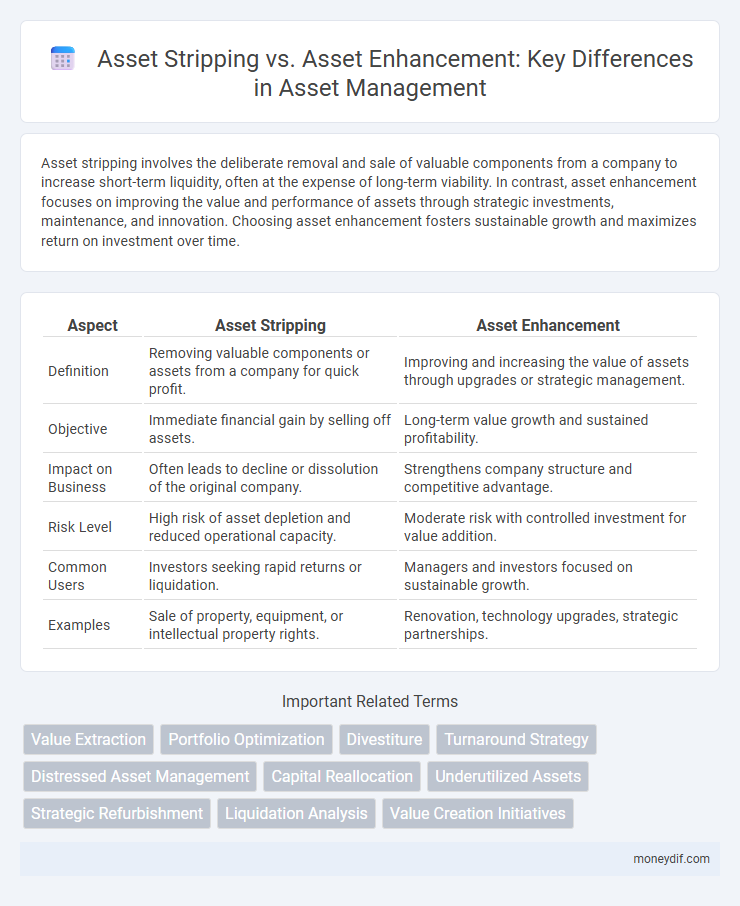

Asset stripping involves the deliberate removal and sale of valuable components from a company to increase short-term liquidity, often at the expense of long-term viability. In contrast, asset enhancement focuses on improving the value and performance of assets through strategic investments, maintenance, and innovation. Choosing asset enhancement fosters sustainable growth and maximizes return on investment over time.

Table of Comparison

| Aspect | Asset Stripping | Asset Enhancement |

|---|---|---|

| Definition | Removing valuable components or assets from a company for quick profit. | Improving and increasing the value of assets through upgrades or strategic management. |

| Objective | Immediate financial gain by selling off assets. | Long-term value growth and sustained profitability. |

| Impact on Business | Often leads to decline or dissolution of the original company. | Strengthens company structure and competitive advantage. |

| Risk Level | High risk of asset depletion and reduced operational capacity. | Moderate risk with controlled investment for value addition. |

| Common Users | Investors seeking rapid returns or liquidation. | Managers and investors focused on sustainable growth. |

| Examples | Sale of property, equipment, or intellectual property rights. | Renovation, technology upgrades, strategic partnerships. |

Understanding Asset Stripping: Definition and Key Concepts

Asset stripping refers to the practice of acquiring a company or its assets with the intent to sell off those assets individually for profit, often disregarding the long-term value of the business. Key concepts include identifying undervalued assets, liquidating non-core divisions, and maximizing immediate returns at the expense of operational continuity. This contrasts with asset enhancement, which focuses on improving asset value through strategic investments and sustainable growth initiatives.

What is Asset Enhancement? Scope and Strategies

Asset enhancement involves improving an asset's value through strategic upgrades, better management, or repositioning to maximize long-term returns. Key strategies include capital improvements, operational efficiency, tenant mix optimization, and market repositioning to increase revenue and asset desirability. The scope of asset enhancement spans real estate, financial portfolios, and operational assets, focusing on sustainable value growth rather than short-term liquidation.

Historical Background: Evolution of Asset Management Approaches

Asset stripping originated in the 1980s as a corporate strategy where companies were dismantled to sell off valuable assets for quick profit, often leading to short-term financial gains but long-term decline. Over time, asset enhancement emerged as a more sustainable approach, focusing on improving the value and operational efficiency of assets through strategic investments and maintenance. This evolution reflects a broader shift in asset management from exploitation toward value creation and preservation within financial and corporate governance frameworks.

Key Differences Between Asset Stripping and Asset Enhancement

Asset stripping involves the deliberate selling off of a company's valuable assets to generate immediate cash flow, often at the expense of long-term operational viability and stakeholder value. In contrast, asset enhancement focuses on improving and optimizing existing assets through strategic investments, upgrades, and management practices to increase their overall value and productivity. Key differences lie in the intent and outcome: asset stripping aims for short-term financial gain by liquidation, while asset enhancement drives sustainable growth and maximizes long-term asset potential.

Financial Implications: Profitability and Risk Factors

Asset stripping involves selling a company's valuable assets to generate immediate cash flow, often resulting in short-term profitability but increased financial risk due to diminished operational capacity and potential legal liabilities. Asset enhancement focuses on improving and optimizing assets to boost long-term profitability, stability, and market value, reducing risk through sustained business growth and improved cash generation. Evaluating financial implications requires balancing immediate gains against future revenue streams and the overall impact on company solvency and shareholder value.

Impact on Company Value: Short-term vs Long-term Perspectives

Asset stripping typically leads to short-term financial gains by selling off valuable company assets, often resulting in a decrease in long-term company value due to the loss of revenue-generating resources. In contrast, asset enhancement strategies focus on improving asset performance and utility, driving sustainable growth and increasing long-term company value through operational efficiency and market competitiveness. Companies prioritizing asset enhancement tend to create enduring shareholder value, whereas those engaging in asset stripping may face diminished market confidence and reduced strategic flexibility.

Regulatory Considerations and Legal Framework

Asset stripping involves the deliberate sale or removal of valuable components from a company, often triggering stringent regulatory scrutiny under corporate governance and securities laws to prevent shareholder harm and market manipulation. Conversely, asset enhancement strategies emphasize lawful value addition through investments or restructuring compliant with financial regulations and disclosure requirements, fostering sustainable growth and stakeholder confidence. Understanding the regulatory frameworks, including fiduciary duties and antitrust laws, is crucial to navigate legal risks associated with both practices effectively.

Ethical Issues in Asset Stripping and Enhancement

Asset stripping often raises ethical concerns due to its potential to undermine long-term value by dismantling companies primarily for short-term gains, frequently harming employees, creditors, and communities. In contrast, asset enhancement emphasizes sustainable growth and value creation by improving operational efficiency and asset utilization, aligning with broader stakeholder interests. Ethical asset management demands transparency, accountability, and consideration of social and economic impacts to balance profitability with responsibility.

Case Studies: Real-world Examples of Asset Stripping and Enhancement

Case studies illustrate stark contrasts between asset stripping and asset enhancement, where firms like British Leyland experienced asset stripping leading to decline and insolvency, while companies such as Apple demonstrate asset enhancement through strategic investment in innovation and brand value growth. Real-world examples show that asset stripping often involves selling or liquidating properties to maximize short-term cash flow, exemplified by corporate raiders in the 1980s, whereas asset enhancement includes capital improvements and operational efficiencies that increase long-term asset value and market competitiveness. These case studies reveal how asset management strategies impact financial health, stakeholder value, and business sustainability.

Choosing the Right Strategy: When to Strip vs When to Enhance

Asset stripping involves selling off a company's valuable assets to unlock immediate cash, ideal for distressed businesses or investors seeking quick returns. Asset enhancement focuses on improving asset value through upgrades, operational efficiencies, or strategic repositioning, suitable for companies aiming for long-term growth and profitability. Selecting the right strategy depends on financial health, market conditions, and investment goals, where stripping suits liquidation needs and enhancement supports sustained value creation.

Important Terms

Value Extraction

Value extraction through asset stripping involves rapidly selling off components for immediate profit, whereas asset enhancement focuses on increasing long-term value by improving and optimizing assets.

Portfolio Optimization

Portfolio optimization balances asset stripping to liquidate underperforming assets with asset enhancement strategies that improve asset value and maximize overall returns.

Divestiture

Divestiture involves strategically selling off assets either through asset stripping to maximize short-term gains or through asset enhancement to increase long-term value.

Turnaround Strategy

Turnaround strategy often involves critical decisions between asset stripping, which focuses on liquidating underperforming assets for immediate cash flow, and asset enhancement, aiming to increase the value of assets through operational improvements and strategic investments. Selecting asset enhancement aligns with sustainable growth by maximizing long-term returns, while asset stripping serves short-term financial stabilization by divesting non-core or inefficient assets.

Distressed Asset Management

Distressed Asset Management focuses on recovering value from underperforming assets, where Asset Stripping involves selling valuable components individually to maximize immediate cash flow, often at the expense of long-term viability. In contrast, Asset Enhancement emphasizes improving the operational efficiency or market position of assets to increase overall value and sustainable returns.

Capital Reallocation

Capital reallocation involves shifting resources from asset stripping, which focuses on selling off underperforming assets, to asset enhancement strategies that improve operational value and long-term returns.

Underutilized Assets

Underutilized assets can be strategically transformed through asset enhancement to increase value, whereas asset stripping involves selling off parts to maximize short-term gains at the expense of long-term potential.

Strategic Refurbishment

Strategic refurbishment focuses on asset enhancement by improving the value and functionality of properties, contrasting with asset stripping which involves dismantling or selling parts for short-term gain.

Liquidation Analysis

Liquidation analysis evaluates the estimated recovery value of a company's assets during financial distress, highlighting the critical difference between asset stripping, where assets are sold off individually often at below-market prices, and asset enhancement, which focuses on improving asset value to maximize overall returns. Understanding these strategies is essential for stakeholders aiming to either minimize losses through quick liquidation or optimize value through targeted asset management.

Value Creation Initiatives

Value Creation Initiatives focusing on asset enhancement prioritize improving operational efficiency and long-term value, whereas asset stripping involves divesting non-core assets to quickly generate cash but may undermine sustainable growth.

Asset Stripping vs Asset Enhancement Infographic

moneydif.com

moneydif.com