Strategic assets are key resources that provide a company with a competitive edge and drive long-term growth, such as proprietary technology or brand reputation. Non-strategic assets, by contrast, are those that support daily operations but do not significantly influence the company's strategic direction, like standard office equipment. Prioritizing investment in strategic assets is essential for sustaining market leadership and maximizing shareholder value.

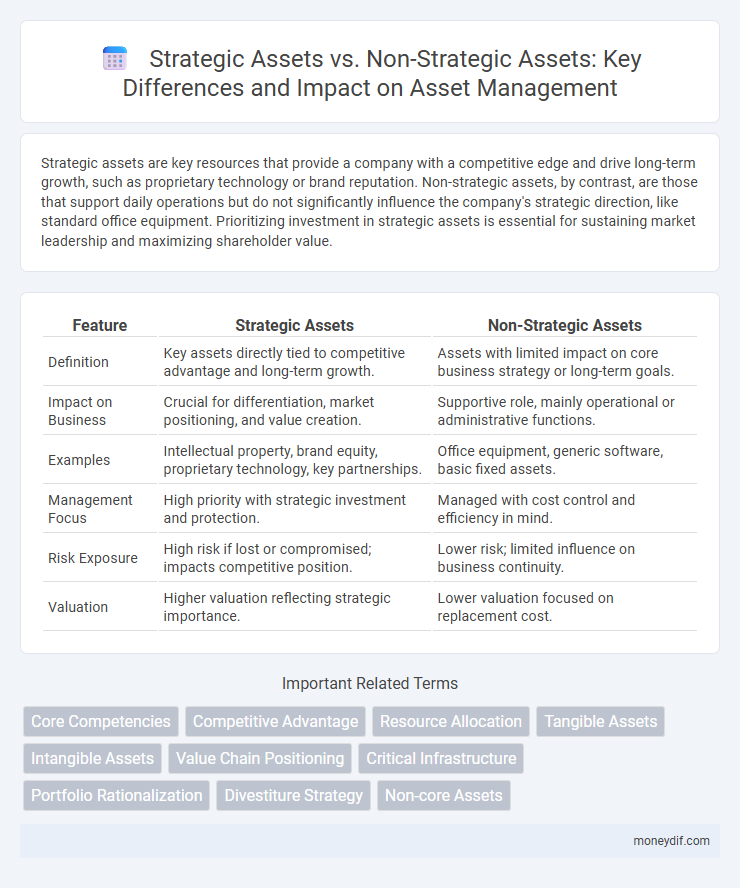

Table of Comparison

| Feature | Strategic Assets | Non-Strategic Assets |

|---|---|---|

| Definition | Key assets directly tied to competitive advantage and long-term growth. | Assets with limited impact on core business strategy or long-term goals. |

| Impact on Business | Crucial for differentiation, market positioning, and value creation. | Supportive role, mainly operational or administrative functions. |

| Examples | Intellectual property, brand equity, proprietary technology, key partnerships. | Office equipment, generic software, basic fixed assets. |

| Management Focus | High priority with strategic investment and protection. | Managed with cost control and efficiency in mind. |

| Risk Exposure | High risk if lost or compromised; impacts competitive position. | Lower risk; limited influence on business continuity. |

| Valuation | Higher valuation reflecting strategic importance. | Lower valuation focused on replacement cost. |

Defining Strategic and Non-strategic Assets

Strategic assets are critical resources or capabilities that provide a competitive advantage and are essential for achieving long-term business objectives. Non-strategic assets, while valuable, do not directly influence the core competitive position or strategic goals and often include surplus or non-core holdings. Identifying and managing these assets effectively ensures optimal allocation of resources and supports sustainable growth.

Key Characteristics of Strategic Assets

Strategic assets possess unique capabilities or resources that provide a sustainable competitive advantage, often characterized by rarity, durability, and inimitability. These assets are integral to an organization's long-term value creation and include intellectual property, proprietary technology, and strong brand equity. Their strategic significance lies in the difficulty competitors face when attempting to replicate or substitute them, ensuring lasting market position and profitability.

Understanding Non-strategic Assets

Non-strategic assets are resources or holdings that do not directly contribute to a company's core competitive advantage or long-term strategic goals. These assets are often underutilized or peripheral, such as excess real estate, obsolete equipment, or non-essential subsidiaries, which can be divested to improve financial flexibility. Understanding non-strategic assets allows organizations to optimize resource allocation, focus on value-driving operations, and enhance overall portfolio efficiency.

Importance of Strategic Assets in Business Growth

Strategic assets, such as proprietary technology, brand reputation, and exclusive partnerships, are critical drivers of sustainable business growth by providing competitive advantages that non-strategic assets lack. These assets enable companies to innovate, differentiate, and capture higher market value, directly impacting long-term profitability and market positioning. Focusing on developing and leveraging strategic assets ensures resilience against market fluctuations and supports scalable expansion in dynamic industries.

Evaluating the Value of Non-strategic Assets

Non-strategic assets often include surplus facilities, underutilized equipment, or non-core business units that do not directly contribute to the company's competitive advantage. Evaluating the value of these assets requires analyzing their potential for liquidation, reallocation, or divestiture to optimize financial performance and capital efficiency. Accurate valuation leverages market comparables, asset condition, and potential alternative uses to ensure strategic redeployment or profitable disposal.

Criteria for Classifying Assets as Strategic or Non-strategic

Criteria for classifying assets as strategic or non-strategic include their impact on competitive advantage, contribution to long-term business goals, and role in core operations. Strategic assets typically possess unique value, are difficult to replicate, and drive sustained profitability, whereas non-strategic assets lack these characteristics and serve more auxiliary or operational purposes. Evaluation often involves assessing asset rarity, relevance to market positioning, and potential to generate sustainable value.

Asset Allocation: Balancing Strategic and Non-strategic Holdings

Asset allocation involves balancing strategic assets, which drive long-term value and competitive advantage, with non-strategic assets that support operations but lack core impact. Prioritizing strategic assets ensures focused investment in high-return, mission-critical resources, while optimizing non-strategic holdings minimizes costs and enhances flexibility. Effective asset allocation leverages this balance to maximize overall portfolio performance and risk management.

Impact of Strategic Assets on Competitive Advantage

Strategic assets such as proprietary technology, strong brand reputation, and exclusive patents significantly enhance a firm's competitive advantage by creating barriers to entry and enabling differentiation. These assets drive sustained superior performance by fostering innovation, customer loyalty, and market power that competitors find difficult to replicate. Non-strategic assets, in contrast, provide limited value in long-term competitiveness and do not contribute meaningfully to unique market positioning.

Divesting Non-strategic Assets: Risks and Benefits

Divesting non-strategic assets enables companies to streamline operations and redirect capital towards core strategic initiatives, enhancing overall profitability. Risks include potential undervaluation of assets and loss of future growth opportunities if market conditions improve. Careful evaluation of market demand and asset performance is essential to maximize divestiture benefits while minimizing financial and operational disruptions.

Best Practices for Managing Strategic and Non-strategic Assets

Effective management of strategic assets involves aligning them with long-term organizational goals, ensuring regular evaluation and investment to maximize their value and competitive advantage. Non-strategic assets require cost-effective maintenance, timely disposal, or repurposing to minimize financial drain and support resource allocation toward strategic initiatives. Implementing robust asset management frameworks and leveraging data analytics enhances decision-making, enabling optimal performance and sustainability across both asset types.

Important Terms

Core Competencies

Core competencies leverage strategic assets to create unique value and competitive advantage, while non-strategic assets offer limited impact on long-term business success.

Competitive Advantage

Competitive advantage is sustained by leveraging strategic assets such as unique capabilities, proprietary technology, or strong brand equity that are valuable, rare, and difficult to imitate. Non-strategic assets, while necessary for operations, do not provide the distinct value or barriers to competition needed to maintain superior market positioning.

Resource Allocation

Effective resource allocation prioritizes strategic assets over non-strategic assets to maximize competitive advantage and long-term organizational value.

Tangible Assets

Tangible assets such as machinery, buildings, and equipment serve as strategic assets when they provide competitive advantage, support core business operations, and enhance long-term value creation; non-strategic tangible assets typically have limited impact on strategic goals and are often easily replaceable or surplus to requirements. Effective management of strategic tangible assets involves leveraging their unique characteristics to drive innovation, efficiency, and sustained market positioning.

Intangible Assets

Intangible assets such as patents, trademarks, and brand reputation serve as strategic assets when they provide sustainable competitive advantages and drive long-term value creation. Non-strategic intangible assets lack this durability and unique positioning, often leading to limited impact on a firm's strategic goals and market differentiation.

Value Chain Positioning

Value Chain Positioning focuses on strategically leveraging core assets that create competitive advantage while minimizing investment in non-strategic assets to optimize operational efficiency and market positioning.

Critical Infrastructure

Critical infrastructure encompasses strategic assets vital for national security and economic stability, while non-strategic assets support general operations without posing significant risk if compromised.

Portfolio Rationalization

Portfolio rationalization optimizes investment allocation by identifying strategic assets that drive core business value and divesting non-strategic assets to enhance operational efficiency and focus.

Divestiture Strategy

Divestiture strategy focuses on selling non-strategic assets to optimize resource allocation and strengthen core strategic assets for improved competitive advantage.

Non-core Assets

Non-core assets are business resources or holdings that do not align directly with a company's primary strategic objectives, distinguishing them from strategic assets which are critical for competitive advantage and long-term growth. While strategic assets drive value creation and operational focus, non-core assets are often divested or managed separately to optimize overall corporate performance and resource allocation.

Strategic Assets vs Non-strategic Assets Infographic

moneydif.com

moneydif.com