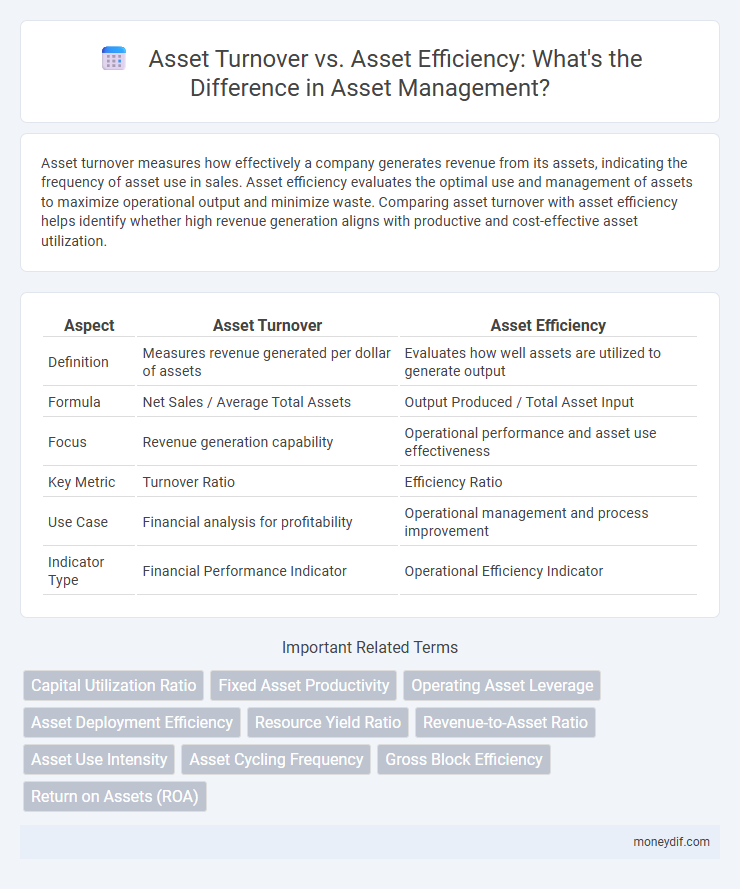

Asset turnover measures how effectively a company generates revenue from its assets, indicating the frequency of asset use in sales. Asset efficiency evaluates the optimal use and management of assets to maximize operational output and minimize waste. Comparing asset turnover with asset efficiency helps identify whether high revenue generation aligns with productive and cost-effective asset utilization.

Table of Comparison

| Aspect | Asset Turnover | Asset Efficiency |

|---|---|---|

| Definition | Measures revenue generated per dollar of assets | Evaluates how well assets are utilized to generate output |

| Formula | Net Sales / Average Total Assets | Output Produced / Total Asset Input |

| Focus | Revenue generation capability | Operational performance and asset use effectiveness |

| Key Metric | Turnover Ratio | Efficiency Ratio |

| Use Case | Financial analysis for profitability | Operational management and process improvement |

| Indicator Type | Financial Performance Indicator | Operational Efficiency Indicator |

Understanding Asset Turnover: Definition and Importance

Asset turnover measures how efficiently a company uses its assets to generate sales revenue, calculated by dividing total sales by average total assets. Higher asset turnover indicates better asset efficiency, reflecting effective utilization of resources to maximize profitability. Understanding this ratio helps businesses identify operational strengths and areas needing improvement in asset management.

What Is Asset Efficiency? Key Concepts Explained

Asset efficiency measures how effectively a company utilizes its assets to generate revenue, emphasizing the return on investment within operational processes. It focuses on maximizing output from existing resources by reducing waste, downtime, and maintenance costs to improve overall performance. Key indicators include asset turnover ratio, capacity utilization, and operational uptime, which together reflect the company's ability to convert assets into profitable results.

Asset Turnover vs. Asset Efficiency: Core Differences

Asset turnover measures how effectively a company generates sales from its total assets, calculated by dividing net sales by average total assets, indicating operational efficiency in revenue generation. Asset efficiency focuses on the optimal use and management of assets to maximize productivity and minimize idle resources, encompassing factors like asset utilization rate and maintenance costs. While asset turnover quantifies revenue output per asset dollar, asset efficiency emphasizes the strategic management and performance optimization of those assets throughout their lifecycle.

Why Asset Turnover Matters in Financial Analysis

Asset turnover measures how effectively a company uses its assets to generate sales, directly impacting revenue growth and profitability. Higher asset turnover indicates efficient asset utilization, helping investors assess operational performance and management effectiveness. Evaluating asset turnover alongside asset efficiency provides a clearer picture of financial health and competitive positioning in the market.

Measuring Asset Efficiency: Common Metrics and Methods

Measuring asset efficiency involves analyzing metrics such as asset turnover ratio, which compares net sales to average total assets, reflecting how effectively a company utilizes its assets to generate revenue. Other common methods include return on assets (ROA), assessing net income relative to total assets, and the fixed asset turnover ratio, which focuses on revenue generated from fixed asset investments. These metrics collectively provide insights into operational efficiency and asset management effectiveness within the organization's financial structure.

Improving Asset Turnover: Strategies for Businesses

Improving asset turnover involves optimizing the use of company assets to generate higher sales revenue with the same asset base. Strategies such as streamlining inventory management, enhancing production processes, and leveraging technology for real-time asset tracking can significantly boost asset efficiency. Focusing on these approaches helps businesses reduce idle assets, increase operational productivity, and maximize return on investment.

Enhancing Asset Efficiency: Best Practices

Enhancing asset efficiency involves maximizing output from fixed and current assets through strategic maintenance, process optimization, and technology integration. Best practices include regular asset performance audits, predictive maintenance to reduce downtime, and leveraging data analytics for real-time asset utilization insights. Improving asset efficiency directly contributes to higher asset turnover ratios, driving better financial performance and sustainable growth.

Industry Benchmarks: Comparing Asset Turnover and Efficiency

Asset turnover measures how effectively a company generates sales from its assets, while asset efficiency evaluates the productive use and management of those assets. Industry benchmarks reveal that high asset turnover ratios typically indicate better sales performance relative to asset base, whereas asset efficiency focuses on minimizing idle assets and maximizing operational output. Comparing these metrics across industries helps identify companies that optimize asset utilization and achieve superior financial performance.

Impact of Asset Turnover and Efficiency on Profitability

Asset turnover measures how effectively a company uses its assets to generate sales, directly influencing revenue growth and operational profitability. Higher asset efficiency reduces waste and maintenance costs, enhancing net profit margins by optimizing asset utilization. Together, improved asset turnover and efficiency drive stronger financial performance by maximizing asset value and minimizing operational expenditures.

Choosing the Right Metric: Asset Turnover or Asset Efficiency?

Choosing between asset turnover and asset efficiency depends on the specific financial insight required. Asset turnover measures how effectively a company generates sales from its assets, making it ideal for assessing revenue performance relative to asset investment. In contrast, asset efficiency focuses on the optimal use and productivity of assets, offering deeper analysis of operational performance and resource management.

Important Terms

Capital Utilization Ratio

Capital Utilization Ratio measures how effectively a company uses its capital to generate revenue, directly linking to Asset Turnover, which calculates sales per unit of assets. Asset Efficiency complements this by assessing how well assets are managed to maximize output, providing a holistic view of operational performance beyond simple turnover rates.

Fixed Asset Productivity

Fixed Asset Productivity measures the efficiency of asset utilization by comparing Asset Turnover, which reflects revenue generated per asset value, against Asset Efficiency, indicating the optimal use and maintenance of assets to maximize output.

Operating Asset Leverage

Operating asset leverage measures the impact of fixed operating assets on profitability by analyzing the balance between asset turnover, which indicates how efficiently assets generate sales, and overall asset efficiency, reflecting the productivity of total asset utilization.

Asset Deployment Efficiency

Asset Deployment Efficiency improves when asset turnover increases relative to asset efficiency, maximizing the return generated per unit of asset value invested.

Resource Yield Ratio

Resource Yield Ratio measures the efficiency of resource utilization by comparing output generated against input resources, emphasizing asset turnover's role in how effectively assets produce revenue. Asset turnover focuses on revenue generated per asset dollar, while asset efficiency captures broader performance metrics including utilization rates and operational effectiveness.

Revenue-to-Asset Ratio

The Revenue-to-Asset Ratio measures asset efficiency by comparing asset turnover, highlighting how effectively a company generates revenue from its assets.

Asset Use Intensity

Asset Use Intensity measures the efficiency of asset utilization by analyzing Asset Turnover, which quantifies revenue generated per asset dollar, against Asset Efficiency, reflecting the operational effectiveness in managing asset-related processes.

Asset Cycling Frequency

Asset Cycling Frequency directly influences Asset Turnover by measuring how often assets are utilized within a period, thus reflecting overall Asset Efficiency in generating revenue.

Gross Block Efficiency

Gross Block Efficiency measures the effectiveness of a company's asset utilization by comparing asset turnover ratio and total asset efficiency to optimize return on investment.

Return on Assets (ROA)

Return on Assets (ROA) measures a company's profitability relative to its total assets and is significantly influenced by asset turnover, which indicates how efficiently a company uses its assets to generate sales. Higher asset turnover reflects better asset efficiency, leading to increased ROA by maximizing revenue from existing asset investments.

Asset turnover vs Asset efficiency Infographic

moneydif.com

moneydif.com