Digital assets exist purely in electronic form, representing value or rights on digital platforms, while tokenized assets are traditional physical or financial assets converted into digital tokens on a blockchain. Tokenized assets offer enhanced liquidity and transparency by enabling fractional ownership and seamless transferability. Understanding the distinction between digital and tokenized assets is crucial for leveraging blockchain technology in modern asset management.

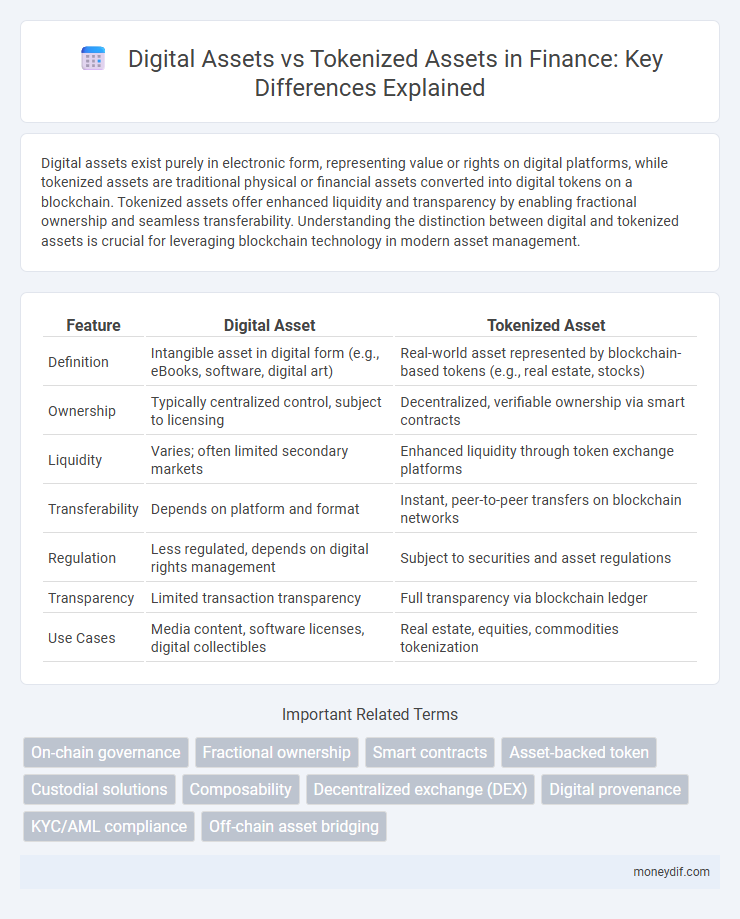

Table of Comparison

| Feature | Digital Asset | Tokenized Asset |

|---|---|---|

| Definition | Intangible asset in digital form (e.g., eBooks, software, digital art) | Real-world asset represented by blockchain-based tokens (e.g., real estate, stocks) |

| Ownership | Typically centralized control, subject to licensing | Decentralized, verifiable ownership via smart contracts |

| Liquidity | Varies; often limited secondary markets | Enhanced liquidity through token exchange platforms |

| Transferability | Depends on platform and format | Instant, peer-to-peer transfers on blockchain networks |

| Regulation | Less regulated, depends on digital rights management | Subject to securities and asset regulations |

| Transparency | Limited transaction transparency | Full transparency via blockchain ledger |

| Use Cases | Media content, software licenses, digital collectibles | Real estate, equities, commodities tokenization |

Understanding Digital Assets: Definition and Types

Digital assets represent any content or media encoded in a digital format, including cryptocurrencies, digital documents, videos, and software. Tokenized assets are a subset of digital assets where physical or traditional assets like real estate, art, or stocks are digitized and represented by blockchain-based tokens, allowing for fractional ownership and easier transferability. Understanding the distinction between purely digital assets and tokenized assets is crucial for grasping their applications in finance, legal frameworks, and digital economies.

What Are Tokenized Assets? Key Concepts Explained

Tokenized assets are digital representations of real-world assets such as real estate, stocks, or commodities, secured on a blockchain to enable fractional ownership and seamless transferability. Unlike purely digital assets, tokenized assets bridge the gap between physical possessions and blockchain technology by embedding the asset's value and legal rights into a token. Key concepts include decentralization, transparency, liquidity enhancement, and regulatory compliance, which collectively transform traditional asset management and investment opportunities.

Core Differences Between Digital Assets and Tokenized Assets

Digital assets are intangible resources stored electronically, such as cryptocurrencies, digital media, or intellectual property, while tokenized assets represent real-world assets like real estate or art converted into digital tokens on a blockchain. Tokenized assets enable fractional ownership, increased liquidity, and transparent provenance, differentiating them from conventional digital assets that do not inherently signify ownership of physical items. The core difference lies in tokenized assets bridging tangible assets to the digital realm, providing enhanced functionality and compliance capabilities compared to standalone digital assets.

Blockchain Technology’s Role in Asset Digitization

Blockchain technology enhances asset digitization by providing a secure and transparent ledger for both digital and tokenized assets. Digital assets exist entirely in electronic form, while tokenized assets represent ownership of physical or traditional assets through blockchain-based tokens. This technology ensures immutability, reduces fraud, and enables fractional ownership, significantly transforming asset management and transfer processes.

Benefits of Digital Assets in Modern Finance

Digital assets enable seamless, borderless transactions and improve liquidity by leveraging blockchain technology and smart contracts for enhanced security and transparency. They reduce intermediaries and costs, increasing efficiency in asset management and trading. Moreover, digital assets provide real-time auditability and programmable ownership, unlocking new opportunities in modern finance ecosystems.

Advantages of Tokenized Assets for Investors

Tokenized assets provide investors with enhanced liquidity by enabling fractional ownership and easier transferability on blockchain platforms. They offer increased transparency and security through immutable ledger technology, reducing counterparty risks and improving trust. Tokenization also broadens market access, allowing a wider range of investors to participate in asset classes traditionally limited by high entry barriers.

Security and Regulatory Considerations

Digital assets, such as cryptocurrencies and digital files, operate primarily within decentralized networks and face varying security risks including cyber-attacks and loss of private keys. Tokenized assets represent real-world assets like real estate or commodities on a blockchain, blending digital security with traditional regulatory frameworks, which often entails compliance with securities laws and investor protection regulations. Regulatory scrutiny is more intense for tokenized assets due to their asset-backed nature, requiring robust security protocols and clear legal frameworks to mitigate risks and enhance investor confidence.

Use Cases: Digital Assets vs Tokenized Assets

Digital assets, such as cryptocurrencies and NFTs, enable seamless online ownership and transfer of value in decentralized finance and digital art marketplaces. Tokenized assets represent real-world assets like real estate or equities on a blockchain, enhancing liquidity and fractional ownership opportunities for investors. Use cases for digital assets focus on digital-native environments, while tokenized assets bridge traditional assets with blockchain technology to optimize trading and asset management.

Challenges and Risks in Asset Digitalization

Digital assets face challenges including cybersecurity threats, regulatory uncertainties, and valuation difficulties that complicate their management and trading. Tokenized assets, while improving liquidity and fractional ownership, introduce risks related to smart contract vulnerabilities, legal compliance inconsistencies, and market volatility. Both asset types require robust frameworks to address issues of transparency, custody, and cross-jurisdictional enforcement.

The Future of Asset Ownership: Digital vs Tokenized

Digital assets encompass electronically stored value such as cryptocurrencies, digital art, and virtual real estate, offering ease of transfer and global accessibility. Tokenized assets transform traditional physical or financial assets into blockchain-based tokens, enabling fractional ownership, enhanced liquidity, and transparent transaction history. The future of asset ownership leans towards tokenization as it bridges conventional investment with decentralized finance, democratizing access and optimizing asset management.

Important Terms

On-chain governance

On-chain governance enables transparent decision-making processes for both digital assets and tokenized assets by automating rules and voting mechanisms on the blockchain.

Fractional ownership

Fractional ownership enables investors to hold digital assets through tokenized assets that represent subdivided ownership rights on a blockchain.

Smart contracts

Smart contracts autonomously execute terms on blockchain networks, enabling secure and transparent management of digital assets, which represent ownership or value in a purely digital form. Tokenized assets convert physical or traditional assets into digital tokens on the blockchain, allowing fractional ownership, increased liquidity, and streamlined transfers governed by programmable smart contracts.

Asset-backed token

Asset-backed tokens represent digital assets directly linked to tangible or financial assets, offering enhanced liquidity and transparency compared to traditional tokenized assets.

Custodial solutions

Custodial solutions for digital assets differ from tokenized assets by providing secure storage and management of private keys, whereas tokenized assets enable on-chain representation and transferability of real-world assets.

Composability

Composability enables seamless integration and interaction between digital assets and tokenized assets within decentralized finance ecosystems, facilitating complex financial products and innovative applications. Tokenized assets represent real-world assets on blockchain platforms, while digital assets exist natively on-chain, both leveraging composability to enhance liquidity, interoperability, and modular development.

Decentralized exchange (DEX)

Decentralized exchanges (DEXs) facilitate peer-to-peer trading of digital assets, including both native cryptocurrencies and tokenized assets representing real-world assets on blockchain networks.

Digital provenance

Digital provenance ensures transparent and verifiable ownership history for both digital assets and tokenized assets by recording immutable data on blockchain networks.

KYC/AML compliance

KYC/AML compliance for digital assets requires stringent identity verification processes, whereas tokenized assets demand enhanced regulatory frameworks to address both underlying asset legitimacy and blockchain transaction transparency.

Off-chain asset bridging

Off-chain asset bridging enables the transfer of value between digital assets native to one blockchain and tokenized assets representing off-chain goods or securities on another chain, ensuring interoperability and liquidity without relying on on-chain consensus for asset verification. This process leverages secure oracles and custodial services to maintain asset pegging and prevent double-spending, facilitating seamless cross-chain transactions between decentralized finance ecosystems and traditional financial markets.

Digital asset vs Tokenized asset Infographic

moneydif.com

moneydif.com