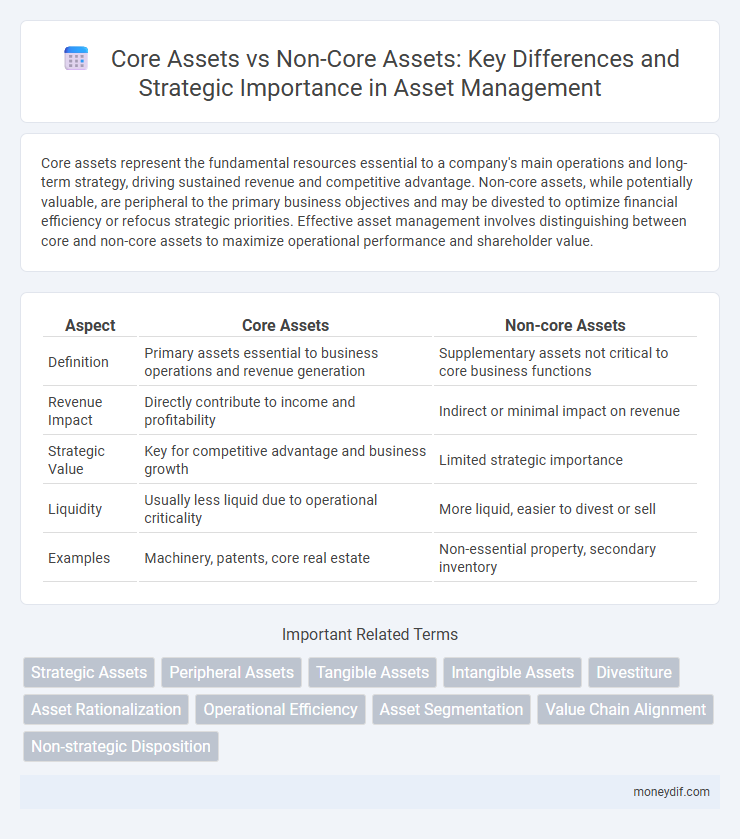

Core assets represent the fundamental resources essential to a company's main operations and long-term strategy, driving sustained revenue and competitive advantage. Non-core assets, while potentially valuable, are peripheral to the primary business objectives and may be divested to optimize financial efficiency or refocus strategic priorities. Effective asset management involves distinguishing between core and non-core assets to maximize operational performance and shareholder value.

Table of Comparison

| Aspect | Core Assets | Non-core Assets |

|---|---|---|

| Definition | Primary assets essential to business operations and revenue generation | Supplementary assets not critical to core business functions |

| Revenue Impact | Directly contribute to income and profitability | Indirect or minimal impact on revenue |

| Strategic Value | Key for competitive advantage and business growth | Limited strategic importance |

| Liquidity | Usually less liquid due to operational criticality | More liquid, easier to divest or sell |

| Examples | Machinery, patents, core real estate | Non-essential property, secondary inventory |

Defining Core Assets: Key Characteristics

Core assets are essential to a company's primary operations, driving long-term value and competitive advantage through their strategic importance and consistent revenue generation. These assets typically include intellectual property, critical infrastructure, and key business units that are integral to the company's mission and growth. Identifying core assets involves assessing their impact on operational efficiency, market position, and ability to sustain future profitability.

What Are Non-core Assets? An Overview

Non-core assets refer to properties or investments that are not essential to a company's primary business operations, often including surplus real estate, minority equity stakes, or underutilized equipment. These assets can be divested or restructured to improve liquidity, streamline operations, and focus resources on core competencies. Identifying and managing non-core assets helps organizations optimize their portfolio and enhance overall financial performance.

Strategic Importance of Core Assets in Business

Core assets represent the most strategically important resources that drive a business's competitive advantage, such as proprietary technology, key intellectual property, and critical infrastructure. These assets are essential for sustaining long-term growth, enhancing market position, and generating consistent revenue streams. In contrast, non-core assets are peripheral and can be divested or outsourced without significantly impacting the company's strategic objectives.

Examples of Core and Non-core Assets

Core assets include properties, machinery, intellectual property, and key software critical to a company's main operations and revenue generation. Non-core assets consist of surplus real estate, secondary equipment, or minority investments that do not contribute directly to business performance. Identifying these assets helps businesses streamline resources by focusing on core assets while liquidating non-core assets to improve financial efficiency.

Criteria for Classifying Assets as Core or Non-core

Core assets are identified based on their strategic importance, consistent revenue generation, and long-term value contribution to the business. Non-core assets lack these critical attributes, often being peripheral or underperforming resources that do not align with the company's primary objectives. Key classification criteria include asset profitability, role in core operations, market demand, and potential for divestiture or reallocation.

Role of Core Assets in Value Creation

Core assets serve as the primary drivers of a company's competitive advantage and sustained profitability, encompassing essential resources like key technologies, intellectual property, and critical infrastructure. These assets enable efficient operations and innovation, directly contributing to long-term value creation and market differentiation. Non-core assets, by contrast, often represent peripheral investments that may be divested to optimize focus on core competencies and capital allocation.

Managing Non-core Assets for Optimal Performance

Managing non-core assets involves maximizing value extraction while minimizing operational distractions from the core business. Effective strategies include regular portfolio reviews, strategic divestments, and targeted asset enhancement to improve liquidity and focus. Optimizing non-core assets enhances overall financial performance and supports sustainable growth.

Core Assets Divestiture: Risks and Rewards

Core assets divestiture involves selling or offloading primary revenue-generating properties critical to a company's operations, offering significant capital infusion and operational focus enhancement. However, this strategy carries risks such as potential loss of competitive advantage, disruption in core business processes, and undervaluation in volatile markets. Careful evaluation of asset valuation, market conditions, and long-term strategic goals is essential to balance the immediate financial gains with sustained business growth.

Impact of Asset Classification on Financial Reporting

Classifying assets as core or non-core significantly affects financial reporting by influencing asset valuation and impairment testing procedures. Core assets, central to business operations, are valued based on long-term productive use, enhancing balance sheet stability and investor confidence. Non-core assets, often subject to reclassification or disposal, require frequent revaluation and can introduce volatility in reported earnings and cash flow statements.

Core vs Non-core Assets: Implications for Business Strategy

Core assets are critical to a company's primary business operations and directly contribute to competitive advantage and revenue generation. Non-core assets, while valuable, are peripheral and often considered for divestiture or outsourcing to optimize resource allocation and focus on strategic priorities. Prioritizing core assets enhances business agility, operational efficiency, and long-term value creation by aligning resources with the company's strategic objectives.

Important Terms

Strategic Assets

Strategic assets are critical resources that provide a competitive advantage and align closely with a company's core assets, which are essential for its primary business operations and long-term growth. In contrast, non-core assets are peripheral resources that do not directly influence the company's strategic objectives and may be divested to improve focus and capital allocation.

Peripheral Assets

Peripheral assets support core assets by enhancing their value and operational efficiency, whereas non-core assets are unrelated or tangential to the primary business focus and may be divested to optimize resource allocation.

Tangible Assets

Tangible assets, such as property, plant, and equipment, are classified into core assets that are essential for primary business operations and non-core assets that may be surplus or held for investment purposes. Core tangible assets directly support revenue generation and competitive advantage, while non-core assets can be leveraged for liquidity or divestiture strategies.

Intangible Assets

Intangible assets classified as core assets directly contribute to a company's primary revenue streams, while non-core intangible assets support secondary functions or potential future growth opportunities.

Divestiture

Divestiture strategically eliminates non-core assets to streamline operations and enhance focus on core assets, maximizing organizational value and efficiency.

Asset Rationalization

Asset rationalization strategically evaluates and categorizes core assets, which are essential for competitive advantage, versus non-core assets that can be divested to optimize operational efficiency and maximize return on investment.

Operational Efficiency

Maximizing operational efficiency involves prioritizing core assets that drive value creation while strategically managing or divesting non-core assets to reduce costs and improve resource allocation.

Asset Segmentation

Asset segmentation divides a company's holdings into core assets, which are essential for operational success and revenue generation, and non-core assets, which are peripheral and can be divested to improve financial flexibility. Effective segmentation enables strategic focus on high-value core assets while optimizing capital allocation through the management or disposal of non-core assets.

Value Chain Alignment

Value chain alignment enhances competitive advantage by prioritizing investment in core assets that drive value creation while optimizing or outsourcing non-core assets to improve operational efficiency.

Non-strategic Disposition

Non-strategic disposition involves divesting non-core assets to enhance focus and investment in core assets that drive long-term competitive advantage.

Core Assets vs Non-core Assets Infographic

moneydif.com

moneydif.com