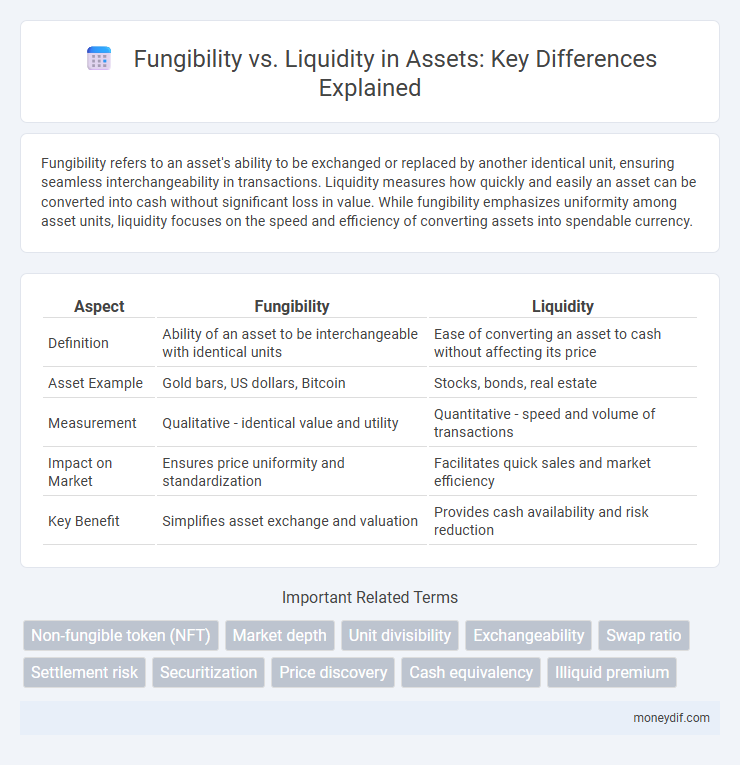

Fungibility refers to an asset's ability to be exchanged or replaced by another identical unit, ensuring seamless interchangeability in transactions. Liquidity measures how quickly and easily an asset can be converted into cash without significant loss in value. While fungibility emphasizes uniformity among asset units, liquidity focuses on the speed and efficiency of converting assets into spendable currency.

Table of Comparison

| Aspect | Fungibility | Liquidity |

|---|---|---|

| Definition | Ability of an asset to be interchangeable with identical units | Ease of converting an asset to cash without affecting its price |

| Asset Example | Gold bars, US dollars, Bitcoin | Stocks, bonds, real estate |

| Measurement | Qualitative - identical value and utility | Quantitative - speed and volume of transactions |

| Impact on Market | Ensures price uniformity and standardization | Facilitates quick sales and market efficiency |

| Key Benefit | Simplifies asset exchange and valuation | Provides cash availability and risk reduction |

Understanding Asset Fungibility

Asset fungibility refers to the ability of an asset to be exchanged or substituted with another identical item of the same kind without loss of value or function. Liquid assets are easier to convert into cash quickly, but fungibility emphasizes uniformity and interchangeability among assets, such as identical shares of stock or currency notes. Understanding asset fungibility helps investors assess the ease of trading and substituting assets within markets, impacting portfolio flexibility and risk management.

What is Liquidity in Financial Terms?

Liquidity in financial terms refers to the ease with which an asset can be quickly converted into cash without significantly affecting its market price. Highly liquid assets, such as stocks and government bonds, can be sold rapidly due to their broad market demand, whereas less liquid assets like real estate or collectibles may require more time and price concessions to sell. Liquidity is critical for investors and businesses to meet short-term obligations and manage financial risk effectively.

Key Differences Between Fungibility and Liquidity

Fungibility refers to an asset's ability to be interchangeable with other identical units, such as physical cash or cryptocurrencies like Bitcoin. Liquidity measures how quickly and easily an asset can be converted into cash without significant price impact, with stocks and government bonds often considered highly liquid. Key differences include fungibility focusing on the uniformity of units, while liquidity emphasizes market ease of transaction and asset convertibility.

Real-World Examples of Fungible Assets

Fungible assets such as gold, crude oil, and Bitcoin possess interchangeable units that maintain consistent value across transactions, enabling seamless trading in global markets. Unlike non-fungible assets like real estate or unique collectibles, these fungible commodities facilitate higher liquidity by allowing quick conversion into cash without significant price fluctuation. The standardized nature of fungible assets enhances their role in hedging, portfolio diversification, and efficient market functioning.

Real-World Examples of Liquid Assets

Cash is the most liquid asset, enabling instant transactions without losing value. Stocks of large publicly-traded companies like Apple or Microsoft offer high liquidity due to active markets and ease of conversion into cash. Government bonds also provide liquidity, as they can quickly be sold in secondary markets with minimal price impact.

The Interplay Between Fungibility and Liquidity

Fungibility directly impacts an asset's liquidity by determining how easily units can be exchanged without loss of value or utility, with highly fungible assets like cash facilitating swift, seamless trades. Liquidity depends on market depth and transaction volume, but fungible assets inherently enhance liquid markets by allowing uniform units to be interchanged without differentiation. Understanding the interplay between fungibility and liquidity is crucial for evaluating asset performance in trading, investment strategies, and portfolio diversification.

Why Fungibility Matters for Investors

Fungibility is crucial for investors because it ensures that individual units of an asset are interchangeable and hold equal value, facilitating seamless trading and portfolio management. Unlike liquidity, which measures how quickly an asset can be bought or sold without affecting its price, fungibility guarantees consistency in asset valuation and reduces transaction complexity. This uniformity enhances market efficiency and investor confidence, especially in assets like stocks, cryptocurrencies, and commodities.

Why Liquidity is Crucial in Asset Management

Liquidity is crucial in asset management because it allows investors to quickly convert assets into cash without significant loss of value, ensuring financial flexibility. Unlike fungibility, which refers to assets being interchangeable, liquidity emphasizes the ease and speed of asset conversion in the market. High liquidity reduces risk and enhances portfolio responsiveness to market changes and investment opportunities.

Risks Associated with Non-Fungible or Illiquid Assets

Non-fungible or illiquid assets carry significant risks, including difficulties in timely selling and accurately valuing the asset. These assets may face marketability challenges, leading to potential financial losses during urgent liquidation needs. Limited buyer pools and price volatility further exacerbate the risk of holding non-fungible or illiquid assets in investment portfolios.

Fungibility vs. Liquidity: Implications for Portfolio Diversification

Fungibility refers to an asset's ability to be easily exchanged or substituted with identical units, while liquidity measures how quickly an asset can be converted to cash without significant price impact. High fungibility, as seen in assets like stocks or commodities, enhances trading efficiency and enables seamless portfolio rebalancing. In contrast, liquidity influences the timing and cost of asset liquidation, affecting portfolio diversification strategies by determining the ease of entry and exit in various markets.

Important Terms

Non-fungible token (NFT)

Non-fungible tokens (NFTs) are unique digital assets that lack fungibility, resulting in lower liquidity compared to interchangeable cryptocurrencies like Bitcoin.

Market depth

Market depth measures liquidity by showing available buy and sell orders at various prices, highlighting how fungibility influences the ease of asset exchange without impacting price.

Unit divisibility

Unit divisibility enhances liquidity by allowing assets to be broken down into smaller, tradable portions, facilitating smoother transactions and market access. Fungibility ensures each unit is interchangeable and identical in value, which is critical for maintaining consistent liquidity across divided units.

Exchangeability

Exchangeability measures an asset's ability to be swapped for another of the same kind, directly impacting its fungibility, while liquidity reflects how quickly it can be converted to cash without affecting its price.

Swap ratio

Swap ratio determines the proportional exchange value between assets, directly impacting fungibility by enabling equal value exchanges, while influencing liquidity through ease of asset conversion in trading markets.

Settlement risk

Settlement risk increases when fungibility is low, as limited asset interchangeability reduces liquidity and complicates transaction completion.

Securitization

Securitization enhances liquidity by converting illiquid assets into tradable securities, enabling easier buying and selling in financial markets. However, the fungibility of these securities may vary depending on their underlying asset pools and structural complexities, affecting standardization and interchangeability.

Price discovery

Price discovery efficiency improves as fungibility increases, directly enhancing market liquidity by enabling seamless asset interchangeability and faster transaction execution.

Cash equivalency

Cash equivalency reflects assets that are easily convertible to cash with minimal price risk, highlighting strong liquidity essential for immediate financial obligations. Fungibility ensures these assets can be exchanged interchangeably without loss of value, reinforcing their reliability in cash equivalency assessments.

Illiquid premium

Illiquid premium represents the higher expected returns investors demand for holding assets that lack fungibility, making them harder to trade quickly without significant price concessions. Assets with low liquidity often exhibit illiquid premiums due to their limited marketability and difficulty in achieving equivalent substitutions in transactions.

fungibility vs liquidity Infographic

moneydif.com

moneydif.com