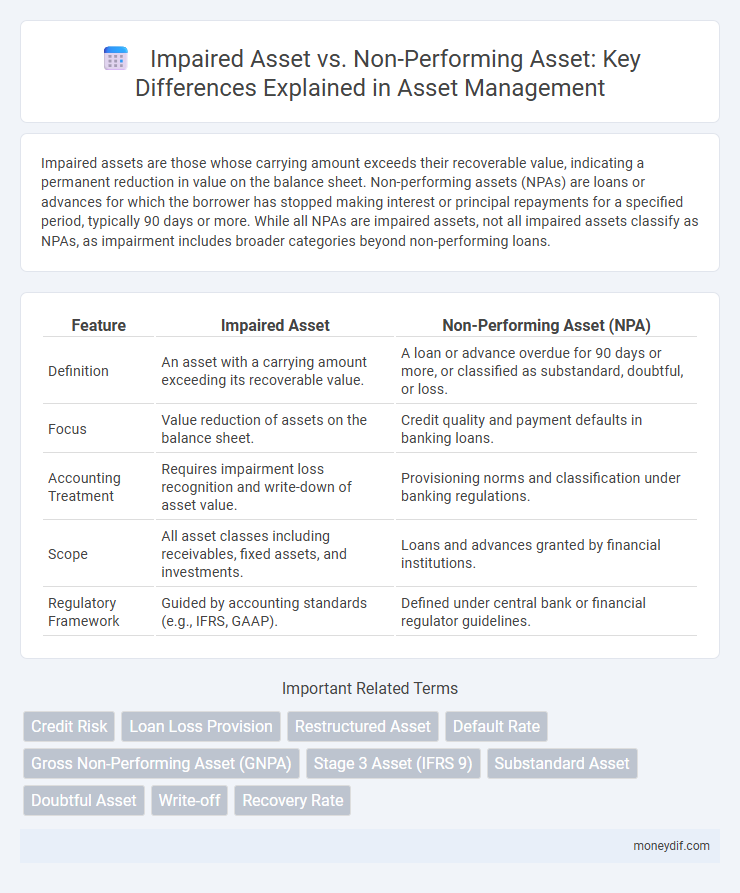

Impaired assets are those whose carrying amount exceeds their recoverable value, indicating a permanent reduction in value on the balance sheet. Non-performing assets (NPAs) are loans or advances for which the borrower has stopped making interest or principal repayments for a specified period, typically 90 days or more. While all NPAs are impaired assets, not all impaired assets classify as NPAs, as impairment includes broader categories beyond non-performing loans.

Table of Comparison

| Feature | Impaired Asset | Non-Performing Asset (NPA) |

|---|---|---|

| Definition | An asset with a carrying amount exceeding its recoverable value. | A loan or advance overdue for 90 days or more, or classified as substandard, doubtful, or loss. |

| Focus | Value reduction of assets on the balance sheet. | Credit quality and payment defaults in banking loans. |

| Accounting Treatment | Requires impairment loss recognition and write-down of asset value. | Provisioning norms and classification under banking regulations. |

| Scope | All asset classes including receivables, fixed assets, and investments. | Loans and advances granted by financial institutions. |

| Regulatory Framework | Guided by accounting standards (e.g., IFRS, GAAP). | Defined under central bank or financial regulator guidelines. |

Introduction to Impaired Assets and Non-Performing Assets

Impaired assets refer to assets carrying a value on the balance sheet exceeding their recoverable amount, indicating a decline in expected future cash flows. Non-performing assets (NPAs) are loans or advances in which the borrower has defaulted or failed to meet repayment obligations for a specified period, typically 90 days or more. Differentiating impaired assets from NPAs is essential for accurate financial reporting and risk assessment in banking and investment management.

Key Definitions: Impaired Asset vs Non-Performing Asset

Impaired assets are financial assets whose market value has declined below their carrying value on the balance sheet, indicating a permanent loss in value. Non-performing assets (NPAs) refer to loans or advances where the borrower has failed to make interest or principal payments for a specified period, typically 90 days or more. While impaired assets reflect asset value deterioration, NPAs specifically denote the borrowing default status impacting asset quality in banking and finance.

Regulatory Framework Governing Asset Classification

Regulatory frameworks governing asset classification distinguish impaired assets as those with reduced recoverable value due to credit deterioration, whereas non-performing assets (NPAs) primarily indicate overdue loan payments beyond a specified period, typically 90 days. Banking regulators such as the Basel Committee on Banking Supervision and national authorities mandate periodic asset quality reviews, requiring financial institutions to identify, classify, and provision for impaired and non-performing assets under strict guidelines. Compliance with these regulations ensures accurate risk assessment, capital adequacy maintenance, and transparency in financial reporting.

Causes of Asset Impairment and Non-Performance

Asset impairment typically arises from factors such as physical damage, obsolescence, changes in market demand, or adverse economic conditions that reduce the recoverable value of an asset below its carrying amount. Non-performing assets (NPAs) primarily result from the borrower's inability to meet scheduled payments due to financial distress, poor cash flow management, or external economic shocks. Both impaired assets and NPAs reflect deteriorated asset quality but differ in underlying causes: impairment stems from diminished asset utility or market value, while non-performance is driven by credit risk and repayment failures.

Accounting Treatment: Impaired Asset vs Non-Performing Asset

Impaired assets require immediate recognition of loss by adjusting the asset's carrying amount to its recoverable value, following International Accounting Standard (IAS) 36. Non-performing assets (NPAs), primarily used in banking, represent loans overdue beyond a certain period and require provisioning as per regulatory guidelines without necessarily writing down the asset's book value immediately. The key accounting difference lies in impairment involving a fair value adjustment, whereas NPAs focus on provisioning and monitoring credit risk without immediate impairment write-offs.

Impact on Financial Statements and Reporting

Impaired assets require recognition of loss allowances on the balance sheet, reducing asset value and impacting net income through impairment expenses, which directly affects shareholders' equity. Non-performing assets (NPAs) specifically influence financial statements by increasing provisions for loan losses, thereby decreasing the bank's profitability and capital adequacy ratios. Accurate reporting of impaired assets and NPAs enhances transparency, aids regulatory compliance, and provides stakeholders with a realistic assessment of financial health and risk exposure.

Risk Assessment and Management Strategies

Impaired assets are those whose carrying value exceeds recoverable amount due to losses identified through risk assessment, signaling a decline in asset quality that requires immediate recognition and provisioning. Non-performing assets (NPAs) are loans or advances where principal or interest payments are overdue for 90 days or more, highlighting credit risk and necessitating stringent monitoring and recovery strategies. Risk management for impaired assets involves timely identification, valuation adjustments, and restructuring, while NPAs demand proactive credit appraisal, enhanced collateral security, and robust recovery mechanisms to mitigate financial losses.

Real-World Examples: Identifying Impaired and Non-Performing Assets

Impaired assets are those whose carrying value exceeds their recoverable amount, such as a factory damaged by fire reducing its book value, while non-performing assets (NPAs) primarily relate to loans or advances on which the borrower has stopped repayments for 90 days or more, exemplified by defaulted bank loans in India's financial sector. For instance, after the 2008 financial crisis, many US banks reported impaired assets in the form of devalued mortgage-backed securities, whereas NPAs increased significantly in emerging markets like India due to prolonged borrower defaults. Identifying impaired assets involves asset-specific valuation assessments, whereas NPAs are identified through monitoring payment schedules and analyzing loan recovery status within banking operations.

Recovery and Resolution Mechanisms

Impaired assets represent financial instruments whose carrying amount exceeds their recoverable value, requiring write-downs and proactive recovery efforts through restructuring or collateral enforcement. Non-performing assets (NPAs) are overdue loans exceeding 90 days, often triggering resolution mechanisms like loan modification, asset reconstruction companies (ARCs), or insolvency proceedings under frameworks such as the Insolvency and Bankruptcy Code (IBC). Effective recovery strategies for both impaired assets and NPAs depend on timely identification, legal enforcement, and structured workout plans to maximize asset value and minimize losses.

Conclusion: Best Practices in Asset Monitoring and Classification

Effective asset monitoring and classification require distinguishing between impaired assets, which show a decline in value requiring write-downs, and non-performing assets (NPAs), which fail to generate expected returns or meet repayment schedules. Implementing robust risk assessment frameworks and continuous financial analysis enhances early identification, enabling timely corrective actions and minimizing potential losses. Consistent application of regulatory guidelines and transparent reporting fortifies asset quality management and supports optimal decision-making in financial institutions.

Important Terms

Credit Risk

Impaired assets are financial assets with diminished recoverable amounts due to identified credit losses, while non-performing assets are loans overdue for a specified period, often 90 days, indicating potential credit risk and default.

Loan Loss Provision

Loan loss provision reflects estimated credit losses on impaired assets, which are a subset of non-performing assets indicating significant deterioration in collateral value or borrower repayment ability.

Restructured Asset

Restructured assets involve modified loan terms to improve repayment capacity, differing from impaired assets which have identified losses, and non-performing assets that are overdue beyond 90 days or exhibit significant credit risk.

Default Rate

Default rate measures the proportion of impaired assets, reflecting loans or credits with significant payment delays, compared to non-performing assets, which encompass a broader category of loans failing to generate expected payments. Understanding the distinction between impaired assets and non-performing assets is crucial for accurately assessing default rates and credit risk in financial portfolios.

Gross Non-Performing Asset (GNPA)

Gross Non-Performing Asset (GNPA) represents the total value of loans and advances classified as non-performing, where repayments are overdue for more than 90 days, indicating potential credit risk to financial institutions. Impaired Assets include GNPA plus loans with significant uncertainty about recovery, reflecting the actual loss in asset quality, with GNPA serving as a key subset to monitor credit health.

Stage 3 Asset (IFRS 9)

Stage 3 asset under IFRS 9 represents financial instruments that have experienced a significant increase in credit risk with objective evidence of impairment, requiring lifetime expected credit losses to be recognized. Impaired assets are specifically those Stage 3 assets with recognized credit losses, while non-performing assets (NPAs) typically denote loans overdue beyond a defined period, often overlapping with Stage 3 but differing based on regulatory criteria and classification standards.

Substandard Asset

Substandard assets are loans or advances that exhibit well-defined credit weaknesses, causing doubts about the borrower's capacity to repay fully, placing them between standard and impaired assets in credit risk classification. Unlike non-performing assets (NPAs), which include substandard, doubtful, and loss assets, impaired assets specifically refer to financial assets with losses recognized due to deterioration in credit quality, often triggering provisioning requirements under accounting norms.

Doubtful Asset

A Doubtful Asset represents a loan or advance where there is a high risk of default, though recovery remains possible, and it is classified between Impaired Assets--where the asset's book value exceeds recoverable amount--and Non-Performing Assets (NPAs), which encompass loans overdue for 90 days or more. Impaired Assets specifically reflect measurable loss due to decreased cash flows, while NPAs indicate loans that have stopped generating income, with Doubtful Assets constituting a critical subcategory impacting provisioning and risk assessment in financial reporting.

Write-off

A write-off occurs when impaired assets, identified by a significant decline in recoverable value, are officially removed from the balance sheet to reflect their loss, whereas non-performing assets (NPAs) represent loans or advances in default or arrears, requiring provisioning before potential write-off. Impaired assets affect financial statements through asset value adjustment, while NPAs influence credit risk management and provisioning policies within banking institutions.

Recovery Rate

Recovery rate measures the proportion of funds recovered from impaired assets, which are loans or credits showing evidence of deterioration, compared to non-performing assets (NPAs) that have ceased generating income due to default. A higher recovery rate from impaired assets directly reduces the severity of NPAs on a financial institution's balance sheet, improving asset quality and liquidity.

Impaired Asset vs Non-Performing Asset Infographic

moneydif.com

moneydif.com