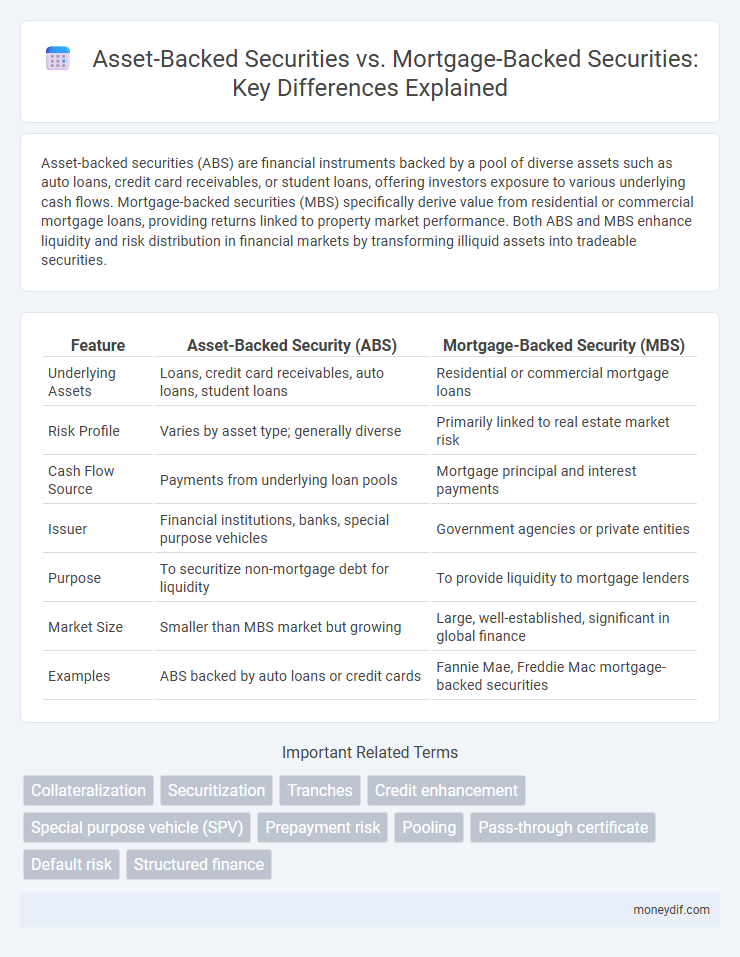

Asset-backed securities (ABS) are financial instruments backed by a pool of diverse assets such as auto loans, credit card receivables, or student loans, offering investors exposure to various underlying cash flows. Mortgage-backed securities (MBS) specifically derive value from residential or commercial mortgage loans, providing returns linked to property market performance. Both ABS and MBS enhance liquidity and risk distribution in financial markets by transforming illiquid assets into tradeable securities.

Table of Comparison

| Feature | Asset-Backed Security (ABS) | Mortgage-Backed Security (MBS) |

|---|---|---|

| Underlying Assets | Loans, credit card receivables, auto loans, student loans | Residential or commercial mortgage loans |

| Risk Profile | Varies by asset type; generally diverse | Primarily linked to real estate market risk |

| Cash Flow Source | Payments from underlying loan pools | Mortgage principal and interest payments |

| Issuer | Financial institutions, banks, special purpose vehicles | Government agencies or private entities |

| Purpose | To securitize non-mortgage debt for liquidity | To provide liquidity to mortgage lenders |

| Market Size | Smaller than MBS market but growing | Large, well-established, significant in global finance |

| Examples | ABS backed by auto loans or credit cards | Fannie Mae, Freddie Mac mortgage-backed securities |

Introduction to Asset-Backed Securities (ABS)

Asset-backed securities (ABS) are financial instruments backed by a pool of underlying assets such as auto loans, credit card receivables, or student loans, offering investors regular cash flows derived from these asset payments. Unlike mortgage-backed securities (MBS) which specifically rely on mortgage loans as collateral, ABS diversify credit risk across various consumer and business loans. The structure of ABS enhances liquidity and provides tailored investment opportunities based on asset performance and credit quality.

Defining Mortgage-Backed Securities (MBS)

Mortgage-backed securities (MBS) are a type of asset-backed security backed specifically by a pool of mortgage loans, where investors receive periodic payments derived from the underlying mortgage principal and interest. Unlike general asset-backed securities (ABS) that may be backed by various loan types such as auto loans or credit card debt, MBS are secured exclusively by residential or commercial mortgages. The defining characteristic of MBS lies in their direct correlation to real estate collateral, making them sensitive to housing market conditions and mortgage default risks.

Core Differences: ABS vs MBS

Asset-backed securities (ABS) represent pools of diversified financial assets such as auto loans, credit card receivables, or student loans, whereas mortgage-backed securities (MBS) are specifically backed by residential or commercial mortgage loans. ABS typically offer higher yield spreads and shorter maturities due to the heterogeneous nature of their underlying assets, while MBS provide exposure to real estate markets with cash flows primarily dependent on mortgage interest and principal payments. Credit risk and prepayment risk vary significantly between ABS and MBS, with ABS generally exhibiting lower prepayment risk because of diversified asset types compared to the more homogenous mortgage collateral in MBS.

Underlying Assets: What Backs These Securities?

Asset-backed securities (ABS) are backed by diversified pools of financial assets such as auto loans, credit card receivables, or student loans, while mortgage-backed securities (MBS) are specifically secured by residential or commercial mortgage loans. The value and risk profile of ABS depend on the performance of various consumer or business loans, whereas MBS rely on the timely repayment of mortgage principal and interest. Understanding the underlying asset type is crucial for investors assessing credit risk, cash flow stability, and market liquidity in these securities.

Risk Profiles and Credit Ratings

Asset-backed securities (ABS) and mortgage-backed securities (MBS) differ in risk profiles and credit ratings primarily due to the underlying assets; ABS are backed by a variety of consumer and commercial loans, leading to diversified risk, whereas MBS are secured by residential or commercial mortgages, which can be more sensitive to housing market fluctuations. ABS credit ratings often reflect the performance of auto loans, credit card receivables, or student loans, generally resulting in a stable risk profile, while MBS ratings heavily depend on mortgage default rates and prepayment speeds, which can lead to higher volatility. Investors in MBS should be mindful of interest rate risk and potential for higher default risk during housing market downturns, whereas ABS typically offer more predictable cash flows and broader asset diversification.

Structure and Tranching in ABS and MBS

Asset-backed securities (ABS) are structured by pooling various types of receivables such as credit card debt, auto loans, or student loans, whereas mortgage-backed securities (MBS) specifically pool residential or commercial mortgage loans. Both ABS and MBS employ tranching to create different layers of risk and return, with senior tranches receiving priority on cash flows and lower tranches absorbing first losses to protect senior investors. The tranche structure in MBS often reflects prepayment risk linked to mortgage behavior, while ABS tranches are typically designed around borrower default risk within the underlying asset pool.

Yield and Returns Comparison

Asset-backed securities (ABS) typically offer higher yields compared to mortgage-backed securities (MBS) due to their diversified underlying assets and varied risk profiles. Mortgage-backed securities generally provide more stable but lower returns, reflecting the relative safety of home loan collateral. Investors seeking enhanced yield may prefer ABS, while those prioritizing predictable income might lean toward MBS due to their mortgage payment structures.

Regulatory Landscape: Compliance and Governance

Asset-backed securities (ABS) face regulatory frameworks such as the Dodd-Frank Act and SEC Rule 144A, emphasizing transparency, risk retention, and investor protection, while mortgage-backed securities (MBS) comply with additional housing finance specific regulations including the Home Mortgage Disclosure Act (HMDA) and Federal Housing Finance Agency (FHFA) oversight. Governance requirements for ABS prioritize underlying asset performance data and credit enhancement mechanisms, whereas MBS governance mandates strict appraisal standards, borrower qualification disclosures, and adherence to government-sponsored enterprise (GSE) guidelines. Regulatory compliance for both securities involves rigorous reporting obligations, stress testing, and ongoing monitoring to mitigate systemic risk and ensure market stability.

Suitability for Investors

Asset-backed securities (ABS) offer diversified exposure to various types of loans and receivables, making them suitable for investors seeking broader risk distribution and moderate yield opportunities. Mortgage-backed securities (MBS) primarily consist of residential or commercial mortgage loans, appealing to investors targeting stable cash flows and potential interest rate sensitivity aligned with real estate markets. Investors with a higher risk tolerance aiming for sector-specific exposure often prefer MBS, while those prioritizing credit diversification may find ABS more advantageous.

Market Trends and Future Outlook

Asset-backed securities (ABS) have shown diverse growth across various sectors like auto loans and credit cards, driven by expanding consumer credit demand and regulatory shifts enhancing transparency. Mortgage-backed securities (MBS) continue to dominate fixed-income markets, supported by low-interest rates and government-backed entities like Fannie Mae and Freddie Mac, though rising rates may pressure prepayment speeds and valuations. Future outlooks suggest ABS markets will benefit from fintech innovations and expanding asset classes, while MBS face challenges from housing market volatility and evolving monetary policies.

Important Terms

Collateralization

Collateralization in asset-backed securities (ABS) involves pooling various financial assets, such as auto loans or credit card receivables, to serve as backing, whereas mortgage-backed securities (MBS) specifically use residential or commercial mortgage loans as collateral. The quality and performance of the underlying collateral directly influence the risk, cash flow, and credit ratings of both ABS and MBS, making the nature of the collateral a critical factor in investment decisions.

Securitization

Asset-backed securities (ABS) are financial instruments secured by a pool of diverse assets like auto loans or credit card debt, while mortgage-backed securities (MBS) specifically derive value from residential or commercial mortgage loans.

Tranches

Tranches in asset-backed securities (ABS) and mortgage-backed securities (MBS) represent prioritized layers of risk and return, with ABS typically backed by diversified assets like loans or receivables, while MBS are specifically backed by pools of mortgage loans.

Credit enhancement

Credit enhancement techniques such as overcollateralization and reserve funds improve the credit quality of asset-backed securities, while mortgage-backed securities often rely on government guarantees and pooling of diversified mortgage loans for credit enhancement.

Special purpose vehicle (SPV)

A Special Purpose Vehicle (SPV) isolates financial risk by holding assets separately from the originator, facilitating the issuance of Asset-Backed Securities (ABS) and Mortgage-Backed Securities (MBS). While ABS pools diverse assets like auto loans or credit card receivables, MBS specifically securitize mortgage loans, both enhancing liquidity and potentially reducing credit risk through structured finance.

Prepayment risk

Prepayment risk in asset-backed securities (ABS) and mortgage-backed securities (MBS) significantly impacts cash flow timing, with MBS typically facing higher prepayment risk due to homeowner refinancing incentives compared to ABS collateralized by diverse consumer or commercial loans.

Pooling

Pooling in asset-backed securities involves aggregating diverse financial assets like auto loans or credit card receivables, whereas in mortgage-backed securities, pooling specifically refers to combining residential or commercial mortgage loans to create tradable investment products.

Pass-through certificate

A pass-through certificate represents an ownership interest in a pool of asset-backed securities, distributing principal and interest payments from the underlying assets, whereas mortgage-backed securities specifically involve pools of mortgage loans serving as collateral.

Default risk

Default risk in asset-backed securities (ABS) varies significantly from mortgage-backed securities (MBS) due to the underlying collateral; ABS typically derives from diversified pools of receivables like auto loans or credit card debt, which may have shorter durations and varied borrower profiles, whereas MBS are backed by mortgage loans that often carry longer amortization periods and are sensitive to housing market fluctuations. The credit enhancement mechanisms and tranche structures also differ, influencing the default risk profile investors face in each type of security.

Structured finance

Asset-backed securities (ABS) pool various financial assets like auto loans or credit card debt, while mortgage-backed securities (MBS) specifically securitize residential or commercial mortgage loans, both enabling structured finance by converting illiquid assets into tradable securities.

Asset-backed security vs Mortgage-backed security Infographic

moneydif.com

moneydif.com