Operating assets are essential resources used directly in the core business operations, such as machinery, inventory, and equipment that generate revenue. Non-operating assets include investments, cash reserves, and other assets not involved in daily operations but may contribute to financial stability or growth. Differentiating between operating and non-operating assets helps in assessing a company's operational efficiency and true profitability.

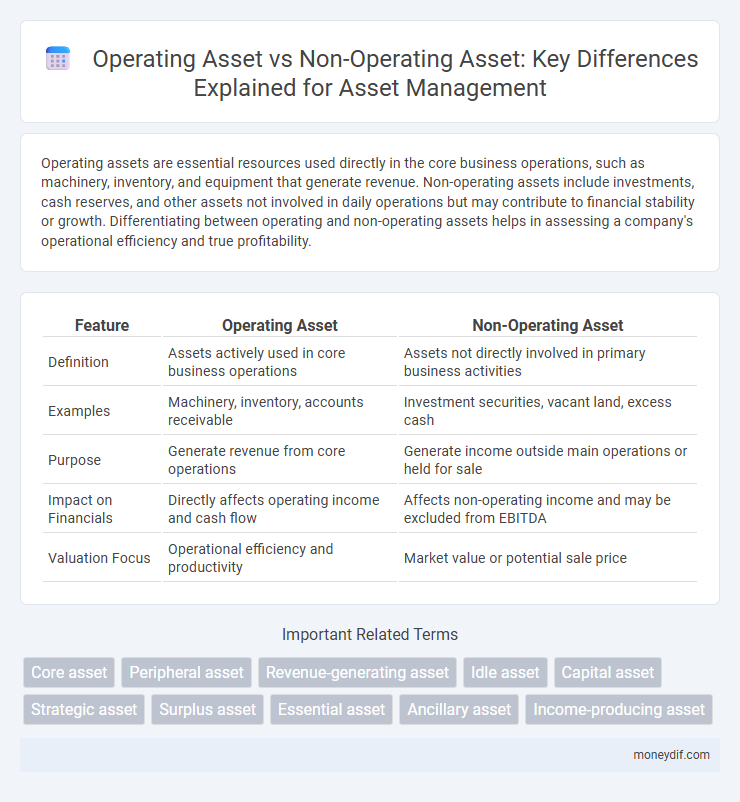

Table of Comparison

| Feature | Operating Asset | Non-Operating Asset |

|---|---|---|

| Definition | Assets actively used in core business operations | Assets not directly involved in primary business activities |

| Examples | Machinery, inventory, accounts receivable | Investment securities, vacant land, excess cash |

| Purpose | Generate revenue from core operations | Generate income outside main operations or held for sale |

| Impact on Financials | Directly affects operating income and cash flow | Affects non-operating income and may be excluded from EBITDA |

| Valuation Focus | Operational efficiency and productivity | Market value or potential sale price |

Introduction to Operating and Non-Operating Assets

Operating assets are essential resources actively used in a company's core business operations, such as machinery, inventory, and buildings that generate revenue. Non-operating assets include investments, excess cash, or idle properties that do not directly contribute to daily operational activities but may provide financial benefits. Distinguishing between these asset types is crucial for accurate financial analysis and valuation.

Defining Operating Assets

Operating assets are resources actively utilized in the core business operations to generate revenue, including machinery, inventory, and accounts receivable. These assets are directly involved in the production process or service delivery, distinguishing them from non-operating assets like investments or idle property. Efficient management of operating assets enhances operational efficiency and profitability.

Defining Non-Operating Assets

Non-operating assets are assets not essential to the core business operations and do not contribute directly to revenue generation, such as investments, surplus cash, or idle property. These assets are often held for strategic purposes, liquidity management, or future growth opportunities rather than daily operational activities. Identifying non-operating assets helps in accurately assessing a company's operating efficiency and asset utilization.

Key Differences Between Operating and Non-Operating Assets

Operating assets generate revenue through core business activities and include property, plant, equipment, and inventory essential for production. Non-operating assets do not contribute to primary business operations and typically consist of investments, idle properties, or excess cash. Distinguishing between operating and non-operating assets is crucial for accurate financial analysis and valuation, as operating assets reflect ongoing business performance while non-operating assets represent ancillary resources.

Examples of Operating Assets

Operating assets include machinery, inventory, buildings, and equipment directly involved in the core business activities generating revenue. These assets play a crucial role in production, sales, and service delivery processes, such as factory machines, retail stock, and delivery vehicles. Unlike non-operating assets like excess cash or investment properties, operating assets are essential for day-to-day operational efficiency and profitability.

Examples of Non-Operating Assets

Non-operating assets include investments in marketable securities, idle land held for future use, and excess cash not required for daily operations. Other examples are royalties from intangible properties and rental properties unrelated to the core business. These assets generate income but are not essential to a company's primary revenue-generating activities.

Importance of Operating Assets in Business Valuation

Operating assets, such as machinery, equipment, and inventory, are crucial for generating a company's core revenue and directly impact its cash flow and profitability. These assets are essential for business valuation because they reflect the company's ability to sustain everyday operations and produce income over time. Non-operating assets, like excess cash or investment securities, typically do not contribute to core business activities and have a lower influence on the valuation of ongoing operations.

Impact of Non-Operating Assets on Financial Statements

Non-operating assets, including investments, unused land, or marketable securities, are reported separately from operating assets on the balance sheet, affecting the total asset value without contributing to core business operations. Their impact on financial statements primarily influences the calculation of return on assets (ROA) and operating margins, often causing distortions if not analyzed distinctly. Proper segregation helps investors assess the company's operational efficiency and true asset utilization by isolating income sources unrelated to primary business activities.

How to Identify and Classify Assets

Operating assets are those directly involved in the core business activities, such as machinery, inventory, and accounts receivable, which generate revenue and support daily operations. Non-operating assets include investments, idle land, or surplus cash that are not essential for primary business functions but may provide financial returns or reserves. To classify assets accurately, evaluate their role in revenue generation, frequency of use in operations, and whether they contribute to the company's key products or services.

Operating vs Non-Operating Assets: Implications for Investors

Operating assets generate revenue through core business activities, such as machinery, inventory, and accounts receivable, directly impacting a company's profitability and operational efficiency. Non-operating assets include investments, excess cash, and real estate holdings not essential to daily operations, often influencing overall valuation but not core earnings. Investors analyze the balance between operating and non-operating assets to assess sustainable growth potential and underlying financial health.

Important Terms

Core asset

Core assets represent essential operating assets directly involved in a company's primary revenue-generating activities, such as machinery, equipment, and property used in production. Non-operating assets include investments, excess cash, or properties not used in daily operations, highlighting their distinction from operating assets critical for core business functions.

Peripheral asset

Peripheral assets, which support but do not directly contribute to core business operations, differ from operating assets used in primary activities and non-operating assets held for investment or idle purposes.

Revenue-generating asset

Revenue-generating assets primarily consist of operating assets such as machinery, inventory, and receivables, while non-operating assets like excess cash or investments do not directly contribute to core business revenue.

Idle asset

Idle assets are non-operating assets that are not currently utilized in production, unlike operating assets which are actively used in day-to-day business operations.

Capital asset

Capital assets include operating assets crucial for daily business functions and non-operating assets held for investment or non-core activities.

Strategic asset

Strategic assets are long-term operating assets essential for a company's core business operations, distinct from non-operating assets which are not directly involved in daily operational activities.

Surplus asset

Surplus assets, distinguished from operating assets that are essential for core business operations, often include non-operating assets such as excess property or investments not directly involved in daily activities.

Essential asset

Essential assets, predominantly classified as operating assets, are critical to a company's core business functions and directly contribute to revenue generation, such as machinery, inventory, and accounts receivable. Non-operating assets, including investments, excess cash, or idle property, do not play a direct role in daily operations but may provide financial flexibility or generate ancillary income.

Ancillary asset

Ancillary assets support the primary functions of operating assets, enhancing operational efficiency without directly generating revenue, while non-operating assets are not essential to core business activities and typically include investments or idle properties. Operating assets are integral to daily business operations, whereas ancillary assets provide supplementary utility, and non-operating assets offer alternative income or strategic value outside primary operations.

Income-producing asset

Income-producing assets generate consistent revenue streams and are integral to a company's core business activities, often classified as operating assets such as machinery, inventory, and accounts receivable. Non-operating assets, including excess cash, investments, and unused property, do not directly contribute to primary operations but can provide additional income or capital gains.

Operating asset vs Non-operating asset Infographic

moneydif.com

moneydif.com