and adaptability.

Table of Comparison

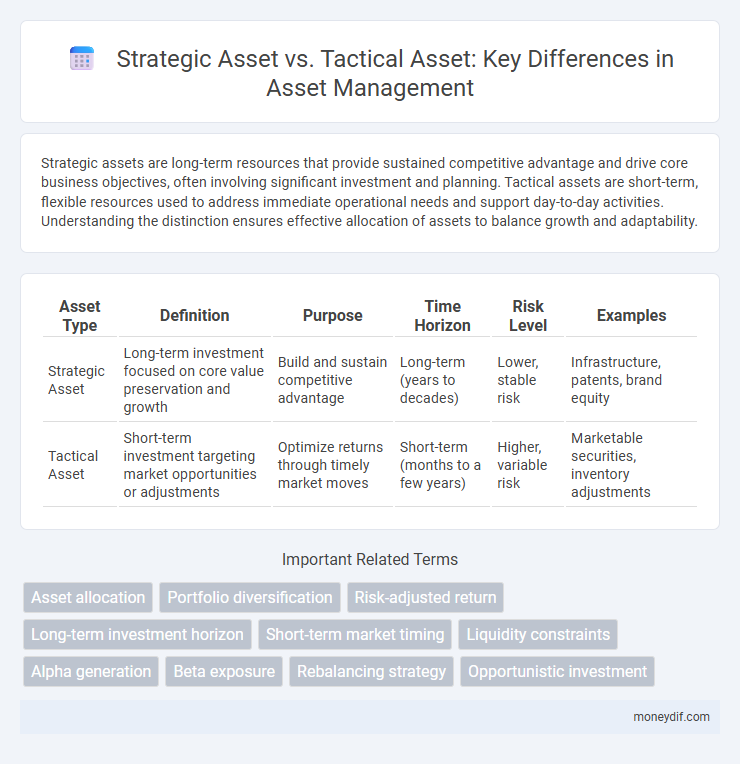

| Asset Type | Definition | Purpose | Time Horizon | Risk Level | Examples |

|---|---|---|---|---|---|

| Strategic Asset | Long-term investment focused on core value preservation and growth | Build and sustain competitive advantage | Long-term (years to decades) | Lower, stable risk | Infrastructure, patents, brand equity |

| Tactical Asset | Short-term investment targeting market opportunities or adjustments | Optimize returns through timely market moves | Short-term (months to a few years) | Higher, variable risk | Marketable securities, inventory adjustments |

Defining Strategic and Tactical Assets

Strategic assets are long-term resources critical to achieving an organization's overarching goals, often involving significant investment and sustained value creation. Tactical assets focus on short-term needs, enabling quick responses and operational efficiency to support immediate business objectives. Differentiating these assets helps in resource allocation, ensuring strategic assets drive growth while tactical assets maintain day-to-day functionality.

Key Differences Between Strategic and Tactical Assets

Strategic assets refer to long-term resources critical for achieving an organization's overarching goals, often involving substantial investment and sustained value creation. Tactical assets are short-term or operational items used to execute specific, immediate tasks that support day-to-day business activities. Key differences include the time horizon, with strategic assets focused on future growth and competitive advantage, whereas tactical assets prioritize flexibility and responsiveness to current demands.

Roles of Strategic Assets in Long-Term Planning

Strategic assets play a crucial role in long-term planning by providing sustainable competitive advantages and supporting core business objectives over extended periods. These assets, such as intellectual property, brand reputation, and proprietary technology, enable firms to invest in innovation and market positioning that align with future growth trajectories. Unlike tactical assets used for short-term operational needs, strategic assets drive enduring value creation and resilience against market fluctuations.

Tactical Asset Allocation: Adapting to Market Conditions

Tactical Asset Allocation (TAA) involves adjusting investment portfolios to capitalize on short-term market opportunities and fluctuations, optimizing returns while managing risk. Unlike Strategic Asset Allocation, which sets long-term targets based on an investor's risk tolerance and goals, TAA requires active management and timely decision-making aligned with evolving market conditions. Effective TAA leverages market trends, economic indicators, and asset class momentum to enhance portfolio performance and achieve superior risk-adjusted returns.

Evaluating the Importance of Asset Time Horizons

Strategic assets are long-term resources that provide sustained competitive advantage and drive growth over extended periods, while tactical assets offer short-term benefits and support immediate operational needs. Evaluating the importance of asset time horizons involves assessing how the duration of asset utility aligns with business objectives and risk tolerance. Organizations prioritize strategic assets for enduring value creation, whereas tactical assets address agile responses to market fluctuations.

Risk Management: Strategic vs. Tactical Approaches

Strategic asset management emphasizes long-term risk mitigation through diversified investment portfolios and robust scenario analysis, ensuring stability and sustainable growth. Tactical asset management prioritizes short-term market opportunities with dynamic adjustments, focusing on agile risk responses to capitalize on immediate trends. Balancing both approaches optimizes overall risk management by integrating strategic foresight with tactical flexibility.

Examples of Strategic Assets Across Industries

Strategic assets vary significantly across industries, such as patented technologies in pharmaceuticals, key brand reputation in consumer goods, and proprietary software platforms in technology firms. Manufacturing companies consider specialized machinery and skilled labor as strategic assets essential for long-term competitiveness. In finance, strategic assets include extensive customer databases and established regulatory licenses that enable sustained market presence.

Tactical Asset Examples and Short-Term Opportunities

Tactical assets include commodities, high-yield bonds, and currencies, which investors use to capitalize on short-term market fluctuations and emerging trends. These assets offer flexibility and the potential for quick gains by exploiting temporary inefficiencies or specific event-driven opportunities. Effective tactical asset allocation enhances portfolio responsiveness, optimizing returns in volatile or uncertain market conditions.

Integrating Strategic and Tactical Assets in a Portfolio

Integrating strategic assets, which provide long-term growth and stability, with tactical assets designed for short-term opportunities enhances overall portfolio resilience and performance. Strategic assets such as blue-chip stocks and government bonds form the foundation, while tactical assets like sector-specific ETFs or commodities allow for agile responses to market fluctuations. Balancing these asset types through dynamic allocation leverages both steady appreciation and opportunistic gains, optimizing risk management and return potential.

Best Practices for Balancing Asset Strategies

Strategic assets, such as long-term investments and core infrastructure, require consistent maintenance and alignment with organizational goals to maximize value over time. Tactical assets, including short-term equipment and operational tools, demand agile management to respond promptly to market fluctuations and immediate business needs. Balancing asset strategies involves regular performance reviews, integrating predictive analytics for asset management, and aligning both asset types with financial planning to optimize ROI and operational efficiency.

Important Terms

Asset allocation

Strategic asset allocation involves setting long-term investment targets based on an investor's risk tolerance and financial goals, focusing on maintaining a diversified portfolio mix across asset classes like equities, bonds, and cash. Tactical asset allocation allows for short-term adjustments to the portfolio in response to market conditions, aiming to capitalize on opportunities or mitigate risks while staying within the broader strategic framework.

Portfolio diversification

Strategic asset allocation establishes a long-term portfolio diversification framework by targeting stable asset class proportions, while tactical asset allocation enables short-term adjustments to capitalize on market opportunities and manage risk.

Risk-adjusted return

Risk-adjusted returns measure the effectiveness of strategic asset allocation versus tactical asset allocation by evaluating performance relative to the level of risk taken in each investment approach.

Long-term investment horizon

A long-term investment horizon emphasizes strategic asset allocation, focusing on maintaining a stable mix of asset classes to achieve consistent growth over time while minimizing risks through diversification. Tactical asset allocation involves short-term adjustments to this strategic mix, exploiting market inefficiencies or trends without deviating significantly from the long-term investment objectives.

Short-term market timing

Short-term market timing focuses on tactical asset allocation by adjusting portfolio positions based on short-term market predictions, while strategic asset allocation establishes long-term target weights for asset classes to maintain consistent investment goals.

Liquidity constraints

Liquidity constraints restrict the ability to adjust strategic assets quickly, making tactical asset allocation essential for managing short-term market opportunities and cash flow needs.

Alpha generation

The Alpha generation process identifies strategic assets that deliver sustainable competitive advantage versus tactical assets primarily used for short-term gains.

Beta exposure

Beta exposure measures a strategic asset's long-term market sensitivity compared to a tactical asset's short-term market responsiveness.

Rebalancing strategy

Rebalancing strategy optimizes portfolio performance by periodically adjusting the allocation between strategic assets, which define long-term targets, and tactical assets, which exploit short-term market opportunities.

Opportunistic investment

Opportunistic investment focuses on high-return, high-risk assets seized through market inefficiencies or unique situations, often categorized as tactical assets due to their short-term, flexible nature. In contrast, strategic assets represent core, long-term holdings aimed at steady growth and stability within a diversified investment portfolio.

Strategic asset vs Tactical asset Infographic

moneydif.com

moneydif.com