Asset pooling involves combining multiple financial assets into a single portfolio to diversify risk and improve returns for investors. Asset tranching divides this pooled portfolio into distinct layers, or tranches, that vary in risk and return profiles, catering to different investor preferences. This strategic structuring optimizes capital allocation and enhances market efficiency by aligning asset exposure with investor risk tolerance.

Table of Comparison

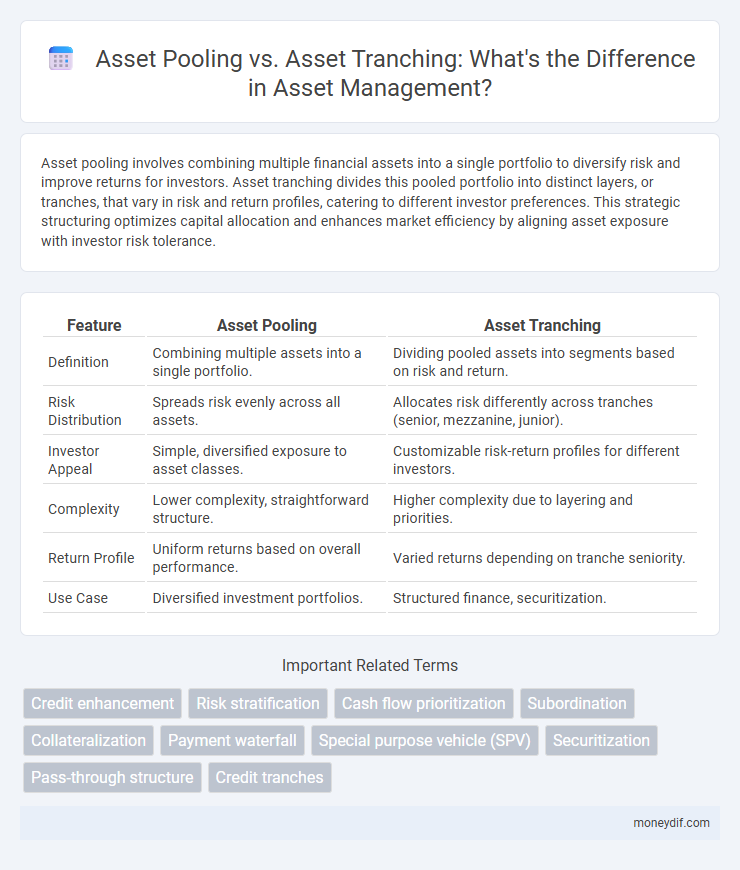

| Feature | Asset Pooling | Asset Tranching |

|---|---|---|

| Definition | Combining multiple assets into a single portfolio. | Dividing pooled assets into segments based on risk and return. |

| Risk Distribution | Spreads risk evenly across all assets. | Allocates risk differently across tranches (senior, mezzanine, junior). |

| Investor Appeal | Simple, diversified exposure to asset classes. | Customizable risk-return profiles for different investors. |

| Complexity | Lower complexity, straightforward structure. | Higher complexity due to layering and priorities. |

| Return Profile | Uniform returns based on overall performance. | Varied returns depending on tranche seniority. |

| Use Case | Diversified investment portfolios. | Structured finance, securitization. |

Understanding Asset Pooling: Definition and Key Concepts

Asset pooling involves combining multiple financial assets into a single portfolio to diversify risk and enhance returns. This approach enables investors to access a broader range of securities, improving liquidity and reducing exposure to individual asset volatility. Key concepts include risk diversification, collective investment, and enhanced market access through aggregated asset management.

What is Asset Tranching? A Clear Overview

Asset tranching involves dividing a pool of financial assets into segments called tranches, each with distinct risk levels, maturity dates, and interest rates. Investors can choose tranches according to their risk appetite and return expectations, enhancing portfolio customization and risk management. This structured finance technique contrasts with asset pooling, which aggregates assets but does not segment them by risk or return profiles.

Key Differences Between Asset Pooling and Asset Tranching

Asset pooling combines multiple financial assets into a single portfolio to diversify risk and enhance liquidity, whereas asset tranching breaks down pooled assets into distinct classes with varying risk and return profiles tailored to investor preferences. Pooling focuses on aggregation and collective management, while tranching emphasizes segmentation and prioritization of cash flows. Key differences include risk distribution methods, investor targeting, and structural complexity in securitization processes.

Benefits of Pooling Assets in Investment Portfolios

Pooling assets in investment portfolios enables diversification, reducing risk by combining various asset types and exposures into a single investment vehicle. This strategy enhances liquidity and economies of scale, allowing investors access to larger, more diverse holdings with lower transaction costs. The aggregated asset base also improves portfolio stability and return consistency compared to individual or segmented asset tranching approaches.

Advantages and Drawbacks of Asset Tranching

Asset tranching allows investors to select exposure based on risk and return preferences by dividing assets into different layers or tranches with varied credit ratings. Advantages include enhanced risk management, improved capital efficiency, and attraction of diverse investor profiles through tailored risk levels. Drawbacks involve increased complexity, potential mispricing of risk, and heightened vulnerability to systemic shocks if lower tranches suffer significant losses.

Risk Management: Pooling vs Tranching in Asset Allocation

Asset pooling aggregates diverse assets to dilute individual risks, enhancing overall portfolio stability through diversification. Asset tranching segments pooled assets into different risk categories, allowing investors to select tranches aligned with specific risk tolerances and return expectations. Risk management in asset allocation benefits from pooling's broad risk distribution and tranching's targeted exposure control within structured financial products.

Real-World Applications of Asset Pooling and Tranching

Asset pooling aggregates diverse financial instruments into a single portfolio, enabling risk diversification and enhanced liquidity for investors in real-world applications such as mortgage-backed securities and mutual funds. Asset tranching divides pooled assets into distinct layers with varying risk and return profiles, commonly utilized in collateralized debt obligations (CDOs) and structured finance to tailor investments according to investor risk appetite. Both techniques optimize capital allocation and risk management, driving efficiency in modern financial markets and investment strategies.

Impact on Investor Returns: Pooling vs Tranching

Asset pooling consolidates multiple assets into a single investment vehicle, diversifying risk and providing investors with more stable, averaged returns. Asset tranching slices pooled assets into graded risk layers, offering investors tailored return profiles based on their risk appetite, with senior tranches generally yielding lower but safer returns and junior tranches promising higher returns at increased risk. The impact on investor returns is determined by the risk segmentation in tranching, which can create asymmetric payoff structures compared to the more uniform return distribution seen in pooling.

Regulatory Considerations for Asset Pooling and Tranching

Regulatory considerations for asset pooling include compliance with securitization laws, investor disclosure requirements, and risk retention rules designed to enhance transparency and reduce systemic risk. Asset tranching faces additional scrutiny due to the complexity of different risk layers, necessitating adherence to regulatory standards for credit ratings and capital adequacy under frameworks like Basel III and Solvency II. Both structures require ongoing regulatory reporting and risk management practices to ensure alignment with legal frameworks and protect investor interests.

Choosing Between Asset Pooling and Asset Tranching: Factors to Consider

Choosing between asset pooling and asset tranching depends on risk tolerance, investment objectives, and market conditions. Asset pooling aggregates multiple assets to diversify risk and improve liquidity, while asset tranching segments pooled assets into layers with varying risk and return profiles tailored to different investor preferences. Evaluating factors such as credit risk, expected yield, investor appetite, and regulatory environment is crucial for optimizing portfolio performance and achieving targeted financial outcomes.

Important Terms

Credit enhancement

Credit enhancement strengthens the creditworthiness of asset-backed securities by reducing default risk through methods like overcollateralization and reserve funds. Asset pooling aggregates diverse financial assets to spread risk, while asset tranching segments pooled assets into layers with varying risk and return profiles, enabling tailored credit enhancement for each tranche.

Risk stratification

Risk stratification enhances portfolio management by categorizing assets into distinct pools for diversification or segmenting them into tranches to allocate risk and return profiles tailored to investor preferences.

Cash flow prioritization

Cash flow prioritization enhances risk management by allocating pooled assets into tranches with varying payment priorities and risk levels to optimize investor returns and credit quality.

Subordination

Subordination in asset pooling involves structuring different layers of debt or equity to prioritize cash flow distribution and risk absorption, enhancing credit quality for senior tranches. Asset tranching segments pooled assets into distinct classes with varying risk levels and returns, allowing investors to select tranches that match their risk appetite while improving overall financing efficiency.

Collateralization

Collateralization enhances credit risk management by securing asset pools, while asset tranching allocates pooled assets into graded risk classes to attract diverse investors.

Payment waterfall

Payment waterfall structures prioritize asset tranching by sequentially allocating pooled asset cash flows to different tranche investors based on predefined seniority and loss absorption rules.

Special purpose vehicle (SPV)

A Special Purpose Vehicle (SPV) is a legal entity created to pool diverse assets for collective investment and subsequently divide these pooled assets into tranches with varying risk and return profiles for targeted investors.

Securitization

Securitization involves pooling diverse financial assets into a single portfolio, then structuring that pool into multiple tranches with varying risk and return profiles to attract different investor classes.

Pass-through structure

Pass-through structures distribute pooled asset cash flows directly to investors, while asset tranching segments pooled assets into prioritized risk and return layers for targeted investor preferences.

Credit tranches

Credit tranches segment pooled assets into layers with varying risk and return profiles, enabling investors to choose exposure levels aligned with their risk tolerance. Asset pooling aggregates diverse financial assets into a single portfolio, while asset tranching divides this pooled portfolio into distinct credit tranches, distributing losses and cash flows according to tranche seniority.

asset pooling vs asset tranching Infographic

moneydif.com

moneydif.com