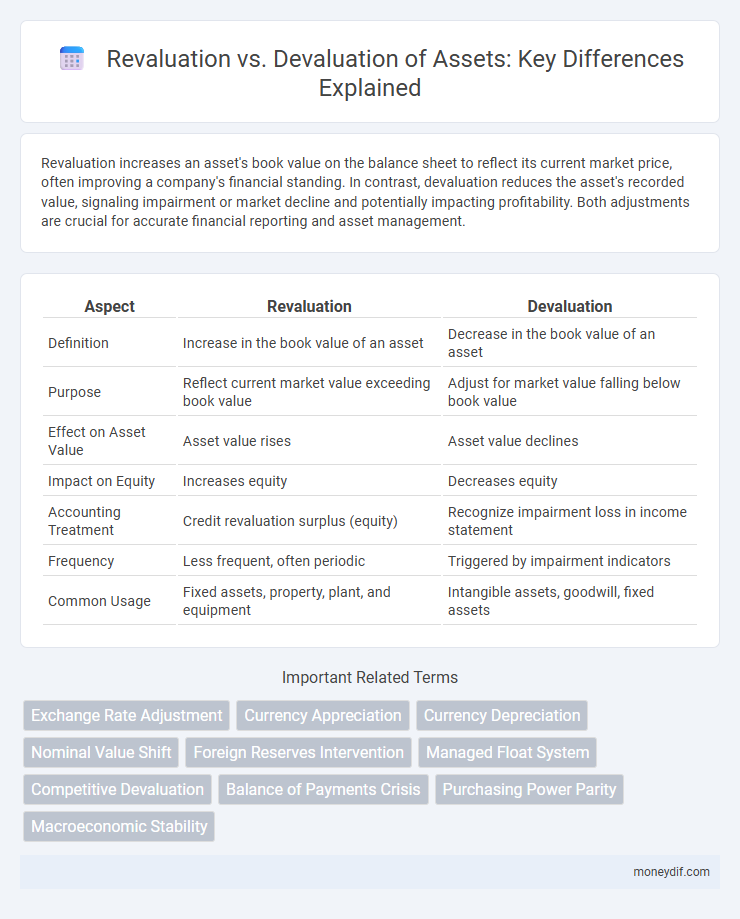

Revaluation increases an asset's book value on the balance sheet to reflect its current market price, often improving a company's financial standing. In contrast, devaluation reduces the asset's recorded value, signaling impairment or market decline and potentially impacting profitability. Both adjustments are crucial for accurate financial reporting and asset management.

Table of Comparison

| Aspect | Revaluation | Devaluation |

|---|---|---|

| Definition | Increase in the book value of an asset | Decrease in the book value of an asset |

| Purpose | Reflect current market value exceeding book value | Adjust for market value falling below book value |

| Effect on Asset Value | Asset value rises | Asset value declines |

| Impact on Equity | Increases equity | Decreases equity |

| Accounting Treatment | Credit revaluation surplus (equity) | Recognize impairment loss in income statement |

| Frequency | Less frequent, often periodic | Triggered by impairment indicators |

| Common Usage | Fixed assets, property, plant, and equipment | Intangible assets, goodwill, fixed assets |

Understanding Asset Revaluation and Devaluation

Asset revaluation adjusts the carrying value of an asset to reflect its current market value, leading to an increase or decrease on the balance sheet. Revaluation results in a gain that enhances equity, while devaluation records a loss that reduces an asset's book value and equity. Understanding these processes is crucial for accurate financial reporting and maintaining asset valuation integrity.

Key Differences Between Revaluation and Devaluation

Revaluation increases the book value of an asset to reflect its current market value, typically used in accounting for fixed assets during inflation, while devaluation reduces the value, often in currency context to adjust exchange rates. Revaluation impacts financial statements by increasing asset values, equity, and potentially depreciation expenses, whereas devaluation mainly affects currency value and import-export competitiveness without directly altering asset book values. The key difference lies in revaluation being an upward adjustment of asset worth within accounting records, and devaluation being a downward adjustment primarily related to a currency's external value.

Causes of Asset Revaluation

Asset revaluation is primarily caused by significant changes in market conditions, such as fluctuations in supply and demand or disruption in economic stability, which affect the fair value of the asset. Technological advancements and improvements in asset utility may also trigger revaluation by increasing the asset's productive capacity or lifespan. Regulatory changes and periodic financial reporting requirements compel companies to adjust asset values to reflect current market prices accurately.

Factors Leading to Asset Devaluation

Economic downturns, technological obsolescence, and physical deterioration are primary factors leading to asset devaluation. Market demand fluctuations and changes in regulatory policies can also significantly reduce an asset's book value. Accurate assessment of these factors is crucial for reflecting the true financial position in asset management.

Impact of Revaluation on Financial Statements

Revaluation of assets increases their carrying amount on the balance sheet, leading to higher total asset values and equity through a revaluation surplus in other comprehensive income. This adjustment affects depreciation expense by increasing its value over the asset's revised useful life, thereby impacting profit margins. The enhanced asset value improves key financial ratios such as return on assets (ROA) and debt-to-equity, reflecting a stronger financial position.

Consequences of Devaluation for Asset Owners

Devaluation reduces the domestic currency value of assets held by owners, leading to a decline in purchasing power and net worth when expressed in that currency. Foreign-denominated liabilities increase in local currency terms, potentially causing financial distress or insolvency for asset owners. Asset prices may become volatile, complicating valuation and investment decisions, and undermining overall financial stability.

Revaluation: Methods and Best Practices

Revaluation of assets involves adjusting the book value to reflect current market conditions using methods such as market price comparison, income capitalization, or replacement cost approach. Best practices include conducting periodic valuations, engaging certified appraisers, and ensuring compliance with relevant accounting standards like IFRS or GAAP. Accurate asset revaluation improves financial transparency, aids in decision-making, and enhances the balance sheet's reliability.

Devaluation: Risks and Mitigation Strategies

Devaluation of assets poses significant risks including reduced market value, impaired financial statements, and potential liquidity challenges. To mitigate these risks, companies implement rigorous asset monitoring, diversify holdings to spread exposure, and employ hedging techniques such as currency swaps when dealing with foreign assets. Proactive re-assessment and timely write-downs ensure that devaluation impacts are managed effectively, preserving financial stability.

Accounting Standards for Revaluation vs Devaluation

Accounting standards such as IAS 16 prescribe the revaluation of assets to reflect fair value, requiring upward adjustments when an asset's market value exceeds its carrying amount, with increases credited to revaluation surplus. Devaluation involves downward adjustments for impaired assets, recognized as losses in profit or loss unless offset against previous revaluation surpluses for the same asset. The treatment under IFRS emphasizes consistent measurement bases and disclosure requirements to ensure transparency and comparability in financial statements.

Real-World Examples of Asset Revaluation and Devaluation

Asset revaluation often occurs in real estate markets where property values rise due to urban development, exemplified by commercial buildings in metropolitan cities like New York appreciating significantly over time. In contrast, devaluation is evident in industries like oil and gas, where assets such as drilling equipment lose value rapidly during downturns in commodity prices, as seen during the 2020 oil price crash. These real-world cases highlight how economic conditions and market dynamics directly influence the book value adjustments of tangible assets on corporate balance sheets.

Important Terms

Exchange Rate Adjustment

Exchange rate adjustment involves revaluation when a currency's value increases relative to others and devaluation when it decreases to correct trade imbalances or economic disparities.

Currency Appreciation

Currency appreciation occurs when a nation's currency value increases relative to others, often driven by revaluation policies or market demand, whereas devaluation signifies an official lowering of currency value to boost exports and correct trade imbalances.

Currency Depreciation

Currency depreciation represents a decline in a currency's market value, contrasting with official devaluation which is a deliberate downward adjustment by a government, while revaluation denotes an official increase in currency value within a fixed exchange rate system.

Nominal Value Shift

Nominal value shift occurs when currency revaluation increases the nominal value of assets or liabilities, whereas devaluation decreases their nominal value, impacting financial statements and international trade balances.

Foreign Reserves Intervention

Foreign reserves intervention involves central banks buying or selling foreign currency to influence exchange rates, directly impacting currency revaluation or devaluation. Strategic accumulation of reserves can prevent excessive devaluation by supporting the domestic currency, while selling reserves may be used to curb overvaluation and induce revaluation.

Managed Float System

The Managed Float System allows central banks to intervene in foreign exchange markets to cause revaluation or devaluation of their currency, stabilizing exchange rates while maintaining some market-driven flexibility.

Competitive Devaluation

Competitive devaluation involves countries intentionally lowering their currency value to boost exports, contrasting with revaluation, which increases currency value to reduce inflation or protect purchasing power.

Balance of Payments Crisis

A Balance of Payments Crisis occurs when a country cannot finance its international payments, often leading to currency devaluation to restore competitiveness by making exports cheaper and imports more expensive. In contrast, revaluation strengthens the domestic currency's value, potentially worsening the crisis by increasing import demand and reducing export revenues, thereby exacerbating deficits.

Purchasing Power Parity

Purchasing Power Parity (PPP) measures the relative value of currencies based on the cost of a standard basket of goods, influencing whether a currency is subject to revaluation or devaluation. Currency revaluation occurs when a nation's currency appreciates due to factors like higher domestic price levels compared to trading partners, while devaluation reflects a deliberate lowering of currency value to restore export competitiveness and correct imbalances indicated by PPP deviations.

Macroeconomic Stability

Macroeconomic stability relies on maintaining balanced exchange rates where revaluation of a currency can reduce export competitiveness but help control inflation, whereas devaluation boosts exports by making goods cheaper abroad but risks higher inflation and capital flight. Policymakers must carefully assess external shocks and trade balances to determine appropriate currency adjustments that support sustainable growth and price stability.

Revaluation vs Devaluation Infographic

moneydif.com

moneydif.com