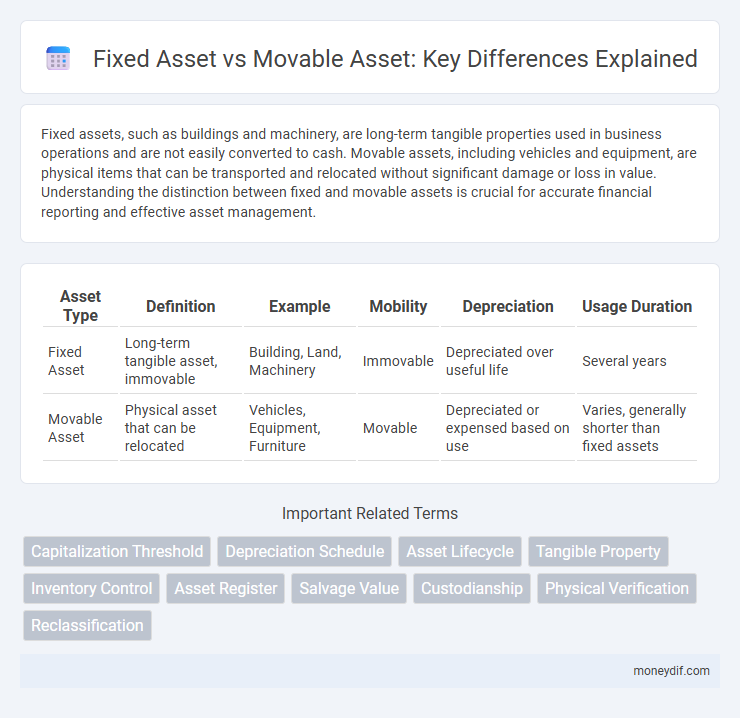

Fixed assets, such as buildings and machinery, are long-term tangible properties used in business operations and are not easily converted to cash. Movable assets, including vehicles and equipment, are physical items that can be transported and relocated without significant damage or loss in value. Understanding the distinction between fixed and movable assets is crucial for accurate financial reporting and effective asset management.

Table of Comparison

| Asset Type | Definition | Example | Mobility | Depreciation | Usage Duration |

|---|---|---|---|---|---|

| Fixed Asset | Long-term tangible asset, immovable | Building, Land, Machinery | Immovable | Depreciated over useful life | Several years |

| Movable Asset | Physical asset that can be relocated | Vehicles, Equipment, Furniture | Movable | Depreciated or expensed based on use | Varies, generally shorter than fixed assets |

Introduction to Fixed and Movable Assets

Fixed assets refer to long-term tangible property such as land, buildings, and machinery that a company uses in its operations and are not intended for sale. Movable assets, also known as personal property, include items like vehicles, equipment, and inventory that can be easily relocated or sold. Understanding the distinction between fixed and movable assets is crucial for accurate financial reporting and asset management.

Defining Fixed Assets

Fixed assets are long-term tangible assets used in a business's operations, such as buildings, machinery, and land, that are not intended for immediate sale. These assets provide lasting value and are subject to depreciation over their useful life. Unlike movable assets, fixed assets are typically stationary and integral to the company's infrastructure and production processes.

Defining Movable Assets

Movable assets refer to physical items that can be easily relocated without altering their structure or use, such as vehicles, machinery, and office equipment. These assets differ from fixed assets, which are permanently attached to property or land, like buildings or infrastructure. Understanding movable assets is crucial for accurate inventory management, depreciation calculation, and asset tracking in accounting and business operations.

Key Differences Between Fixed and Movable Assets

Fixed assets are long-term tangible properties such as buildings, machinery, and land used in business operations, characterized by their immobility and depreciation over time. Movable assets include items like vehicles, equipment, and furniture, which can be relocated without altering the business location. The key difference lies in their physical mobility and accounting treatment, as fixed assets are capitalized and depreciated whereas movable assets may have variable depreciation and higher liquidity.

Classification Criteria for Assets

Fixed assets are long-term tangible assets that remain stationary and are used in the production of goods or services, such as land, buildings, and machinery. Movable assets, also known as tangible personal property, include items like vehicles, equipment, and furniture that can be relocated without altering their function. Classification criteria for assets primarily depend on their physical mobility, useful life, and role in business operations, influencing accounting treatment and depreciation methods.

Examples of Fixed and Movable Assets

Fixed assets include buildings, machinery, and land, which are essential for long-term business operations and typically cannot be moved without significant effort. Movable assets consist of equipment, vehicles, and office furniture, which can be relocated easily and are often critical for daily business activities. Understanding the distinction between fixed and movable assets aids in accurate financial reporting and asset management.

Valuation Methods for Each Asset Type

Fixed assets such as buildings and machinery are typically valued using methods like historical cost, depreciation, and revaluation models, reflecting their long-term use and gradual wear. Movable assets, including equipment and vehicles, are often appraised through market value or fair value techniques, emphasizing their liquidity and frequent turnover. Valuation accuracy for both asset types is critical for financial reporting, impacting balance sheets and depreciation schedules.

Depreciation and Amortization Considerations

Fixed assets, such as buildings and machinery, undergo depreciation to allocate their cost over useful life, reflecting wear and tear or obsolescence. Movable assets, including vehicles and equipment, also depreciate but often have shorter useful lives and different depreciation rates, impacting tax and financial reporting. Amortization primarily applies to intangible fixed assets like patents, which differ from tangible movable assets in accounting treatment and expense recognition.

Importance in Financial Reporting

Fixed assets, such as buildings and machinery, are critical in financial reporting due to their long-term value and depreciation impact on a company's balance sheet. Movable assets, including equipment and vehicles, play a significant role in reflecting a company's operational capacity and liquidity position. Accurate classification between fixed and movable assets ensures precise asset valuation and compliance with accounting standards.

Impact on Asset Management Strategies

Fixed assets, such as buildings and machinery, require long-term asset management strategies focused on depreciation schedules, maintenance planning, and capital budgeting, ensuring value retention and operational efficiency. Movable assets, including vehicles and equipment, demand dynamic management approaches emphasizing tracking, utilization rates, and lifecycle optimization to enhance flexibility and reduce downtime. Differentiating asset types shapes inventory control, risk assessment, and resource allocation, directly influencing organizational financial planning and operational effectiveness.

Important Terms

Capitalization Threshold

The capitalization threshold defines the minimum cost at which a fixed asset, whether movable or immovable, must be recorded on the balance sheet rather than expensed immediately.

Depreciation Schedule

A Depreciation Schedule systematically allocates the cost of fixed assets, such as buildings and heavy machinery, over their useful life to reflect wear and tear, whereas movable assets like vehicles and equipment often have shorter depreciation periods due to higher usage intensity. Accurate classification between fixed and movable assets ensures proper depreciation methods, tax compliance, and precise financial reporting.

Asset Lifecycle

Asset lifecycle management distinguishes fixed assets, which are long-term and immovable like buildings, from movable assets such as vehicles and equipment, optimizing depreciation schedules and maintenance planning accordingly.

Tangible Property

Tangible property classified as fixed assets includes long-term physical items like buildings and machinery, while movable assets encompass physical items such as vehicles and equipment that can be relocated.

Inventory Control

Effective inventory control distinguishes between fixed assets, which are long-term and immovable, and movable assets, which are easily transferable, to optimize asset management and operational efficiency.

Asset Register

An asset register systematically records fixed assets like buildings and machinery separately from movable assets such as vehicles and equipment to ensure accurate tracking, valuation, and depreciation management.

Salvage Value

Salvage value is the estimated residual worth of a fixed asset at the end of its useful life, factoring into depreciation calculations, while movable assets often have varying salvage values depending on condition and market demand. Accurate salvage value assessment helps in optimizing asset management strategies and financial reporting for both fixed and movable assets.

Custodianship

Custodianship involves managing and safeguarding fixed assets like buildings and machinery separately from movable assets such as vehicles and equipment to ensure accurate tracking, maintenance, and accountability.

Physical Verification

Physical verification ensures accurate accounting by distinguishing fixed assets, which are long-term tangible property like buildings and machinery, from movable assets that include equipment and inventory subject to frequent relocation.

Reclassification

Reclassification between fixed assets and movable assets involves adjusting the asset category in accounting records to accurately reflect the asset's usage and characteristics, ensuring compliance with financial reporting standards. This process affects depreciation methods, asset valuation, and tax implications, as fixed assets are typically long-term and immovable, whereas movable assets are portable and may have different accounting treatments.

Fixed Asset vs Movable Asset Infographic

moneydif.com

moneydif.com