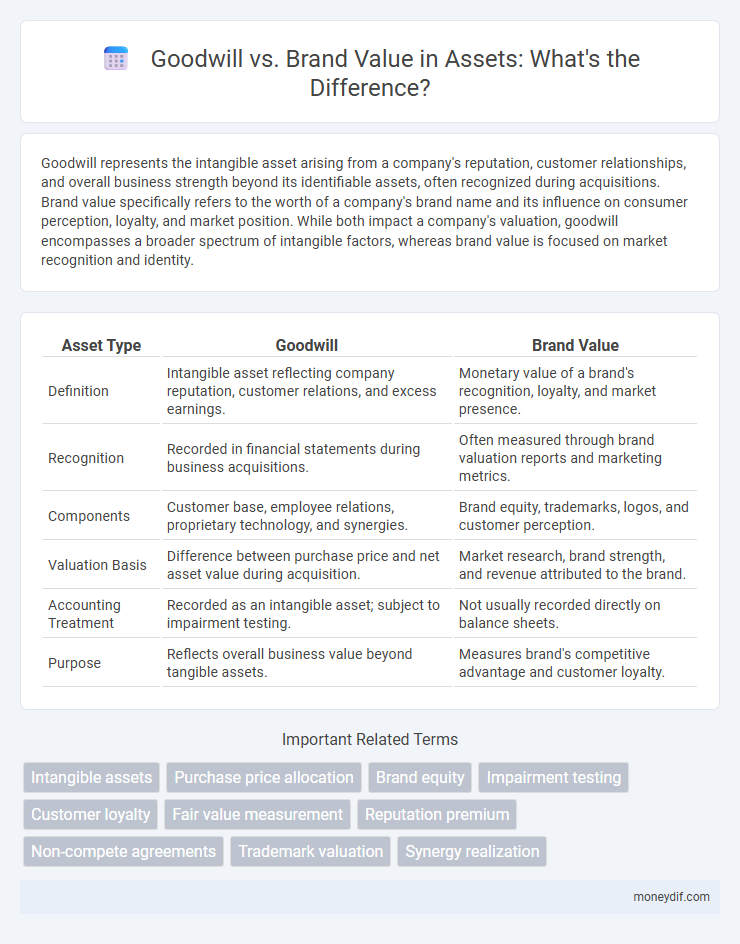

Goodwill represents the intangible asset arising from a company's reputation, customer relationships, and overall business strength beyond its identifiable assets, often recognized during acquisitions. Brand value specifically refers to the worth of a company's brand name and its influence on consumer perception, loyalty, and market position. While both impact a company's valuation, goodwill encompasses a broader spectrum of intangible factors, whereas brand value is focused on market recognition and identity.

Table of Comparison

| Asset Type | Goodwill | Brand Value |

|---|---|---|

| Definition | Intangible asset reflecting company reputation, customer relations, and excess earnings. | Monetary value of a brand's recognition, loyalty, and market presence. |

| Recognition | Recorded in financial statements during business acquisitions. | Often measured through brand valuation reports and marketing metrics. |

| Components | Customer base, employee relations, proprietary technology, and synergies. | Brand equity, trademarks, logos, and customer perception. |

| Valuation Basis | Difference between purchase price and net asset value during acquisition. | Market research, brand strength, and revenue attributed to the brand. |

| Accounting Treatment | Recorded as an intangible asset; subject to impairment testing. | Not usually recorded directly on balance sheets. |

| Purpose | Reflects overall business value beyond tangible assets. | Measures brand's competitive advantage and customer loyalty. |

Understanding Goodwill and Brand Value

Goodwill represents the intangible asset arising from a company's reputation, customer relationships, and employee loyalty, typically recorded during acquisitions when the purchase price exceeds the fair value of net identifiable assets. Brand value quantifies the worth of a brand's recognition, customer loyalty, and market position, often assessed through marketing metrics and consumer perception. Understanding the distinction helps businesses evaluate overall asset strength and informs strategic decisions in mergers, acquisitions, and brand management.

Defining Goodwill as an Intangible Asset

Goodwill represents the intangible asset arising from the acquisition of a business, reflecting factors such as customer loyalty, superior management, and employee expertise that exceed the fair value of identifiable net assets. Unlike brand value, which specifically measures the worth associated with brand recognition and reputation, goodwill encompasses broader elements including synergies and unidentifiable assets. Accounting standards require goodwill to be tested annually for impairment rather than amortized, emphasizing its unique role in reflecting acquired business advantages beyond tangible and separately identifiable intangible assets.

What Constitutes Brand Value?

Brand value represents the monetary worth attributed to a brand's recognition, reputation, and customer loyalty, derived from tangible and intangible assets such as trademarks, logos, and market presence. It encompasses customer perceptions, emotional connections, and competitive positioning, which collectively influence a company's revenue potential and market share. Unlike goodwill, which is an accounting term reflecting excess purchase price over net asset value during acquisitions, brand value is a dynamic measure of a brand's long-term influence and strength in the marketplace.

Key Differences Between Goodwill and Brand Value

Goodwill represents the intangible asset arising from business reputation, customer relationships, and employee expertise, often recorded during acquisitions when purchase price exceeds net assets. Brand value specifically quantifies the worth of a brand's recognition, loyalty, and market presence, reflecting consumer perception and marketing impact. While goodwill is an accounting concept linked to overall business assets, brand value focuses exclusively on the brand's influence and equity in the marketplace.

How Goodwill is Calculated in Asset Valuation

Goodwill is calculated in asset valuation by subtracting the fair market value of identifiable net assets from the total purchase price paid during an acquisition. This intangible asset represents the premium paid for aspects such as reputation, customer relationships, and intellectual property that are not separately identifiable. The calculation involves detailed financial analysis, including assessing liabilities, tangible assets, and identifiable intangibles to establish accurate goodwill value.

Methods for Assessing Brand Value

Brand value is assessed using quantitative approaches such as the cost-based method, which calculates historical brand investments, and the market-based method, comparing similar brand transactions. The income-based method projects future cash flows attributable to the brand, discounted to present value, offering a forward-looking perspective. These methods contrast with goodwill valuation, which is typically derived as a residual value after accounting for tangible and identifiable intangible assets.

The Role of Goodwill and Brand Value in Financial Statements

Goodwill represents the intangible asset arising from a company's acquisition price exceeding the fair value of its net identifiable assets, reflecting reputation, customer relations, and intellectual property. Brand value measures the market's perception and strength of a brand, often influencing customer loyalty and revenue, but it is generally not recorded separately in financial statements unless acquired through purchase. Financial statements recognize goodwill as an asset subject to annual impairment tests, while brand value remains a strategic intangible benefit impacting company valuation and investor confidence.

Impact of Mergers and Acquisitions on Goodwill and Brand Value

Mergers and acquisitions significantly influence goodwill by often creating a premium paid over the fair market value, representing intangible assets like reputation and customer loyalty. Brand value can be enhanced or diminished depending on how the merged entity leverages combined brand equity and market presence. Accurate valuation during these transactions is crucial to reflect the true impact on both goodwill and brand value on the balance sheet.

Goodwill and Brand Value in Business Strategy

Goodwill represents the intangible asset arising from a company's reputation, customer loyalty, and employee relations, impacting mergers and acquisitions with its influence on purchase price allocation. Brand value quantifies the financial worth associated with brand recognition, market position, and consumer perception, shaping marketing strategies and revenue growth. Integrating goodwill and brand value into business strategy enhances competitive advantage by leveraging both relational and brand equity for long-term financial performance.

Implications for Investors: Goodwill vs Brand Value

Goodwill represents the premium paid over the fair value of net identifiable assets during an acquisition, reflecting intangibles like reputation and customer relationships, whereas brand value quantifies the financial worth of a company's brand equity. Investors must distinguish between goodwill's potential impairment risk, which can impact earnings and shareholder value, and brand value's influence on competitive advantage and future revenue streams. Understanding the differences enables more accurate assessment of a company's true asset quality and long-term investment potential.

Important Terms

Intangible assets

Intangible assets encompass non-physical resources like goodwill, which reflects the premium paid during acquisitions based on reputation and customer relations, whereas brand value represents the recognized worth of a company's name and logo influencing customer loyalty and market position. Both goodwill and brand value significantly impact a firm's balance sheet and investor perception but differ in measurement and accounting treatment.

Purchase price allocation

Purchase price allocation allocates the acquisition cost among tangible and intangible assets, with goodwill representing the premium paid over the fair value of identifiable assets, often reflecting synergies and future earnings potential. Brand value, classified as a separately identifiable intangible asset, is specifically measured and recorded distinct from goodwill to capture the worth of brand recognition and customer loyalty.

Brand equity

Brand equity represents the overall value and strength of a brand in the market, encompassing customer loyalty and perception, while goodwill specifically accounts for the intangible asset recorded in financial statements during acquisitions, and brand value quantifies the monetary worth of the brand based on market performance and recognition.

Impairment testing

Impairment testing involves assessing the recoverable amount of goodwill to ensure it is not overstated on the balance sheet, whereas brand value is typically treated as an intangible asset separately valued through market-based or income-based approaches. Goodwill impairment arises when the carrying amount exceeds the fair value of a cash-generating unit, while brand value impairment requires regular reviews based on market conditions and revenue projections.

Customer loyalty

Customer loyalty significantly enhances a company's goodwill by fostering long-term trust and positive reputation, which contributes to sustained revenue and market stability. While brand value reflects the financial worth associated with brand recognition and market share, goodwill encompasses the intangible benefits from loyal customers that drive repeat business and positive referrals.

Fair value measurement

Fair value measurement differentiates goodwill as an intangible asset without physical substance and indefinite life, while brand value represents a quantifiable marketing asset with specific market-based fair value implications.

Reputation premium

Reputation premium quantifies the financial advantage a company gains from goodwill surpassing mere brand value by reflecting trust, customer loyalty, and intangible assets.

Non-compete agreements

Non-compete agreements protect a company's goodwill by restricting former employees from leveraging proprietary relationships and confidential information, whereas brand value primarily reflects customer recognition and loyalty independent of such agreements.

Trademark valuation

Trademark valuation quantifies intellectual property worth by assessing brand value's market influence and goodwill's intangible reputation impact separately.

Synergy realization

Synergy realization in mergers often enhances goodwill by capturing intangible benefits beyond measurable brand value, reflecting combined operational efficiencies and customer loyalty gains.

goodwill vs brand value Infographic

moneydif.com

moneydif.com